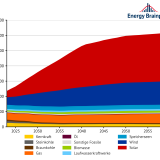

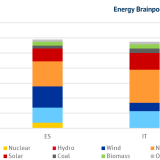

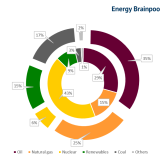

With the current “EU Energy Outlook 2060”, Energy Brainpool shows long-term trends in Europe. The European energy system will change dramatically in the coming decades. In addition to climate change and an outdated power plant fleet, current geopolitical tensions are also forcing the European Union and many countries to change their energy policies. What do these developments mean for power prices, revenue potential and risks for photovoltaics and wind?

Continue reading