While the EEG amendment for 2021 has still not been finally adopted, the new energy balancing market started in Germany on 2 November 2020. Besides that, the EU Commission has approved the German coal phase-out. Prices on the futures market rose again in November 2020.

A new version of the Renewable Energy Sources Act is scheduled to come into force on January 1, 2021. In the following, we describe the latest developments towards the EEG amendment 2021.

EEG amendment 2021 on the home straight?

- On September 1st, 2020, the German Ministry for Economic Affairs (BMWi) presented the first draft of the EEG 2021. There was no complete restructuring, but rather a further development of the previous law.

- On September 14th, 2020, the BMWi published the draft bill, which has since been updated, and gave permission to proceed for the association hearings. The comments had to be submitted within the short period of three days. This caused a wave of criticism.

- On September 23rd, 2020, the Federal Government presented the cabinet draft of the EEG 2021.

- On November 6th, 2020, the Federal Council commented on the Federal Government’s draft law and called for further amendments to the draft. In particular, there was criticism that the expansion paths for renewable energies were not sufficiently high and that the smart meter obligation for plants above 1 kW was disproportionate.

- Barely a week later, on November 11th, 2020, had the Federal Government responded immediately. Most of the proposals for improvement were rejected and only a few will be considered in further reviews. (source: prometheus). Associations, industry experts and scientists fear a green electricity gap that could result from the weakening of new renewable energy generation.

- Due to European legal requirements, EEG 2021 must enter into force on January 1st, 2021. To this end, the German Parliament should have passed the amendment by the end of November and the EU Commission should have waved the bill through by the end of 2020.

However, the German Parliament is lagging behind schedule and is still in the budgeting process. The introduction of the law could therefore prove difficult. If the law does not enter into force, various legal problems would arise. (source: energiezukunft)

Next month the central changes of the EEG amendment will be explained in a separate blog post.

EU Commission approves German hard coal closure tender

By 2038, the German government has set itself the target of decommissioning all coal-fired power plants. In order to move closer to this goal, the Federal Network Agency has submitted a draft for a tendering procedure to the EU Commission. The EU Commission approved the hard coal closure tender on 25 November 2020. The situation is different for the lignite closure. These will not receive approval for the time being, as the small number of market participants does not allow tendering.

With regard to the hard coal closure, the European Commission has made only one change: The last tender round in 2027 will not take place as planned. Between 2027 and 2030, the closures will then take place in a purely regulatory manner, without any compensation for the operators.

The first tendering round took place on September 1st, 2020 and 4 GW of total capacity was tendered. No later than seven months after the Federal Network Agency announces the tender results, the plants are to be taken off the grid. If the transmission system operators determine that the power plants in question are systemically relevant, the plants would no longer be able to market their power on the power market but would have to acta as reserves (source: BMWi).

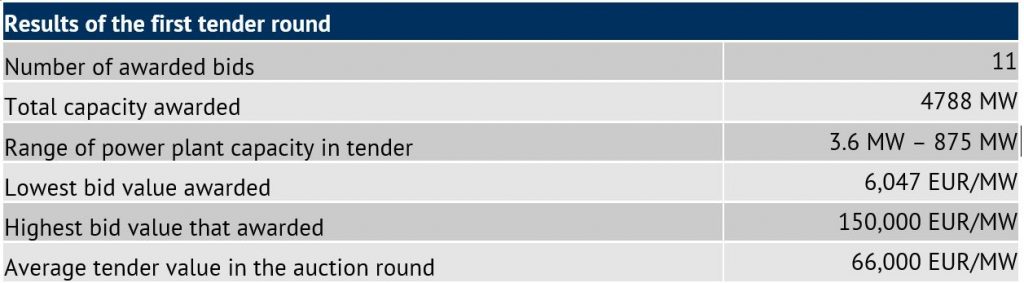

The results of the tender are shown in the table below:

As the tender round was heavily oversubscribed, the bid which exceeded the tender volume of 4,000 MW for the first time, was still awarded. The high level of competition pushed the awards well below the maximum price of 165,000 EUR/MW. (source: Bundesnetzagentur).

The auction was subject to criticism from various sides, due to the specific power plants that have been awarded. On one hand, plants that had been in the red numbers anyway got reimbursed for shutting down. While, on the other hand, comparatively young plants with high efficiencies were taken off the grid.

In this context, the Moorburg Block A and Block B power plants of Vattenfall, which only went on the grid in 2015, should be mentioned (source: klimareporter). RWE’s Westfalen power station also went online just six years ago. In addition to the Ibbenbüren power plant, RWE was awarded the largest contracts, worth €216 million, which is a good two-thirds of the total awarded value of €317 million.

Starting signal for the new energy balancing market

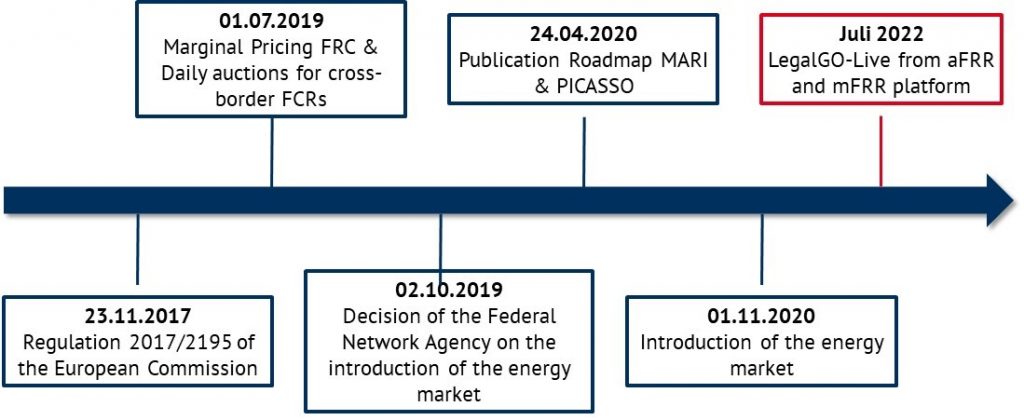

The new energy balancing market should have been introduced on 1st June 2020. However, it did not start until 2nd November.

Up to now, capacity and energy were auctioned together one day ahead of delivery in the balancing market. Now, trading of power and energy takes place in successive and separate markets. Suppliers can now offer energy bids directly on the energy market, even if they have not been awarded a contract on the capacity market (source: 50hertz). This gives the capacity market the role of an “insurance” for the energy market.

If the energy market fails due to technical problems, the service offered on the capacity market can be used. Anyone who has been awarded a contract in the capacity market should nevertheless offer an energy price in the energy market; otherwise, their bid could be called up for 0 euros. The contracts are awarded based on the bid price, i.e. in the pay-as-bid procedure.

The time between Gate Closure on the energy market and the time slice in questions is now one hour. This means that the participation of suppliers who cannot determine their generation volume in the long term, i.e. renewable energy sources, has been simplified (source: FORRS).

The change in the allocation system will gradually bring the harmonisation of a European reserve and markets closer in accordance with the Electricity Balancing Guideline (EBGL). In the long term, the PICASSO and MARI platforms are to be introduced for the cross-border trading of regulatory work for aFRR and mFRR in Europe (source: bdew).

Prospect of vaccine boosts prices despite COVID-19

Oil prices reached a five-month low in late October. This was due to stronger European measures against COVID-19 and the uncertain outcome of the US elections at the time (source: montel). In early November, the price was then boosted by the hope of a vaccine. In addition, the clarity after the US elections contributed to the rise in oil prices. The oil price reached its highest level for eight months on 25 November and rose by almost 10 per cent in the course of the month. For 2021, the International Energy Agency expects demand to recover by 5.8 million bbl/day to 97.1 million bbl/day. This is almost 3 million bbl/day below the level of the previous year (source: montel).

The Cal 21 last rose on the EEX to 41.45 EUR/MWh – a 7-week high. This is the response of the front year in the German electricity market to the vaccine and the associated improvement in the economic situation. In addition, the rise is also due to the prospect of cooler temperatures and less wind (source: montel).

The weather also had a strong influence on the price for the Front Year gas. In mid-November, the price fell due to mild temperatures. Towards the end of the month, on the other hand, temperatures are forecast to be 3 degrees below average for December, which ensured a continued upward trend (source: montel).

The EUA lead contract for December 2020 had a rising trend in November, reaching a nine-week high of 28.90 EUR/t at the end of the month (source: montel). Towards the end of the month, the EU Commission announced that the 2021 auction for CO2 would not take place before the end of January or the beginning of February. The resulting gap of 6 weeks allows CO2 contracts to rise further (source: montel).

Figure 2 shows the price developments of the front year electricity Germany as well as for CO2 certificates, oil and gas since the beginning of October 2020.

Figure 2: percentage price development of the German power front year (candle sticks), CO2-certificates with delivery in December 2020 (red line) and Brent oil with delivery in February 2021 (green line) and front year gas at the TTF (orange line) from the beginning of October to the end of November 2020 (source: Montel)

Strong gas-fired power generation in November

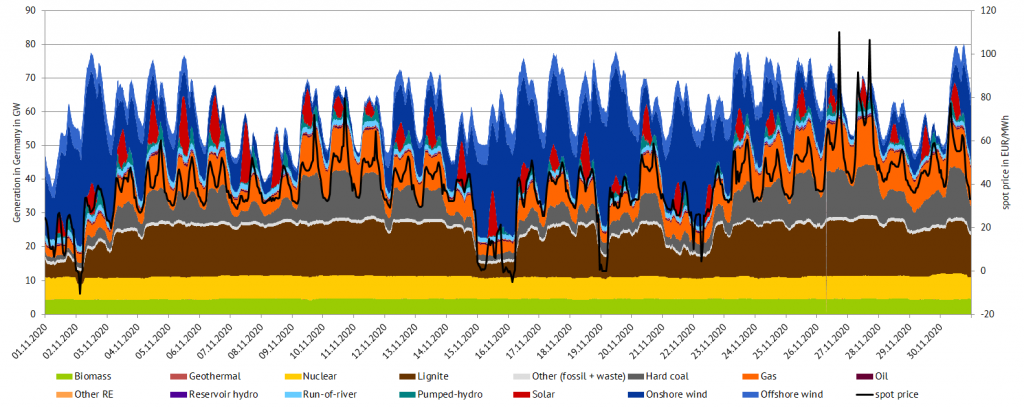

The share of renewable energies in November is unusually low at 40% on average (source: Energy Charts). On the one hand, this is due to the low level of solar radiation in the winter months, solar power is approaching its average low point with 1.7 TWh of electricity generated in November. On the other hand, strongly fluctuating wind feeds of 1.50 GW and 33.01 GW contribute to the low share of renewable energies. As a result, hard coal production is particularly high at 5 TWh. Gas also sets records at 7 TWh, despite mixed weather, and in November achieved its highest monthly net contribution to electricity generation in 2020.

Figure 3 shows electricity generation from different technologies and day-ahead prices in November 2020 for Germany.

What do you say on this subject? Discuss with us!