In the second part of this blog series, we elaborate on the links between the coronavirus pandemic and energy markets. Specifically, we examine the possible medium-term consequences for the front years 2021 to 2025 on Europe’s electricity markets due to the coronavirus and the turbulences on the oil market. We conducted the analysis using the fundamental model Power2Sim.

Authors: Carlos Perez Linkenheil, Christopher Troost and Calvin Triems

A collapse in demand and supply are facing each other on the energy market. Using three different scenarios, we are attempting to separate the factors that are currently having the biggest impacts. Subsequently, the authors assess the effects on electricity prices, emissions and sales revenues of renewable energies, as well as shifts in the merit order.

In the first article of this two-part blog series we have already presented an overview of the current situation. In order to be able to give a medium-term outlook, it is important to put the recent events into perspective.

Negative signs even before Corona

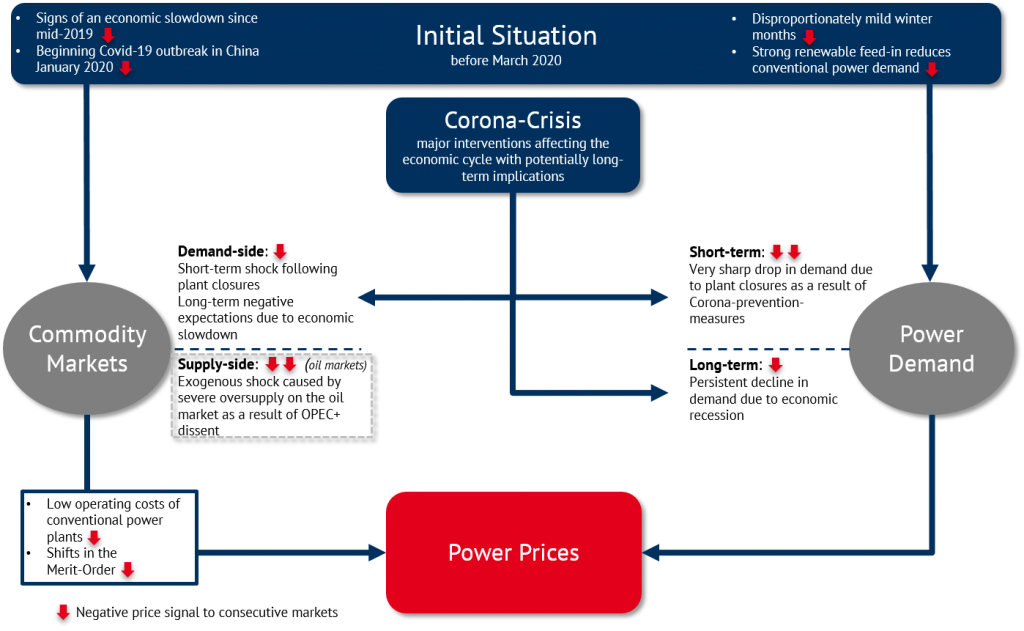

First, it must be noted that a cooling of global economic growth has been in evidence since the end of 2018. This has also been accompanied by a below-average demand for electricity due to the mild winter, as well as the recent strong feed-in of renewable energies. So, reaching mid Q1/2020, there was already negative pressure on the power demand and commodity markets. Both of these channels are now additionally negatively impacted by the coronavirus pandemic.

The demand side is severely affected

On the commodity markets, the corona crisis is mainly felt on the demand side. In the short term, a strong demand shock can be observed due to hard measures to stop the spread of the virus. Meanwhile, in the medium– to long-term, concerns about the economic outlook are playing a decisive role.

It is also important to recognise that the sharp drop in prices is also due to an abrupt increase in supply on the oil market following the failed OPEC+ negotiations. Both effects combined significantly amplified the fall in commodity prices.

The EUA (European Union Allowance) market also suffered significant losses, which, in addition to the short-term procurement of liquidity through the sale of CO2 certificates, is primarily due to lower demand. The situation is similar for power demand. Besides that the shutdown of entire industries reduces electricity consumption instantly. But what do the effects of the corona crisis imply for the medium-term power demand? The main question here is, whether a recession will follow the phase-out of the coronavirus containment measures and how severe it will be.

It follows that the two key parameters for a medium-term electricity price forecast are the price expectations for commodities and the development of electricity demand beyond 2020.

Scenario assumptions & methodology

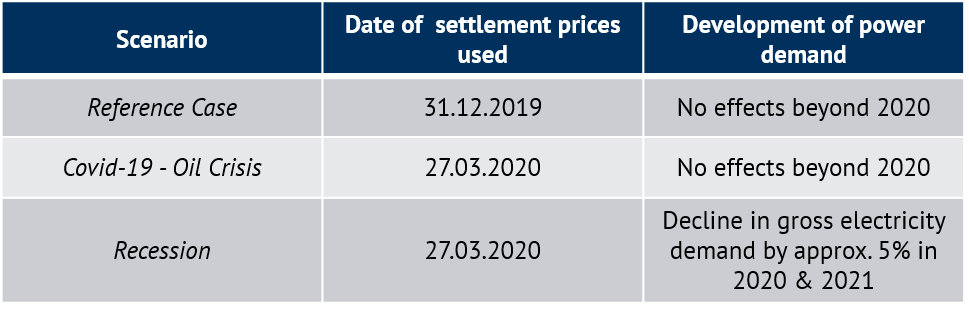

In order to differentiate between the effects of these two developments, we will use the three different scenarios “Reference”, “Covid-19 Oil Crisis” and “Recession” below.

Scenario 1: Reference Case

The “Reference Case” should represent a possible situation without the influence of the corona crisis or OPEC+ dissent. On the commodities side, the generally negative signals of a cooling economy have been factored in. However, the point in time of the settlement prices we use is at the beginning of the year. This means that it is still ahead of the first responses to a novel virus in China – a market that is by no means insignificant, especially for coal and oil. We do not anticipate any impact on power demand beyond 2020.

Scenario 2: Covid-19 – Oil Crisis

The “Covid-19 – Oil Crisis” scenario serves us as an interim scenario to isolate the impact of the commodity price decline on electricity prices from a sustained decline in electricity demand. To this end, we include in our model both the short-term decline in demand resulting from Covid-19 and the supply-side oil price shock resulting from the failure of the OPEC+ negotiations.

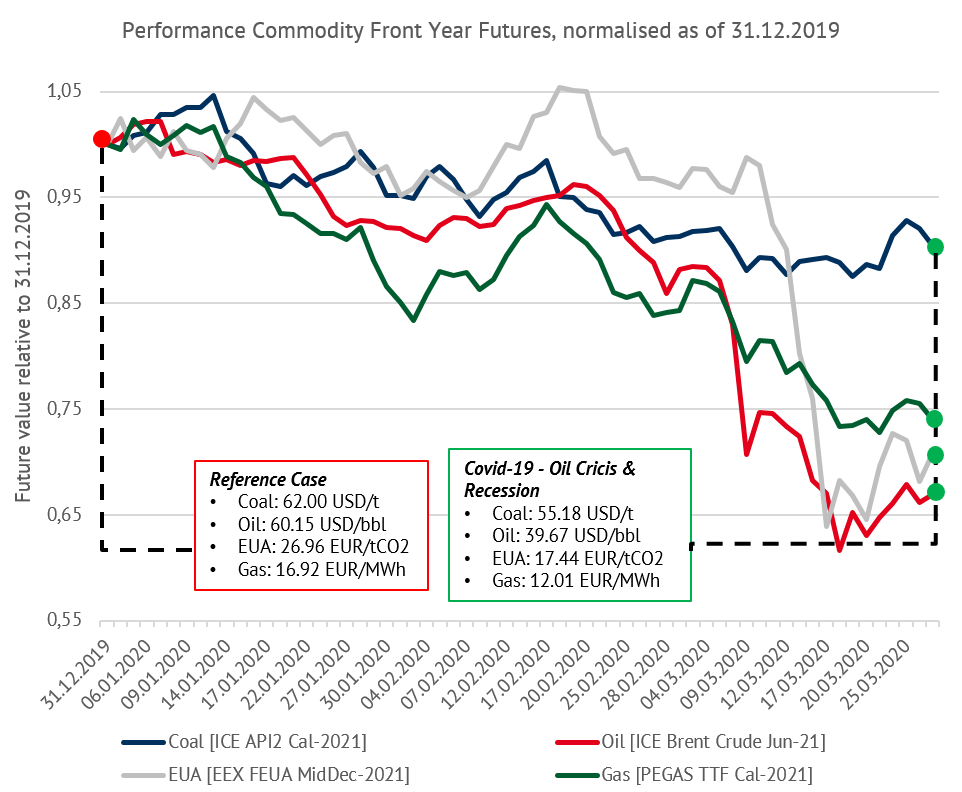

Both effects, the dissent of the OPEC+ countries (09.03) as well as the declaration of the WHO that the coronavirus was now a pandemic (13.03) can be seen very clearly in the chart (Commodity performance). We leave the power demand beyond 2021 unaffected.

In its initial base scenario assessment, the Bundessachverständigenrat der Wirtschaftsweisen (Germany’s Federal Council of Economic Experts) assumes a sharp decline in economic output of -2.8% this year, but expects an increase of +3.7 % in 2021. If we apply this rebound to the demand for electricity, we must not expect any adverse effects beyond 2020.

Figure 3: Performance of the front year futures, nomalised as of 31.12.2019 (Source: ICE, EEX, PEGAS)

Scenario 3: Recession

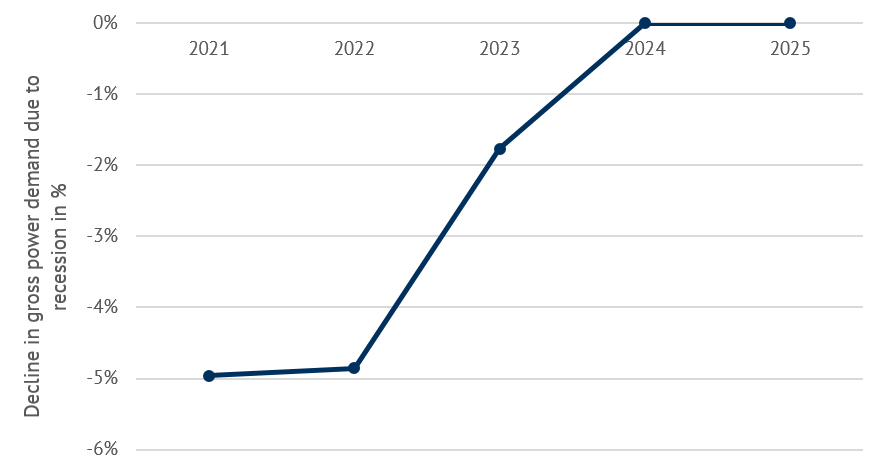

In the third scenario, “Recession”, we assume a decline in electricity demand beyond 2020 in our fundamental model Power2Sim in addition to the fallen commodity prices. This scenario serves as a worst-case estimate from a current perspective, assuming a recession for the years 2021 and 2022.

The key parameters here are the intensity of the economic slump and its penetrative power on the electricity markets. It has to be noted that both are difficult to pinpoint at the time of this analysis.

In the underlying scenario, we assume a reduction in electricity demand in the years 2021 and 2022. This corresponds to the decline in electricity demand in 2009 compared with 2008 and 2007. A full recovery is not assumed until 2024.

Scenario results and conclusions

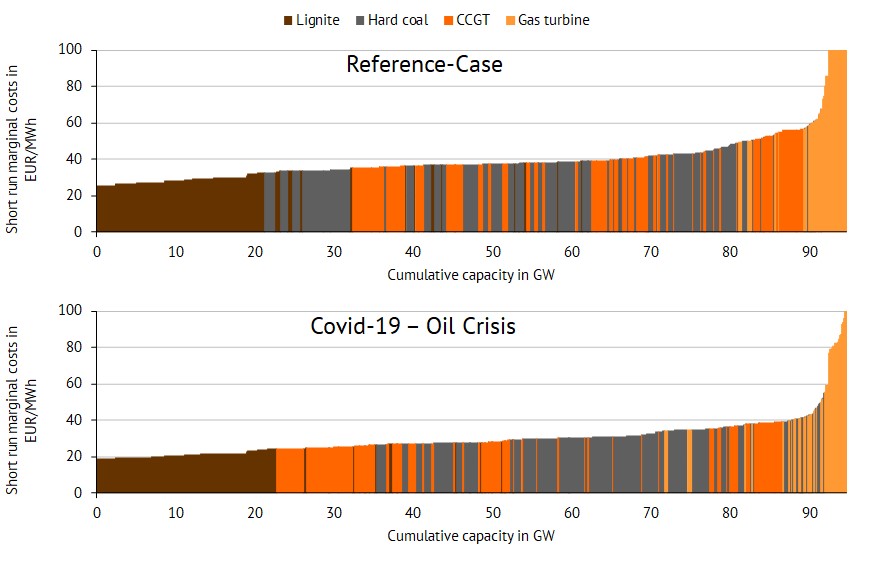

The effects on the commodity markets described above change the position of power plants in the merit order, which is determined by their short-term marginal costs. Figure 5 shows the effects based on the fossil German power plant park

Despite the sharp drop in CO2 prices in the scenarios “Covid-19 – Oil Crisis” and “Recession” compared to the “Reference” scenario, the CCGT power plants are further ahead in the merit order in the more current scenarios (Covid-19 and Recession) than in the Reference Case scenario. The main reasons for this is the likewise sharp fall in gas prices and only a very moderate decline in hard coal prices. Despite low CO2 prices, this currently gives gas-fired power plants an advantage in the merit order.

Figure 5: Merit order comparison „Reference“ and “Covid-19 – Oil Crisis” scenarios (Source: Energy Brainpool)

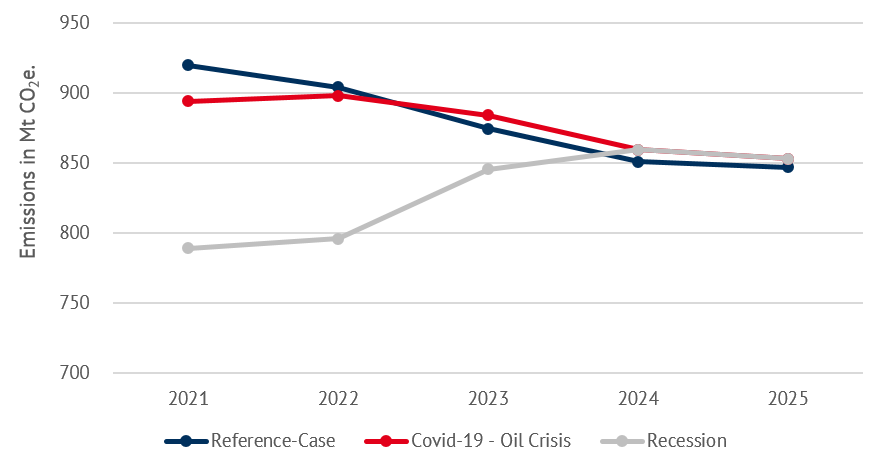

The phenomenon described above can also be observed via the resulting emissions in the different scenarios. Due to the short-term favourable position of coal-fired power plants in the “Reference Case”, more is emitted here in 2021 and 2022 than in the other two scenarios.

In the “Recession” scenario, emissions are lowest due to the reduced demand for electricity. Only in the years 2023-2025 do emissions in the “Reference Case” scenario fall below the other two scenarios. The reason for this is the current rise in gas prices on the futures market in the delivery years 2022-2024 compared to the front year. At the same time, CO2 prices rose only slightly in the same years.

In order to keep emissions low, the price of CO2 will have to rise significantly in the coming years compared to the current expected level. Factors indicating that CO2 prices will rise again are the market stability reserve, which will remove surplus certificates from the market, the expected rebound of the industry, and the abolition of flight restrictions.

Figure 6: Differences in emissions depending on the respective scenarios for selected EU-countries (Source: Energy Brainpool)

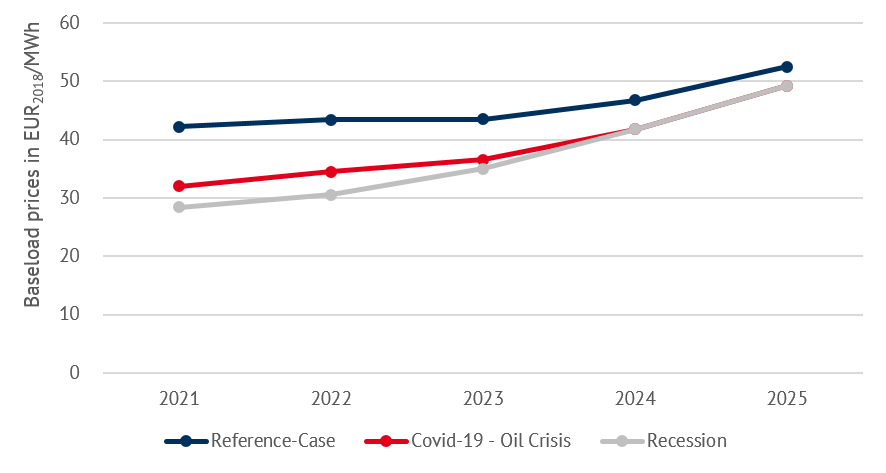

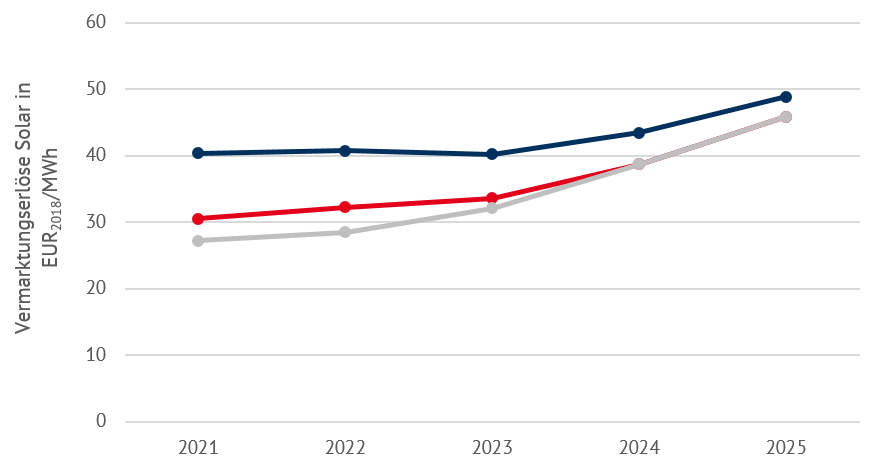

Reviewing the performance of electricity prices in our scenarios confirms the predictions made earlier. In both the “Covid-19 – Oil Crisis” and the “Recession” scenario, the average level of European electricity prices is substantially lower. Of particular interest is the relatively small difference in the resulting electricity prices in the two scenarios.

The distortion on the commodity markets leads to a price reduction of EUR 10.20/MWh in 2021, while a recession-induced slump in power demand of around 5 percent increases the losses by (“only”) EUR 3.60/MWh. With the recovery of electricity demand, the two scenarios converge and from 2024 onward, the two scenarios move at approximately the same level. However, the expected level from the “Reference Case” will not be reached by 2025.

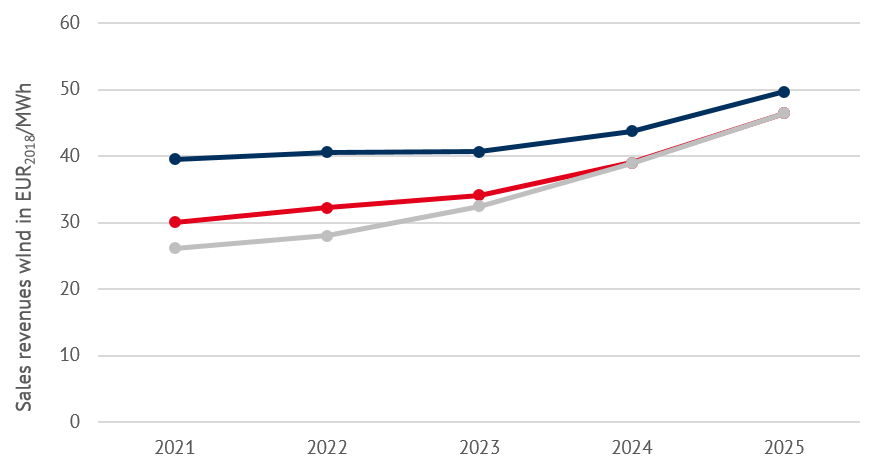

The effects on the sales revenues of renewable energies follow those of electricity prices. They are at an even lower level than baseload prices due to the cannibalization effects of renewables.

It can be concluded that the collapse of prices on the oil, EUA and gas markets in particular will lead to profound distortions on the power markets. Depending on the severity and duration of a following recession and the associated decline in electricity demand, this effect will be intensified accordingly. With regard to commodity prices, however, it should be noted that all prices are currently already at historical lows, which means that the potential for an upturn in the coming months and years is significantly higher than for a further drop in prices.

Further details can be found in our Energy BrainReports. A general classification of the energy market developments regarding the coronavirus pandemic can be found in the first part of the blog series.

Source:

[1] Germany’s Federal Council of Economic Experts: Special Report 2020 “THE ECONOMIC OUTLOOK IN THE CORONAVIRUS PANDEMIC”, 30.03.2020

What do you say on this subject? Discuss with us!