After a long back and forth, the Renewable Energy Act (EEG) 2021 was finally approved in the German parliament on 17 December 2020 and came into force on 1 January 2021. This blog post outlines the most important changes of the amendment and gives an up-to-date insight into the PPA market.

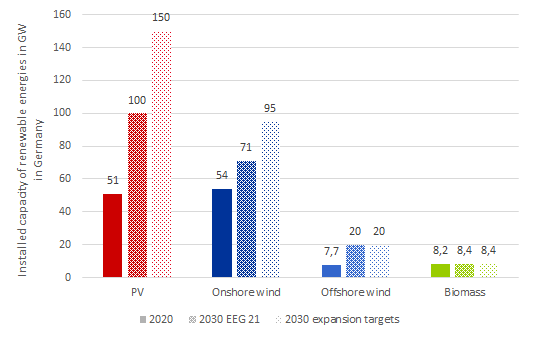

Compared to the earlier renewable energy act the expansion plans have been increased. Figure 1 shows the current capacities of renewable energies together with the expansion targets for 2030 set out in the EEG 2021.

Expansion paths are increased

Federal Environment Minister Svenja Schulze however called for higher expansion paths in Germany. The reason for this call are the more ambitious EU climate targets just two weeks after the new law went into force. Basically, the expansion target for photovoltaics should be one third higher than currently planned. For onshore wind energy, 95 GW should be on the grid in 2030 instead of 71 GW of installed capacity. In spring 2021, the first negotiations could take place to decide on higher expansion paths than those currently specified in the EEG 2021 (source: Handelsblatt).

Continued remuneration of post-support plants

In the run-up to the amendment of the EEG many operators wondered how to deal with plants whose remuneration period expired at the end of 2020. The term “post-support plants” was introduced in this context.

In the first step, a distinction is made between wind turbines and all other power plants below 100 kW. These have different regulations regarding the subsequent funding. Until the end of 2021, wind turbines are eligible for an additional support added on the monthly market value.

Only wind turbines can participate in special tenders for the subsequent funding after 2021. The tenders will take place in 2021 and 2022, with funding already ending in 2022. A total of 2.500 MW will be put out to tender and the bid level must be between 3 and 3.8 ct/kWh.

On the contrary, all other plants under 100 kW that make their electricity available to the grid operator will receive a feed-in tariff in the amount of the technology-specific annual sales value minus a flat marketing fee of 0.4 ct/kWh. If an intelligent metering system is installed, the marketing fee is halved to 0.2 ct/kWh. This regulation applies until the end of 2027.

4 is the new 6: New regulation on negative prices

After numerous objections to the first draft of the EEG 2021, the initially threatened loss of remuneration was ultimately not implemented after the first negative hour on the spot market. Consequently, the EEG 2021 provides that the remuneration for plants commissioned after 01.01.2021 will be cancelled after four negative hours on the spot market. However, the entire remuneration period is extended by the number of negative hours where no renumeration has been paid.

Pilot wind turbines and power plants with an installed capacity of less than 500 kW are exempt from the loss of remuneration. For existing plants, the 6-hour regulation according to the EEG 2017 applies as before (source: EEG 2021).

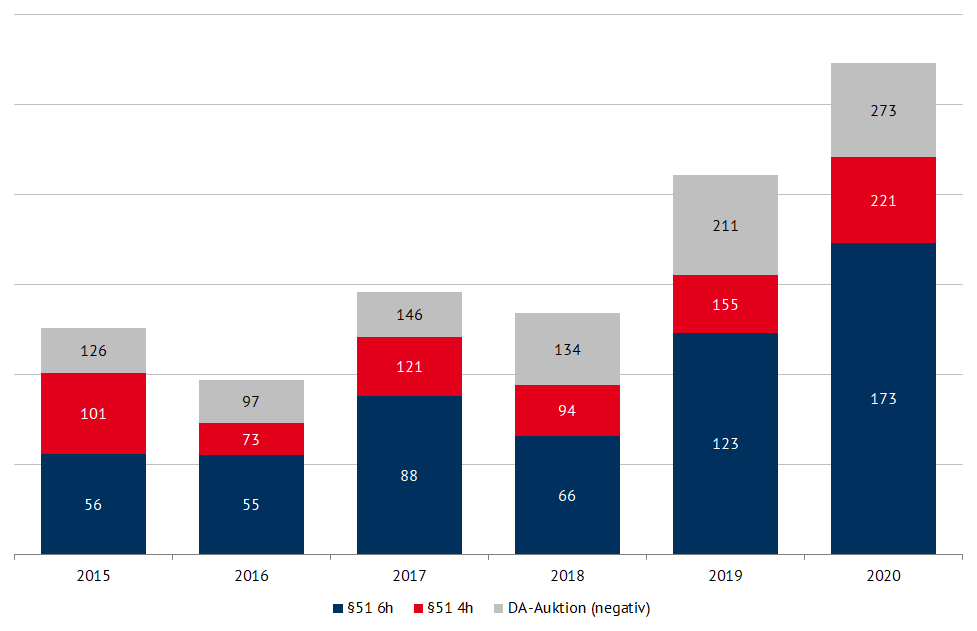

Figure 2 depicts our analysis of the effects of the new regulation. It shows the number of hours in the years 2015 to 2020 that were negative in the hourly day-ahead auction. At the same time, it also shows the number of hours that were negative in a time window of six subsequent hours (old regulation) or would have been negative in a time window of four subsequent hours under the new regulation in the EEG 2021. The loss of remuneration would have increased by 20 to 50 percent with the new regulation.

Figure 2: number of negative hours in different time windows (6 hours, 4 hours, 1 hour day-ahead) from 2015 to 2020 (source: Energy Brainpool)

New tender class for Photovoltaics

For the solar energy tenders, as before, rooftop photovoltaic plants (on or in a building or on a noise barrier) and ground-mounted plants (ground-mounted plants and plants on other structural plants) up to 750 kW do not have to participate in the tenders. For plants above 750 kW participation in the tenders is mandatory, for both ground-mounted plants and roof-mounted plants.

A new feature is that separate tenders have been introduced for roof-mounted plants. Project developers of roof-mounted plants between 300-750 kW have the opportunity to participate in the tendering process on a voluntary basis.

The tenders for ground-mounted plants will take place between 2021 and 2028 with a total tender volume of almost 13 GW. A maximum bid price of 5.9 ct/kWh is set for 2021. In contrast, tenders for roof-mounted plants will be held between 2021 and 2028 with a total tender volume of 2.9 GW and a maximum bid of 9 ct/kWh in 2021 (source: DGRV).

EEG-levy and own consumption

In general, a new limit has been set for own consumption and the exemption to pay the EEG-levy. The capacity limit is raised from 10 to 30 kW for old and new plants. A maximum annual electricity consumption of 30 MWh may not be exceeded. If the plant exceeds the exempted output or consumption, the 40 percent EEG-levy on private consumption will apply as before.

However, the EEG 2021 also clarified uncertainties regarding the supply chain model. According to the law, an energy service provider – instead of the plant operator – may now act as a tenant electricity supplier and supply the final consumer with electricity. This facilitates the operation of tenant electricity projects (source: energie-experten).

Changes to onshore wind energy

Over the period from 2021 to 2028, three tender dates with a total tender volume of approximately 31 GW will take place annually. However, the volume of the wind energy tenders will be reduced by the Federal Network Agency if a undersubscription is foreseeable two weeks before the bid date. In short, this measure is supposed to ensure continued competition between the participants.

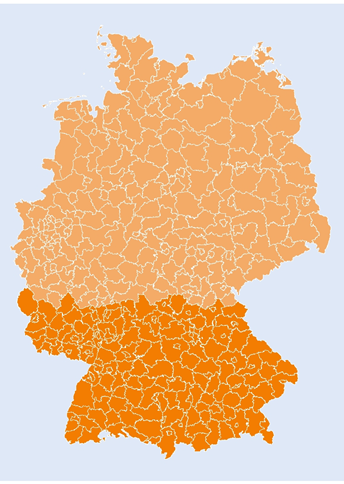

A so-called “southern quota” has also been introduced, while the grid expansion area in the north of the republic is history. In brief this means that 15 per cent (2022 and 2023) and from 2024 even 20 per cent of the tender volume will initially be awarded to plants in southern Germany (compare figure 3). Only then further bids will be considered. This is intended to dissolve the existing grid bottleneck between the north and south of Germany (source: EEG 2021).

Green hydrogen: exempted from levies

According to the EEG 2021, green hydrogen is only “green” if the electricity for electrolysis comes exclusively from renewable energy sources that do not claim any subsidies under the EEG. In return, both the EEG and the CHP (Combined heat and power) levy on the electricity purchased are dropped. Of course, the Ministry of Economic Affairs has yet to issue more precise details in an ordinance. This is expected in the spring or summer of 2021 (source: EEG 2021).

In this context, the conclusion of green power PPAs is particularly relevant. The wording of the EEG suggests that either separate green power PPAs must be concluded for green hydrogen production. Another possibility would be to use electricity from old renewable plants that no longer receive financial support.

Are PPAs now gaining momentum?

The legal follow-up support for “phased-out plants” has reduced the pressure on the operators of the old and non-supported renewable energy plants. To be precise, they were under pressure to find other revenue streams, such as in other direct marketing of electricity or through other purchase agreements. Nevertheless, the current regulations provide for follow-up support for wind only until the end of 2022. For wind turbines that are subsequently no longer eligible for financial support. Therefore, follow-up PPAs could become very interesting.

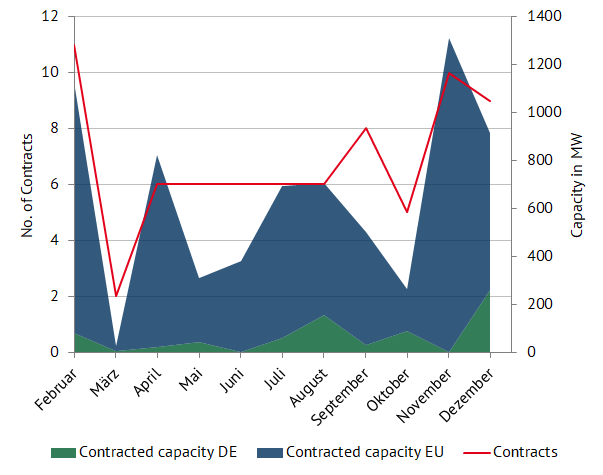

Our PPA database also shows that the conclusion of renewable electricity supply contracts outside the EEG has increased despite the Corona pandemic (figure 4). It turns out that corporate PPAs in particular are the market driver in Germany.

If, for example, corporate goals regarding CO2 savings or the use of green electricity are to be achieved in the coming years. In fact, the course for this must be set today and thus corporate PPAs have to be concluded. This is happening largely unhindered by the pandemic, which is more likely to have a price impact in the next one to five years.

For the economic evaluation of PPAs, we at Energy Brainpool therefore use our fundamental model Power2Sim, with which we simulate the European electricity markets using a large number of scenario analyses up to 2050. In addition to the price influence of the future development of the power plant fleet, electricity demand and commodity prices. The future evaluation of the merit order effect of wind and solar energy (keyword “cannibalisation risks”) also plays a role here.

Weather influences or a stronger expansion of renewables strengthen this effect, while increasing flexible electricity consumers (e.g. electrolysers, electric cars) weaken it.

Do not hesitate to contact us if you have any questions about the EEG 2021 or PPAs or attend our expert seminar on PPA evaluation in English.

What do you say on this subject? Discuss with us!