The year 2023 not only brought the German electricity market a substantial recovery from the high price phase in 2022, but also held some exciting developments in the areas of prices, generation, capacity expansion and electricity trading.

In particular, the shutdown of the last three remaining German nuclear power plants sparked some controversial debates.

Saving energy and relaxation of the market: falling electricity prices in 2023

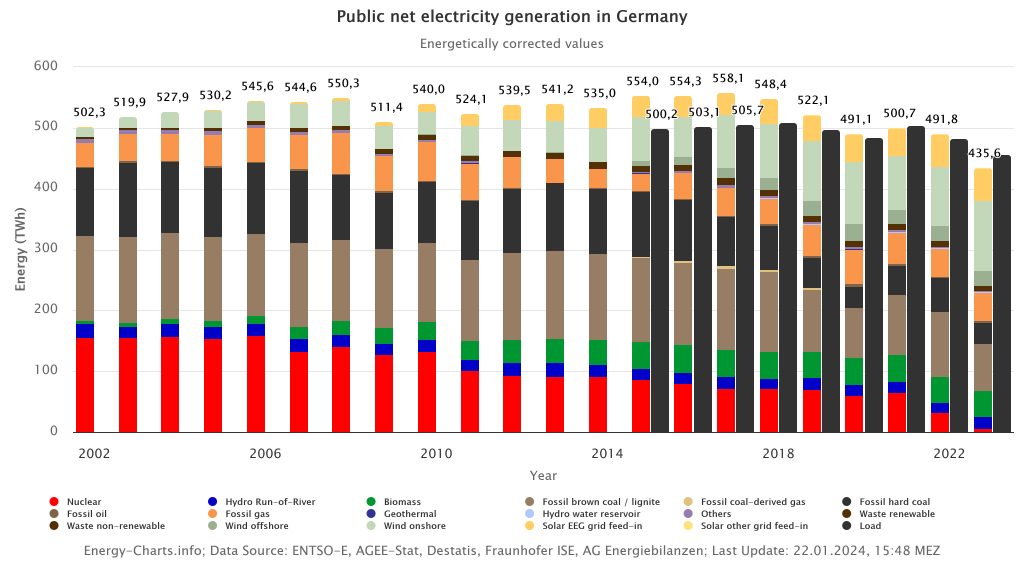

In 2023, both net electricity generation and load in Germany have fallen to their lowest levels since the early 2000s, as shown in Figure 1. Last year, 435.6 TWh of energy was supplied in public net electricity generation, which represents a decrease of 56.2 TWh compared to the previous year. Although the load has also fallen, its decline has been smaller than the drop in generation, resulting in a discrepancy of around 22 TWh. The decline in load is mainly due to two factors:

- On the one hand, both private and commercial consumers reacted to the rise in electricity prices and the comparatively mild weather conditions and reduced their consumption. Due to the economic situation and high electricity prices, companies in energy-intensive industries also reduced their consumption.

- In addition, private and commercial consumers have increasingly been relying on decentralised electricity production and prosuming, particularly of solar power. This led to a lower grid load, which encouraged a reduction in net public electricity generation on the German power market.

Figure 1: Public net electricity generation and load in Germany up to 2023 (Source: energy-charts.info)

In addition to the changes in energy volumes, we also observed significant changes in prices in 2023. Compared to 2022, the volume-weighted average prices fell by more than half. In 2023, the average volume-weighted day-ahead power price was €92.29/MWh or 9.23 cents/kWh, and the average volume-weighted intraday hourly power price was €97.92/MWh or 9.79 cents/kWh. This compares to values from 2022 of € 230.57/MWh (day-ahead) and € 232.55/MWh (intraday). Indeed, the average prices in 2023 even fell below the 2021 prices. At the time, the average volume-weighted day-ahead power price was €93.36/MWh and the average volume-weighted intraday hourly power price was €99.90/MWh. The situation on the electricity market has thus calmed down considerably compared to the crisis year 2022, although power prices remain significantly higher than before the COVID-19 pandemic.

Renewables – the most important power source for the German energy market

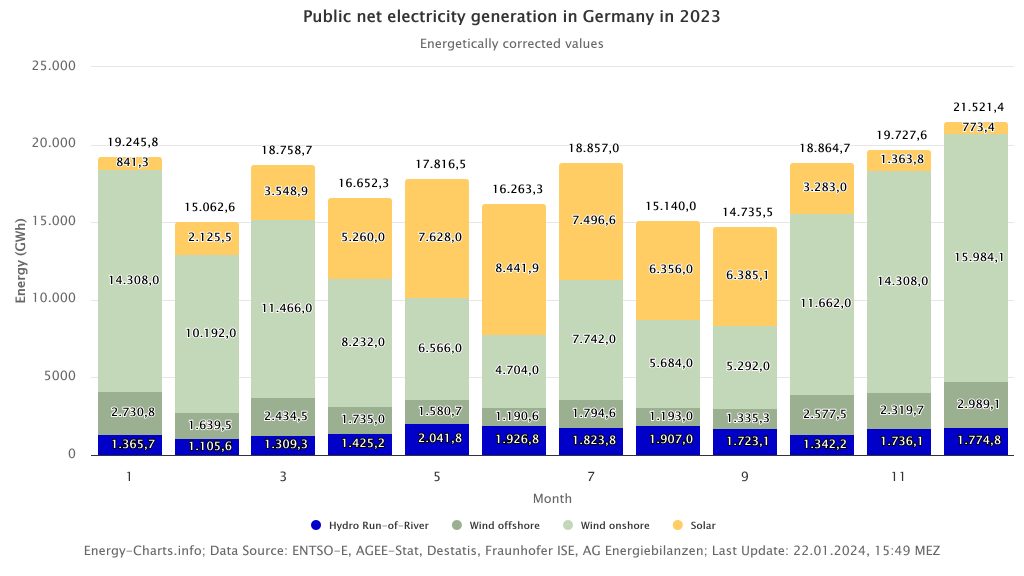

In 2023, renewable energy sources such as solar, wind, hydropower and biomass produced around 260 TWh. This represents an increase of around 7.2 % on the previous year’s level of 242 TWh.

Figure 2: Public net electricity generation from renewable energy sources in Germany in 2023 (Source: energy-charts.info)

Wind power not only constitutes the largest renewable energy source, but is also the most important source of electricity for the German power market as a whole. In total, wind power plants fed in around 140 TWh in 2023. Of this, around 115.3 TWh came from onshore wind turbines and 23.5 TWh from offshore wind turbines. With an increase of approx. 17.3 TWh, total wind power generation was 14.1 % higher than in 2022. This is primarily due to the favourable weather conditions, as installed capacity only increased by 5 % to 69.5 GW.

A comparison of the development of full-load hours for onshore and offshore wind turbines reveals marked differences. While onshore wind was able to benefit from 13.9 % more full-load hours than in the previous year, offshore wind suffered a decline of 8.7 %. Due to the expansion and the windy weather, onshore wind generated 19 % more electricity than in the previous year and offshore wind was able to limit the decline in generation to 5.2 %. This may seem counterintuitive at first, as wind conditions off the coast are usually more favourable than on the mainland. The main reason for the discrepancy is grid congestions, which have restricted utilisation of the full amount of wind energy available.

A significant increase in solar installations was observed in 2023. However, as there were fewer hours of sunshine last year than in 2022, the full load hours for solar power generation fell by a significant 13.3 %. Nevertheless, the amount of solar energy generated increased by 1 TWh to 59.9 TWh.

Although there was no increase in hydropower, with installed capacity remaining at 4.94 GW, generation nevertheless rose from 16.3 TWh in the previous year to around 19.5 TWh in 2023.

The installed capacity for biomass increased slightly. Nevertheless, 3% less energy was generated from biomass compared to the previous year, so production totalled 42.3 TWh in 2023.

Renewable energies accounted for the highest share of the load on record in 2023. For the third time, the share of renewable energy fed into the public electricity grid in Germany exceeded the threshold of 50%, which was surpassed by more than ever before in 2023 at 56.9%. In addition, the share of renewable energies in total net electricity generation, including solar prosuming by industry and commerce, exceeded the 50% mark for the first time in 2023, at 54.9%. Compared to 45.5% in the previous year, renewable energies became considerably more important in the German energy landscape.

Non-renewable energy sources on the decline

Even though non-renewable energy sources have become less important over the past year, they still made an important contribution to energy generation and often determined the price of electricity.

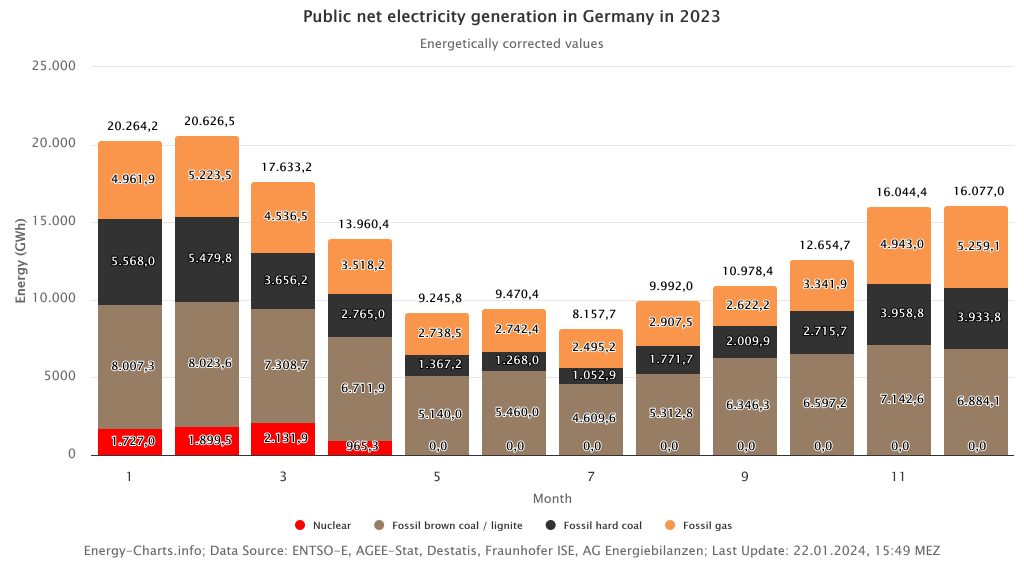

Figure 3: Public net electricity generation from non-renewable energy sources in Germany in 2023 (Source: energy-charts.info)

The year 2023 marked a turning point for nuclear power. All remaining nuclear power plants were shut down by 15 April, completing the nuclear phase-out after almost 12 years. Before the shutdown, German nuclear power plants generated 6.7 TWh of electricity in 2023.

Electricity from lignite and hard coal-fired power plants was in high demand in 2022 due to the tough market situation, but was increasingly replaced by other energy sources in 2023, continuing the general downward trend of recent years. As a result, 2023 saw as little electricity (gross) produced from lignite as in 1963. With a reduction of 26.8 TWh compared to the previous year, lignite-fired power plants provided 77.5 TWh net for public electricity consumption and 3.7 TWh for industrial auto-consumption in 2023.

In percentage terms, the importance of hard coal fell even more sharply in 2023. A decrease of 21.4 TWh represents a 36.8 % reduction in power production from hard coal. In 2023, 36.1 TWh was produced for public electricity consumption and 0.7 TWh for industrial auto-consumption. The last time gross electricity generation from hard coal was at this level was in 1955.

Electricity from gas-fired power plants only saw 1.1 TWh less demand in 2023 than in the previous year. Gas-fired power plants supplied 45.8 TWh for public electricity supply and 29.6 TWh for industrial auto-consumption this year.

Expansion statistics show solar energy on the rise

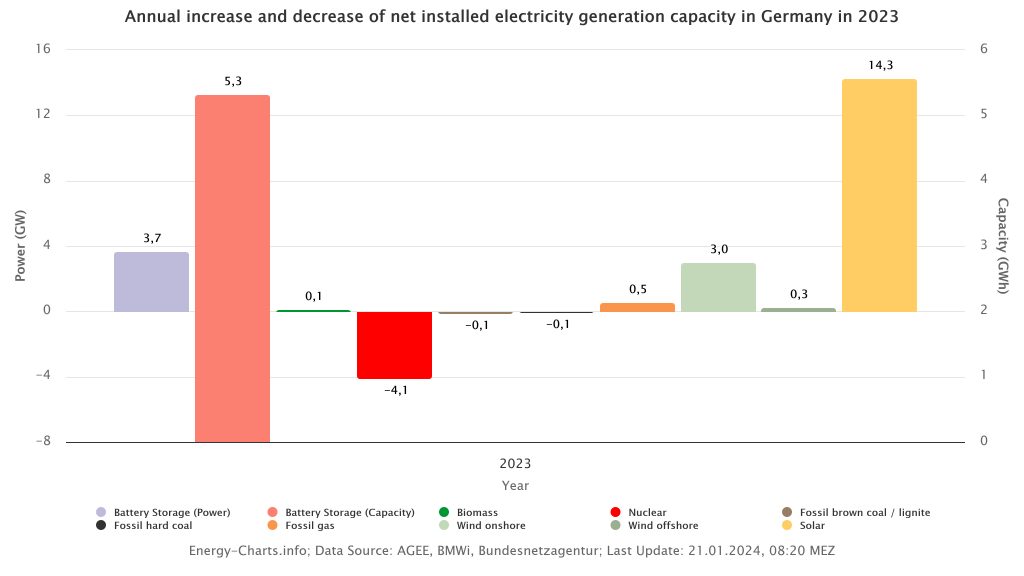

Developments in the expansion and decommissioning of net installed capacity in 2023 also fit seamlessly into the pattern of increasing renewable generation and declining generation from non-renewable sources.

Figure 4: Expansion and decommissioning of installed net capacity and power for selected energy sources in Germany in 2023 (Source: energy-charts.info)

It is particularly noticeable that a significant expansion of PV systems totalling 14.3 GW has taken place, bringing the installed capacity in the solar sector above 80 GW for the first time. This means that the German government’s self-imposed target of 12 GW has even been exceeded. Wind energy installations were also expanded to a lesser extent, with 3 GW added to onshore wind power and 0.3 GW added to offshore wind power. The installed capacity for onshore wind has thus risen above 60 GW for the first time, while the capacity for offshore wind amounts to 8.5 GW. The installed capacity of wind turbines has increased by 5% to 69.5 GW in the past year. However, the actual target of 3.9 GW of new capacity was clearly missed. Another renewable energy source, the installed capacity for biomass was expanded slightly (by 0.1 GW), and at 9 GW is just above the figure for offshore wind power.

Natural gas was the only fossil energy source to see an expansion. Installed capacity was increased by 0.5 GW in 2023, maintaining its status as the third-largest energy source for Germany at 34.8 GW. The installed capacity for lignite was reduced by 0.1 GW, while a smaller change was observed for hard coal. At 18.6 GW (lignite) and 18.9 GW (hard coal), these two energy sources remain significant elements in the German energy landscape. The biggest change was observed in nuclear energy, which after the nuclear phase-out no longer plays a role in the German power mix, with capacity reduced from 4.1 GW to 0 GW.

The development of battery storage systems, which enable more flexibility on the German electricity market, is particularly interesting. With the addition of 3.7 GW of power and 5.3 GWh of capacity, these will increasingly come into play. By the end of November 2023, Germany had achieved a total of 7.9 GW of power and 11.6 GWh of capacity for battery storage systems, which also shows how significant the expansion was in 2023 alone. Both power and capacity almost doubled, indicating an increasingly important role for battery storage in the German electricity market in the coming years. [1]

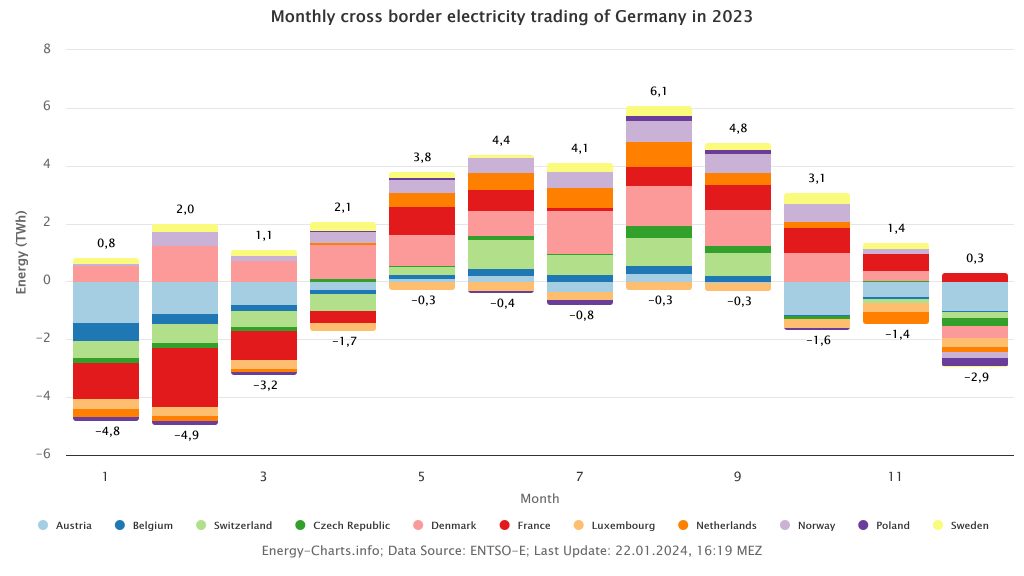

Electricity imports mainly came from Northern Europe in 2023

The discrepancy between power generation in Germany and the German load was offset by imports. In electricity trading on the futures market, Germany ultimately had an import surplus of around 11.7 TWh, with imports becoming particularly attractive in summer due to low power prices in neighbouring countries. The physical electricity flows also resulted in an import surplus of 8.6 TWh.

Denmark (10.7 TWh), Norway (4.6 TWh) and Sweden (2.9 TWh) exported the most to Germany in futures trading. At the same time, Germany also exported, primarily to Austria (5.8 TWh) and Luxembourg (3.6 TWh). However, the most important partner for imports and exports, France, does not appear on this list, as the import balance for the year as a whole was 0.4 TWh. This is due to Germany’s large electricity exports to France between January and April 2023, which France offset with exports to Germany over the remaining eight months and exceeded the amount only by 0.4 TWh.

What awaits the German energy landscape in the future?

The future prospects for the energy transition are difficult. Rising interest rates, budget problems for the Climate and Transformation Fund and the rapid depletion of the German government’s “EEG” account pose major challenges for the energy transition. As a result of these developments, not only are the financing costs of new expansion projects rising, but there is also less money available for public funding. On the other hand, there was a record expansion of photovoltaic systems and battery storage systems last year, which indicates a high level of interest in these technologies from private actors. In addition, at the COP28 in Dubai in December 2023, the German government supported the call to accelerate phasing out fossil fuels. To reduce its reliance on natural gas, the German government has also adopted an ambitious hydrogen strategy, the first projects of which are already being implemented. The slowly rising CO2 prices, which will make fossil fuels less attractive in the long term, will also contribute to its implementation. A long-awaited reform of the energy markets at the EU level in 2024 also promises a boost for renewable energy sources.

The political will certainly exists, even if the implementation of the energy transition is currently hampered by financial bottlenecks. It remains to be seen how the German government can make climate-friendly technologies attractive and achieve its expansion targets this year.

Please compare the insights from 2023 with our blogpost about the energy market of 2022: War, gas shortages and extreme prices: 2022 throws energy markets off track

Sources:

www.energy-charts.info, Fraunhofer ISE (2023)

Bruno Burger for Fraunhofer ISE, „Stromerzeugung in Deutschland im Jahr 2023“, 10th January 2024, https://www.energy-charts.info/downloads/Stromerzeugung_2023.pdf

[1] Energy Brainpool’s experts discussed the German market for battery storage systems in greater detail in a blog article in October 2023: https://blog.energybrainpool.com/en/revenue-potential-for-battery-storage-systems-on-the-power-market-current-developments/

What do you say on this subject? Discuss with us!