“Jamaica in the coal dilemma”, “Black-Green quarrel over coal”, “coal phase-out is the taboo word in the Jamaica debate”. During the exploratory talks on a possible Jamaica coalition, the coal phase-out demanded by the Greens was a central point of discussion. How did the electricity market react to this? Can the struggle for coal capacities to be (not) decommissioned be read off from the electricity price? And what does that say about the energy-only market?

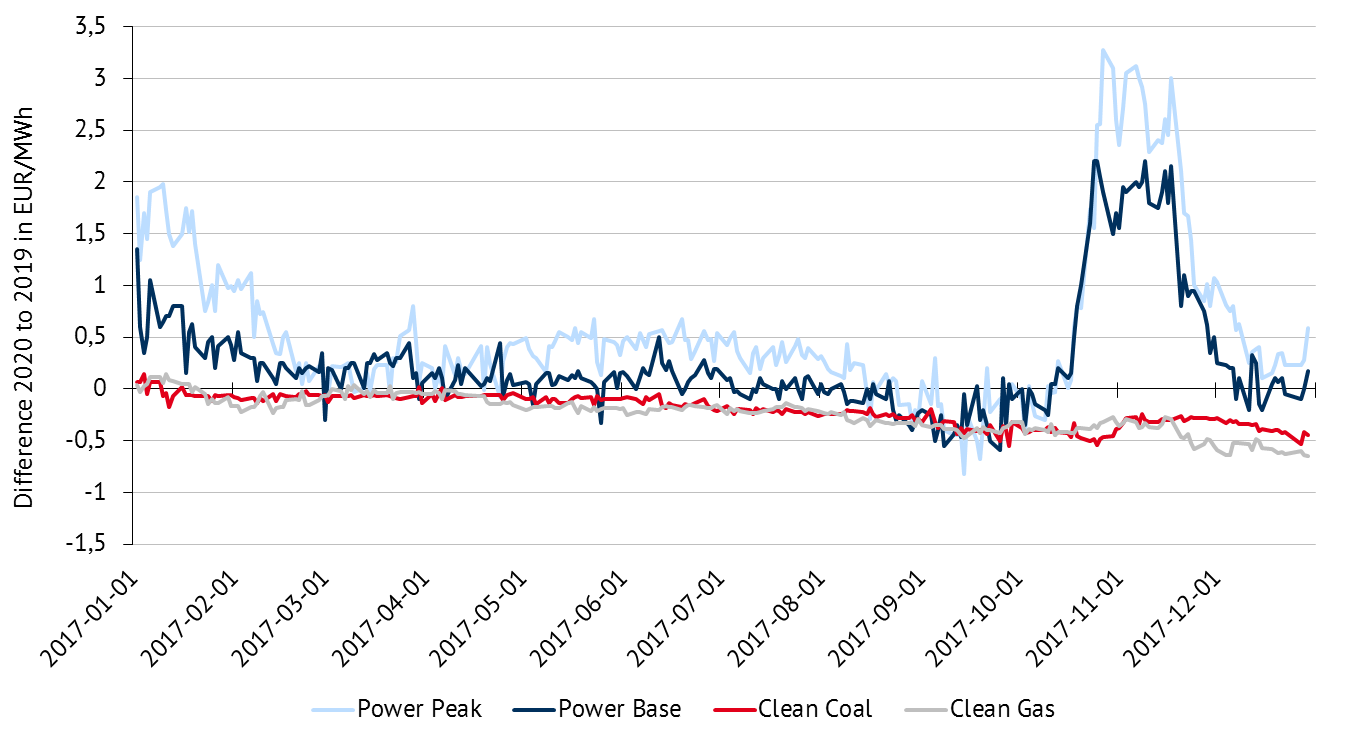

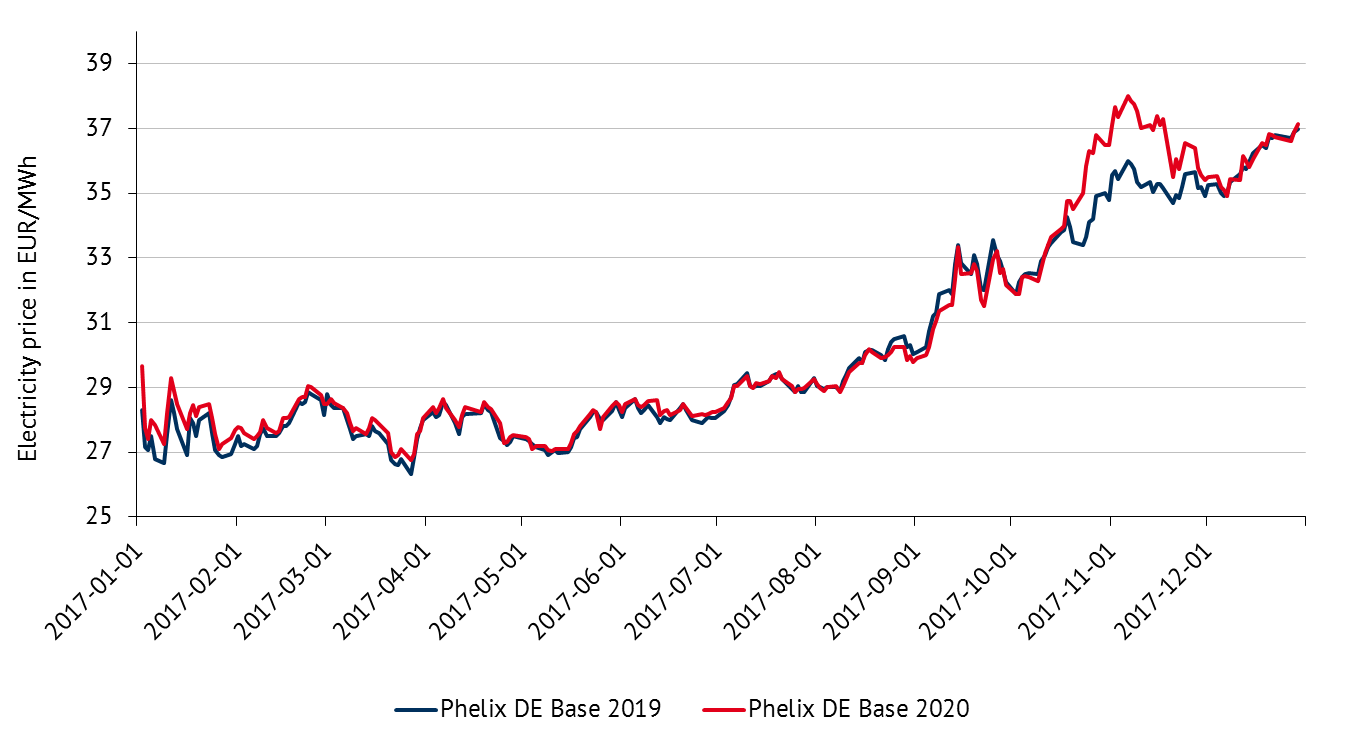

Let us first look at the prices of the German electricity futures traded in 2017 on the EEX for the delivery years 2019 and 2020 [1]. The indicator that for each trading day reflects the current expected value of electricity traders above the future average electricity price:

Figure 1: electricity price trend (Phelix DE, Base, Year Future, Last Price) for the years 2019 and 2020 (source: Energy Brainpool)

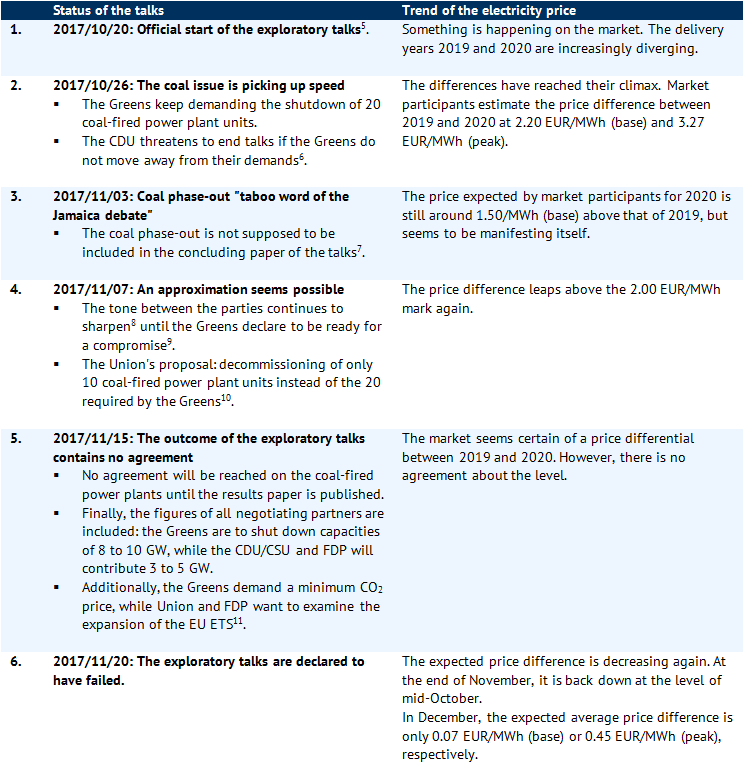

Here, the price development from mid-October to the end of November 2017 catches the observer’s eye: The price curves for the delivery years 2019 and 2020 diverge strikingly. Electricity traders appear to have expected electricity prices to jump from one delivery year to the next in the corresponding period. The respective peak prices, that is, the expected value for future electricity prices in the high-consumption hours, show even greater deviations for the same trading period. This is shown in Figure 1. We will try to track down these deviations.

In the series “The price of electricity depends on the price of coal”[2] it was already explained that the base price reacts sensitively to a changing coal price. The price for CO2 certificates has a major influence on the forward market prices for electricity as well. With a shortening merit order in the course of the nuclear phase-out, capacities with higher marginal costs (e.g. import electricity, gas power plants) are increasingly setting prices. This is a starting point: Was the observed development of electricity prices perhaps provoked by these typical parameters? As Figure 2 shows, the price differences for clean coal and clean [3] gas in the supply years 2019 and 2020 are not likely to be the cause of the price distortions in electricity supplies in 2019 and 2020.

Coal, gas and CO2-prices do not explain the development of electricity prices.

As it happens, the exploratory talks for a possible Jamaica coalition were underway at that time. Even before the talks began, the Greens brought the target year 2020 for the shutdown of 20 power plant units into play. They considered the coal phase-out a “key issue” in order to achieve the climate targets. The Free Democratic Party (FDP), on the other hand, made it clear that it was sticking to market principles and wanted to reduce CO2-emissions through emissions trading instead of a state-imposed coal phase-out [4].

During the exploratory talks, the topic was discussed rather heatedly. The market was thus offered the prospect of an increase in generation costs either through a shortening of generation capacities due to the shutdown of coal capacities or CO2 taxes / minimum prices. Are these new perspectives displayed in the course of electricity prices for 2019 and 2020?

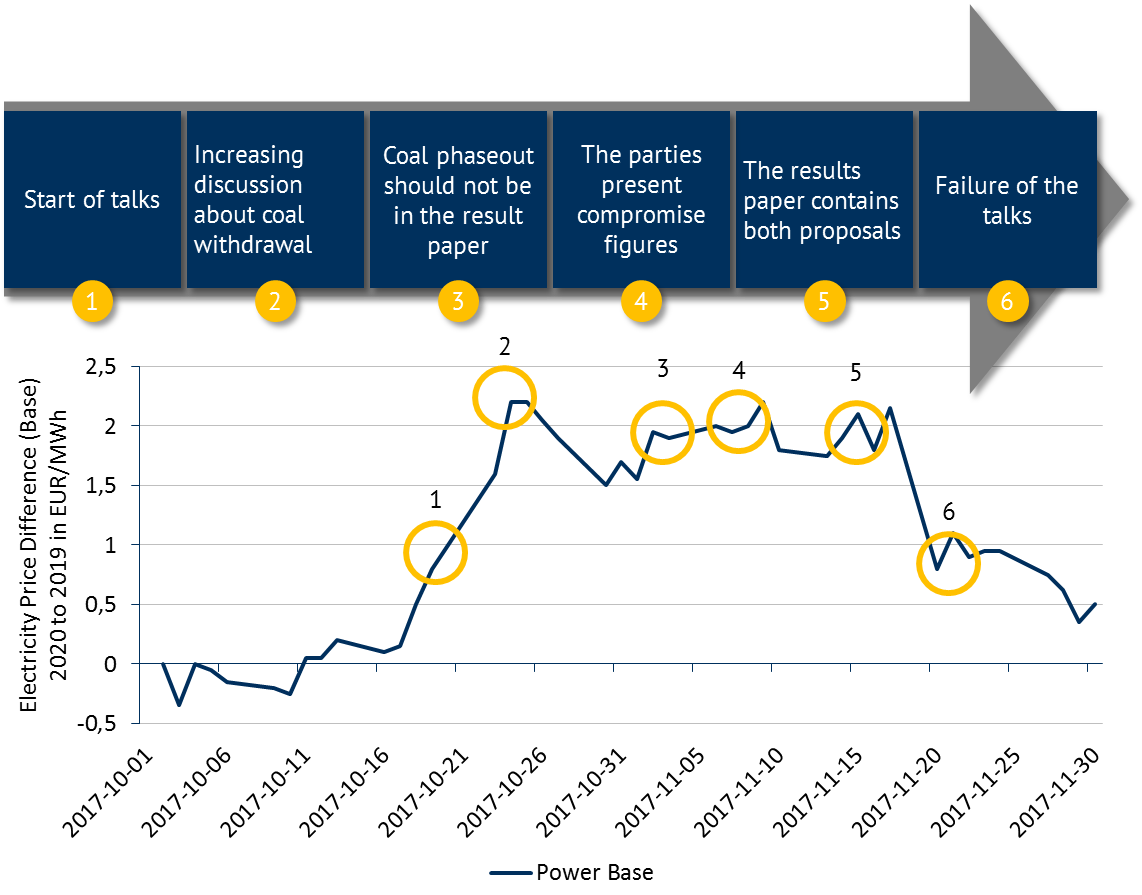

At this point, it is worth taking a closer look at the progress of the coalition talks. The intermediate results of the exploratory talks and the price trend are compared below (cf. Table 1):

Figure 3: course of the exploratory talks and price difference in comparison (source: Energy Brainpool)

What does this reaction tell about the functioning of the Energy-Only-Market?

In the course of the discussions about the Coal Commission, which is to rapidly develop a mechanism for phasing out coal, the German discourse on capacity markets is waking up from its slumber. The industry is again looking at how to finance investments in new and lower-emission generation technologies over the next decade.

The development of power term prices during the exploratory talks is an example of how the energy-only market sends out long-term price signals. Speculation about a possible phase-out of coal alone was enough to cause a price ascent. Thus, the Energy-Only-Market and the electricity market 2.0 basically passed their functioning test. An actual decision to withdraw from the coal market in a Jamaica coalition agreement would then presumably have caused term market prices to rise even more sharply.

Consequences for the merit order

With the shutdown of the coal-fired power plant units in 2020, the merit order would have suddenly shifted in favour of gas power plants and electricity imports. In a rising number of hours in 2020, these power sources would have set the price. The result would have been an increase in the full utilisation hours and thus in the contribution margins of gas-fired power plants while reducing Germany’s abundant surplus in electricity exports – a price signal that potential investors would also have noticed as well.

The market players temporarily priced in the opportunity or, depending on the viewpoint, the risk of an exit from the coal market at price increases of more than 2 EUR/MWh, which corresponds to 6 per cent. How high the price signal would have been in the event of a coal-phaseout cannot be seen from market prices. This is currently one of Energy Brainpool’s focus areas of analysis.

In addition to the effect of rising average electricity prices, the future hourly price distribution with the level and frequency of scarcity prices must also be analysed when evaluating investment incentives. Scarcity prices are a signal that demand is more difficult to meet using only the capacities available on the market. This stimulates investments in generation technologies. The stronger peak price increase by more than 3 EUR/MWh, or 8 percent, provides at least one indication that the expected increase in electricity prices will take place, especially in those hours of high electricity demand in which scarcity prices would also occur.

Excursus electricity market 2.0

With the Electricity Market Act of 2016, the German government confirmed and further developed the current electricity market design. In this context, the principle of free pricing should be mentioned above all. The legislator stipulates that electricity generation capacities should be able to refinance themselves via the free formation of prices on the market. Price fluctuations and price levels send signals of shortages or surpluses to market players.

In principle, free pricing was nothing new or “revolutionary”. However, the new paragraph 1a of the Energy Industry Act (EnWG) “Principles of the Electricity Market” has once again strengthened these very principles, including higher transparency and greater integration into the EU internal electricity market.

In the course of the development of “electricity market 2.0”, a capacity market was also discussed, which was however rejected and replaced by the introduction of a capacity reserve. This should only be used in extreme situations without balancing supply and demand.

For more information, see: https://www.bmwi.de/Redaktion/DE/FAQ/Weissbuch/faq-weissbuch.html

Co-Author: Marie-Louise Niggemeier (Expert)

[1] EEX, Phelix DE, Base, Year Future, Last Price

[2] https://blog.energybrainpool.com/beim-strompreis-kommts-auf-den-kohlepreis-an/

[3] API2 (converted from USD to EUR on the basis of temporally equivalent exchange rates) or TTF. Assumptions: Hard coal: 0.34 t/MWh th, gas: 0.2 t/MWh th

[4] http://www.sueddeutsche.de/wirtschaft/regierungsbildung-knackpunkt-kohle-1.3699740

[5] https://www.tagesschau.de/inland/jamaika-sondierungen-115.html

[8] https://www.tagesschau.de/inland/jamaika-123.html

[9] http://www.zeit.de/politik/deutschland/2017-11/jamaika-koalition-gruene-kohleausstieg-kompromiss

[10] https://www.tagesschau.de/inland/jamaika-sondierungen-137.html

[11] https://www.handelsblatt.com/downloads/20596948/2/jamaika-sondierungspapier.pdf