Waiting came to an end: the German government has agreed on the most important points of its Corona economic stimulus package. It seems that only the pandemic and the ensuing economic crisis have given politics a leg up. This article gives an overview of the most important changes and points of the Corona economic stimulus package for the energy industry.

The crisis as an opportunity

The extensive economic stimulus and future package announced by the German government on the evening of 3 June 2020 is aimed in particular at two dimensions. Firstly, it is all about securing jobs and secondly, stopping and at best reversing the economic downturn.

“In view of the consequences of the corona pandemic, a courageous response is needed,” said Chancellor Merkel (source: Federal Government). The EUR 130 billion programme includes aid for local authorities, subsidies for families, a reduction in VAT and the promotion of future technologies. It took a major crisis for politicians to take decisive action now.

Which derivatives are relevant for the energy sector?

The package is intended in particular to support and promote climate-friendly technologies. Many of the points to be found in the “Future Package” have been demanded by science and parts of the energy industry for months or even years.

The measures for climate protection and the energy industry focus on the following topics:

- reduction or better stabilisation of the EEG levy

- various subsidies for e-mobility and alternative drives

- hydrogen strategy

- a climate-friendly building renovation programme

Almost at the same time, the expansion targets for offshore wind were raised. The PV cap of 52 GW, which the coalition partners fought over for months, is finally to be abolished immediately (source: X2E).

The measures at a glance

The removal of the PV cap and also the increase in the expansion targets for offshore wind turbines do not require any specific financial support, but both are intended to contribute to achieving a 65 percent share of renewable energies in gross electricity consumption in 2030.

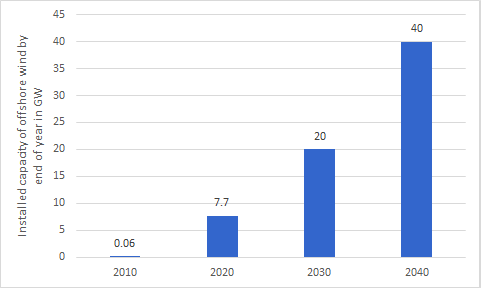

The offshore expansion targets have now been increased from 15 GW to 20 GW by 2030, with a target of 40 GW in 2040 (source: Montel). Figure 1 shows the installed capacity of offshore wind energy in 2010 and 2020 and the targets for the next two decades.

Figure 1: installed capacity of offshore wind energy (GW) in Germany in 2010 and 2020 and targets for 2030 and 2040 (Source: Energy Brainpool)

Due to the 0-cent bids that have occurred in the past, the tender design will be changed. If such zero-cent bids are submitted, a second round of bidding will take place (source: Erneuerbare Energien).

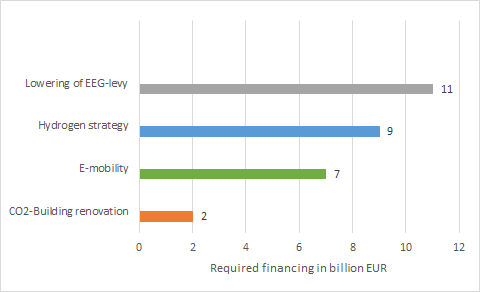

However, financial support will be required for the further measures of the Corona economic stimulus package. Taken together, however, the financing for climate protection and the energy industry represents less than a quarter of the total amount of the package of EUR 130 billion.

The results of the coalition committee can be found on the website of the Federal Ministry of Finance (source: BMF). Figure 1 shows the financing requirements for the individual items in the energy sector.

Figure 1: financing requirements of the energy industry items in the Corona economic stimulus package of June 2020 (source: Energy Brainpool)

Focus 1: EEG levy

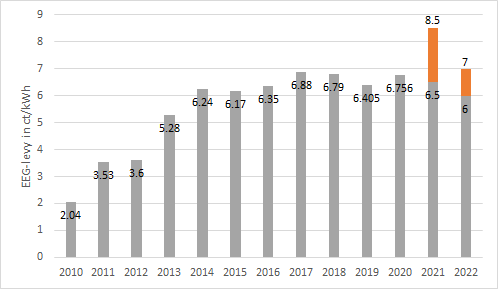

The reduction or capping of the EGG levy to 6.5 ct/kWh in 2021 and to 6 ct/kWh in 2022 is the largest item in the energy sector. This cap is intended to provide financial relief to electricity consumers. The EEG levy for 2020 is 6.756 ct/kWh.

For 2021, estimates so far assume an EEG levy of more than 8 ct/kWh. Figure 3 shows how the EEG levy has developed since 2010 and how it would probably have developed in 2021 and 2022 without the cap due to the corona pandemic (sources: Agora Energiewende, PV Magazine).

Figure 3: development of the EEG levy in ct/kWh from 2010 to 2022 (grey) and development without political cap (orange) (Source: Energy Brainpool)

Falling stock market electricity prices due to lower demand during the corona pandemic will increase the differential costs of promoting renewable energies. Part of the financing requirement will come from the revenues of the Federal Emissions Trading Act, while the remaining EUR 11 billion is to be financed from the federal budget.

Focus 2: hydrogen strategy

The second largest point concerns the hydrogen strategy. Even though the Federal Government’s hydrogen strategy has not yet been finally published, there are already indications of its contents. By 2030, industrial hydrogen production plants with a capacity of up to 5 GW should be built.

Another 5 GW of electrolysers are to be added by 2040. The exemption of green hydrogen production from the EEG levy is aimed at according to the Corona economic stimulus program. A subsidy of EUR 7 billion is to be provided to finance hydrogen production plants and the development of a hydrogen infrastructure in Germany. A further EUR 2 billion is available for foreign trade partnerships, i.e. the implementation of hydrogen production abroad for subsequent import into Germany.

Focus 3: e-mobility

All in all, the development of e-mobility should be accelerated. The Corona economic stimulus package provides a total of around EUR 7 billion for various measures. From January 1st, 2021, the motor vehicle tax is to be raised further for CO2-intensive vehicles. Furthermore, the already existing exemption from the motor vehicle tax for electric vehicles is to be extended until 31.12.2030. Until 31.12.2021, the purchase premium will be 6000 EUR instead of 3000 EUR (net list price of the e-vehicle: 40000 EUR). The expansion of the charging station infrastructure and the promotion of research and development in the field of battery cell production will also be co-financed.

Focus 4: CO2 building refurbishment

The CO2 building refurbishment programme for the years 2020 and 2021 will be increased by EUR 1 billion to EUR 2.5 billion. The funding programmes for the energy-efficient renovation of municipal buildings and for the promotion of climate adaptation measures will also be supported with EUR 1 billion.

Criticism of the Corona Package

In general, the energy sector responded positively to the Corona economic stimulus package. At least the government was able to agree on measures and a purchase premium for vehicles with combustion engines as lobbied for by the automotive industry did not find its way into the package.

Nevertheless, there is also criticism: “Too little money is being spent on climate-friendly building renovation,” according to BUND. Also the reduction in VAT (financing requirement of EUR 20 billion), i.e. the attempt to get the economy back on its feet with the watering can principle instead of providing targeted ecological incentives, makes the package “pale green at best”, according to Greenpeace climate expert Austrup. The increased expansion of onshore wind and PV is also not part of the discussion so far (source: PV Magazine).

The components of the package for climate protection and the energy industry in its current form are probably the best possible compromise between the coalition parties. At the very least, the roadmap for financing important areas of the energy industry has been more clearly defined by the package and has been published promptly despite the corona pandemic. In the medium term however, a major reform of the renewable energy law and electricity pricing will be unavoidable.

What do you say on this subject? Discuss with us!