In October 2021, new record prices on energy markets are prevailing. The EU Commission launches a toolbox as short-term response to high energy and commodity prices. Another consequence of the price rally: A switch took place from natural gas to oil and oil products in the energy sector. Besides that, there will be a reduction of the EEG levy for 2022.

Not only a gas to coal switch, but also a gas to oil switch

Due to very high gas prices, there has been an increasing use of coal instead of gas for the purpose of electricity generation in recent months. However, due to the increase in coal-fired power generation and difficulties in the global supply chain, there was also a price increase for coal. In some cases, the situation on the commodity markets even led to a switch to oil in the energy and industry sectors. According to the international energy agency, Reuters this has never happened before as until now the market always made efforts to switch from expensive oil to cheaper gas. (Source: Reuters)

As it happens, even one of the largest German energy suppliers, EnBW, began to use oil instead of gas in its gas turbines at their combined heat and power plant in Altbach/Deizisau. According to the spokesperson, it was simply better to operate with oil than with gas from the economic point of view. Since the three turbines in Altbach are designed for both, natural gas and oil operation, the change in commodities did not pose any technical problems. (Source: Montel)

Different handling among energy suppliers

However, there was no unanimity among German energy suppliers regarding the fuel switch. While some of them preferred the switch to oil, such as Leipzig’s municipal utilities, others continued to fulfil their supply obligations by using gas.

On the other side, suppliers like the regional utilities in Duisburg and Jena have abandoned the option of firing oil a long time ago due to the climate crisis. (Source: Montel) From the economic point of view, this switch may have been more favourable, but that was certainly not the case when it comes to the CO2-balance. The emission factor of heavy heating oil with 79.4 kg CO2/TJ or other petroleum products with 80.102 kg CO2/TJ is significantly higher than the one of natural gas with 55.75 kg CO2/TJ. (Source: Federal Environment Agency)

Developments in the industry

Nevertheless, the switch to heating oil was also noticeable in industry. Accordingly, some forecasts have increased their projection of global oil consumption by several hundred thousand barrels per day (bpd). (Source: Reuters) Even Saudi Arabia’s energy minister anticipated a 500,000-600,000 bpd increase in demand. (Source: Reuters) According to ITHS Markit, the substitution of gas by the usage of oil will not be as significant in Europe due to climate concerns as it will be in Asia. (Source: IHS Markit)

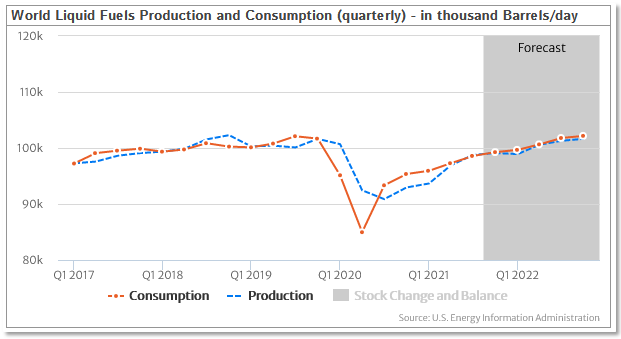

The following chart shows the steady increase in oil demand in 2021 with an additional forecast for 2022. Due to this and the generally high prices at the energy market, oil prices also increased in Q3 2021. They have risen relatively sharp after OPEC+ announced that it would stick to its plan to only rise its production by 0.4m bbl/day per month and not increase it, despite constant requests of other countries. Even though the U.S. and Japan make efforts to increase global production, the oil market remains tight. (sources: Montel)

Fig. 1: world liquid fuels production and consumption (quarterly) – in thousand Barrels/day (source: Montel)

The EEG levy in 2022: What is next?

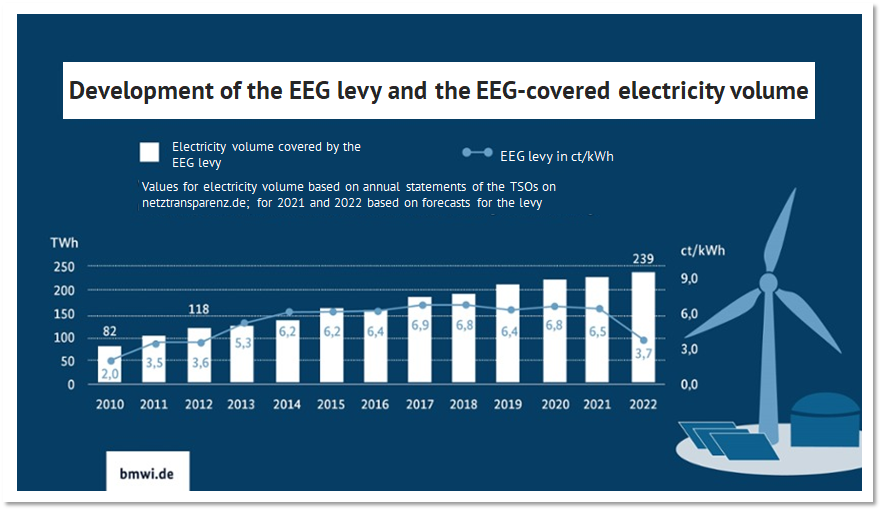

On the 15th of October 2021, German transmission system operators announced that the EEG levy for the upcoming year 2022 would fall from 6.5 ct/kWh to 3.723 ct/kWh. This corresponds a reduction by 42.72 percent. As figure 2 shows, the levy thus reaches the lowest level of the past ten years. (source: BMWi)

Fig. 2: yearly development of the EEG levy and its electricity generation (source: BMWi)

Last year, the system operators predicted the EEG levy to be 6 ct/kWh in 2022. That would correspond a reduction of only 7.7 percent. At that time though, this figure was forecasted due to a negative levy account and no prospects of its recovery. Now, however, after three grants from the federal budget in 2021, the levy account is at its peak of EUR 8 billion. The grants were partly financed from the revenues of the national CO2 price, mainly though by the taxpayer.

In sum, they amounted to exactly EUR 10.8 billion in 2021. In addition to the grants, the high electricity prices of the last months have also contributed to the currently high EEG account balance. The EEG levy, which is defined as the difference between market revenues and the amount of subsidies for renewable energies, was very small due to the high market values and thus the EEG account was less burdened.

Discussion about abolishing the EEG levy?

Nevertheless, subsidies from the federal government of EUR 3.25 billion are planned for next year. These will contribute to a reduction of 0.934 ct/kWh. (sources: Montel)

However, many voices are now rising in favour of the complete abolition of the EEG levy, which is being seen as a big contributor to the high electricity costs. Even the Federal Minister of Economics, Peter Altmaier (CDU), said that it should be reduced to zero in the future. The current reduction alone contributes to a price reduction of 11 percent based on the current average electricity price of 31.38 ct/kWh (October).

The chairwoman of the BDEW executive board, Kerstin Andreae, as well as Ingbert Liebing, the head of the Association of Municipal Enterprises (VKU), see this reduction as the first right step. But at the same time they demand a complete abolition and a general electricity price reform. After all, simply abolishing the EEG surcharge will not lead to a lowering of electricity prices in the long term. (source: Montel)

EU Commission presents the “toolbox”

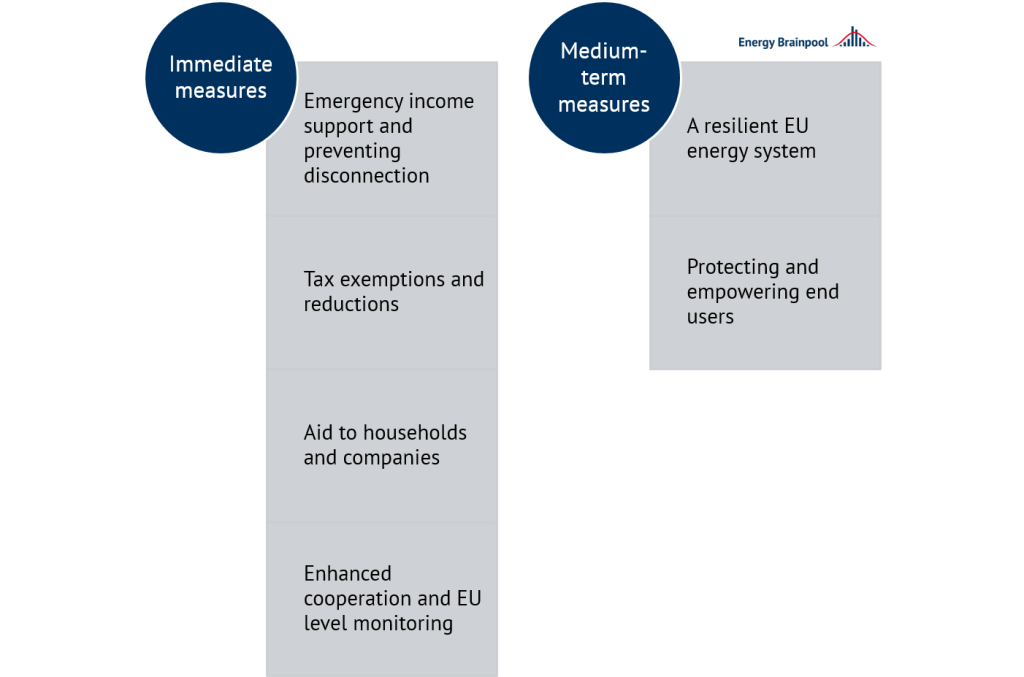

On the 13th of October 2021, EU Energy Commissioner Kadri Simson presented a “toolbox” which contains various tools that can be used by member states to counteract the effects of steadily rising energy prices. It includes many different short- and mid-term measures, such as relieving the burden on households and small businesses.

The revenues of the emissions trading system could finance such measures since the sharp rise of certificate prices, led to an income of EUR 2.4 billion in the first half of the year. By the end of the year, the record of earnings of EUR 3.2 billion in 2019 will probably be surpassed. (Source: Montel)

Figure 3 reveals some of the toolbox suggestions. These include provisions to prevent a shutdown of energy supply to households and the authorisation of a temporary deferral of payments. Another short-term measure suggests a tax reduction (rebate or outright exemption) to ease the burden on consumers. However, it is emphasised that the measures should only be applied temporarily.

Fig 3: suggestions of the toolbox of the European Commission (source: European Commission)

As a mid-term measure, an increased cooperation on the gas market is proposed. It is also to be examined whether there is a possibility of joint storage of strategic gas reserves. Furthermore, a study aimed at providing a more detailed analysis of the European electricity market has been commissioned. Its results could possibly be incorporated into the legislative proposal at the beginning of December. According to the toolbox, member states are advised to invest more in renewable energy, building renovation and energy efficiency and additionally speed up auctions and licensing procedures for renewable energy. (sources: Die Zeit, European Commission)

Despite the current high commodity prices, the Scandinavian countries as well as Germany and the Benelux countries rejected interventions in the energy markets or in the European emissions trading system. Despite this, all EU countries agreed to support low-income households. (source: Montel)

New records after “panic buying”

On the 6th of October 2021, the front-year electricity contract rose for a few hours to an all-time high of EUR 179/MWh. Front-month also shot up to EUR 350/MWh, but then fell again. The high prices were due to an increase in spark spreads, which is currently decisive for forward contracts due to the price-setting gas-fired power plants.

In addition, supply fears due to low storage levels and predicted cold temperatures have triggered panic buying. The Dutch TTF front-month contract for natural gas also posted a new record of EUR 162.13/MWh. Similarly, the EUA Dec 21 lead CO2 contract initially rose to 65.05 EUR/t, but then fell back to 60 EUR/t. (Sources: Montel)

Fig. 4: price development of German power front year (candle sticks), CO2 allowances with delivery in December 2022 (red line), Brent oil with delivery in April 2022 (orange line), gas front year at the TTF (green line), and coal front year (yellow line) from mid-August to the end of October 2021 (Source: Montel).

At the end of October, gas prices stabilized due to the easing of the gas shortage such as higher LNG volumes for other markets thanks to increased Chinese coal production and Vladimir Putin’s announcement to increase gas supplies from Gazprom as of the 08th of November.

Currently, the German gas storages are 71 percent full, although last year at this time the level was already at 94 percent. The European storage is 77 percent full (compared to 2020s storage level at 94 percent). The low storage levels are another reason for the constantly high gas prices as well as a 12percent increase in gas demand compared to 2020 (sources: Montel).

Lern more about electricity price forecasting techniques in our live online training on December 1-2.

Above average feed-in of renewable energies

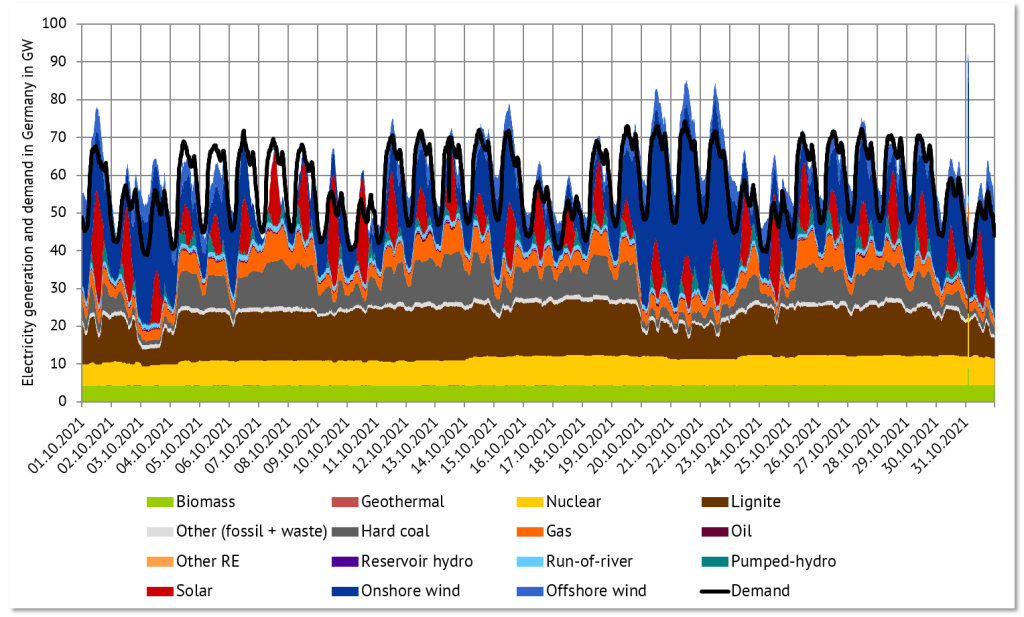

The share of solar power generation set a new record of 3.6 TWh in October, up 50 percent year-on-year. This new high is also due to the 400 MW newly installed photovoltaic capacity in October. Wind power generated another 13.3 TWh. At 16.9 TWh, the contribution of wind and solar generation exceeded that sum of hard coal, lignite and gas generation (16.4 TWh). The average share of all renewables in net electricity generation was 50.3 percent in October, slightly above this year’s average. (source: Montel)

Due to the low forecasts for wind feed-in for the 6th of October, the day-ahead contract in the exchange auction of base load rose to a new all-time high of EUR 302.53/MWh. This was EUR 118.41 above the price of the previous day and EUR 1 above the previous record from 2006. The peak load contract came in at EUR 324.91/MWh with EUR 100.37 more compared to the previous day but well below the record from 2006. (source: Montel)

On the short-term markets, the EUA contract fell to a two-month low of EUR 54.01/t. Shortly after, it climbed to an intraday high of EUR 60.20/t. The low prices were caused, among other things, by the discussion about possible market intervention by the EU to limit energy prices. (source: Montel)

Figure 5 shows the overall power generation and consumption in October 2021.

Fig. 5: electricity generation and consumption in Germany in October 2021 (source: Energy Brainpool)

What do you say on this subject? Discuss with us!