The futures market price for electricity is the current average estimate by traders of the electricity prices of the future. Many factors, which are difficult to estimate in advance, have to be considered by traders: How is the supply of electricity, i.e. the available feed-in capacity of European power plants and their costs such as gas, coal and CO2 prices, developing? How is demand developing in terms of both its level and its structure? Another factor is also becoming increasingly important: the weather.

Weather and wind conditions influence the electricity price

An important factor influencing the energy price is the weather. For example, if there is a lot of wind, wind turbines can generate more electricity. This allows conventional power plants to shut down, which in turn leads to a lower electricity price. The futures market price for 2020 traded on the Leipzig Energy Exchange (EEX Phelix-DE Futures) is currently 47.45 EUR/MWh (as of 26 August 2019).

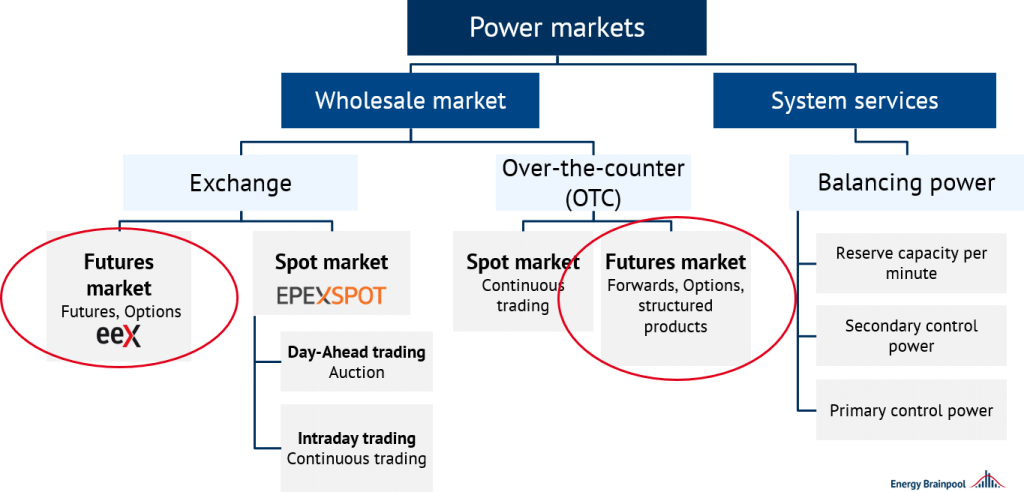

The weather of the next year cannot be exactly predicted. Due to this fact, the weather factor (in particular: wind force, solar radiation, temperature, precipitation) was not taken into account or averaged when estimating the futures market price. Figure 1 shows how the futures market can be classified in the electricity markets.

Figure 1: overview of the electricity markets and classification of the derivatives market (Source: Energy Brainpool)

The inclusion of weather scenarios for 2020 leads to a dispersion of possible fundamental deviations of the actually traded price.

Evaluation of the futures market price 2020 by comparison with the weather years 2007-2016

Using the fundamental model Power2Sim, price scenarios for the next year can be determined by integrating various factors. The scenarios show possible deviations from the currently traded futures market price for 2020. For example, the model generates how high the electricity price would be in 2020 if the same weather conditions as in one of the previous twelve years prevailed next year.

In order to model a best possible picture of the development of the electricity market price with the influence of the competitor in 2020, the data for several weather years (2007-2016) were added. Thus, we determine how the electricity price of the next year could vary solely due to these different weather scenarios (see Figure 2).

![base price electricity, Germany 2020 [in EUR/MWh], if the weather is like in the years 2007-2016 compared to the futures market price 2020, Energy Brainpoolm Futures market price base price electricity, Germany 2020 [in EUR/MWh], if the weather is like in the years 2007-2016 compared to the futures market price 2020, Energy Brainpoolm Futures market price](https://blog.energybrainpool.com/wp-content/uploads/2019/12/Picture-1-Energy-Brainpool-futures-market-prices-1024x656.png)

Figure 2: base price electricity, Germany 2020 [in EUR/MWh], if the weather is like in the years 2007-2016 compared to the futures market price 2020 (as at: August 2019; source: Energy Brainpool)

In contrast, an undervaluation of electricity prices would occur if 2020 were particularly wind-poor (like 2010). According to the fundamental model, an electricity price of 50.90 EUR/MWh would be expected, which would exceed the futures market price by almost 3.49 EUR. This would be the case if the wind were particularly low in 2020 (as in 2010).

If the entire period 2007-2016 is evaluated, the mean value is 46.74 EUR/MWh. This means that if we take into account the different weather and wind conditions within a period of twelve years, we can forecast an electricity price of around 46.74 EUR/MWh for 2020.

The fundamental view shows a slightly overvalued futures market price (47.45 EUR/MWh) by the traders. Reasons for this may be the anticipation and valuation of possible events in the future. These include, for example, Brexit, the decline in coal-fired power plant output or a change in demand due to economic developments. In the latter case, we are talking about a recession in Germany. This is seen by many economic experts as a possible scenario for 2020 and would have a negative effect on the development of electricity prices.

Influence of a recession on the electricity market price – and what significance this has for the futures market price in 2020

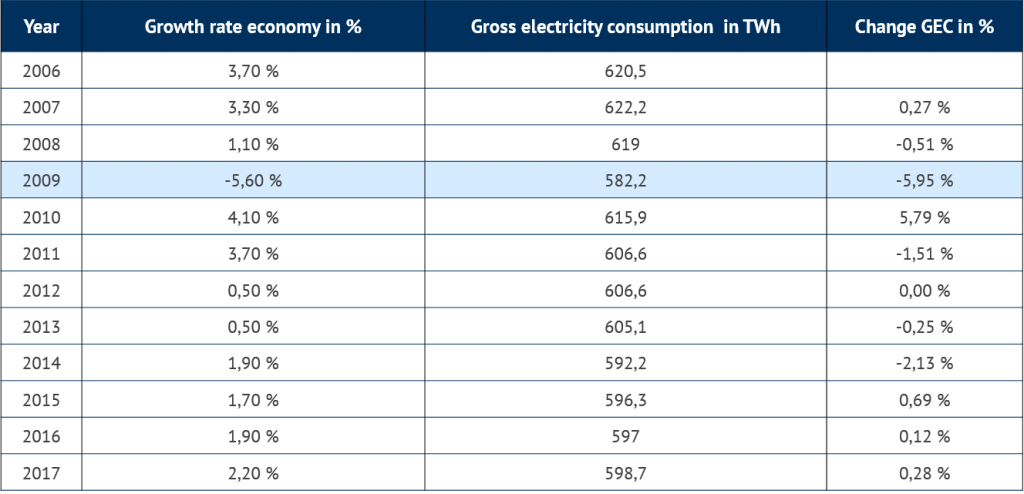

Gross electricity consumption (GEC) fluctuates around 600 TWh between 2006 and 2017. The year 2009 is particularly striking with a sharp decline in consumption (-5.95 %) compared to the previous year (see Table 1).

Table 1: change in annual gross electricity consumption compared with economic growth rate, 2006-2017 (Source: Energy Brainpool)

These fluctuations in gross electricity consumption (change GEC in %) show two facts in a direct comparison with the respective annual economic growth rate: On the one hand, the least electricity was consumed in 2009. On the other hand, 2009 was the only year of this period with a negative economic growth rate. This slump in growth was caused by the global economic crisis.

Thus, it can be stated that a recession has a negative influence on the GEC, i.e. the demand for electricity. The decline in demand leads to a lower price on the electricity market. Accordingly, a recession in 2020 would also influence the future development of electricity prices.

Let us assume that a recession always causes a change in the FSIO of -6 % compared to the previous year. In this case, a GEC (2020) of around 563 TWh (GEC in 2019: 599 TWh) would be expected for the incoming scenario “recession in 2020”.

Strong overvaluation of the futures market price for 2020 due to inclusion of weather and recession factors

If the recession factor in the fundamental model Power2Sim is applied to the modelled electricity market price for 2020 in the same way as the weather factor (previously determined as electricity price 2020 [“Weather”] = 46.74 EUR/MWh), the model calculates an electricity market price for 2020 [“Wet” and “Recession”] of 43.63 EUR/MWh.

When comparing this price forecast with the traded futures market price (47.45 EUR/MWh), a strong overvaluation of the next year’s electricity price (overvalued by 3.48 EUR) emerges from a fundamental point of view.

From this it can be concluded that traders did not take into account a possible recession in 2020 and did not (completely) price it in.

However, a recession affects all sectors of the economy and electricity consumption is only one of the changing variables. How electricity prices will develop, with fuel prices falling in an economic crisis could be examined in further scenarios.

Possible consequences of a Brexit

An increase in commodity prices next year is likely. This is partly due to the reports of the “economic wise men” in August about a possible recession and the threatening Brexit. At the same time, a fall in CO2 certificate prices is also possible.

The Brexit could result in British CO2 certificates flooding the EU ETS market again with certificates. Rising commodity prices and falling certificate prices will have opposite effects on the development of electricity prices.

In summary, it is difficult to assess whether the current futures market price for 2020 adequately reflects these various risks.

What do you say on this subject? Discuss with us!