Starting with the year 2021, the first wind turbines will leave the EEG subsidy regime. From a technical perspective, a further operation of some plants is possible. However, is this feasible under economic conditions?

Since the year 2000, the Renewable Energy Sources Act (German abbreviation: EEG) has ensured that wind energy plants receive financial support from the start of their commission for a period of 20 years through the EEG remuneration. From 2021 onwards, wind turbines will annually reach the end of their funding period. Under those circumstances, it raises the question of what to do next: decommissioning, repowering or further operating. Nevertheless, the inception of the auction procedure for the subsidies for renewable energy plants opens up new hurdles for the option of repowering. For the continued operation of wind turbines, the electricity generation costs play the essential role in the 20-30 years of operation, since the plants are already depreciated. Figure 1 shows the expected costs compared to the anticipated revenues.

Figure 1: Onshore marketing revenues in the range of the Energy Brainpool scenarios compared to the costs in the years of operation 2021 – 2030 in EUR 2015 (an average investment was used for the valuation), Derivatives Market Prices as of 01.09.2017 (EEX), Source: Energy Brainpool

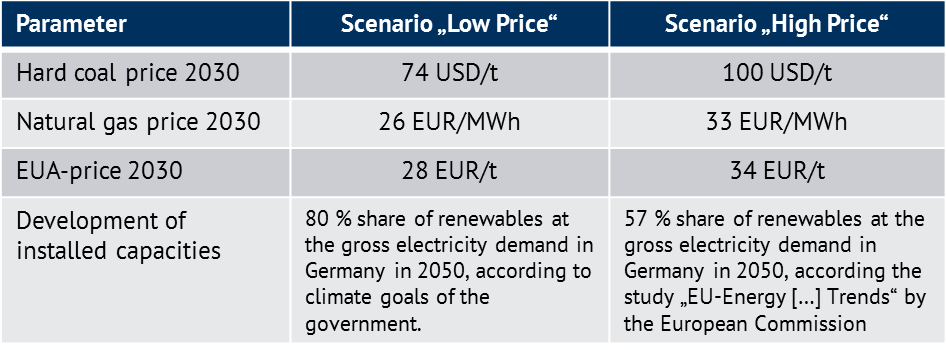

The expected revenues were calculated in two various scenarios. They demonstrate a range of rating by Energy Brainpool. The calculation of revenue for non-subsidized fluctuating production is defined in the White Paper “Valuation of revenues of fluctuating renewable energy sources ”. It becomes clear that, according to the current forward price level for the year 2020, literally only a few plants could extend to operate economically (blue dashed line). In two calculated scenarios, onshore wind turbines can generate marketing revenues in future which are higher than their operating costs. Overall, the high-price scenario proceeds to 64 per cent higher than the low-price scenario for 2030, while the two levels in 2021 are still very adjacent. Nevertheless, both scenarios assume that CO2 prices will undeniably increase from 2021 (see chart 1).

Depending on the scenario (Low Price and High Price), a very low cost investment (see Figure 1, lower limit of the cost corridor) can generate contribution margins of between 225.000 EUR2015 and 150.000 EUR2015. The contribution margins of a plant with comparably high continued operating costs (see figure 1, upper limit of the cost corridor) fluctuate between 60.000 EUR2015 and minus 12.000 EUR2015. If prices remain at the current forward market price level over the next decade, therefore an expensive investment over the first five years would post a net contribution of minus EUR 105.0002015. A favorable investment in the comparison can achieve a gross margin of a total of 57.000 EUR2015.

The first years of the coming decade will be very exciting: The revenue opportunities are too low to economically operate a large number of plants although the continued operation will then quickly become more economical towards the middle of the decade. For systems with medium to high operating costs, the cost-effectiveness is only given with sharply rising electricity prices, for instance due to rising CO2 prices. At very low operating costs, the continued operation from 2021 can be worthwhile. The cost-effectiveness of investments for continued operation is highly dependent on market conditions until 2024. The component of a rising CO2-price is currently heavily in the discourse. That is the reason why the French President Macron has demanded a minimum price of 30 EUR/t CO2. According to these conditions, the economic conditions for post-EGG plants would greatly improve.

On the topic of the minimum price of CO2, you will find information in the white paper entitled “Effect of a CO2 floor price in Germany”.