The importance of electrolysers for energy transition research is steadily increasing these days. But can electrolysis products compete with fossil fuels in practice? This question is the subject of a brief analysis conducted by Energy Brainpool on behalf of Greenpeace Energy eG.

What does hydrogen from a current electrolyser cost?

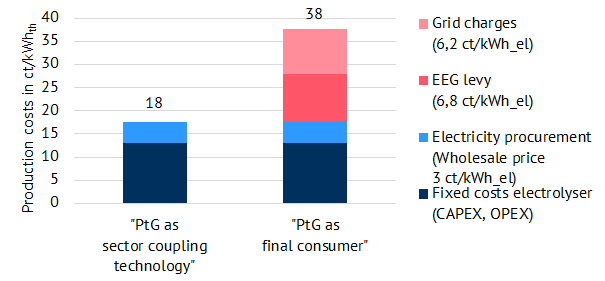

The production costs of electrolysis gas are currently around 18 ct/kWh for ecologically sensible and grid-supportive plant operation (the specific analysis can be obtained from the entire study). According to FFE, the production costs of hydrogen of fossil origin are around 4 ct/kWh. This means that hydrogen electrolysis cannot currently be offered at competitive prices. These high expenses due to the very high fixed costs to date. This should soon change due to a reduction in investment and operating costs. The fixed costs over the lifetime of the electrolyser vary greatly depending on the number of full load hours of use. For example, a number of 3,000 full load hours results in fixed costs of almost 13 ct/kWh. If EEG levy (renewable energy levy in Germany) and grid charges are added, full costs of up to 38 ct/kWh result, as shown in Figure 1.

Figure 1: Production costs for electrolysis gas (PtG: power-to-gas) at a current plant and ecologically sound, grid-supportive operation (3,000 full load hours), depending on the classification of PtG as a sector coupling technology or as an end user, Source: Energy Brainpool

One way of using electrolysis hydrogen is to feed up to ten per cent of hydrogen into the natural gas grid. Compared to current natural gas prices of 1.7 ct/kWh (closing price NCG (German gas market area) for gas supply in 2019 on 7 March 2018), this is not yet economical. Also, hydrogen electrolysis can be used in industry as a substitute for fossil hydrogen.

How will the costs of electrolysis gas and fossil natural gas develop until 2040?

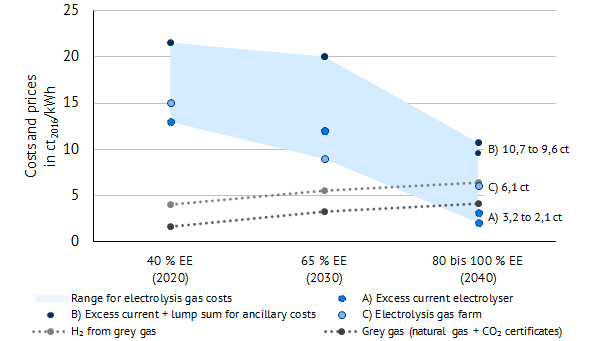

There is great potential for further cost degression through continuous application and industrial development of electrolysers. In addition, technical life and efficiency can be increased. In the short analysis, Energy Brainpool compares three scenarios for the development of full costs. The market experts consider the following case to be the most sensible: an electricity system with a high proportion of renewable energy generation in which electrolysers only run in those increasingly frequent phases of excess renewable electricity. This gas of renewable origin can then be used when a dark cold doldrum occurs. The excess electricity purchase is possible at very low electricity prices. In the analysis, an average of 3 EUR/MWh is assumed. However, such low-cost electricity procurement is also a prerequisite for the associated competitiveness. The current allocation and levy system for electricity consumers does not yet make this favourable excess electricity purchase possible and would have to be adjusted.

In contrast to the reduction of production costs for electrolysis gas, costs for fossil natural gas are expected to rise. This is particularly true for price scenarios in which the climate targets of the energy industry are achieved and the emissions of CO2 become significantly more expensive. The so-called “grey gas” price, i.e. the effective price for natural gas, is used for the calculation: Price for “grey gas”=price for natural gas + (price for CO₂ * emission factor)

For example, in the “Sustainable Development” scenario of the International Energy Agency from 2017, the cost of “grey gas” will double to 4.19 ct/kWh by 2040. This is due to increased natural gas and CO2-prices for 2040 (2.1 ct/kWh and 107 EUR/tCO2 respectively).

Will electrolysis gas become cheaper than fossil natural gas?

Fossil natural gas has process-related advantages over electrolysis gas in terms of production and transport costs. The cost increase in the course of defossilisation of the energy industry is a factor that cannot be ignored. Figure 2 shows how the price expectation for “grey gas” and thus the production costs of hydrogen produced from “grey gas” are rising. Electrolysis gas is declining in cost down to 2.1 ct/kWh depending on the share of renewables. This cost degression ensures more economical operation of the electrolyser with fewer required full load hours. Falling fixed costs and falling costs for renewable electricity purchases make this development possible. Excess electricity in electricity systems with a high share of 80 to 100 per cent renewable energies (case A in Figure 2) ensures that electrolysers consume electricity that could otherwise not be marketed (see Energy Brainpool time series analyses). This reduces electricity procurement prices. Further conceivable scenarios would be a supplementary payment of fixed electricity price components for flexibly consumed excess electricity (case B in Figure 2) or the case of off-grid electrolysis gas farms (based on a current study commissioned by Agora Energiewende). This is shown in case C in Figure 2. The latter cases are less efficient or systemic than case A utilising the excess electricity and might significantly reduce the competitiveness of electrolysis gas.

Figure 2: Future development of production costs of electrolysis gas for three operating cases A, B and C and costs for the use of fossil natural gas including CO2 certificates (“grey gas”) according to World Energy Outlook 2017 “Sustainable Development”, Source: Energy Brainpool

From the mid-2030s, the production of electrolysis gas can be cheaper than the purchase of fossil natural gas (natural gas + CO2-certificates), as evaluations show . The prerequisites for this are cost degression for electrolysers through continuous investment in the technology, low electricity procurement costs for the otherwise curtailed excess electricity, the achievement of climate protection targets and the targeted share of renewable energies.

Please find the entire study at: https://www.energybrainpool.com/fileadmin/download/Studien/Kurzanalyse_2018-03-19_GPE_Kurzanalyse_Kostenentwicklung-von-Elektrolysegas-erneuerbaren-Ursprungs.pdf