May 2023 held some exciting news for the energy industry. The German Minister of Economics, Robert Habeck, presented a working paper on the industrial electricity price. While industry representatives praise the concept, there are also critical voices. In May, the French National Assembly voted in favor of more nuclear power. In addition, the EEX published the first market-based index for hydrogen.

Germany records high feed-in from renewables in May 2023. Gas is increasingly displacing coal from the electricity mix. This is mainly due to price developments on the short-term markets. A continuing downward trend is discernible on the futures markets. All background information is discussed in the following blog post.

Industrial electricity price concept – what does it say and what does it not say?

On May 5, the German Economics Minister presented an industrial electricity price concept. This is intended to ensure competitive electricity prices for selected energy-intensive industries after the electricity price brake expires on June 30, 2024. The concept includes a two-stage plan and government subsidies worth billions.

In the first stage, a “bridge electricity price” of 6 cents per kilowatt-hour is to be set. This is to apply to 80 percent of the electricity consumption of the relevant companies. The first phase is until the year 2030.

In the long term, a “transformation electricity price” is planned in the second stage, through which energy-intensive companies can benefit directly from low-cost electricity from renewable energy sources. This is to be achieved via contracts for difference (“CfDs”) and subsidized industrial PPAs. In addition, further measures are planned to accelerate the expansion of renewable energies and reduce the cost of electricity. Since the implementation of the projects would take time, the start of this phase is not dated until 2030. (Source: BMWK).

While industry representatives praise the concept as an “important signal,” there are also critical voices. BDEW CEO Kerstin Andreae, for example, warns of possible intervention in price formation and the associated price distortions. It must be carefully examined whether the planned measures are sufficient to avoid market distortions (Source: Montel). In addition, according to Andreae, the concept curtails the attractiveness of long-term power purchase agreements (PPAs). The planned electricity price cap would eliminate the need to conclude long-term contracts.

In addition, the concept presented leaves some questions unanswered. BDEW assumes that the electricity price cap refers to the day-ahead market. However, this is not specified in the concept. It also remains open how the costs incurred will be covered. According to Habeck, these will be between two and six billion euros per year. The Federal Minister of Economics favors financing via the Economic Stabilization Fund. (Source: Montel)

Green hydrogen – will a new index bring more price transparency?

Due to its broad range of applications and flexible usability, green hydrogen will play a significant role on the road to climate neutrality. A fundamental building block for a market ramp-up is a high degree of price transparency. Since there has been no on-balance sheet trading for hydrogen so far, the available price signals are very limited. However, this could change as of now (see also: New white paper: How hydrogen helps achieve European climate neutrality by 2050)

The Leipzig-based energy exchange EEX has announced that it will henceforth publish a hydrogen index called Hydrix every Wednesday at 4 pm. This will be made available on the EEX transparency platform (Source:Montel). Basically, the new index is intended to create transparency about actually traded prices for green hydrogen. The index is calculated on the basis of supply and demand prices provided by partners from industry and the energy sector.

The first market-based index for green hydrogen closes an important gap. It can be used as a criterion for investment decisions, for example, and thus promotes investment in technologies for the use and production of green hydrogen (Source: EEX).

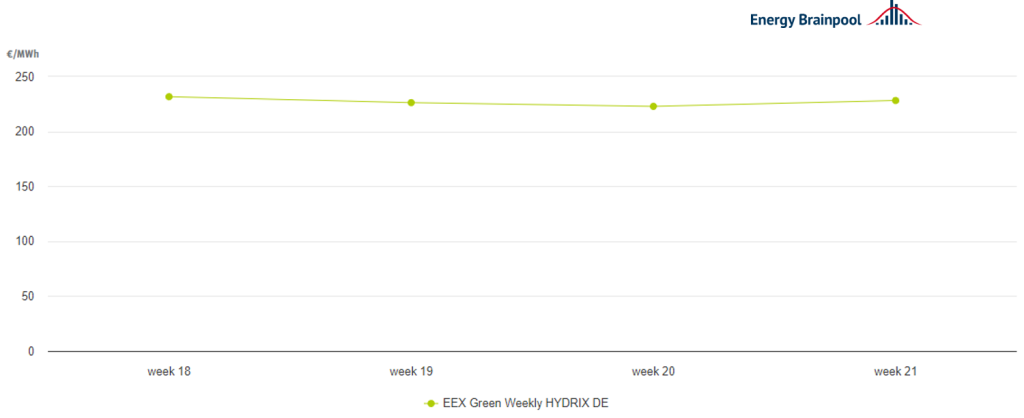

Figure 1: EEX Green Weekly HYDRIX DE (Source: EEX)

Figure 1 shows the development of the index in calendar weeks 18 to 21. In the first four published weeks, the hydrix has remained at a constant level, most recently at €228.16 per megawatt hour.

Political context

From the political side, the current amendment to the Energy Industry Act (EnWG) was passed in May. The amendment aims to obtain approval for a hydrogen core network from the German Federal Network Agency. The core network is to be modeled by the transmission system operators in the coming months. This will be followed by a consultation with the public, the federal states and market participants. The final design of the core network will then be developed and approved by the Federal Network Agency. By the end of this year, the aim is to define a hydrogen network plan in the EnWG . The core network will initially connect the demand centers of energy-intensive industries (Source: Montel). With the amendment, politicians are also laying a foundation for the market ramp-up of hydrogen.

After Germany’s exit – France facilitates construction of nuclear reactors

In April, Germany finally implemented its nuclear phase-out. On April 15, the last three nuclear power plants were taken off the grid. Since then, the German electricity mix has managed without their feed-in. However, this path is not supported by all European countries. News on this subject came from France in May.

In May, the French parliament passed a law to further promote the use of nuclear power plants. France is known to rely heavily on the use of nuclear power plants. The law will continue to pave this way.

Specifically, the faster construction of nuclear reactors is to be made possible by reducing bureaucracy. From now on, construction of non-nuclear components may begin even before an overall license has been issued by the nuclear regulatory authority ASN. The licensing process is also to be simplified.

In addition, the current regulation to reduce the share of nuclear energy in France’s electricity mix to 50 percent by 2035 no longer applies. Currently, the share is around 70 percent. The current capacity limit of 62.3 gigawatts will also be lifted (source: Montel).

Lots of sun and less coal – this is how the feed-in profile looked in May

The month of May showed a high feed-in of electricity from renewables. In addition, coal was partially displaced from the electricity mix due to low gas prices. We speak of the so-called “fuel switch”.

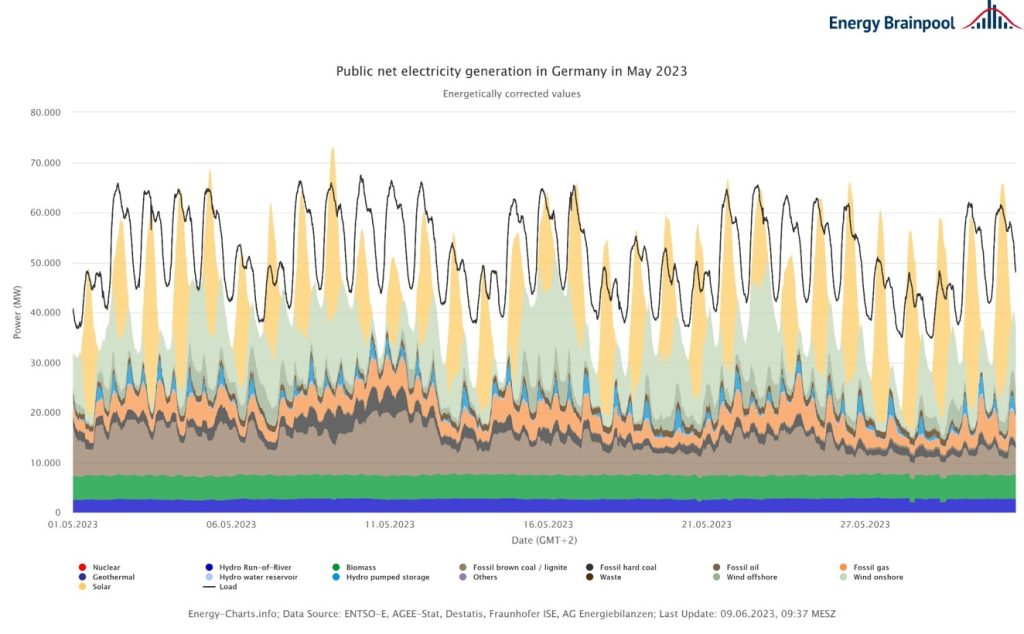

Figure 2: Electricity generation and consumption in Germany in May 2023 (source: energy-charts)

Figure 2 shows electricity generation and consumption in Germany in May 2023. The month of May was sunnier than average. With 244 hours of sunshine, the sunshine duration exceeded the long-term average from 1990 to 2020 by about 15 percent (source: DWD). The result was a strong feed-in from solar energy. Overall, the share of renewable energies in electricity generation was 69 percent in May. Compared with April 2023, this is an increase of around 10 percent. In May of the previous year (2022), the share of renewables in electricity generation was just 55.2 percent.

In addition to the strong feed-in of renewables, it is also worth taking a look at the energy sources natural gas and hard coal. Persistently low natural gas prices on the short-term market mean that electricity generation from natural gas is temporarily cheaper than from coal. As a result, coal is increasingly being displaced from the electricity mix. (Source: Montel).

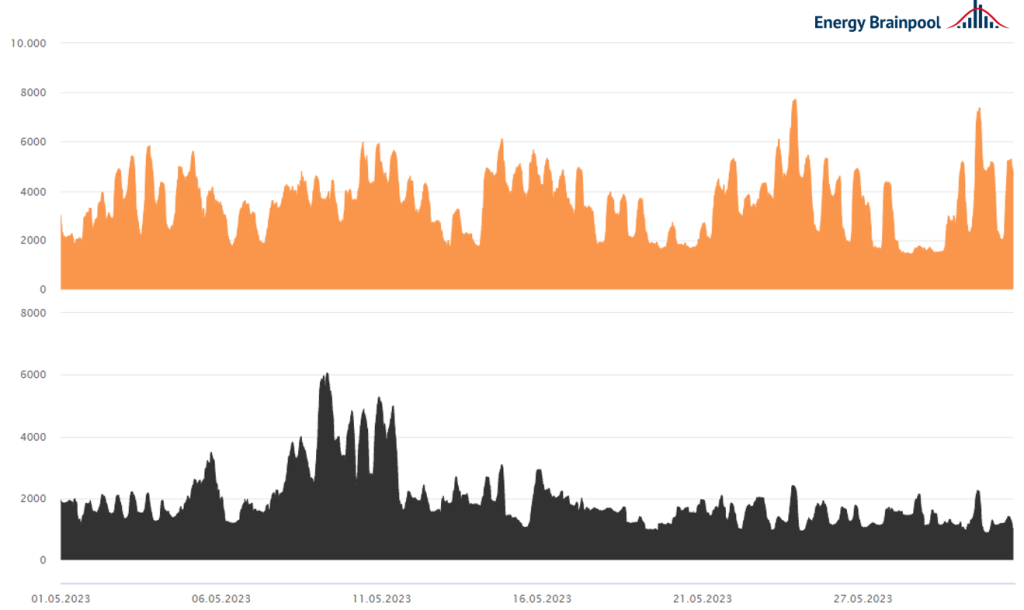

Figure 3: Net public electricity generation in Germany from natural gas (orange) and hard coal (black) in MW (source: energy-charts)

Figure 3 compares electricity feed-in from natural gas (orange) with electricity generation from hard coal (black). Particularly in the second half of the month, lower electricity generation from hard coal can be seen. If, on the other hand, we look at the feed-in from natural gas-fired power generation, very high values are visible at times.

Continuing downward trend on the futures markets – what were the reasons?

The German front-year contract for electricity (Cal 24) was on a sustained downward trend in May. It was last quoted at 122 euros per megawatt hour. The contract thus fell by 18 percent during May, reaching its lowest level since January 21, 2022 (Source: Montel). The Cal 24 development is due to an oversupply of coal, gas and electricity markets.

Figure 4: Percentage price development of German electricity front year (candle sticks), CO2 allowances with delivery December 2023 (orange line), gas front year at the TTF (yellow line), and coal front year (red line) (Source: Montel)

Figure 4 shows the price developments of the German power front year (candle sticks), CO2 allowances with delivery December 2023 (orange line), gas front year at the TTF (yellow line) and coal front year (red line).

High coal inventories and well-stocked gas storage facilities caused markets to come under pressure. The front year for coal fell 32 percent in May, and the TTF front year for gas traded 24 percentage points lower. This trend was critical to the downward movement of the power front year.

On Wednesday, May 31, gas and power markets briefly rose after a gas leak at the Hammerfest LNG terminal in Norway became known. However, after the gas leak was repaired, the gas markets fell sharply again.

The EUA December 23 lead contract also fell in the second half of the month. The loss in May was 7 percent. Factors in this development include mild weather and high renewable generation. At the same time, sharply falling gas prices are causing a fuel switch. Coal is being replaced by cheaper gas in power generation. This in turn reduces EUA demand (Source: Montel).

Are you new to the electricity industry and want to understand the electricity market? Then we recommend our live online training on August 30 & 31, 2023: https://www.energybrainpool.com/veranstaltung/starterkit-stromwirtschaft-august

And what happened in the energy market in April 2023? Click here to go to the previous blog post.

Further sources:

BDEW warnt vor Eingriff in Preisbildung durch Industriestrom (montelnews.com)

Industriestrompreis schwächt PPA-Markt – Andreae (montelnews.com)

EEX startet Index für grünen Wasserstoff (montelnews.com)

Hydrix Germany (eex-transparency.com)

Kabinett gibt Startschuss für Wasserstoff-Kernnetz – BMWK (montelnews.com)

Frankreichs Parlament stimmt für mehr Kernkraft (montelnews.com)

Stromproduktion | Energy-Charts

Wetter und Klima – Deutscher Wetterdienst – Presse – Deutschlandwetter im Mai 2023 (dwd.de)

Carbon- EUAs see 2% weekly drop amid pressure from gas (montelnews.com)

GERMAN – Cal 24 hits fresh 16-month low on weak gas, CO2 (montelnews.com)

CO2: EUA fallen mit schwachen Fundamentaldaten um 8 % (montelnews.com)

What do you say on this subject? Discuss with us!