The year 2022 is primarily dominated by the Russian-Ukrainian war. The resulting geopolitical changes caused a state of emergency on the power markets this year. However, the framework conditions for the energy industry will not be the same in the future: energy security, diversification as well as efficiency and savings measures are coming to the fore. In the short term, energy prices in the EU have risen to record levels. The consumption of natural gas in Germany has already been reduced year-on-year. In the coming months, it will remain important to keep an eye on gas import volumes and the filling levels of storage facilities.

Geopolitical watershed brings exceptional situation

Since Russia’s attack on Ukraine at the end of February 2022, there has been a watershed in Europe. In addition to the local tragedies, the ongoing war is causing geopolitical and economic distortions worldwide. Rising food prices and expensive energy raw materials are direct effects that hit poorer regions in particular. The sabotage and partial destruction of the Nord Stream 1 and 2 gas pipelines in September 2022 also brought the safety and security of physical energy infrastructure to the fore.

The European countries, which before the war bought about 50 percent of their gas imports from Gazprom in Russia, are now changing track. Partly because of the decision of the importing countries, partly because of the Russian gas company’s supply stop. Gazprom’s delivery volumes to Europe fell by 45 percent in the first eleven months of 2022 compared to the same period last year (source: Montel). The situation is similar for imports of hard coal and oil from Russia to the EU. Thus, in the medium and long term, Russia is losing its most important buyer of raw materials. However, other countries are partly taking up the volumes, as Figure 1 shows (source: CREA).

![Figure 1: Exports of fossil fuels from Russia in EUR million/day (30-day average) (source: CREA, 2022). [1] Figure 1: Exports of fossil fuels from Russia in EUR million/day (30-day average) (source: CREA, 2022). [1]](https://blog.energybrainpool.com/wp-content/uploads/2022/12/2022-12-03_Abb_1_russian-exports_en-1024x287.png)

Figure 1: Exports of fossil fuels from Russia in EUR million/day (30-day average) (source: CREA, 2022). [1]

Price extremes for electricity and gas

Prices for electricity and gas in Europe started to rise as early as the end of 2021. One of the reasons was Gazprom’s relatively low supplies and the low levels of storage facilities managed by Gazprom (compare our article Price rally across the energy markets). With Russia’s invasion of Ukraine, gas prices in Europe went through the roof. Over the summer of 2022, Russia gradually halted its gas supplies through the Nord Stream 1 gas pipeline. The result: prices rose to more than ten times the pre-war level. In several blog posts we have analysed the developments of gas and power prices in detail (topics: storage targets, spot market prices for electricity and gas market development).

Figure 2 shows the price development of the most important energy commodities and of the emission allowances in the European emissions trading system from October 2021 to the beginning of December 2022. The extreme price increase until August 2022 is clearly visible, as is the decline and stabilisation of gas and power prices in particular at a high level in the fall of 2022.

![Figure 2: Percentage development of commodity prices from Oct 2021-Dec 2022: power front year 2023 Germany (candle sticks), gas front year 2023 TTF (yellow line), coal front year 2023 (red line), crude oil Brent Q2 2023 (green line) and EUA delivery Dec 2023 (orange line) (source: Montel, 2022). [2] Figure 2: Percentage development of commodity prices from Oct 2021-Dec 2022: power front year 2023 Germany (candle sticks), gas front year 2023 TTF (yellow line), coal front year 2023 (red line), crude oil Brent Q2 2023 (green line) and EUA delivery Dec 2023 (orange line) (source: Montel, 2022). [2]](https://blog.energybrainpool.com/wp-content/uploads/2022/12/2022-12-13_Abb-2_Commoditypreise-1-1024x454.png)

Figure 2: Percentage development of commodity prices from Oct 2021-Dec 2022: power front year 2023 Germany (candle sticks), gas front year 2023 TTF (yellow line), coal front year 2023 (red line), crude oil Brent Q2 2023 (green line) and EUA delivery Dec 2023 (orange line) (source: Montel, 2022). [2]

Further energy policy developments

In addition to dealing directly with the effects of the war in Ukraine, other important decisions were made for the energy industry in 2022. The details are beyond the scope of this short article, but the list below should provide an overview:

- Abolition of the EEG surcharge as a component of the power price of end consumers

- Change in subsidy conditions for electric vehicles and energy-efficient buildings

- Ambitious targets for the expansion of renewable energies in Germany (80 percent by 2030) in the EEG 2023 and at EU level through REPowerEU

- Energy Security and Energy Saving Act with regulations to avert gas shortages

- Start of construction of LNG import terminals to secure gas supply (see our article about LNG terminals)

- Return of (coal-fired) reserve power plants to the power market (supply reserve)

- Extension of power generation from nuclear power plants in Germany until mid-April 2023

- Partial nationalisation of or acquisition by the state of gas storage operators (SEFE) and gas importers (Uniper)

- Comprehensive relief packages for end consumers (electricity and gas price brakes)

- Skimming off “excess profits” from electricity producers to finance price brakes

Gas consumption down, coal and renewables up

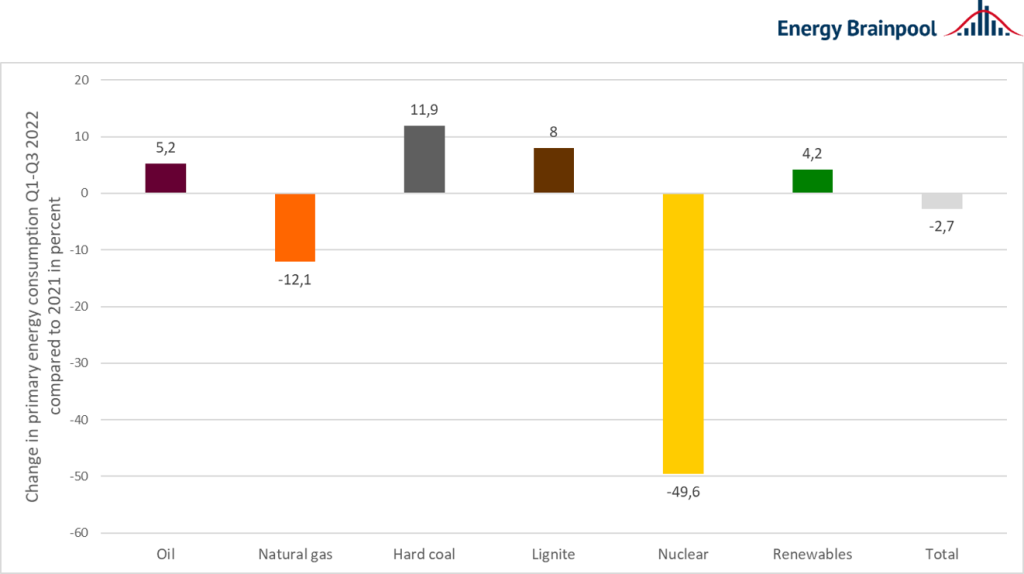

In the first nine months, primary energy consumption in Germany decreased by 2.2 percent after adjustment for weather conditions. A large part of this is due to the high energy source prices. In particular, the efforts to reduce gas consumption have already been reflected in the statistics, as shown by the Arbeitsgemeinschaft Energiebilanzen (source: AGEB). Natural gas consumption decreased by 12 percent compared to the first three quarters in 2021. The use of nuclear energy declined by almost 50 percent due to the shutdown of three power plants at the end of 2021. Nuclear energy accounted for just over 3 percent of primary energy consumption during the period under review.

In contrast, however, the consumption of coal increased by about 10 percent, particularly in power generation. The reason for this are the very high gas prices, which make the use of coal-fired power plants more lucrative as well as Germany’s increased electricity exports to neighboring countries such as France. The use of renewable energy increased by more than 4 percent. From January to the end of September 2022, it covered 17.3 percent of Germany’s primary energy demand. Figure 3 presents the percentage changes in primary energy consumption in the first three quarters compared with the same period last year.

Figure 3: change in primary energy consumption of various energy sources in Q1-Q3 2022 compared to 2021 (source: Energy Brainpool, 2022).

During the period under review, energy-related CO2 emissions increased by 2 percent compared to the previous year due to higher coal-fired power generation. Germany’s greenhouse gas emissions are therefore still not on target in 2022. Thus, further efforts are necessary to achieve the sectoral targets laid down in the Climate Protection Act.

What will be important in 2023?

The gas crisis is far from over at the end of 2022. In particular, the temperatures from January to April 2023 will determine whether short-term shortages do occur, despite the very high levels of gas storage at the beginning of December 2022 and savings in households and industry. With average winter temperatures, the gas storage facilities should be able to meet the legal requirement of 40 percent as of February 1, 2023. This would also facilitate refilling next year under the more difficult conditions of much lower Russian gas imports. In summary, this means that in 2023, we will continue to be affected by the gas storage levels and the LNG import volumes delivered to Germany.

Another important topic are the medium- and long-term interventions and changes that are being discussed at EU level but also in Germany regarding the power market design. A working group of key stakeholders is to present proposals for Germany in the coming year. The introduction of a capacity market or tradable supply security contributions in Germany is on the agenda.

In addition to the acute problems of the energy industry due to the war in Ukraine, the focus on emission reductions must not diminish. Important decisions on this are still to be made in the EU trilogues on the Fit for 55 package in 2023. Another decisive factor will be the extent to which the expansion of renewable energies actually progresses and whether approval procedures can be accelerated. Only if the course is set for right here during the next year can the target of 80 percent renewable electricity come within reach.

Continue reading

Would you like to learn more about the situation on the gas market? You can find a review here: No more woes on the gas market? A review of the current developments

Click here for our latest blog article: EU Energy Outlook 2060 – How will the European electricity market develop over the next 37 years?

Source of figures:

[1] CREA, 2022

[2] Montel, 2022

What do you say on this subject? Discuss with us!