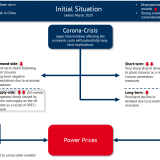

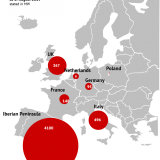

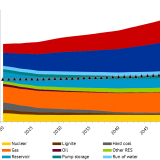

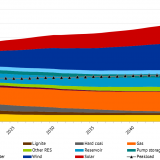

In the second part of the World Energy Outlook 2020 blog series, we provide a detailed overview of the significantly adjusted development expectations for the global oil, gas and coal markets. For this, we use our fundamental model Power2Sim. The model allows us to quantitatively estimate the long-term effects on European power prices until 2040 as well as the sales revenues of renewable energies.

Continue reading