The offshore wind auction clears subsidy free. The new federal government will set the course for climate policy in Germany. Preparations for the start of national emissions trading are in full swing. New record prices for gas & co. have been set on the short-term and futures markets.

Zero-cent bids of the tenders for offshore wind

On 9 September 2021, the Federal Network Agency announced the results of the first tenders for offshore wind with a pre-investigated area. The bidding date will take place annually on 1 September from 2021 on. The wind farms awarded bids are scheduled to go into operation from 2026. The bidding volume is based in each case on the area development plan. The award entitles the bidder to a grid connection and the right to operate the offshore wind farm for 25 years (source: Federal Network Agency).

This year, three areas with a total tender volume of 958 MW were put out to tender. Two areas (N-3.7 and N-3.8) are located in the North Sea and one area in the Baltic Sea (O-1.3). RWE Renewables Offshore Development Two GmbH was awarded the N-3.7 site (225 MW). EDF Offshore was awarded the contract for site N-3.8 (433 MW). RWE Renewables Offshore Development One GmbH was awarded the contract for area O-1.3 (300 MW). The award value on all three areas is 0 ct/kWh. This means that the bidders intend to market the electricity generated without money from the EEG subsidy. Moreover, this underlines the applicants’ great interest. In two cases, the decision was made by drawing lots because several bidders had offered zero-cent bids (Source: BWO).

The outcome of the German federal elections – what will future climate policy look like?

The outcome of the German federal elections will set the course for climate policy in Germany. Exploratory talks are currently taking place. The Greens and the FDP, in particular, represent partly quite different views. While the FDP advocates the digitalization of the energy transition, the Greens see government regulation as the right solution (source: DNR). But important common goals can also be found. Both parties strive to design the approval process leaner in order to expand the construction of solar and wind parks more quickly. It is important to them to increase the recycling rate and to further promote the circular economy. To this end, they also advocate the renaturation of peatlands as CO2 reservoirs. In climate policy, both the FDP and the Greens focus on smart CO2 pricing. On the subject of transport and mobility, the parties agree that the charging station infrastructure for electromobility must be expanded. However, the Greens want only emission-free cars to be newly registered from 2030. The FDP rules this out completely. Opinions also differ on the issue of climate neutrality from 2050. The FDP wants to achieve climate neutrality in 2050, while the Greens aim for early 2040 (source: DW).

National Emissions Trading – Certificate Sales Start

Over the month of September, preparations for the introduction of the national emissions trading system (nEHS) were in full swing. The start of sales is on 5 October 2021 (source: EEX).

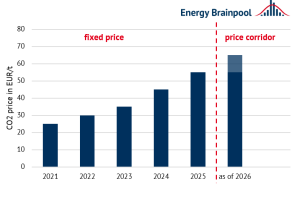

The EU ETS and the nEHS both operate according to the cap and trade principle. The key difference is that the EU ETS is a “downstream” emissions trading system. The nETS, on the other hand, operates according to the “upstream” principle. This means that in the EU ETS, those who emit CO2 have to pay. In the nETS, the participants who market the fuels have to buy certificates. Accordingly, this refers to companies that sell or supply fossil fuels. All fuels that emit CO2 when burned are included, as well as biomass. The heat and transport sectors are also taken into account because of their large CO2 reduction potential. As figure 1 shows, the nEHS will start with a fixed price from 2021 to 2025. In this period, the prices for the allowances are already fixed for the respective years. From 2026, the CO2 prices will be determined within a price corridor. The minimum price is 55 EUR/ t CO2 and the maximum price is 65 EUR/ t CO2 (source: DEHSt).

Extremely high gas, electricity and coal prices

Record prices for gas, electricity and coal are trading at multi-year highs. This is due to the rapid increase in demand caused by the expected below-average low temperatures. Figure 2 (source: Montel) shows that gas in particular saw a steep rise in September due to low storage levels, and prices were trading at all-time highs. Front month traded above 85 EUR/MWh. Front year reached a record high of just over 60 EUR/MWh (source: Montel).

The coal price rose to a 13-year high and front year traded at 144.50 USD/t. The extremely high price is supported by low-temperature forecasts, low spot supply and low gas supply. The low levels of gas storage are significantly increasing the profit margins of coal-fired power plants (source: Montel).

The rise in gas prices and a general bullish atmosphere also created new all-time highs in the power market. The Cal 22 Base reached 129.44 EUR/MWh and an end is not yet in sight. The CO2 price decoupled early on from the course of skyrocketing gas and power prices and hovered around 60 EUR/t CO2. At the end of the month, the EUA lead contract nevertheless reached a new all-time high of 65.77 EUR/t CO2 (source: energate-messenger).

In our PPA Intensive Seminar XL on December 7-9 2021 (in German), we will discuss current developments and provide you with the necessary understanding for evaluating price developments in the coming months based on an exemplary analysis.

Fig. 2: Percentage price development of the German electricity front year (candle sticks), CO2 allowances with delivery in December 2021 (red line), Brent oil with delivery in December 2021 (orange line), gas front year on the TTF (yellow line) and coal front year (green line) from the beginning of September to the beginning of October 2021 (source: Montel)

Little renewable power generation and peak prices on the German short-term market

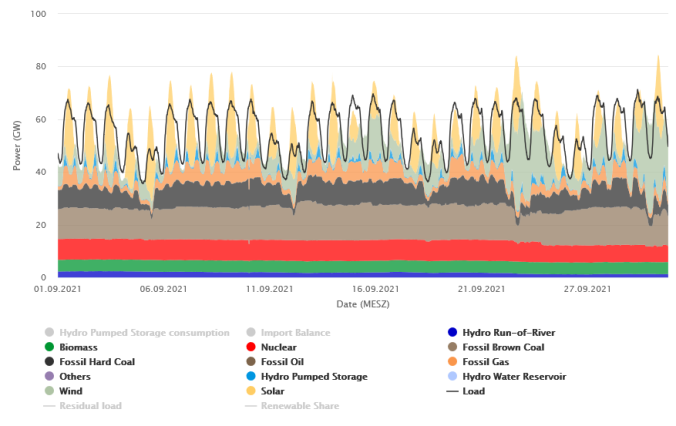

At 41 percent, the share of renewables in electricity generation was significantly below both the previous month and the annual average of 47 percent. Towards the end of the month, high wind feeds announced themselves, which are usual for this time of year.

In addition to the records on the futures market, there were also new price peaks on the short-term markets. The gas price on the day-ahead rose to over 65 EUR/MWh (source: Montel). The electricity price on the day-ahead climbed to 130.23 EUR/MWh at the end of the month, a new all-time high (source: energate-messenger). Figure 3 (source: Energy-Charts) shows electricity generation and consumption in September 2021.

Lern more about electricity price forecasting techniques in our live online training on December 1-2.