Energy crunch in Europe? Energy prices have been breaking one record after another for several weeks. Where does the extreme rise in electricity, coal and gas prices come from? Is the price rally a short-term outlier or a sign of higher energy prices also in the future? In this article, we explain main global and regional causes of the current price developments on the energy markets.

“Energy suppliers file for bankruptcy” or: “Shortage of fuel in the UK” – headlines like these are spreading for a few weeks now. Recently, prices for electricity, gas and coal have increased to their highest levels since the start of the liberalised energy market, or at least within the last 15 years.

A price rally without equal

The price for the delivery of electricity in the German market area for the year 2022 reached over 150 EUR/MWh at the beginning of October. Gas front month prices on the Dutch TTF trading point were up to EUR 120/MWh on 5 October 2021, and coal prices for November delivery also climbed to over 260 USD/tonne.

It seems like a new record is set on a daily basis, and that we encounter prices that only a few months ago belonged to the realm of fantasy. Figure 1 shows the percentage price movement for electricity, gas, coal and CO2 since the beginning of 2021 (source: Montel). Starting on 6 October 2021, there was a short-lived price collapse in the energy market, highlighting the challenging uncertainties and risks due to high price volatility.

Figure 1: Percentage price development of the German electricity front year (candle sticks), CO2 allowances with delivery December 2022 (red line), gas front year at the TTF (green line) and coal front year (yellow line) from the beginning of 2021 to 11 October 2021 (source: Montel)

Rising prices for energy commodities

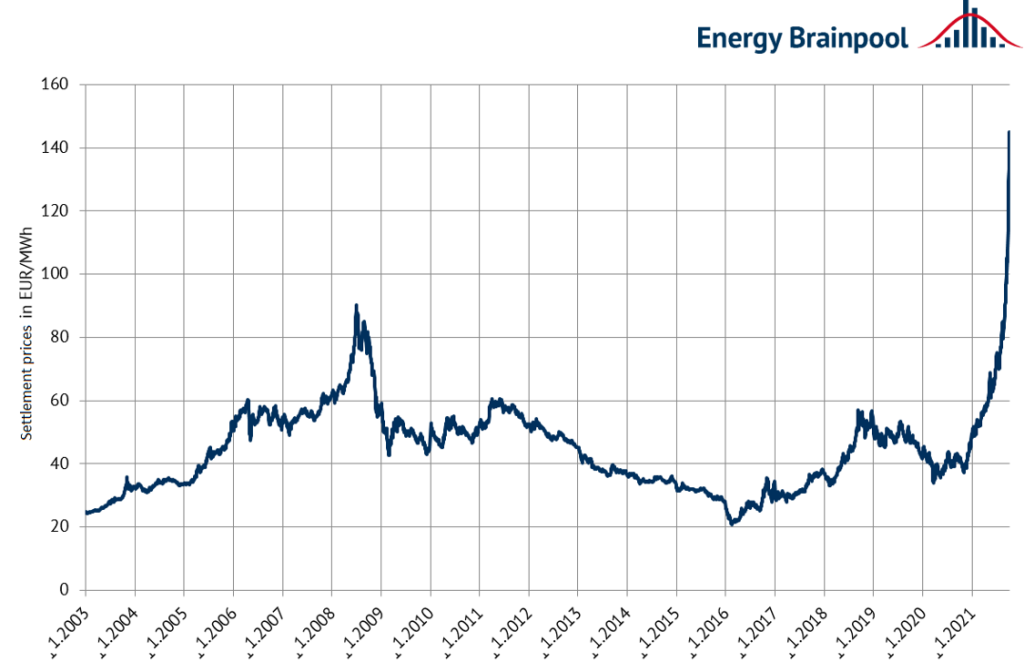

Since the beginning of September, there has only been one path for energy commodities: upwards. It is clearly visible in Figure 1 that CO2 certificates (red line) held the role as the main price driver for electricity up to July 2021. However, the record prices at which electricity is traded on the energy exchanges today are mainly due to the unprecedented rise in prices for gas (green line) and coal (yellow line). It is therefore hardly surprising that electricity prices are also at their highest level in a long-term comparison (see Figure 2). The price peak reached before the global financial crisis in 2008 has now been far exceeded. Electricity prices for base-load delivery in 2022 were almost twice as high as 13 years ago at the beginning of October 2021.

Figure 2: Front-year prices for the supply of base-load electricity for Germany, as of 5 October 2021 (source: Energy Brainpool)

What factors led to the current price situation?

From a global perspective, various events led to the currently elevated energy prices in Europe. A low feed-in from renewable energies in 2021, the high CO2 prices in the European emissions trading system due to increased climate protection efforts, or the discussions about the Nord Stream 2 gas pipeline are hardly responsible as individual and simple reasons for the current price situation. Rather, we can speak of a perfect storm, i.e. the coincidence of various factors, some of which are interdependent and some of which are independent of each other, which ultimately cause these extreme prices. Several of those factors are briefly explained below.

Main global and regional causes of the current price developments

The feed-in from wind energy, in particular in Germany, has been strongly below average so far in 2021. Together with an increase in demand since the Coronavirus pandemic, conventional power plants had to generate more electricity. This increased the demand for gas and coal, and drove up the prices of both commodities.

In addition, the EU Commission published its “Fit for 55 Package” in July 2021 to implement increased climate ambitions. Already in the run-up to the publication of the proposals to adjust the European emissions trading system, the prices for CO2 certificates rose. Market participants already anticipated the potential future shortage of emission allowances in the prices since the beginning of the year. The higher CO2 prices were added to the electricity generation costs of the fossil power plants and thus also led to higher electricity prices.

On the fuel side, there were frequent supply restrictions for hard coal which is traded on the world market in the course of 2021 due to strikes and natural disasters in important producing countries, such as Colombia and South Africa. At the same time, global electricity consumption also increased again in 2021 compared to 2020. The reason for this was not only a resurgent economy but also the demand for electricity for cooling systems due to the very hot summer in Asia. A limited supply situation thus met with higher demand for coal and boosted prices.

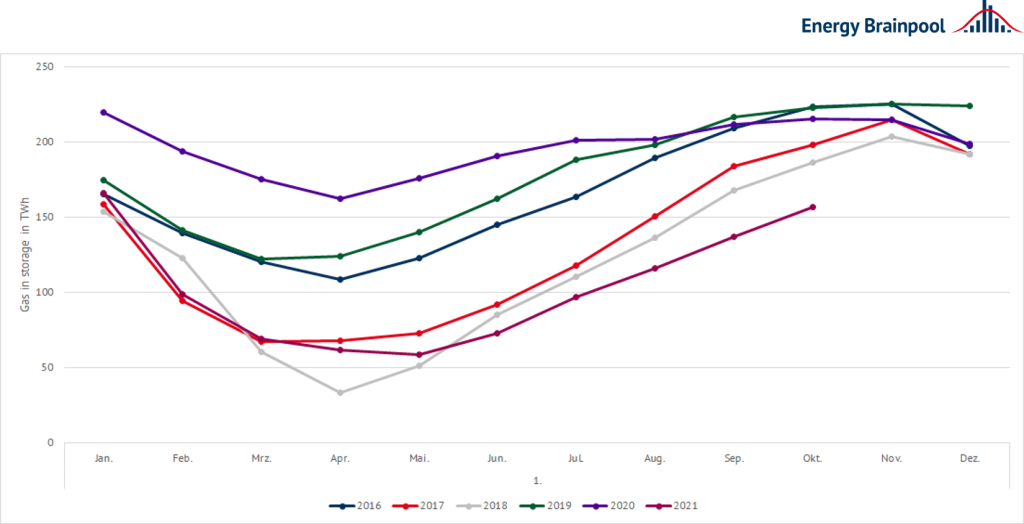

In the case of gas prices, higher demand also met with moderate supply. A long heating season in Europe lasting until May was followed by heavy air conditioning use in Asia throughout the summer of 2021, driving global demand for gas. Therefore, compared to previous years, filling up the European gas storages for winter demand only started towards June. The low storage level can also be seen in Figure 3, which shows the gas storage level of German facilities at the beginning of each month from 2016 to 2021.

Figure 3: Level of German gas storage facilities at the beginning of the month 2016 – 2021 in TWh (source: Energy Brainpool)

Furthermore, liquefied natural gas (LNG) deliveries went to the Asian region over the summer, as customers showed a greater willingness to pay. Likewise, higher imports of LNG were recorded by South America, where low hydropower generation had to be compensated by gas-fired power plants due to droughts and low water levels (source: Timera). The geopolitical debate surrounding the new Nord Stream 2 gas pipeline and Russia as a gas supplier also came to a head: Gazprom did not make any capacity bookings beyond existing contracts on gas pipelines via Ukraine and Poland despite the high prices in Europe.

Where do we go from here?

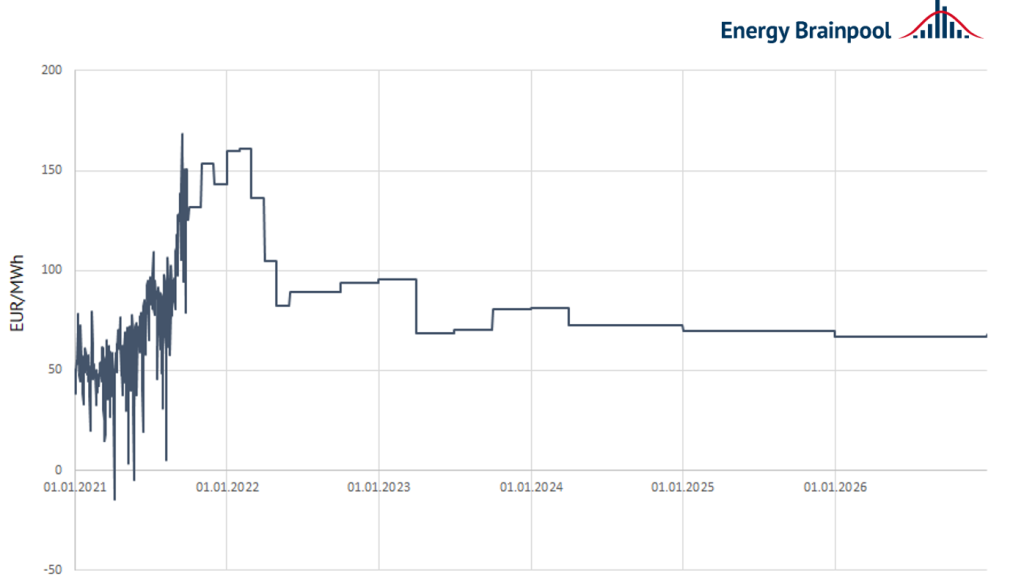

As of the beginning of October, gas prices are the biggest driver of electricity prices. If the upcoming winter turns out to be mild and gas storage levels continue to approach the long-term average, gas prices – and hence electricity prices – can be expected to decline or at least stabilise. Nevertheless, high prices seem to be set for this winter. Not until spring 2022 does the price forward curve of the front products for the base load supply of electricity point downwards again (see Figure 4). On the market side, a normalisation of prices can thus be expected from the middle of next year.

Figure 4: Price-forward curve for base load power Germany on the EEX in EUR/MWh from end of September 2021 (source: Energy Brainpool)

In any case, the high price phase will force energy suppliers to rethink their procurement and sales strategies and possibly change them. A consideration of the geopolitical context as well as strategies for hedging price risks are indispensable in this volatile phase and will become increasingly important as gas and energy markets continue to grow together globally.

However, this market development also offers operators of EEG plants new opportunities for additional revenues. Alternatives to the market value-based remuneration model are supplementary fixed price regulations within the market premium model as well as the short-term switch to other direct marketing. A data-based evaluation of these alternatives including a discussion of the options for action is part of our PPA Intensive Seminar XL from 7 to 9 December 2021.