Due to the war in Ukraine, February 22 was characterised by strong price movements on the short-term and futures markets. The certification of Nord Stream 2 has now been finally suspended. Due to the current high energy prices, the German government is already abolishing the EEG levy in the middle of this year. In addition, while the nuclear phase-out is scheduled for the end of this year in Germany, further nuclear power plants are being planned in France.

Abolition of EEG levy: hoped-for relief for consumers?

Last month, the federal government had already announced a legal reform to protect consumers from higher energy prices. According to the Federal , consumers had to pay 20.5 percent more for energy in January 2022 than in the previous year. For this reason, the German government took further steps at a coalition summit on 23 February and decided to abolish the EEG levy on 1 July.

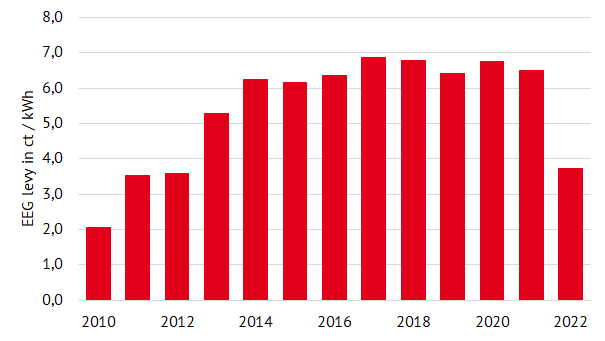

This will provide relief for the end consumer six months earlier than planned. The high electricity prices are mainly the result of high gas prices as well as high CO2 levies and increased grid fees (source: Renewables Now). As shown in Figure 1, the EEG levy has remained above 6 ct/kWh since 2014 and is now for the first time below this level at 3.723 ct/kWh. This means that the levy has fallen by 43 percent (source: netztransparenz).

Subsequently, the decrease is partly due to the rise in exchange prices and thus higher sales revenues for renewable energy sources. In addition, since 2021, the EEG account has been credited with the revenues from the national CO2 price. Actually, these amounted to 10.8 billion euros in 2021. In 2022, the subsidy amounts to 3.25 billion euros (source: BMWI).

According to the Minister of Finance, Christian Lindner, the abolition of the EEG levy will lead to relief amounting to 6.6 billion euros. Whether the benefits will reach end consumers to this extent remains unclear (source: Renewables Now).

Figure 1: development of the EEG levy from 2010 to 2022 (source: Energy Brainpool)

How can Germany become less dependent on Russian gas imports?

After Russia invaded the country, the certification process of Nord Stream 2, which had already been halted, has now been definitively suspended. By using the pipeline, it would have been possible to transport 55 billion cubic metres of gas per year into the territory of the European Union. Currently, 65 percent of Germany’s imported natural gas comes from Russia.

It is unlikely that Russia will stop its gas exports to the EU, as the country relies on the financial income from energy exports (source: Reuter). In order to achieve supply independence, German Economics Minister Robert Habeck announced the establishment of a national gas and coal reserve (source: energate-messenger).

In this context, there is also an increasing talk about importing LNG (Liquified Natural Gas). Germany does not currently have its own terminal. But the construction of the first terminal in Niedersachsen has been initiated. However, it will take until 2026 before this terminal is operational and until then Germany can only import LNG via its neighbouring countries Belgium, France or the Netherlands (source: Offshore-Energy). Figure 2 shows existing and planned LNG terminals for the EU.

Figure 2: LNG-terminals in Europe, status: 2022 (source: EU Commission)

Nuclear power: Germany is phasing out, France announces more nuclear power plants

While Germany is due to phase out nuclear power at the end of this year, France currently still generates about 70 percent of its net electricity from nuclear power. French President Macron is now announcing six new nuclear power plants. As early as 2035, the first could go online. The aim is to continue to guarantee security of supply and clear the way to climate neutrality (source: The Guardian).

The French electricity provider EDF had already discovered safety deficiencies in a nuclear power plant in December last year. Consequently, two more nuclear power plants were shut down last month as a preventive measure in order to be further investigated. Cracks were found in the safety circuits of the reactors.

As a result, the nuclear power plants’ generation target for this year was lowered to 295–315 TWh (the original plan was 300-330 TWh). By the end of 2023, all 56 reactors in France are to be inspected and thus shut down. For this reason, the nuclear power plant production target for 2023 has also been lowered by 12 percent to 300-330 TWh (compared to the previously planned 340–370 TWh (source: Montel).

Why the European Commission has included nuclear power in the EU taxonomy and classified it as climate-friendly can be read here.

Strong price movements on the future markets

In the first half of the February month, prices were depressed by a record high wind feed-in. With Russia’s invasion of Ukraine, the futures markets reacted with strong price movements and electricity, gas, oil and coal prices shot up. Temporarily, the front-year gas price reached 73 EUR/MWh on 24 February, only to fall by 20 per cent the next day. The recovery was due to mild weather, high LNG storage levels and surprisingly high gas supplies from Russia (source: Montel).

Cal 23 has risen to a record high of 132 EUR/MWh. The coal price also reacted to the conflict with a strong increase of about 30 per cent. The front month for Brent oil reached a 7-year high on 22 February. It rose to USD 97.83/bbl (source: Montel)

On 8 February, the EUA contract traded at a new all-time high of 98.49 EUR/t EUA. With increasing sanctions against Russia, the CO2 contract has fallen and closed the month at around 83 EUR/t EUA (source: Montel).

Figure 3: percentage price development of the German power front year (candle sticks), Brent oil with delivery in April 2022 (orange line), CO2 allowances with delivery December 2022 (red line), gas front year at the TTF (yellow line) and coal front year (green line) from the beginning of February 2022

Record wind feed-in and the Ukraine crisis drive short-term market prices

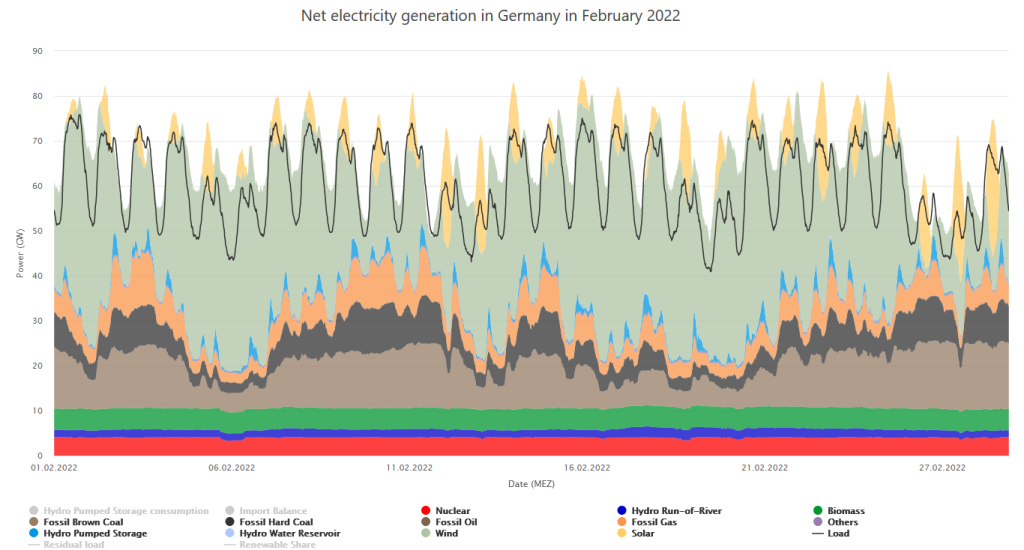

In fact, renewables’ share of net electricity generation was at a record high of 61.70 per cent. In comparison: In February 2021, the share was 44.7 percent. As a matter of fact, the high share is due in particular to the record-high wind feed-in this month (source: Energy-Charts).

The storm low “Zeynep” brought the wind feed-in to 41,000 MWh on 19 February. This pushed spot prices into negative territory for 4 hours. Despite the record wind feed-in of 48,663 MWh on 20 February due to the storm low “Antonia”, the sport prices remained in positive territory (source: energate-messenger).

Besides that prices on the short-term markets were also subject to strong price fluctuations due to the Ukraine crisis. The day-ahead on the Dutch TTF came out of trading at 100 EUR/MWh.

Figure 4: electricity generation and consumption in February 2022 in Germany (source: Energy-Charts)

Are you interested in what happend last month? Then check the energy market review January 2022.

You want to have an overview about the last year? Here, you can find our annual review.

What do you say on this subject? Discuss with us!