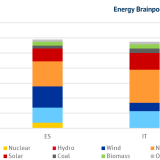

After comparing the German and French energy systems, we now look at the number three and four in the EU: Italy and Spain. Both countries have a power plant fleet and electricity generation of similar size. However, Italy’s power generation is based on natural gas, while Spain generates larger shares of its electricity from wind power and nuclear power. A look at the figures below reveals similarities and differences.

Continue reading