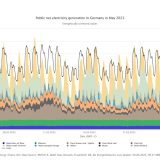

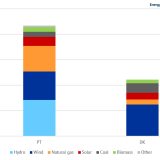

In August 2023, the German energy market experienced record-breaking electricity generation from wind and solar. However, this is not the only thing that is causing problems for coal. In the meantime, the increased CO2 prices also mean a significant competitive disadvantage for fossil energy generation. Gas and oil prices did not settle down in August either. The LNG strike and OPEC production cuts drove prices up.

Continue reading