If the electricity prices on the spot market are negative for at least six consecutive hours, the payment of remuneration for renewable energies will cease. This matter of fact is determined by §51 of the EEG 2017. Nevertheless already this year in the period of the 28th to the 29th of October, 21 consecutive hours with negative prices have been recorded. As a result the future assures that renewable energy systems will be denied by compensation payments. Energy Brainpool has published a white paper which examines this risk over the period 2016-2036.

The expansion of fluctuating power generation capacities, such as wind and solar power plants, is highly increasing. This fact leads to more volatility in power generation and electricity prices: There exist period of times when plants generate more electricity than they eventually would need to. Consequently, the electricity prices fall to the negatives. This effect occurs as a result that subsidized renewable energies have, according to the EGG, a right to payment of the feed-in tariff, even on negative prices. On the other hand many inflexible conventional power plants are not able to react to low electricity prices (must-run capacity of approximately 20 GW[1]. All things considered sometimes power plants amongst one another take the opportunity of market their electricity economically away. Therefore, §51 of the EEG 2017 attempts to counteract this cannibalization effect: If the prices of electricity on the spot market are negative for at least six consecutive hours, the payment of reimbursement for renewable energies will cease[2]. In November 2014, Energy Brainpool analysed in a short study on behalf of the German Wind Energy Association the future effects of the six-hour rule according to § 24 EEG 2014 on the basis of assumptions made at that time. The current white paper examines the actual impact of the six-hour rule on wind energy and solar systems based on § 51 EEG 2017, taking current market analyses and findings on the behaviour of market players since the introduction of the rule into account.

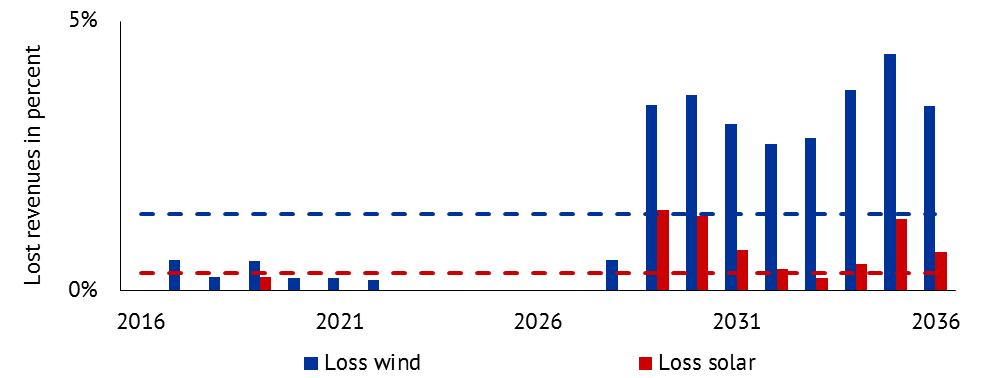

Figure 1: Annual lost revenues (market value and market premium) for wind and solar plants in percent of total annual revenues (source: Energy Brainpool)

Figure 1 demonstrates that already nowadays situations that fall under the six-hour rule occur (see blog post). As the capacity of renewable energies will expand furthermore, these situations will also develop more frequently in the future: In 2036, the share of lost turbine payments is prognosticated to approximately four percent and as for solar systems with about one percent.

On an average, wind turbines with the denoted launch year of 2016 have to relinquish over the 20 year compensation period approximately 1.4 percent of the total compensation. The loss for Solar systems amount to about 0.3 percent of the total compensation. Nevertheless these lost revenues represent three percent of the total investment costs of wind energy and on average one percent of the respective investment costs[3] for solar systems.

The equation of wind turbines and solar systems clarify that the forfeitures/losses of wind turbines are significantly higher than those of the solar plants. This is attributable to the fact that the power generation by solar systems reaches their maximum during the day at times of high electricity demand. In contrast to wind turbines, which also produce often during night hours, where electricity demand is usually on a low level and are therefore more frequently affected by the six-hour rule as solar systems.

Under those circumstances that the six hour rule already leads to a reduction in the revenues of wind energy and solar plants, it is an indispensable risk factor for the financing and planning of renewable energy plants. Nevertheless for an optimal estimation of the possible risks of the six-hour rule, various wind years as well as varying power plant savings and commodity price scenarios must necessarily be calculated as a general sensitivity.

[1] Consentec, „Konventionelle Mindesterzeugung – Einordnung, aktueller Stand und perspektivische Behandlung (2016)“

[2] Power plants with an installed capacity below 500 kW as well as wind turbines with an installed capacity below 3 MW are excluded from the six-hour rule

[3] Average investment costs from meta-analysis of 15 studies conducted by Energy Brainpool

24. November 2017

The risk is not only for the financing of RES plants in the next two decades. There is also a technical risk called “wind eclipse” as the market premium is cancelled by a step function which leads to a synchronised incentive to cease RES production. This leads to higher ramps than those already visible during the solar eclipse in March 2015, which was stressful for transmission system operators.

Man-Made Wind Eclipse: Market Triggered Step Response of Electric Power Systems

https://www.researchgate.net/publication/319702301_2017-09-13_INREC_Wind_Eclipse_FINAL

28. November 2017

Dear Mr Kästle,

thanks for your comment. The regulation is definitely questionable due to the different negative aspects as we have shown in our analysis: “Zukünftige Auswirkungen der Sechs-Stunden-Regelung gemäß § 24 EEG 2014”. (https://www.energybrainpool.com/fileadmin/download/Studien/Studie_2014-12-11_BWE_Sechsstunden-Regelung_EnergyBrainpool.pdf)

Kind regards

Lydia Bischof