Amidst German high-tech laboratories, significant scientific innovations are born, which, along with German chemical products, are exported to the entire world. The impact of chemical-pharmaceutical products extends far beyond national borders. However, their production is accompanied not only by economic gain but also by an enormous consumption of energy and resources. Hence, a vital contemporary question arises: How can carbon neutrality be reconciled with the chemical industry?

The unquestionable “energy hunger” conflicts with the goals of achieving carbon neutrality by 2050. A migration of this sector would be an economic disaster. With a gross value added of 70 billion and 787 thousand employees, the chemical and pharmaceutical industry is among Germany’s most crucial economic pillars [1]. Simultaneously, this would not serve the climate well. If domestic production shifts to countries with lower environmental standards, it could lead to a “carbon leakage” effect. Experts use this term to describe increased emission transfers to third countries. But how can the German chemical industry be steered towards carbon neutrality while preventing an migration?

The Path to Carbon-Neutral Chemistry – a Herculean Task

This question doesn’t have a straightforward answer. The Roadmap Chemistry 2050 [2], published in 2019, developed into the production of crucial base chemicals. Base chemicals are immensely significant, serving as raw materials for many other industrial products. However, they also contribute the most emissions within the chemical industry. The findings of the Roadmap 2050 underscore the immense effort required to achieve carbon neutrality in the chemical industry. Although it can be assumed that existing manufacturing and processing processes will become somewhat more efficient, this effect is likely to be limited.

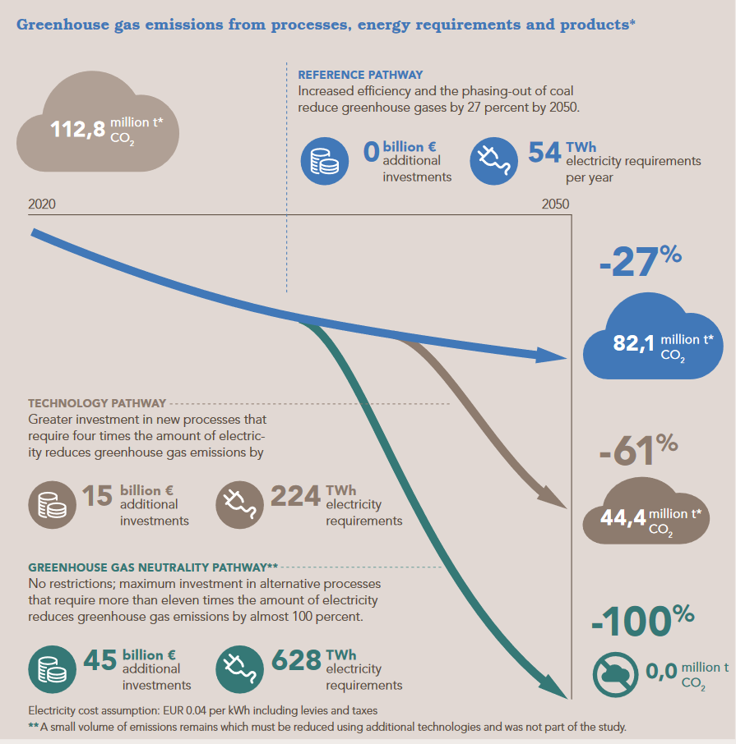

The ongoing transition of the energy system and coal phase-out will indeed reduce the industry’s emissions to some extent, but not nearly to a sufficient degree. Without further interventions, emissions would only decrease by approximately 27 percent by 2050 compared to the present. To adequately lower emissions, new and significantly more electricity-intensive processes are necessary. However, this demands not only additional investment of 45 billion euros but also an additional demand of a total of 628 terawatt-hours of green energy. To manage this transformation, the price of this electricity should be set at 4 cents per kilowatt-hour.

Figure 1: Greenhouse gas emissions from processes, energy demand and products (Source: VCI, How the transformation of the chemical industry can succeed, Final Report 2023, page 10-11)

Green energy – Between Desire and Reality

These numbers are certainly not encouraging. Currently, around 500 to 550 terawatt-hours of electricity are produced in Germany. Of this, approximately 250 terawatt-hours are from renewable sources. By 2050, the total generated electricity could increase to 750 to 1000 terawatt-hours. Nonetheless, electricity will remain a scarce and contested resource. The electrification of the heating and transportation sectors is expected to significantly raise demand, potentially leading to conflicts over the distribution of green electricity. Moreover, we are not merely dealing with a generation challenge. The expansion of the power grid would need to keep pace with this heightened electricity volume. A governmental subsidy on the electricity price would also be necessary if prices don’t fall to 4 cents per kilowatt-hour. In short, while such a transformation might be technically conceivable, it appears rather improbable.

How the Transformation Can Still Succeed!

Building upon this study, the Association of the Chemical Industry published its final report “Chemistry 4 Climate” in late April 2023 [3], outlining the path to achieving rapid carbon neutrality in the chemical sector. The positive news from this study is that the immense electricity demand required for achieving carbon neutrality in the chemical industry can be significantly reduced.

How Can This be Implemented in Concrete Terms? The study took into account the potential of biomass and the contribution of plastic waste to the carbon supply. Due to climate change, we will need to transform our forests. The residual wood from these activities should primarily be utilized as biomass for material purposes. Plastic waste could be reused as secondary raw material, partially fulfilling the carbon requirements. The equation is simple: The more of these materials are available, the lower the electricity and investment demand will be.

With the optimal utilization of these potentials, the estimated electricity demand would be reduced to 325 terawatt-hours – almost half of what the Roadmap Chemistry 2050 originally projected. The investment cost, at 25 billion euros, would be significantly lower than the original estimate. Nonetheless, this transformation requires, among other things, the collection, transportation, and processing of approximately 30,000 kilotons of biomass demand and 5,300 kilotons of plastic waste.

Furthermore, the demand for hydrogen, especially for material use, is estimated to be 148 terawatt-hours. This corresponds to about eight times the current already high demand of the chemical industry, which requires both competitive prices and carbon neutrality.

The Key Role of the Energy Industry

In summary, it remains to be noted that while still sounding highly demanding, this approach is much more realistic from an energy industry perspective. The planned utilization of biomass and plastics does come with a significantly increased effort in other areas. However, this could create a much more resilient system that remains less vulnerable to exogenous shocks.

For the energy industry, this also signifies that both grid expansion and the growth of renewable generation must be capable of accommodating these levels of demand. Such a task can only be successful in a European context and necessitates further integration within the European electricity markets. But that’s not all; hydrogen will also play an enormous role in the success of this endeavor. This places substantial demands on the political transformation plans concerning:

- diversified import strategies

- Promoting green hydrogen and

- regulatory framework.

What Direction Will the Energy Industry and Markets take in the Future? This question goes hand in hand with considering how businesses should position themselves in this evolving landscape. Even as the situation on the international markets has settled down again, it remains nonetheless uncertain. Many companies are currently reevaluating their business strategies, factoring in energy considerations more comprehensively for the first time.

What you need for this is security and predictability, which electricity price scenarios can provide. These scenarios model electricity prices within an internal market under specific assumptions and can shed light on uncertainties. You can find more information about electricity price scenarios for Germany and Europe here.

Sources:

[1] IWF (2022). Branchenportrait der Chemischen Industrie in Deutschland. URL: https://www.iwkoeln.de/fileadmin/user_upload/Studien/Report/PDF/2022/IW-Report_2022-Chemie_Branchenportrait-neu.pdf

[2] FutureCamp Climate GmbH & DECHEMA Gesellschaft für Chemische Technik und Biotechnologie e. V. (2019). Roadmap Chemie 2050. VCI. URL: https://www.vci.de/services/publikationen/broschueren-faltblaetter/vci-dechema-futurecamp-studie-roadmap-2050-treibhausgasneutralitaet-chemieindustrie-deutschland-langfassung.jsp

[3] FutureCamp Climate GmbH & DECHEMA Gesellschaft für Chemische Technik und Biotechnologie e. V. (2023). Chemistry 4 Climate. VCI. URL: https://www.vci.de/services/publikationen/chemistry4climate-abschlussbericht-2023.jsp

What do you say on this subject? Discuss with us!