In order to maintain security of supply at a high level, there must always be a balance between production and consumption in the electricity supply system. This form of system security is the responsibility of the transmission system operators (TSOs).

The balancing energy market exists to enable grid operators to cost-effectively compensate for power and voltage fluctuations in the transmission grid. How this market works is explained in the first part of the series “The German electricity balancing market in transition”.

The most important reasons for changes in the design of the balancing market are examined in more detail. The following two articles in the blog series focus on the transition pathway in the balancing market from October 2017 to the implementation of the new design in 2020.

Why is a balancing market necessary?

The transmission system operators have the task of ensuring the security and reliability of the electricity supply system. In order to achieve this, the generation must correspond to the consumption at all times.

The TSOs have numerous planning tools at their disposal to ensure this in advance. If, for example, unforeseen fluctuations occur within the generation process, it is necessary to react immediately to the change, as this in turn can result in a high fluctuation of the grid frequency and the voltage.

The consequences of these fluctuations range from flickering of a lamp to large-scale power outages.

In order to create a uniform reaction space within the European network system, the acceptable range of fluctuation is defined by standard values. The voltage band in the transmission network (380 kV) lies between 400 kV and 360 kV. The target frequency is 50 Hz with an acceptable range of +/- 0.2 Hz.

In order to remain within the acceptable range in the event of an unplanned power plant failure, generating capacity must be made available to the system to maintain the frequency.

This necessary generating capacity is procured and maintained by the TSOs in advance at the balancing power market in order to be able to react immediately to these unforeseen generation fluctuations.

The task of the balancing market is to provide this balancing power and also the required amount of energy, i.e. the balancing energy at a reasonable price. The balancing market is a tendering regime separated from the day-ahead and intraday markets and set up by the TSOs (source: TSOs).

In general, there are three different balancing markets. In all liberalised European countries, three different submarkets exist. However, as these differ in detail, we will only deal with the German market in the following.

The basic principles of the German balancing market

The German balancing market is organised as a balancing power market. This means that the participation at the market is determined by a balancing capacity price auction. The three different balancing power markets existing in Germany differ in their activation principle and the time scale of their utilisation.

The requirements for the three different types, the primary control reserve (PCR), the secondary control reserve (SCR) and the tertiary control reserve (TCR), are determined by the TSOs. These reserves are procured in three different auctions.

The participants in the tenders are prequalified power plant operators whose generation units must comply with certain technical guidelines (source: TSOs).

Within the three types of balancing, or control power, a distinction is made between positive balancing power (increase in generation capacity/feed into the grid by producers or reduction in electricity consumption by consumers) and negative balancing power (reduction in generation capacity/feed into the grid by producers or increase in electricity consumption by consumers).

In addition, the provision of the capacity itself is remunerated (capacity price in EUR/MW) for all three standard service types. For the SCR and TCR, if requested by the TSOs, the energy fed into the grid or taken from the grid is also remunerated in the positive and negative sense (energy price in EUR/MWh).

However, a bid can only be awarded to a participant in the working price procedure, if his bid also was successful in the capacity price auction (source: Next Kraftwerke).

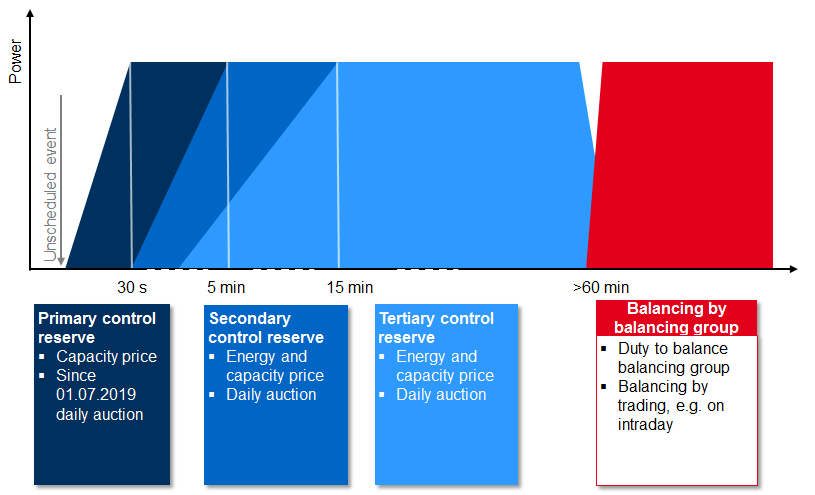

Finally, automatic and complete activation within 30 seconds applies to the primary control. The PCR must be available to the system for up to 15 minutes. The SCR is activated immediately and automatically by the TSO concerned within 5 minutes.

Full activation of the TCR shall take place within 15 minutes for a period to be covered ranging from 15 minutes to several hours.

Due to the short retrieval time at the PCR, an additional energy price is not charged here and therefore only the provision of the capacity is remunerated. Figure 1 shows the different balancing/control power types and their use (source: Energy Brainpool).

Why is the balancing market undergoing changes at all?

Now one might think that the existing three balancing power markets and the existing regulations are sufficient to keep the fluctuations of the grid frequency under control. In principle, this assumption is also correct.

However, the generation structure has changed considerably in the past ten years due to the expansion of renewable energies and the pooling of generation plants in virtual power plants.

The participation of renewable energies as virtual power plants was hardly possible due to existing regulations, in particular weekly tenders. In order to integrate renewable energies into the balancing market, tender periods and time slices for the provision of services were shortened.

In addition, the European Commission aims to develop standardised regulations for all EU countries. This makes it possible to bid for standard balancing services across national borders thus leading to reduced costs of maintaining this important system service.

This harmonisation is accompanied by unavoidable changes in the design of the balancing markets in many European countries (source: EU Commission).

Ultimately, it is the task of the balancing market to guarantee the stability of the electricity grid frequency in a cost-effective manner. Since in the past very high bid prices have been entered by the participants in the tenders, there were also voices to revise the design and the regulations.

The decisive bid

For technical reasons, a maximum price of 99,999 EUR/MWh can be offered on the market for SCR and TCR. Suppliers of balancing power often take advantage of this and set “fantasy offers” such as 77,777 or 88,888 EUR/MWh (source: Energie Chronik).

However, these bids are at the upper end of the merit-order of balancing energy prices and are normally not activated.

In other words, there were sufficient lower bids to cover the balancing energy demand. In general, the existing design of the control energy market encouraged relatively low bids to be submitted for the balancing capacity price.

This is because the bid submitted for the balancing energy price is also accepted with the capacity price component. Market participants therefore have the option of “refinancing” their low bid for the capacity price by setting high energy prices if there is a sufficiently high demand for balancing energy.

What happend on October 17, 2017?

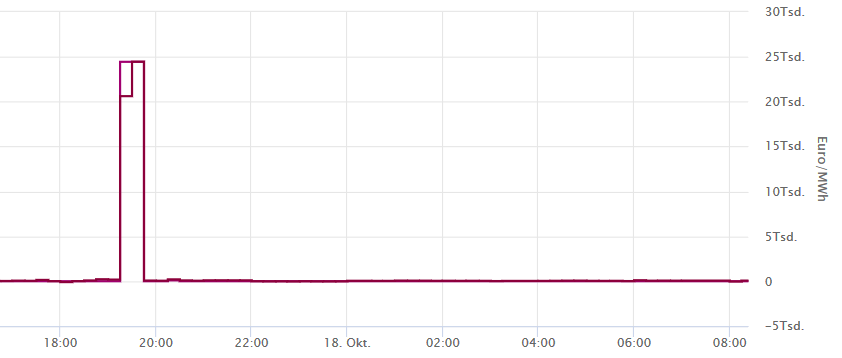

In October two years ago, in the evening hours of 17 October 2017 to be precise, this system led to very high costs. The highest price of the positive TCR stood at 77,777 EUR/MWh, with the average of the energy prices rising from 7 to 7.30 pm landing at just under 24,440 EUR/MWh.

Figure 2 shows the working prices and the resulting compensation energy prices for the corresponding period. The latter also rise to over 20,000 EUR/MWh (source: Energie Chronik).

Figure 2: maximum prices for the positive TCR and the corresponding compensation energy prices on 17 October 2017 (Source: SMARD)

The costs of the energy prices are allocated to the balancing group managers via the compensation energy prices. Further information on the system of the compensation energy prices can be found here and here.

Accordingly, the Federal Network Agency felt compelled to investigate the incident. The authority concluded that there was no market shortage on that day and that such a price swing could not be justified (source: Energate).

In the second part of the series “The German electricity balancing market in transition” you will learn about the changes in the balancing market since the peak prices of October 2017, how the participants reacted to them and what effects the new design had on price formation.

What do you say on this subject? Discuss with us!