The German government’s power plant strategy is leading to significant changes in the conventional power plant fleet. What developments have shaped the past and why are gas-fired power plants essential for the energy transition?

Even if the energy transition means that fossil fuels will be phased out sooner or later, conventional power plants will remain crucial to securing supplies for a long time to come. The existing power plant fleet must be further developed for this purpose. This is the only way it can provide the cleanest possible energy with high flexibility and low costs. To this end, the German government has developed a new power plant strategy. In general, this sets new framework conditions for the construction of new flexible power plants to support the energy transition. The plan from February 5, 2024 is an important step for the energy transition in Germany and Europe.

However, in order to be able to classify the goals and changes, it is important to know the status quo of the existing power plant fleet. This blog post therefore looks at various historical and current developments in the area of fossil fuel power plants. Energy Brainpool has its own EU Power Plant Database (KWV), a very useful tool for analysing the large European power plants. All thermal power plants are listed in this database:

- from an output of 20 MW

- in 36 European countries

- with valuable information on the plants, such as coordinates, output, efficiency, technology and dates of commissioning.

From coal and oil to nuclear power and gas as an energy source

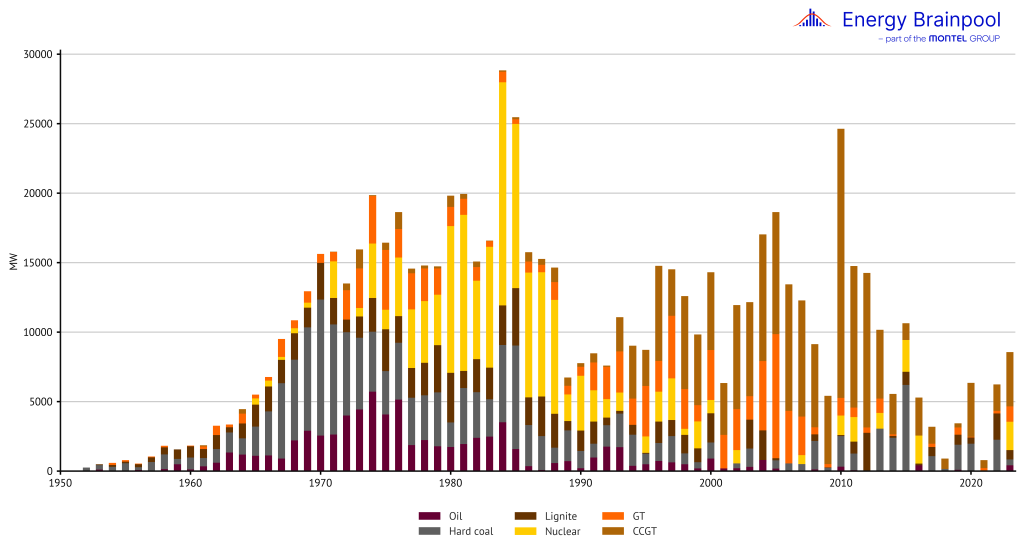

The European electricity supply system is subject to constant change. The changes in the preferred generation types show this most clearly. Figure 1 shows a breakdown of all European power plant installations in the EU Power Plant Database since 1950 by year of construction and generation type. Three trends can be clearly identified:

- Hard coal in first place around 1970

The first large power plants were mainly fired with coal and oil. Hard coal in particular accounted for the majority of generation capacity around 1970. Oil-fired power plants, which only play a subordinate role today, also accounted for a large proportion of electricity generation back then.

- Nuclear power on the rise from 1980

Around 1980, the influence of nuclear power finally grew and new power plants increasingly used nuclear energy to generate electricity. However, this trend was halted by the Chernobyl nuclear disaster in 1986.

- Natural gas overtakes nuclear power

Since this catastrophe, there has been a strong focus on gas as an energy source. Gas has various advantages. Firstly, gas is much easier and cheaper to transport via pipelines than coal, for example. Secondly, burning gas produces less CO2 than other fossil fuels. For a long time, importing gas from Russia was also relatively cheap. Despite rising costs, gas-fired power plants will remain important in the future and play a central role in the German government’s power plant strategy.

Figure 1: Annual expansion of power plant capacity since 1950, broken down by type of power plant (source: Energy Brainpool)

Increasing efficiency with all common technologies

When considering the conventional power plant fleet in Europe, it is not only the fuel that plays an important role, but also the technology used. Accordingly, the EU Power Plant Database distinguishes between three technologies: steam turbines (ST), gas turbines (GT) and combined cycle gas turbines (CCGT). GT and CCGT are therefore listed separately in Figure 1.

For a long time, the steam turbine was the dominant technology. This is due to the predominant types of power plant – coal and nuclear power – until around 1990. After that, gas became increasingly valuable as a fuel and so did the gas turbine. Besides that the combination of gas turbine and steam turbine also quickly gained relevance.

With this power plant technology, efficiency can be significantly increased by using the waste heat from the gas turbine to operate a steam turbine. This means that more usable energy is generated for the same fuel costs. This is reflected in the levelised cost of electricity, which can even be lower in CCGT power plants than the cost of generating electricity from coal. [1]

The technology and the associated efficiency are key factors for cost-effective operations and for the assessment of the power plant portfolio. For this reason, the EU Power Plant Database also lists the efficiency values of the individual power plants in addition to the technologies.

Important for both conventional and renewable energy sources: suitable geographical conditions for power generation

Certainly, the generation of electricity from fossil fuels always goes hand in hand with a centralised power generation system. There are a small number of large power plants that generate electricity at usually sensibly selected locations and then distribute it to consumers via the electricity grid.

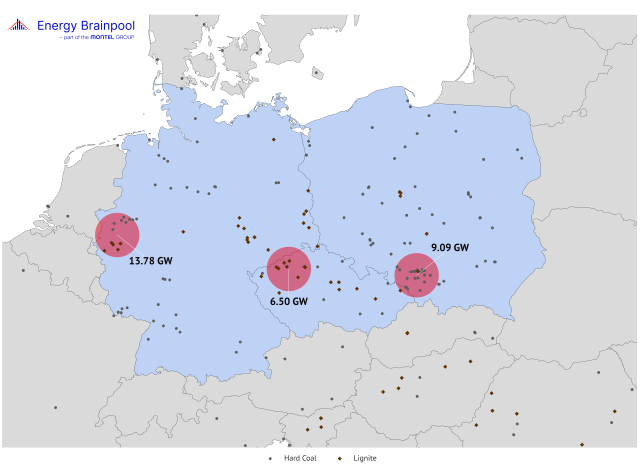

The various power plant locations are selected on the basis of a wide range of factors. Figure 3 shows the locations of hard coal and lignite-fired power plants in Central Europe as an example, based on information from the EU Power Plant Database. Above all, transportation costs are a major cost factor when generating electricity from coal. Due to the low energy density and therefore the large volume to be moved, the transportation of lignite is very expensive.

For this reason, lignite-fired power plants are always operated as close as possible to the lignite mining areas. This can be clearly seen from the distribution of lignite-fired power plants in Germany, with a concentration of power plant locations in North Rhine Westfalia (NRW) and around Leipzig. Proximity between mining and production sites is also a great advantage for hard coal. Accordingly, Poland and the Czech Republic also have a large amount of generation capacity in coal mining areas.

Figure 2 shows this centralised system very clearly. In NRW, there are coal-fired power plants with a capacity of almost 14 GW within a radius of 100 km. This corresponds to more than a third of the total capacity of coal-fired power plants in Germany. This aspect is even more extreme in the Czech Republic, where more than half of the coal-fired capacity is located in a corresponding area.

Figure 2: Map of all coal-fired power plants in Germany, Poland and the Czech Republic (source: Energy Brainpool)

Another important location factor are rivers, which play different roles in power generation depending on the energy source. Hydroelectric power plants are particularly important near the Alps, for example on the Inn and Isar rivers. However, as these are not thermal power plants, they are not listed in the EU Power Plant Database.

Coal-fired power plants are also often located next to rivers. The rivers are used as a cost-effective transportation route. Another particularly important function can be seen in France. The French electricity generation system is heavily dependent on nuclear power. This requires reliable cooling of the reactors. This cooling function is generally provided by river water, and the power plants in France are distributed along rivers as a result. [2]

Another aspect is the proximity to consumers. This is why large industrial companies have historically often been located close to large fossil fuel power plants, such as in the Ruhr region. All the geographical features mentioned above can be identified in the EU Power Plant Database through information on the locations of the more than 3,400 power plants in Europe.

The strategic choice of appropriate locations is also important for the new gas-fired power plants from the power plant strategy. The main aim here is to reduce the load on the electricity grid by distributing the plants geographically. It also makes sense to locate the new power plants in such a way that the existing grid infrastructure can be reused, for example on the site of former coal or nuclear power plants.

Getting out of coal

The overarching goal of the power plant strategy is to achieve electricity generation that is independent of fossil fuels and to make renewables the main source of energy instead. Renewable energy sources were already responsible for 60 percent of the electricity generated in 2023. This figure is set to increase significantly over the next few years. The rest will continue to be generated by conventional power plants. [3]

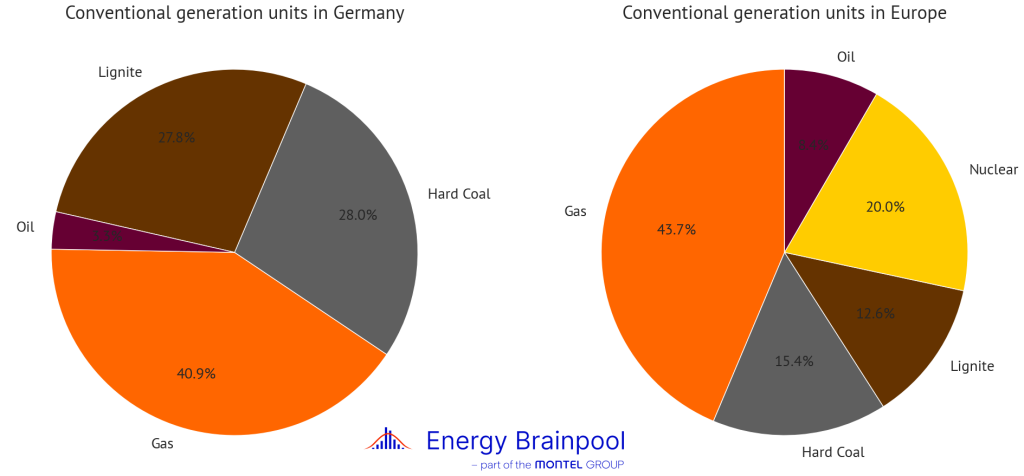

Figure 3 shows the breakdown of the conventional power plant fleet in Germany and Europe by energy source at the end of 2023. This clearly shows the differences between Germany and Europe. In Europe, nuclear power accounts for 20 percent of existing capacities.

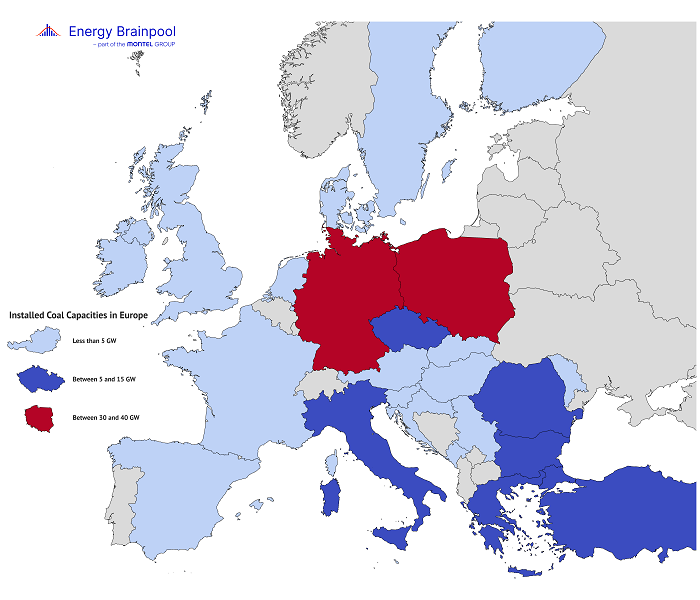

Instead, coal is much more dominant in Germany than the European average. The share of coal capacities in Germany is almost twice as high as the share of coal in Europe as a whole. With the EU Power Plant Database, the total electricity generation capacity from coal can also be broken down by country. The absolute figures also confirm that Germany, together with Poland, has a special position in Europe in terms of coal-fired generation capacity.

Figure 4 shows the total generation capacities from hard coal and lignite for each country in GW. Poland and Germany both have significant capacities from coal. They are taking different approaches to replacing this capacity in the coming years: Poland is focusing on building new nuclear power plants. [4] Germany has instead phased out nuclear power and is focusing entirely on renewables.

Why gas-fired power plants are so important for the energy transition

The data also shows that the construction of new conventional generation capacity has been significantly lower in recent years than in the past. This can be explained by the increasing expansion of renewable energies. However, gas-fired power plants also fit in well with this expansion path: A first advantage is the better controllability of gas-fired power plants compared to other conventional power plants. This means that fluctuating generation output from wind and solar can be balanced out well.

However, it is important for achieving the climate targets that the gas-fired power plants are also H2-ready. This means that the gas-fired power plants can also be operated with hydrogen or can be converted to do so. This makes it possible to operate gas-fired power plants without emitting CO2. In its power plant strategy, the German government also emphasizes that gas-fired power plants need to be designed for future operation with hydrogen.

In addition, the cost structure of the various conventional power plant types also speaks in favor of using gas-fired power plants as back-up power plants for renewables. It is worth taking a close look at the capex and opex costs. Overall, electricity from gas turbines is expensive. However, there are various advantages compared to other conventional sources.

The fundamentally high price is due to the operating costs for running the plants, which are driven by high commodity prices. Put simply, a kilowatt hour of energy in the form of gas is significantly more expensive than a kilowatt hour of energy in the form of coal or oil. This results in different short-term marginal costs for the systems. At current gas and CO2 certificate prices and average efficiency, a gas-fired power plant has marginal costs of around EUR 83/MWh. In contrast, the marginal costs for hard coal are lower at around EUR 65/MWh.

In contrast to the high opex costs, however, gas turbines have the lowest capex costs. At EUR 400 per kW of output, the investment costs for gas turbines correspond to around a quarter of the investment costs per kW of output of a hard coal-fired power plant (EUR 1500/kW). It is therefore important for coal-fired power plants to spread the investment costs over the largest possible amount of electricity produced. Accordingly, the full load hours of such power plants must be very high. The same applies to nuclear power plants, which have to refinance even higher capex costs. [1]

However, the function of the back-up power plants in terms of the power plant strategy is to only produce when electricity production from renewables is insufficient. Accordingly, the full load hours of the back-up power plants will be relatively low and will continue to fall due to the further expansion of renewables and the electricity grid. It is therefore better to operate power plants with low capex costs during this period. The higher opex costs only have a minor impact on the overall costs due to the low number of full load hours of the plants. Nevertheless, this low capacity utilisation is not sufficient to recoup the incurred capex costs.

This means that investing in back-up power plants via the normal electricity market is not worthwhile. This problem is often referred to as the missing money problem. The power plant strategy therefore provides for the construction costs of the plants to be subsidized. A capacity mechanism is also planned.

The idea behind this is to remunerate power plant operators not only for the electricity they generate, but also for providing generation capacity. This means that there will be a payment per capacity held available over a certain period of time. This remuneration ensures that the capex costs can be refinanced even when capacity utilization is low and that investments in back-up power plants also make economic sense. However, the details of the planned capacity mechanism are not yet known.

This also shows that the construction of nuclear power plants, as has been repeatedly demanded, does not fit in with the energy transition with a maximum share of renewable energies. Both the cost structure and controllability do not meet the requirements. If nuclear power plants are operated, existing renewable energy capacities have to be curtailed instead, which entails additional costs.

Conclusion

Overall, these considerations show how important gas-fired power plants are for the energy transition and why such a power plant strategy has long been expected in the industry. Energy Brainpool will also closely monitor the changes in the future and constantly adapt the EU Power Plant Databaseto new developments. KWV will therefore provide interesting insights into the European electricity market in the future as well.

In addition, fossil fuel power plants will continue to have a major influence on electricity prices in Europe despite the increasing generation capacities from renewable energies. Accordingly, the EU Power Plant Database will continue to form the basis for modeling the European electricity market.

Further information and contact details for EU Power Plant Databasecan be found here.

Co-Authors: Elena Dahlem, Alex Schmitt, Johannes Nörthemann

Sources:

[3] https://energy-charts.info/charts/energy_pie/chart.htm?l=de&c=DE&interval=year&year=2023

[4] https://www.tagesschau.de/ausland/europa/polen-atomenergie-103.html

What do you say on this subject? Discuss with us!