An early coal phase-out, 80 percent renewable energies by 2030, and climate neutrality by 2045: These are the three energy industry cornerstones of the German government’s ambitious plans in the coalition agreement. Implementing the contents of two legislative packages is on the agenda this year.

All things considered, the envisaged changes potentially have a very strong impact on the energy market. Explicitly, the wholesale electricity price decreases, phases of full supply from renewables increase, and at the same time the demand for gas power plants, hydrogen and electricity increases.

The Energy Brainpool analysis team first assesses the potential economic impacts of the coalition agreement in the form of scenario sensitivity. In this blog post, we present some of the results.

Coal phase-out please, ideally by 2030

Currently, coal-fired power plants offer 34.4 gigawatts (GW) of capacity on the energy market [1]. If these are to exit the market by 2030, part of their controllable capacity will have to be replaced. By 2024, 2.9 GW are expected to be added to the current gas-fired power plant capacity of 28.6 GW. Here we only take into account those power plants that will offer their output on the energy market.

New gas-fired power plants take around two years to plan and two years to build. Assuming approval is granted, the additional capacity is technically feasible if it is economically viable.

For three reasons, it is not necessary to replace all closed coal and nuclear power plant capacities 1:1. Firstly, there will be an increased European exchange of electricity, secondly, although there are now small European power plant overcapacities that still exist, and thirdly, electricity demand will be made more flexible.

Results of the modelling

If we take these factors into account, Energy Brainpool’s hourly European energy market modelling results in a gross capacity requirement of 45.9 GW of gas-fired power plants (+14.4 GW) for 2030. In particular, the exact figure depends on

- controllable power plant capacities of neighbouring countries,

- the degree of flexibilisation of electricity demand,

- the storage capacities,

- as well as the availability of European cross-border interconnection capacities.

At present, it is still unclear whether and how this technically necessary expansion can be stimulated by energy policy.

A geopolitical impact is particularly explosive against the backdrop of the current energy price crisis. In our scenario, electricity generation from natural gas power plants increases by 51 percent from 2020 to 2030. The dependence of energy generation on natural gas imports thus increases sharply. However, this figure is put into perspective when one considers that energy generation accounted for only 14 percent of German gas demand in 2020 [2].

200 (!) GW photovoltaics

Admittedly – when we at Energy Brainpool first saw this target in November 2021, we were surprised at the level and ambition. Our hourly modelling shows that the targeted share of solar power will increasingly challenge the electricity system.

The amounts of PV electricity that would have to be marketed at negative electricity prices in the midday hours rise to up to 13 percent of total generation in our calculation. If we assume in the modelling that the charging of the 15 million e-cars in 2030 is not controlled, this value increases drastically once again.

This is a huge challenge that is currently unsolved. For Germany can only achieve a share of 80 percent renewable energies if these generation volumes are integrated. Alternatively, for every percentage point of electricity that is curtailed at midday, a good one percentage point of additional PV capacity must be installed.

In addition, the average sales revenues of solar power in 2030 are already 8.4 percent below those of onshore wind power. Today, it should be noted, the reverse is still true: over the course of the year, electricity from solar plants has a higher market value than electricity from wind power plants. This is mainly due to the fact that electricity consumption is higher during daylight hours. However, this advantage is relativised by the greater increase in the planned construction of solar power compared to wind power.

Over the year, the share of photovoltaic electricity in our scenario calculation is around 26 percent in 2030. Since winter in Germany is not known to be sunny, the average power feed from June to August is about four times the value of generation from December to February.

Insights into the modelling

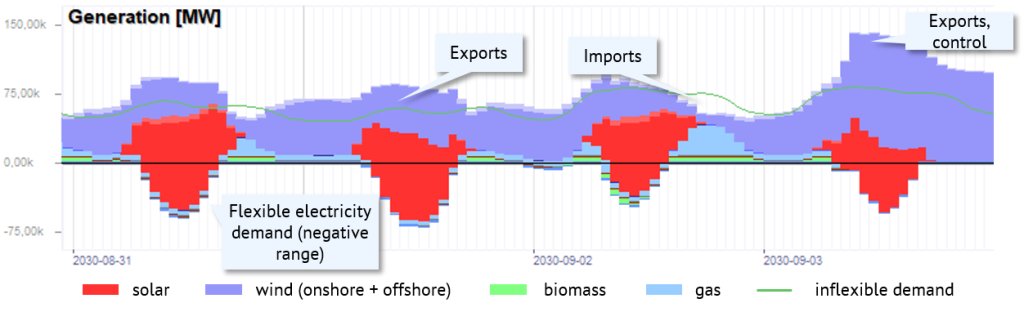

The following figure shows the electricity system on four days in late summer 2030 according to the hourly energy market modelling. When there is plenty of sun and wind, the inflexible electricity demand is supplemented by flexibilised load (e-cars, heat pumps, electrolysers) and surpluses are exported. If sun and wind are scarce, additional gas-fired power plants kick in and imports cover part of the load. There are also days with renewable energy overfeed.

In our modelled world, despite negative electricity prices, flexible electricity demand, electricity storage and exports, in some situations there is no longer a consumer for individual generation load peaks.

Figure 1: hourly generation and demand structure in the modeled electricity system on four days in late summer 2030 (source: Energy Brainpool)

It’s getting cosy in the North Sea

For offshore wind power, there are a few more road markers in the coalition agreement: “We will significantly increase offshore wind power capacity to at least 30 GW in 2030, 40 GW in 2035 and 70 GW in 2045.” [3]. Since offshore wind power is the load king among fluctuating renewables, this is a real booster for renewable power generation for the period after 2030.

The realisation of an installed wind capacity of more than 40 GW, especially on the North Sea, goes hand in hand with exceeding a critical power density, i.e. the amount of installed capacity of wind turbines per area. This can cause noticeable mutual shadowing of the turbines. So far, we assume that the average full utilisation hours will be reduced by 23 percent from 2035 to 2045, but we see a need for further research on this.

Economically, wind turbines get off lightly compared to solar plants. The capture rate of onshore wind energy is “only” reduced to just under 80 percent in the scenario year 2030, and only 87 percent for offshore wind energy. This value indicates the ratio of the market value of the weather-dependent generation profile of wind or solar plants compared to the market value of a base load supply. For solar plants, on the other hand, this value drops much more drastically to 71 percent.

We can do it (?)

In many conversations, customers have asked us “is this even realistic?” Under the condition of achieving 80 percent electricity from renewable energies in 2030 with simultaneous sector coupling, this is at least the most realistic battle plan from our point of view.

First, an increase in the EEG compensation or a solar obligation increases the construction of rooftop PV systems. This is followed by larger ground-mounted PV plants with a somewhat longer planning period in a mix of tenders and large PPA-financed projects.

For onshore wind power, the plan stands or falls with the availability of land. From our point of view, an EEG adjustment and regulation change needs at least four years’ lead time before the annual gross additions start to move into the home straight. In addition, the adjustment faces the increased risk of whether and how long old plants can continue to be operated.

We do not expect an additional increase in offshore wind energy until the end of the decade. An entire industry has to be revived here, and both grid planning and expansion will still take a lot of time.

All in all, we see the coalition agreement as a very ambitious, but possible plan. The good news for electricity consumers: if the plan works out, the wholesale price will fall significantly despite the coal phase-out. Especially with time-variable tariffs for flexible consumers and electricity consumption in summer, very low electricity purchase prices could be realised in the future.

Are you interested in current trends in the energy markets? Find the right workshop for you and your team in the Energy Brainpool seminar calendar.

Reading tip: You can find our general analysis on the results and potential conflict points of the energy and climate policy agenda of the future German federal government here.

[1] List of power plants of the Bundesnetzagentur (nationwide; all grid and transformer levels) as of 15.11.2021

[2] BDEW: Development of natural gas sales in Germany, as of 13.12.2021

[3] Coalition agreement between SPD, Bündnis 90/Die Grünen and FDP 2021, p. 57

What do you say on this subject? Discuss with us!