In August 2023, the German energy market experienced record-breaking electricity generation from wind and solar. However, this is not the only thing that is causing problems for coal. In the meantime, the increased CO2 prices also mean a significant competitive disadvantage for fossil energy generation. Gas and oil prices did not settle down in August either. The LNG strike and OPEC production cuts drove prices up.

In this article, as usual, we look at the energy generation of the past month. In August 2023, more than half of the German electricity mix, i. e. about 19.3 TWh, came from renewable energy sources. About a third, 12.2 TWh, was generated by fossil fuels, while the remaining 15 per cent was covered by electricity imports from abroad. However, how does August compare to previous years?

Renewables year-on-year

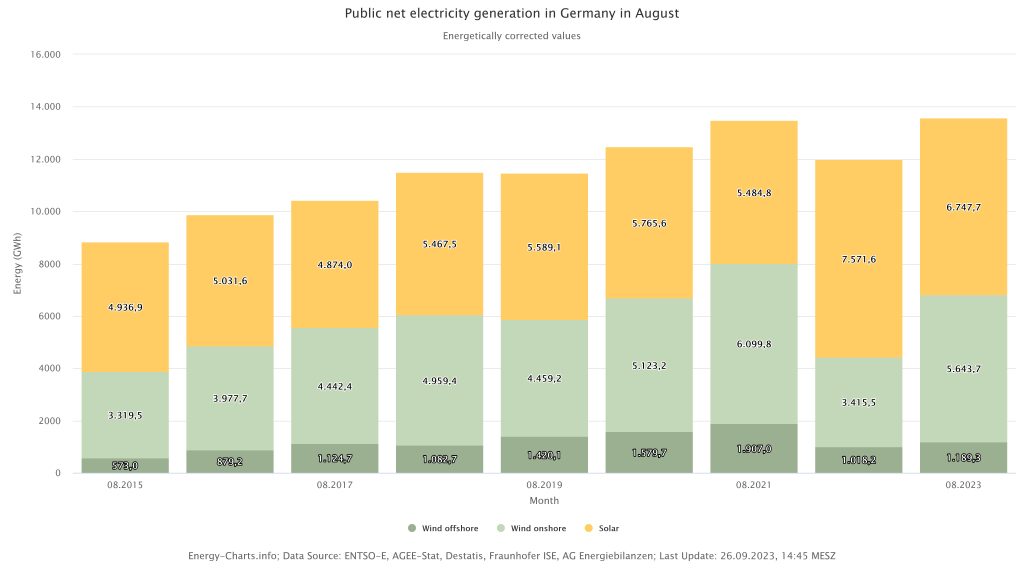

So far, 2023 has been a pleasing year for renewable energy, and August 2023 continues this positive trend. These pleasing figures are mainly due to to record-breaking amounts of energy from solar and wind power. Thanks to favourable weather conditions and high solar irradiation in August 2023, solar plants were able to generate a remarkable 6.7 TWh. This value represents the second highest August value, with only August 2022 being higher at 7.5 TWh. Similarly, wind power contributed 6.8 TWh to electricity generation, landing in second place year-on-year, just behind the peak value from 2021 (Figure 1).

Figure 1: Wind and solar for August 2023 in annual comparison” (Source: Fraunhofer EnergyCharts based on data from EntsoE)

Fossil energy production on the retreat

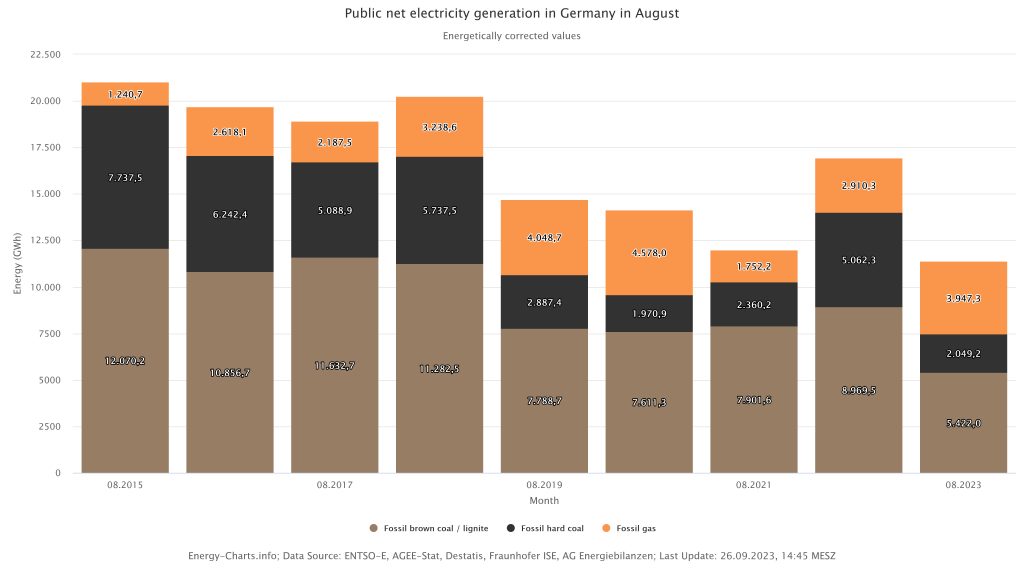

A clear downward trend is emerging in energy production from fossil fuels. In particular, the use of lignite as an energy source has fallen drastically compared to previous years. Actually, power generation from lignite reached its historically lowest level. In August 2023, lignite contributed only a fraction of its former energy volumes, at 5.4 TWh (Figure 2).

The falling price of natural gas partially compensated for this decline. Compared to previous years, natural gas was used significantly more for electricity generation. This trend can largely be attributed to the increased prices for CO2 certificates, in addition to the simultaneously relaxed development of gas prices. These price increases for CO2 certificates affect lignite much more than natural gas and hard coal.

Figure 2: Gas, hard coal and lignite for August 2023 in annual comparison (Source: Fraunhofer EnergyCharts based on data from EntsoE)

Record high electricity imports – a warning signal?

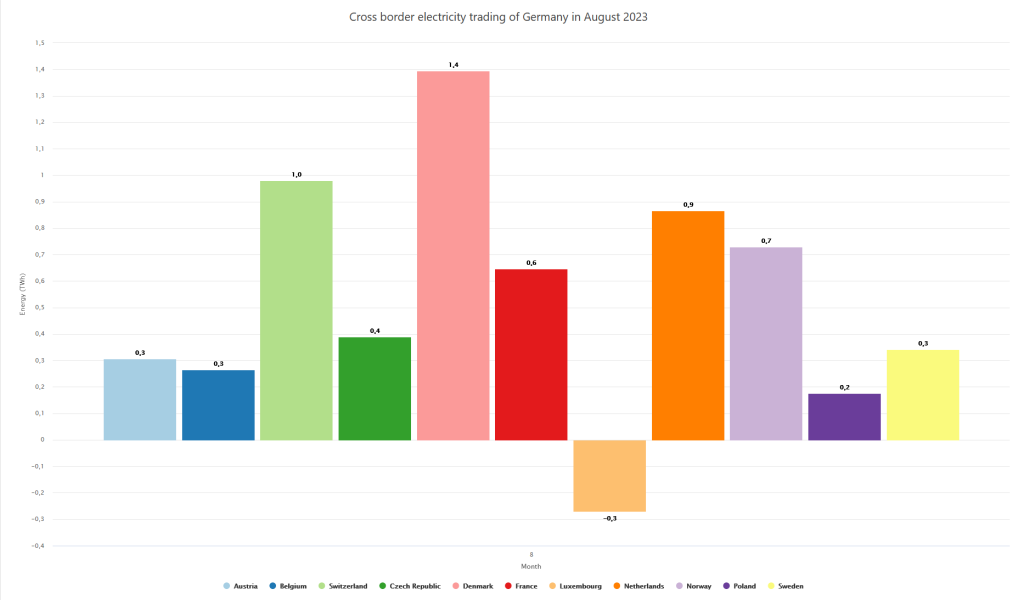

Another record was set in the cross-border electricity market. In August 2023, Germany never before imported so much electricity from abroad. The total import balance amounted to 5.8 gigawatt hours. These volumes came mainly from Denmark, Switzerland, the Netherlands and Norway. Just a few months ago, Germany was a net exporter on the electricity market. Nevertheless, since the phase-out of nuclear energy, the tide has turned: We now import significantly more electricity. However, why is that? Do we no longer have enough capacity of our own to cover our electricity needs? Is a possible blackout looming?

The insinuation that Germany no longer has sufficient capacity of its own to cover its electricity demand is nonsense. In fact, there are still 77 gigawatts of secured capacity available through conventional power generation. These can cover Germany’s electricity needs even in times of highest demand and complete wind and solar slackness. Nevertheless, increased costs for fuel and emission certificates have made importing electricity from abroad more economically attractive than commissioning our own power plants.

The progressive European integration of the electricity market now makes it possible for foreign power plants to offer their energy on the German market. The contract is always awarded to the power plants that submit the most favourable offer – the last one sets the price. This principle is known in the energy industry as “marginal pricing” or “merit order model”. Electricity from renewable energies in particular can bid at very favourable prices here due to its low production costs.

The imported electricity volumes are thus not the result of a lack of capacity, but rather a sign of increasingly efficient pricing on the European electricity markets. All available capacities are taken into account. Bruno Burger of the Fraunhofer Institute explained on Twitter that the imported electricity volumes consisted mainly of 56 % renewable energy, 19.5 % nuclear energy and 24.2 % fossil sources. The data comes from the institute’s own calculation.

In summary, it can be said: Electricity imports are efficient from an economic perspective, smooth electricity price peaks and benefit all stakeholders.

Figure 3: Electricity imports in August 2023 by country and distinction between conventional and renewable (Source: Fraunhofer EnergyCharts based on data from EntsoE, https://twitter.com/energy_charts_d/status/1697927321598988489 (15.09.2023)

Solar expansion picks up speed! Wind is in the doldrums!

The political expansion targets in Germany for 2023 are clearly defined: 9 gigawatts (GW) of new solar plants and just under 4 GW of new wind power plants are to be built. But the current environment is anything but favourable for renewable energies. The interest rate turnaround, strained supply chains and inflation pose significant challenges for German companies when it comes to implementing renewable energy projects.

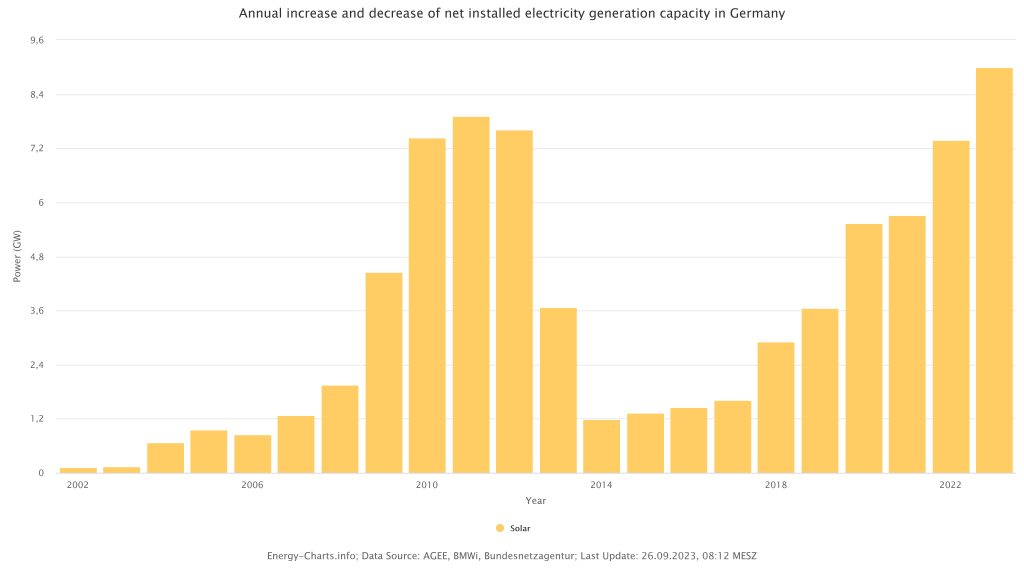

Despite these adversities, solar energy is recording an impressive new construction record. By 14 September, 9 GW of new installations had already been connected to the grid. This means that the political targets have already been 100 per cent achieved. If this trend continues at this pace for the rest of the year, we could even add up to 12 GW of new solar capacity by the end of the year.

The previous record in the addition of solar capacity was reached in 2011 with 7.9 GW. In 2013 and 2014, the figures fell sharply due to the reduction in the EEG tariff at that time (Diagram 4). Since then, the costs of conventional power generation have risen significantly, while solar technology has continuously improved. This led to the use of solar energy becoming more profitable again and the expansion figures rising again.

Figure 4: Addition of installed solar capacity (Source: Fraunhofer EnergyCharts based on data from EntsoE)

This is good news for the solar industry. Especially, since the expansion, targets are to be significantly increased again in the next few years. From 2026 onwards, up to 22 GW are to be added annually (BWMK, 2023). By way of comparison: at the beginning of 2022, there were still a total of 67 GW connected to the grid.

The situation with wind power, on the other hand, differs significantly from solar energy. Wind power expansion remains well below the targets set. A turnaround seems unlikely. By 14 September 2023, only 45 per cent of the expansion targets for 2023 had been achieved. The tender results of the Federal Network Agency (BNetzA) also give little hope. The tender for onshore wind energy took place on 1 August and was signed again. Although the BNetzA had already reduced the volume to 1.6 GW, bids totalling only 1.4 GW were submitted.

But why is wind power doing so much worse than photovoltaics? Overall, the legal framework conditions for wind power are significantly different from those for photovoltaics. Lengthy approval procedures, citizen protests and rising interest costs make new wind projects unattractive.

Another factor is the location. If many wind turbines are already installed in close proximity to each other, they produce their electricity simultaneously. This can lead to grid bottlenecks where the generated electricity cannot be transported from the producer to the consumer. In such cases, the wind turbines are stopped by a so-called redispatch to prevent an overload of the network. The operator then receives an outage payment to partially compensate for the loss. However, this is counter-financed by the grid charges. As a result, end consumers in areas with a lot of wind power could be burdened by higher grid fees, which reduces the acceptance of wind turbines among the population. This factor will have to be taken into account more strongly in the future when new areas are put out to tender and could also slow down the growth of wind power.

Currently, solar and wind energy are distributed very unevenly in Germany. The southern states of Bavaria and Baden-Württemberg have the highest installed solar capacity, but bring up the rear in terms of wind energy expansion. The northern states of Lower Saxony, Schleswig-Holstein and Brandenburg, on the other hand, lead in wind power expansion. For the success of the energy transition, it is crucial to have sufficient wind energy available alongside solar energy, evenly distributed across the country. The targets of the EEG 2023 envisage 115 GW for wind power by 2030 (BMWK, 2023). For this to happen, the pace must be significantly increased to meet the target. Determined political measures are needed to further advance the expansion.

Commodity price development

No calm on the gas markets!

At the beginning of August 2023, the gas price on the TTF was 32 Euros per megawatt hour. The signs were actually favourable that calm could finally return to the gas markets. However, in the months of June and July 2023, reports of throttled Norwegian gas supplies and growing competition for LNG (liquefied natural gas) in Asia drove up gas prices. Nevertheless, by early August the price seemed to have recovered from these developments. Gas storage facilities were filled to record levels and gas consumption was at an all-time low.

But this upswing was short-lived. In the course of August, the price of gas rose significantly again. News of an impending strike at the Australian LNG producer Woodside fuelled the markets. Australia is responsible for around 10 per cent of the world’s LNG production and thus plays a key role in global gas supply. So if there are disruptions in supply from this country, whether through strikes or other shocks, the LNG and gas markets react accordingly. While many analysts assume that this price increase is only a temporary phenomenon, the market remains in an extremely sensitive state.

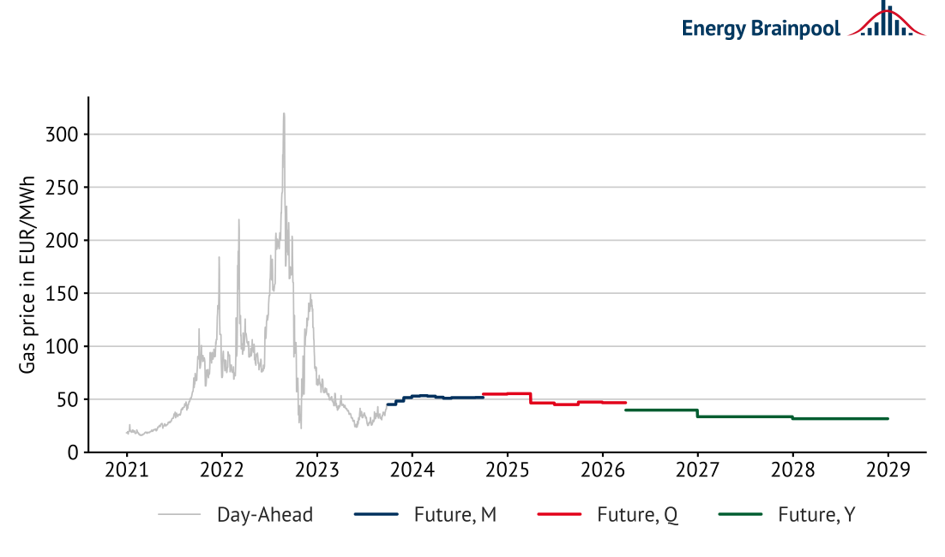

The question of where the journey is heading, however, is anything but easy to answer. A look at the so-called price forward curve can help. This shows the expected prices for an energy product based on the currently traded futures contracts at various points in the future. For the coming heating season and the following years 2024/25, the markets show expectations of a gas price of over 55 euros per megawatt hour. This is about double the pre-crisis level. From 2026 onwards, however, price expectations decline significantly.

Nevertheless, these figures naturally do not provide a reliable answer to the question. They merely reflect expectations under today’s conditions. Gas markets remain vulnerable to external shocks, which means that the signs could change again as early as tomorrow.

Coal and oil prices get a boost

In the course of 2023, the coal price recorded an overall decline. But in August, it suddenly picked up noticeably again. The ICE monthly contract for September was still trading at around 105 US dollars per tonne at the beginning of August. Driven by the uncertainties on the gas market, the coal price could even rise to 128 US dollars at times despite the low demand from power plants. In the meantime, however, the coal price has stabilised again somewhat, together with the gas price, and has even fallen slightly.

In contrast, the oil price has only known one direction since the middle of the year: upwards. Already in May, the price per barrel reached its low for the year of 76 US dollars. Since then, the oil price has easily overcome all obstacles on the way up. Currently, it is quoted at a level of over 90 US dollars. Recently, less than encouraging economic news from Europe, China and the USA has been doing the rounds. Normally, such news leads to a drop in the oil price. But this was countered by a much stronger price-driving factor. The major oil producing countries, Saudi Arabia and Russia, announced that they would maintain their already reduced production levels until the end of the year. This announcement stabilised the price and even drove it up further.

It remains difficult to predict how long this price rally will last. However, prolonged price increases in the oil or energy markets can fuel inflation. If the price continues to rise at this pace until the end of the year, this could be a cause for concern.

External sources:

- Fraunhofer EnergyCharts (2023), URL: https://energy-charts.info (retrieved: 18.09.2023)

- Bruno Burger (2023) via Twitter, URL: https://twitter.com/energy_charts_d/status/1697927321598988489 (retrieved: 18.09.2023)

- BMWK (2023), Eckpunkte einer Windenergie an Land Strategie. Link: https://www.bmwk.de/Redaktion/DE/Publikationen/Energie/photovoltaik-stategie-2023-entwurf.pdf?__blob=publicationFile&v=12 (retrieved: 18.09.2023)

- BMWK (2023), Photovoltaikstrategie. Link: https://www.bmwk.de/Redaktion/DE/Publikationen/Energie/photovoltaik-stategie-2023-entwurf.pdf?__blob=publicationFile&v=12 (retrieved: 18.09.2023)

What do you say on this subject? Discuss with us!