The currently rising wholesale price for electricity is particularly pronounced in Poland. As before (e.g. August 2015), the old Polish power plant park is not in a position to cover the entire demand for electricity in times of shortages. Where the demand is high, there follows the price.

Electricity prices on the futures market are currently 66 EUR/MWh for 2019, but this is also due to the price of coal and CO2. Wind turbines can sometimes already be operated in Poland at this price, but need a long-term price guarantee to finance them. This could be accomplished through PPAs (Power Purchase Agreements) with consumers or energy suppliers. For an existing plant, such a PPA was only recently concluded between VSB and Mercedes Benz. From Energy Brainpool’s point of view, it is no coincidence that the two German companies are joining forces on the Polish market.

Status analysis of the power system in Poland

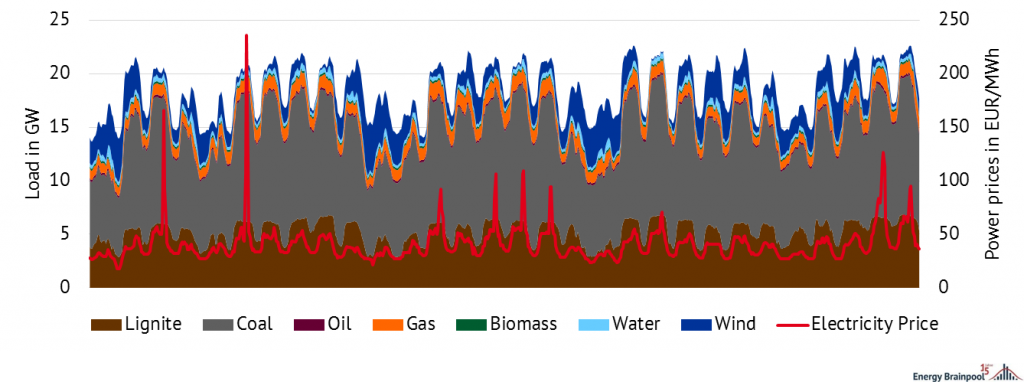

In December 2014 and August 2015, the Polish electricity system sent out very clear scarcity signals. Hourly electricity prices exceeded 300 EUR/MWh. At least in August 2015, the demand for electricity could not be met, one speaks of brown-outs where industrial consumers need to reduce their electrical power.

The situation has only eased to a limited extent since then: Last November 2017, electricity prices of over 100 EUR/MWh regularly occurred around 4 pm. For the most part, these scarcity prices did not occur at the same time as European scarcity prices or were higher in size. The hourly Polish electricity prices in the Polish Day-Ahead Market and the electricity generation according to ENTSO-E data per power plant type show that, with low wind input, the conventional, controllable generation capacity is regularly fully called up in the afternoon.

During this period, electricity producers compete with each other in markups and offer above their marginal costs – in some cases this results in high electricity price peaks. You can find further details about the condition analysis in our study on European electricity market integration in Poland from 2016. You can access it free of charge via our study directory. (in German only)

Futures market sets European impulses, the Polish power system reinforces them

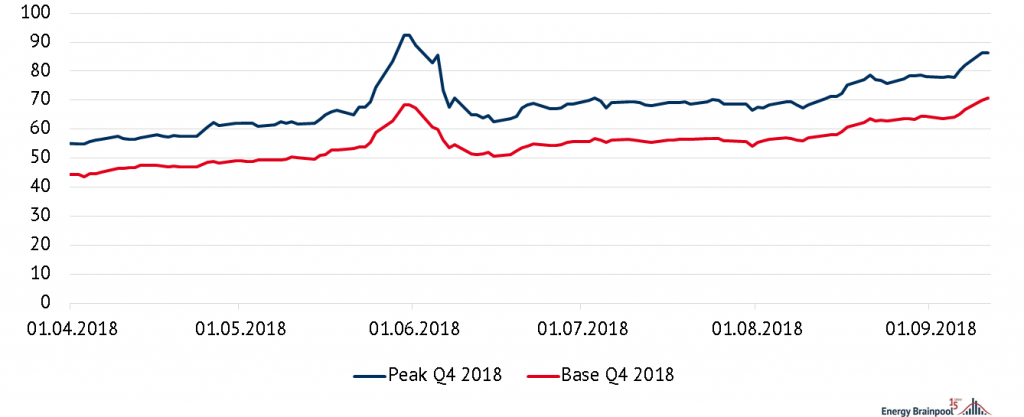

The high historical electricity prices on the spot market are also expected in the future and are priced into today’s futures market: Let us take a look at the price expectations for the quarter that is about to begin/Q4 2018[1]:

Individual speculations on the scarcity situation in June 2018 led to peak prices of short-term over 90 EUR/MWh for the months of October to December. Meanwhile, the futures market is moving further and further towards this. The difference between base and peak prices fluctuates between 10 and 20 EUR/MWh The price peaks are increasingly expected in the peak period Monday to Friday from 8 a.m. to 8 p.m. In contrast, the general upward trend in electricity prices is not a Polish phenomenon, but a European price movement driven by coal and CO2 prices. Angela Pietroni has written a detailed analysis of this effect in 2017.

Naturally, Polish electricity generation based on lignite and hard coal is particularly affected by this price development. Here, the fuel switch has a particularly high impact on the revenues of hard coal-fired power plants. Gas-fired power plants have historically not had a high place in the Polish electricity system due to concerns about energy self-sufficiency (in particular, dependence on Russian gas imports).

For the whole of next year, electricity is currently (11.09.2018) being charged at 66 EUR/MWh (base), the peak period priced at 89 EUR/MWh.

Is a PPA worthwile as an hedge?

The price dynamics described above are particularly wavering in Poland due to the simultaneous occurrence of scarcity situations (so far without a visible long-term solution strategy) and the commodity-price-driven upward movement of electricity prices. This entails some risks for electricity consumers. The following example shows that they are basically prepared to issue long-term price guarantees for electricity supply:

At the end of July 2018, VBS and Mercedes Benz concluded a Power Purchase Agreement (PPA) for an electricity supply from 22 45 MW wind turbines that were built in 2013 at the Taczalin Wind Farm and are located 10 km from the new Mercedes Benz engine plant. Electricity supply starts in 2019 and includes a long-term commitment -– more is not known. At the beginning of 2018, we summarised for you on our White Paper the basic knowledge on the subject of PPA.

Wind power plants perspective:

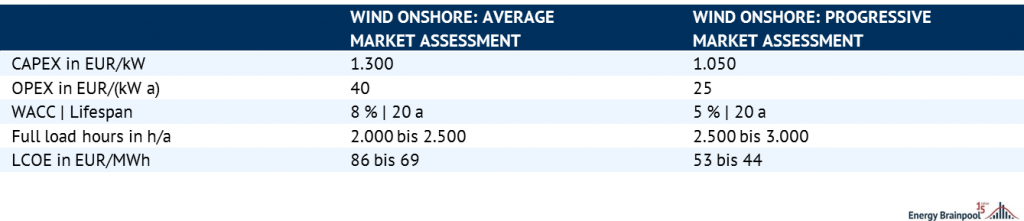

In principle, the market parity for some wind power plants (WPP) has been reached in Poland at the current electricity price level. The following rough project calculation for onshore wind energy of current projects without financial support shows electricity generation costs between 86 and 44 EUR/MWh.

In recent years, the market value of wind power has fluctuated between 90 and 92 per cent due to the merit order effect, averaging 91.2 per cebt. Translated to today’s forward price level for 2019 of 66 EUR/MWh, this means a sales value of 60 EUR/MWh with today’s hedge for 2019. Under favourable financing and wind conditions, electricity generation costs between 44 EUR/MWh and 53 EUR/MWh.

For such financing conditions (WACC of 5 per cent) however, there is no long-term price guarantee. Currently, market participants will not guarantee the 2019 price level for a long period.

The international framework conditions for an increasing share of wind power are good: The price dynamics of previous tender rounds have shown that with very favourable financing conditions and high competition for wind projects, electricity production costs can fall even further. Many wind projects in Poland are expected to be pre-developed and could lead to high competition in the future.

The most important reasons for the non-implementation of projects are two: on the one hand the risk arising from the uncertain Polish legislation on the promotion of renewable energies and on the other hand, the lack of a visible future strategy for Polish electricity generation.

In addition: Electricity markets with a higher extension of variable renewable energy sources have shown, that such an extension places high demands on the flexibility of existing electricity producers. Higher load ramps, more start-stop cycles and lower full utilisation hours are flexibility requirements which the old Polish power plant park cannot meet in every respect. This gives rise to doubts as to how far a wind energy/solar expansion could be slowed down by regulatory measures.

You can find an evaluation of how far power-to-gas technologies can make flexibility-hungry renewable energy sources controllable, in our white paper about controllable renewable energies.

Consumer perspective:

The market value of the average Polish consumption profile in recent years has been 103 to 104 per cent of the base price. If these figures are extrapolated from today’s perspective, average Polish electricity consumption for 2019 will have amounted to 66 EUR/MWh * 103,3 per cent = 68 EUR/MWh. This electricity price level has become a risk, especially in European comparison.

The difference between electricity production costs and current electricity procurement costs, leaves room for the discussion of a long-term price guarantee with a price minimum close to the electricity production costs of wind power plants. However, some obstacles currently prevent the conclusion of such PPAgreements.

Although fluctuating renewable energies can hedge price risk in the long term, they are not an hedge against imminent capacity gaps and further brown-outs. In times of strongly fluctuating electricity prices, long-term price maintenance prevents electricity consumers from participating fully in falling electricity prices, and long-term portfolio management is often not yet established.

What might a PPA look like?

Example 1: Corporate PPA

The risks and opportunities of both stakeholder groups, producers and consumers, are oppositely distributed. While consumers want to protect themselves against constantly high or rising electricity prices, operators of wind power plants fear falling electricity prices – because they have to refinance themselves over many years. Both stakeholder groups can conclude long-term electricity supply contracts directly with each other.

One proposal are PPAs, which set price floor and price cap limits for a long period of time. Rolling a price is always fixed, for example, for three years in advance, according to a price formula to be defined. The differences between wind generation and consumption profiles are then compensated on the electricity market. The costs to be forecast for this will influence the PPA price and the amount of electricity covered.

Example 2: Hybrid Merchant PPA

An intermediary plays a central role here, often an energy supply company. These could be Polish energy suppliers such as PGE, because they have a high risk due to the high proportion of fossil electricity in their portfolio and the currently rising CO2 prices. Increasing the share of renewable energies in the portfolio is a good option in terms of diversification.

Electricity from wind power plants can be integrated into the energy supply company ‘s portfolio by physical delivery or can be extended by long-term price guarantees as financial security. Two strategies can be considered for the counterposition of such a price guarantee: first, a long-term price guarantee can be given to consumers and this can be linked in perspective to a green electricity supply.

Due to the unclear long-term planning for the Polish electricity supply, the risk of high electricity prices in the long term and temporary shortages among Polish electricity consumers is disproportionately high. In contrast to neighbouring markets, the basis for demand is provided by long-term price guarantees from consumers. Secondly, a counter position in the futures market corresponding to the PPA volume can be built up, for example, by selling futures and forwards.

A value-neutral rolling hedge with the respective tradable front contracts would be a common hedging instrument.

[1] Data: TGE Polish Power, in EUR at the exchange rate of 11th September 2018

What do you say on this subject? Discuss with us!