Anyone who thought the energy year 2021 would be rather quiet after the turbulent Corona year 2020 was proven wrong by September 2021 at the latest. While climate protection was the main topic in the first half of the year, the second half brought record prices in almost all markets.

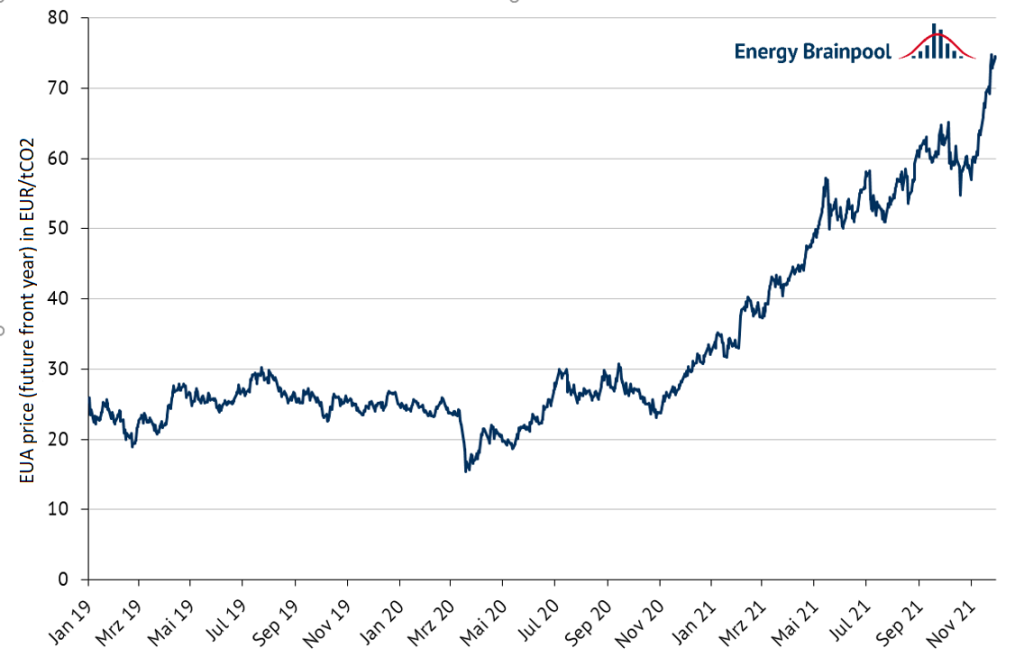

Since the end of 2020, certificate prices for CO2 in the European Emissions Trading Scheme (EU ETS) have risen steadily. One reason was the improved economic situation following the global Corona lockdowns of 2020. Furthermore, the announcement of a tightening of the European climate target from 40 to 55 per cent greenhouse gas emissions in 2030 compared to 1990 caused CO2-prices to rise to almost EUR 50/ton in the first quarter of 2021.

Climate protection plans drive CO2-market

The market anticipated what was published by the EU Commission on July 14, 2021. Namely, the “Fit for 55” package, which significantly revised the EU’s climate protection efforts upwards until 2030. A shortage of allowances in the EU ETS, the integration of shipping as well as the establishment of a new EU ETS for buildings and road transport kept the energy and climate experts busy. Read our analyses of the Fit-for-55 package in detail (Part I and Part II). Figure 1 shows the development of CO2 allowance prices from the beginning of 2021 to the start of December 2021, topping 75 EUR/ton.

Figure 1: EUA prices over the course of January to the end of November 2021 in EUR/ton (source: Energy Brainpool)

Towards the end of the year, however, long-term price expectations due to the new climate targets played less of a role in the CO2 market. Rather, certificate prices rose in line with gas and coal prices.

However, more ambitious plans were put forward not only at EU level, but also in Germany. In May 2021, the national government defined stronger climate protection paths for the various sectors in the new Climate Protection Act following a ruling by the Federal Constitutional Court. According to our calculations, to achieve the target of 65 per centemissions in 2030 compared to 1990, much more renewables would have to be added. At the same time the coal phase-out would have to be brought forward in parts to 2030.

Rising energy consumption and weak renewables

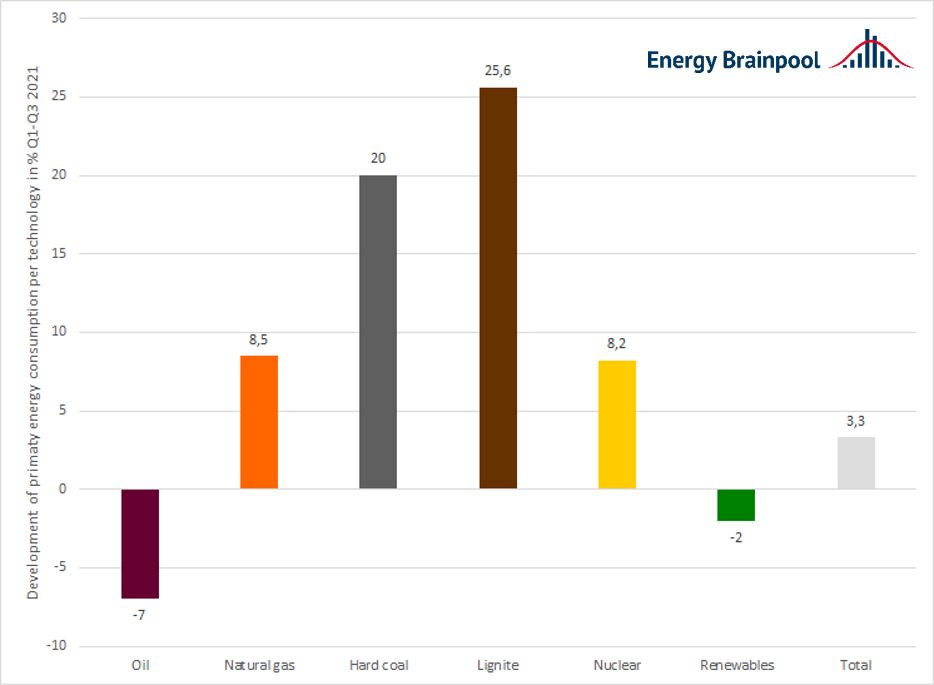

The economic recovery in 2021, together with cold weather, led to rising energy consumption, especially in the first five months of the year. The Arbeitsgemeinschaft Energiebilanzen (Working Group on Energy Balances) forecasts growth in primary energy consumption of just under 3 per centfor 2021 as a whole.

Gas and coal consumption rose in particular by 8.5 and over 20 per centrespectively, during the first nine months of the year. This was due in no small part to a lower supply of wind energy over the course of the year. The percentage changes in the various energy sources compared to the first three quarters of 2020 can be seen in Figure 2.

Figure 2: development of primary energy consumption by technology in per centQ1–Q3 2021 compared to the same period last year (source: Energy Brainpool)

Accordingly, Germany’s energy-related emissions will increase by about 4 per centcompared to 2020. However, 2021 consumption levels are still below pre-Corona 2019 levels. Major changes for electricity generation next year will result primarily from the decommissioning of three nuclear power plants with a capacity of over 4 GW at the end of 2021.

Scarce energy commodities cause record prices

While prices for coal and gas on the world markets stood at a moderate level at the beginning of 2021, they rose steadily during the year. Less Corona measures and lockdowns boosted the global economy and also caused demand for fossil raw materials to rise.

From September 2021, however, prices skyrocketed. The monthly reference price for European natural gas at the TTF trading point reached over EUR 120/MWh, while coal prices rose to over USD 250/ton. Rising natural gas demand in Asia meant that fewer LNG deliveries were available for Europe. In the meanwhile, coal prices set new records due to high Chinese power and thus coal demand.

We have taken a closer look at the causes and developments in the commodity markets perturbations of 2021 here and here. Figure 3 shows the price trend from the beginning of the year to the end of November 2021 for different energy commodities.

Figure 3: percentage price development of German front year base 2022 (candle sticks), gas front year at the TTF 2022 (light green line), CO2 allowance prices for December 2022 (orange line), and API2 coal prices for 2022 (red line) from the beginning of 2021 to the end of November 2021 (source: Montel).

The very high price situation from the beginning of October 2021 has calmed down somewhat towards the end of the year. However, price movements still show high fluctuations. The extreme situation around commodity prices in the fall and winter of 2021 will certainly still lead to far-reaching discussions about supply security, the approval of the Nord Stream 2 gas pipeline and the procurement strategies of energy suppliers in the coming months.

What will move the markets in 2022?

The high volatility and record prices in 2021 will keep market participants busy for some time. Procurement strategies and risk manuals will become more important in dealing with an ever-changing market environment. High electricity prices are likely to boost further renewable PPAs by combining reliable prices and green co-benefits. Hedging long-term PPAs, as well as switching between renewable energy marketing models, is likely to become more important in light of high market values.

The new coalition of Social Democrats, Greens and Liberals has to make a number of important decisions in the coming year (source: coalition contract):

- drastically accelerating the expansion of renewables (2 per centof the land area for onshore wind, 200 GW PV and 30 GW offshore wind by 2030)

- dealing with coal phase-out and capacities for gas-fired power plants (coal-phase out by 2030 and reviewing capacity mechanisms)

- further developing and harmonising of climate protection targets with EU-level targets and systems (80 per cent renewable electricity by 2030, minimum price for CO2)

The energy markets certainly will have interesting times ahead during the next year.

We look forward to accompanying and supporting you with our expertise.

What do you say on this subject? Discuss with us!