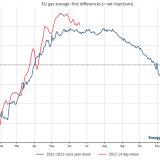

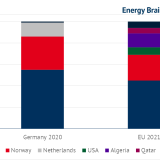

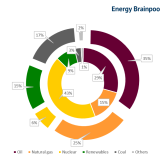

The year 2022 is primarily dominated by the Russian-Ukrainian war. The resulting geopolitical changes caused a state of emergency on the power markets this year. However, the framework conditions for the energy industry will not be the same in the future: energy security, diversification as well as efficiency and savings measures are coming to the fore. In the short term, energy prices in the EU have risen to record levels. The consumption of natural gas in Germany has already been reduced year-on-year. In the coming months, it will remain important to keep an eye on gas import volumes and the filling levels of storage facilities.

Continue reading