So far in 2021, prices on the energy markets have reached record highs. Coal and gas prices in particular have risen sharply, reaching their highest levels in over a decade. These developments have partly led to a backswitch from gas to coal-fired power generation and thus, in conjunction with rising CO2 prices, also to high electricity prices. In the following, we clarify the underlying processes.

Front-month and quarterly prices for the fuels hard coal and gas have been at over 13-year highs in recent weeks. On the side of coal prices, globally rising electricity demand led to higher consumption. Together with simultaneous supply restrictions due to strikes and weather events in Colombia and Australia, this led to sharply rising prices. For example, API 2 index prices for hard coal have more than doubled from just under 70 USD/tonne at the beginning of 2021 to over 160 USD/tonne in September 2021.

Record highs in coal and gas prices

Gas prices in the EU have moved upwards due to the cold first half of the year, low storage levels, fewer deliveries from Russia and more LNG deliveries to the still higher-priced Asian region. Here, the prices tripled since the beginning of the year: at the most liquid gas trading point in the EU, the Dutch TTF, prices for the fourth quarter of 2021 rose from around 17 EUR/MWh at the start of 2021 to over 55 EUR/MWh at the beginning of September 2021.

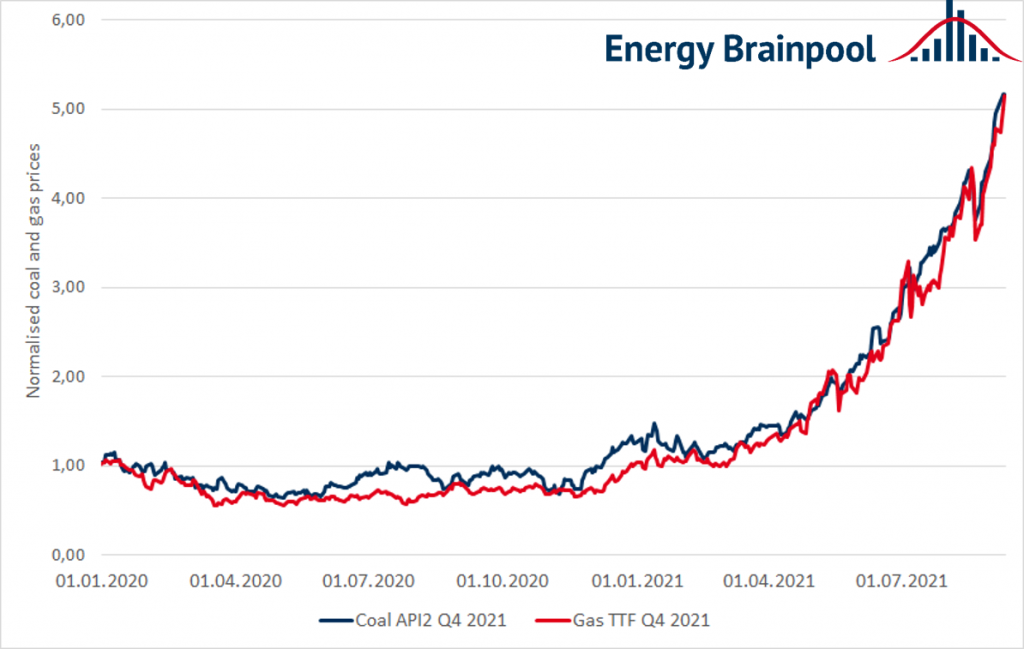

Figure 1 shows the normalised prices of the Q4 2021 forward market contracts for the hard coal price index API2 and the European reference gas price at the trading point TTF in the Netherlands from the beginning of 2020 to 9. September 2021. From the normalised price movement since the beginning of last year, it is clear that prices have moved very strongly upwards, especially from Q2 2021 onwards.

Fig. 1: Normalised prices Q4 2021 for API 2 coal and TTF gas from the beginning of 2020 to the beginning of September 2021 (source: Energy Brainpool).

Coal-fired power generation is coming back

Electricity demand in Europe rebounded from the pandemic-induced slump in 2020. At the same time, wind power feed-in in the first half of 2021 was very low compared to the average. In Germany, electricity generation by onshore wind turbines fell by 21 percent compared to the previous year, while offshore turbines fell by 16 percent. Thus, more thermal power plants have generated electricity. The rising fuel costs and also higher CO2-prices of over 50 EUR/tonne thus had a price-increasing effect on electricity prices as well.

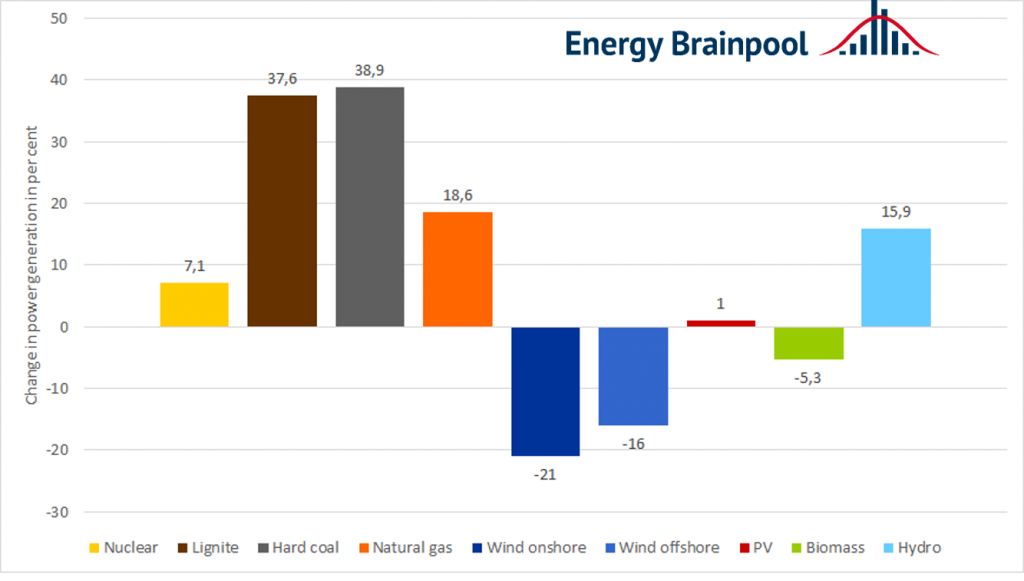

The aforementioned effects of low generation from renewable energy and higher consumption led to a significant increase in coal-fired power generation, at least in Germany (source: Fraunhofer ISE). Lignite-fired power plants, which had to calculate with rising CO2 prices but not with rising fuel costs, experienced an increase in electricity generation of almost 38 percent in the first half of 2021 compared to the same period last year. Similarly, by the end of June 2021, generation from coal-fired power plants was 39 percent higher than in the first six months of 2020. However, generation from coal-fired power in the first half of 2021 was still below the levels seen in 2019. Figure 2 presents the percentage changes in net electricity generation from the different generation technologies in the 1st half of 2021 compared to 2020.

Fig. 2: Percentage change in electricity production comparing H1 2020 to H1 2021 (source: Energy Brainpool).

Fuel switch or backswitch?

Despite the sharp rise in gas prices, the overall picture still shows a fuel switch from coal to gas. In the first six months of this year, Germany’s gas-fired power plants generated almost 19 percent more electricity than in 2020 and 25 percent more electricity than in 2019. The increase in coal-fired power generation is thus mainly driven by low renewable generation, increased electricity demand and partly also by the high gas prices this year. However, despite the increase in coal-fired power generation in Germany, there is still no sign of a definite backswitch from gas back to coal.

What is important in this context is above all the relationship between the price increases for coal, gas and CO2. If the rise in CO2 prices is higher than the rise in gas prices in percentage terms, and if prices for hard coal increase as well, the generation costs of hard coal-fired power plants are in most cases still higher than the electricity generation costs of modern and efficient gas-fired power plants. That is due to higher CO2 intensities of electricity generation in hard coal power plants. Lignite-fired power plants are also slowly but surely slipping into the loss zone at even higher CO2 prices than currently. Depending on the gas price, this would lead to either higher gas generation in Germany or higher imports of electricity to cover demand. In recent weeks, however, the increase in gas prices has been higher than that of CO2 prices in percentage terms, so that in some cases coal-fired power plants are again driving gas-fired power plants out of the market.

In any case, the current development shows the complex processes on the energy market and the effects of interacting commodity prices on shifts in the generation mix.

Learn more about energy futures market trading in our live online training “The Futures Market for Optimising Power Trading” on 6 and 7 October 2021 (available in English on demand).