What was the development for renewable energies and e-mobility in recent months? What effect did the corona pandemic have on the expansion of both and can conclusions be drawn for the rest of 2020 or beyond? These are the questions we will answer in this article.

RE expansion increases compared to the previous year

The analysis of the data of the Federal Network Agency for solar and wind Energy up to June 2020 shows that the expansion of renewable energies has improved compared to last year (source: Federal Network Agency).

In detail the expansion of PV was even able to increase compared to the first half of the previous year, reaching 2362 MW at the end of June 2020. The main drivers for expansion are small rooftop PV systems. In fact they can be built outside of the tender system.

Besides that the expansion of onshore wind energy has also more than doubled compared with the very meagre first half of 2019. However, the expansion is at a low level and still below target. Figure 1 shows the expansion of PV and onshore wind energy from 2013 to the first half of 2020.

It clearly shows the slump in wind expansion since 2018 and the start of a stronger expansion of solar energy at the same time. We have analysed the reasons for this in more detail in another article.

Figure 1: annual newly installed capacity PV and onshore wind 2013 to June 2020 (Source: Energy Brainpool)

If the expansion of PV and onshore wind energy continues to develop as in the first few months of the year, a gross expansion of 4-5 GW of PV and around 1.5 GW of onshore wind energy can be expected for 2020 as a whole. Even if the figures for onshore wind power expansion are too low to meet the climate and energy policy targets, there is a certain amount of optimism in the industry (source: Energiezukunft).

Expansion of renewable energies hardly influenced by Corona

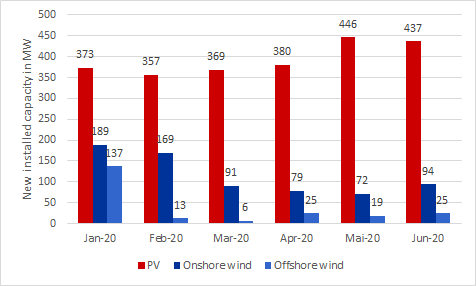

The growth in offshore wind turbines has hardly changed compared to the first half of 2019, while only 31 MW of biomass plants were commissioned in the first six months of 2020. Figure 2 shows the monthly growth of PV, onshore and offshore wind. Despite the corona pandemic, the expansion of PV has increased (keyword: abolition of 52 GW cap).

There is a slight dent in new wind power installations between March and May 2020, whereas they increased again in June 2020. This dent could be a corona effect, but is also of a reporting nature, as some plants from 2019 were not reported as newly commissioned until January and February 2020.

Figure 2: monthly new PV, onshore wind and offshore wind in the first half of 2020 in MW (Source: Energy Brainpool)

To sum up: The expansion of renewable energies was hardly affected by the corona pandemic, but is rather subject to longer-term political framework conditions.

Strong growth of e-Mobility

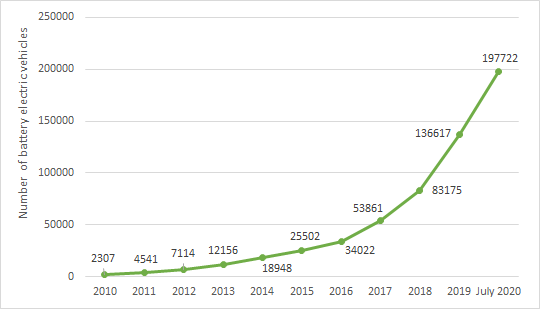

Even though the corona pandemic has severely dampened demand for consumer goods and also for vehicles, electric mobility appears to be benefiting so far. The Corona economic stimulus package we have been investigating is probably also playing its part in this. For example, the purchase premium for electric vehicles with a net list price of EUR 40,000 or less was increased from EUR 3,000 to EUR 6,000. The growth of electric vehicles has increased steadily over the past ten years.

At the end of 2019, for example, more than 136,600 purely battery-powered electric vehicles (BEV) were on German roads. This corresponds to a share of 0.3 percent of the private passenger vehicle stock. In contrast, the number of hybrids was just under 540,000 (102,000 of which were plug-in hybrids), accounting for 1.1 percent of the stock. Figure 3 shows the strong growth of pure BEV in Germany from 2010 to July 2020.

Figure 3: development of registered battery electric passenger vehicles in Germany (Source: Energy Brainpool)

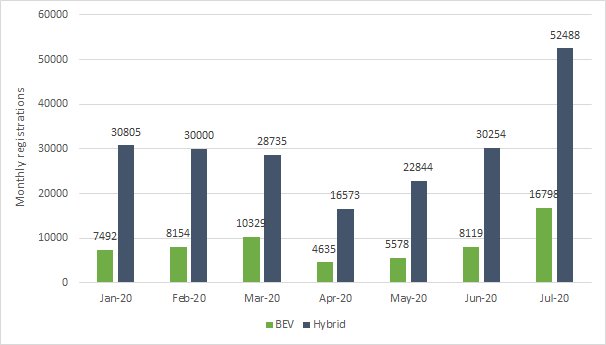

Interesting data can be obtained from the monthly vehicle registration reports of the Federal Motor Transport Authority (source: KBA). For example, the monthly new registrations of electric vehicles in 2020 show a strong increase compared to 2019. The monthly average in 2019 for the BEVs, by comparison, was just under 5300 vehicles.

This means that between January 2020 and July 2020 almost 3,500 more BEVs were registered each month than the monthly average in 2019. However, Figure 4 also shows that corona caused a dent, especially in April and May 2020.

Figure 4: monthly registrations of electric passenger vehicles in Germany (Source: Energy Brainpool)

July 2020 in particular stands out. Last month, the innovation premium for the purchase of an electric car or plug-in hybrid was applied for more often than at any time since its introduction in 2016, with around 20,000 applications received by the Federal Office of Economics and Export Control (BAFA) (source: Electrive).

It is also interesting to note that new BEV registrations from January to July 2020 (61,105) have already almost reached the total number of registrations for 2019 (63,281). The top models for new registrations of pure battery vehicles since the beginning of 2020 are the Volkswagen e-Golf and the Renault Zoe, each with almost 10,000 (source: Electrive).

Share of e-vehicles in new registrations doubled

The share of electric vehicles in new registrations has also risen sharply in 2020. While its mean value for BEVs and hybrids in 2019 was still 1.75 and 6.7 percent respectively, this figure has roughly doubled in the first seven months of 2020. By July 2020, BEVs accounted for just under 4 percent of new registrations and hybrids for about 13.7 percent. However, the share of new registrations has only risen so sharply because the corona pandemic has severely curbed sales of petrol and diesel vehicles.

Since vehicle manufacturers will also have to reckon with penalties for fleet limits of over 95 g CO2/km from 2021 onwards, the corporations are bringing more electric vehicles onto the market (source: ADAC).

E-mobility has gained momentum due to the higher purchase premium, at least in the first half of 2020, even though the corona pandemic led to a two-month dent. The high number of applications for the innovation premium at the BAFA to date shows that 2020 will probably be a key and record year for e-mobility in Germany.

Learn all about electricity price forecasts in our live online training on 27 and 28 october 2020.

What do you say on this subject? Discuss with us!