The global spread of the Sars-CoV-2 pathogen has an impact on all global energy markets. With lower demand for energy due to social and economic constraints, commodity prices on the markets have collapsed dramatically.

In this first of two articles on the Corona Pandemic and commodity prices, we focus on the links between the pandemic and the energy markets. In the second part we want to further quantify the energy economic consequences of the pandemic with a scenario analysis.

From local outbreak to global crisis

After a new type of lung disease first appeared in China in particular in the megacity of Wuhan at the beginning of 2020, most people could not yet imagine that three months later public life in most European countries would come to a standstill. However, in our globalised and highly networked world, the pathogen known as Sars-CoV-2 and the new disease COVID-19 were able to spread rapidly despite the shielding and lockdowns of millions of people.

With the sometimes drastic measures taken in the affected countries to slow the spread, economic activity, and in particular individual travel, has so far been declining. Since energy is necessary for all economic activities, the Corona Pandemic also has a strong impact on global energy markets.

China with the longest experience

In China, the country with the longest experience with the virus, a number of energy indicators are 20 to 40 percent below normal levels because of the measures taken to contain further spreading. Coal-fired power generation, for example, was reduced by up to 36 percent, while CO2-emissions in China fell by 25 per cent or 200 million tons year-on-year by early March (source: Carbon Brief).

As of the end of March, similar effects are likely to be seen in the rest of the world. A global recession has already become slightly apparent in 2019 (source: Businessinsider). However, with the accelerator of a pandemic, the economic downturn is likely to be more drastic.

Effects on the global energy markets

In any case, the reactions of the energy and commodity markets point to lower demand for the coming months or even years. At the same time, the prices for oil, gas, electricity or CO2-certificates have fallen sharply, especially from the beginning of March.

Oil prices

On 9 March, oil prices suffered their deepest fall since the outbreak of the Gulf War almost 30 years ago. However, the fall in oil prices is not only due to reduced demand caused by travel restrictions and lower economic activity. Saudi Arabia and Russia are also engaged in a price war after the two producers were unable to agree on a common line. Saudi Arabia subsequently increased its oil production (source: Foreignpolicy). The coincidence of lower demand and supply-side increases made a downward correction inevitable. At the end of March, oil prices were more than 50 percent below the levels at the beginning of the year.

Prices for CO2-certificates

The prices for CO2-certificates under the EU ETS also fell from around EUR 23/tonne to EUR 16/ton in mid-March. Electricity prices, particularly for monthly deliveries, fell by up to 40 percent compared with their levels at the start of the year. Figure 1 shows the German electricity prices for monthly deliveries in April, May, June and the front year 2021 from the beginning of January 2020 to the end of March 2020.

Figure 1: Price development of monthly deliveries in April (yellow), May (red), June (orange) and the front year 2021 (candle sticks) for electricity in the German market area (source: Montel)

The first data on the decline in demand for electricity in European countries are also already available.

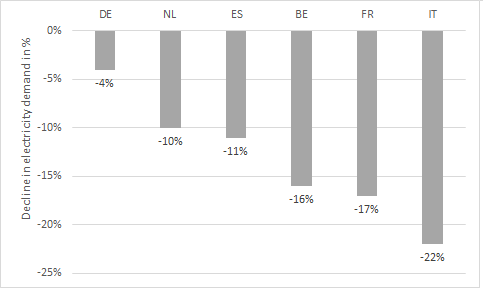

In the worst affected countries, such as Italy, France and Spain, electricity consumption fell by 10 to 20 percent in March (source: Montel). In Germany, the decline by the end of March was about four percent. Figure 2 shows the percentage decreases in electricity consumption in various European countries (source: Montel).

Figure 2: Decline in electricity demand in selected European countries compared to the norm in per cent (Source: Energy Brainpool)

With almost 50 per cent or 250 TWh per year, industry is the largest electricity consumer in Germany. With the impact of the pandemic on global supply chains and demand for goods, and in view of the effects of the financial crisis in 2009, Germany’s electricity demand could fall by around 10 to 15 percent this year.

Longer-term consequences of the pandemic

Producers suffer most from the low prices of fossil fuels, especially oil and gas. Many countries are dependent on income from the sale of these energy resources. The low prices could therefore have a destabilising effect on exporting countries and lead to geopolitical shifts if the pandemic continues or if a shutdown of the economies is the main reaction to the corona virus. A prolonged oil price war between Saudi Arabia and Russia further exacerbates the problem of low prices and low government revenues for dependent oil producers. An economic recession would be almost inevitable if the pandemic were to come to a prolonged economic and social standstill.

Effects on the carbon footprint

In 2020, Germany is expected to achieve a greater reduction in energy-related greenhouse gas emissions than was expected at the beginning of the year. The corona crisis could thus save Germany’s climate balance for 2020 (source: Agora Energiewende). However, such a one-off effect should not obscure the fact that greater efforts will be needed to achieve a long-term reduction in CO2-emissions of 55 per cent by 2030. After many economic crises, CO2-emissions rose even more sharply afterwards.

The current situation could also lead to a decline in the expansion of renewable energies and investments in energy efficiency due to the economic crisis. If companies and individuals have less money available, normally unnecessary expenses are cut. The declining demand for energy services does not stimulate the expansion of renewable energies. Neither do low fossil fuel prices. If measures against the recession are taken by politicians, the focus on climate protection and corresponding climate-friendly investments should not be lost.

Stabilisation on the energy markets since mid-March

However, there are also more positive energy industry data. Prices on the energy markets have stabilised for the time being since the sharp fall in mid-March (see also Figure 1). There is also a slight all clear for long-term oil prices, at least as of the end of March 2020. Figure 3 shows the price trend for Brent oil in various delivery months. After the sharp fall on 9 March 2020, prices have stabilised, at least for those contracts that lie further in the future, and have even risen slightly compared with the lows.

Figure 3: Development of oil prices for delivery in May 2020 (candle sticks) and December 2020 (orange), 2021 (red), 2022 (green) and 2023 (yellow) (source: Montel)

The economic effects of the Sars-CoV-2 are therefore already priced into the long-term products and become smaller and smaller the further in the future the product is to be delivered. Even if we cannot predict the future, it seems that the biggest price losses on the energy markets have been overcome for the time being (as long as the spread of COVID-19 slows down).

In the second part of this series, we look at the medium-term effects of the current commodity price and electricity demand situation. For this purpose, we use our fundamental model Power2Sim for the European electricity markets and show how the corona crisis affects electricity prices, the merit-order of electricity generation and emissions.

What do you say on this subject? Discuss with us!