What course was set for the energy industry in 2019 and what will be remembered until the next decade? In 2019, the discussion was completely dominated by the climate package, the “right” CO2 price and the preparations for the coal phase-out. Another top topic from the market side: PPAs come leave their niche. For renewables positive as well as negative records have been set.

Of climate package and other decisions

Without going into detail about the discussions on the climate package, the associated CO2-pricing scheme and the expansion of renewable energies, the political decisions on these topics were and are probably the most far-reaching for the energy industry during this year.

On 20 September 2019, the Climate Cabinet of the grand coalition agreed on the roadmap for achieving Germany’s climate targets by 2030. You can find our detailed analysis of the Climate Protection Programme 2030, or climate package, here.

Although a wide range of topics became part of the climate package (e.g. additional pricing of CO2-emissions in the heating and transport sectors, expansion of subsidy programmes for climate-friendly heating and e-mobility, as well as tax changes to improve rail transport), in the end it seems it will only have small effects. In summary, the energy sector was largely disappointed by the programme.

Adjustment necessary

In particular, the climate package does not support the expansion of renewable energies to reach the 65 percent target in 2030. A missed target or an adjustment in the course of the next decade can therefore be foreseen.

The legislative procedures for the regulations from the climate package are only partially completed by the end of 2019 (November 2019 Review), so that uncertainty still prevails on important issues.

The implementation of the results from the Coal Commission has also been delayed. Furthermore, associations are accusing the government of a departure from the recommendations of the Coal Commission (source: Energate).

PPAs come out of the niche

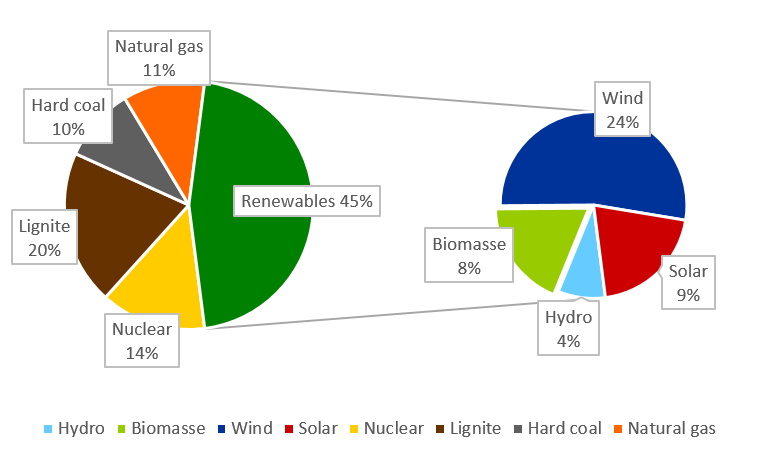

Unlike in the political arena, renewable PPAs, i.e. purchase agreements for electricity from renewable energies, have seen some progress. Not only are there more and more industrial companies showing interest in renewable electricity procurement. But the energy sector also sees new opportunities in the market expansion compared to the support regime of the renewable energy law. Figure 1 shows PPAs for various renewable technologies in European countries.

Operational issues are now coming to the fore. In particular, questions regarding the design of a PPA contract, fair pricing and hedging of long-term renewable PPAs must now be clarified. Our White Paper “PPA II: Market Analysis, Pricing & Hedging Strategies” provides a good overview.

Electricity generation and price trends in 2019

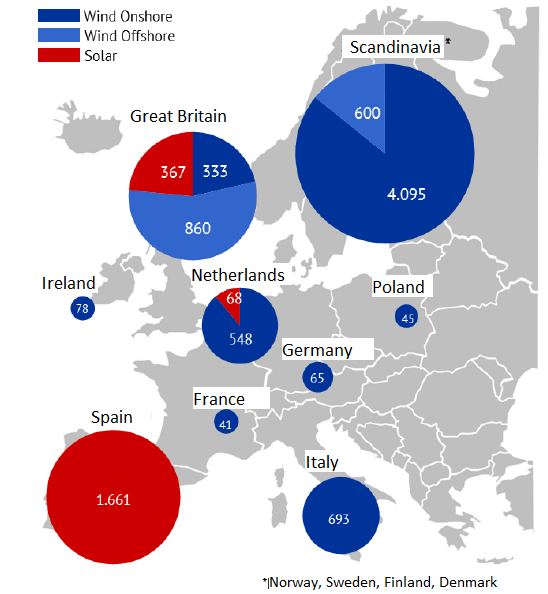

For various reasons, the expansion of onshore wind energy declined as sharply in 2019 as never before (source: Energy Brainpool). Many of the wind tenders were also undersubscribed. Nevertheless, wind energy, with a share of 24 percent, was the strongest energy source for electricity generation in Germany over the course of the year.

As data shows by mid-December, the share of renewable energies in net electricity generation in 2019 will rise to a record high of around 45 percent compared to 40 percent in 2018. Figure 2 shows the shares of various generation technologies in net electricity generation in Germany in 2019. In general, there was a sharp decline in coal-fired electricity generation of around 50 TWh compared with the previous year.

Figure 2: shares of various technologies in net electricity generation in Germany in 2019 (source: Energy Brainpool)

On the price side, the upward trend of commodities from 2018 was halted. The reasons for this lie in the worsened situation of the global economy. Uncertainties about Brexit and the trade dispute between the USA and China reduced demand for products and fuels.

With an average of around 25 EUR/ton, CO2 certificate prices remained at the level they had in the end of 2018. During the year, however, there were fluctuations of up to 5 EUR/ton around this level. At the same time, gas prices fell from 20 EUR/MWh at the beginning of 2019 to around 14 EUR/MWh at the end of the year.

As a result, electricity prices for the 2020 calendar year have remained within a limited corridor. The maximum price for base load delivery in the German market area for 2020 reached over 52.5 EUR/MWh at the end of July. However, the price fell to below 42.5 EUR/MWh towards the end of the year. This can also be seen in Figure 3.

Figure 3: price development during 2019 for baseload supply of electricity for Germany in 2020 (source: Montel)

What will be the trends in the energy sector in 2020?

During the year 2020, especially the legal implementation of the climate package – with all its details about the national emissions trading system and tax changes – as well as the coal phase-out will cause changes in the industry.

New regulations to accelerate the expansion of renewable energies, possibly through a major amendment of the renewable energy law, are inevitable if the targets for 2030 are to be achieved.

These changes might include higher tender volumes, the abolition of the 52-GW cap for PV and regulations for faster approval procedures for onshore wind energy.

New impetus for the national hydrogen strategy

Similarly, the topic of green hydrogen and power-to-gas seems to be getting stronger political support. The German government has developed a national hydrogen strategy for this purpose (source: BMBF). Hydrogen partnerships are to be established, which will allow Germany to import renewable gases in the future. Furthermore, research on the topic of green hydrogen will receive even more financial support.

Further developments in the gas sector will certainly remain relevant. Be it in preparation for the merger of the two German market areas or the construction and expansion of the German LNG infrastructures.

In particular, the linking of the two sectors electricity and gas will be more on the front. The value chains of the two sectors will become more intertwined, for example with regard to the production of synthetic gas and its storage (source: Energy Brainpool).

We are looking forward to accompanying and supporting you during this interesting time for the energy sector.

Last but not least, we wish you all a successful New Year!

25. January 2020

One of the interesting things about Hydrogen in this decade will be the cost reduction to produce as electricity becomes cheaper and then the question will be how to move hydrogen from where it is made to where it is needed. Will it be cheaper to move the electricity or the hydrogen?

28. January 2020

Dear Bo,

thank you for your comment. Indeed, the generation of hydrogen via renewables will be an important corner stone of decarbonised energy systems. We already analysed its potential competitiveness in this article: https://blog.energybrainpool.com/en/electrolysis-gases-of-renewable-origin-on-the-way-to-competitiveness/. In Germany, the gas companies and gas grid operators aim to become part of the energy transition by putting their infrastructure into the focus for green gases. If electricity or hydrogen transport is cheaper depends in many cases also on tariffs and fees on certain energy carriers. And those tariffs and fees are different in different countries, so a one-fits-all answer might not exist.

Kind regards

Your Energy-Brainpool-Team