The ideas for a new edition of the Grand Coalition fall behind those of the Jamaica negotiations. Changes to the Renewable Energies Act and larger tender volumes will be unavoidable. Long-term Power Purchase Agreements (PPAs) could develop to be the main compensation form next to the EEG. After the earthquake in the Netherlands, the gas sector must adjust to further cuts in L-gas imports. The electricity prices at the long end go down according to political announcements to postpone a coal exit and due to lower coal prices.

Pre-governmental talks fall behind Jamaica ideas

According to the current state, it is not unlikely that Germany will soon be governed again by a grand coalition of the CDU/ CSU and the SPD. While in the Jamaica-negotiations last year, progressive elements such as the shutdown of up to 7 GW of coal capacity were plans on the table, the entire issue of a coal phase-out should be outsourced to a commission named “Growth, structural change and employment”. By the end of 2018, a plan for the reduction and ultimately the phase-out of coal-fired power generation might be available. The climate protection target of 40 percent emission reduction by 2020 compared to 1990 was also abandoned, but should be achieved in the early 2020s. The focus should now be on securing the target for 2030. Nevertheless, the future coalition partners have also agreed to raise the share of renewables in the electricity sector to 65 percent by 2030. Special tenders of 4,000 MW of each wind and solar energy in 2019 and 2020 should contribute to this (Source: Energate).

Associations, the Greens, but also the federal states of Lower Saxony, Baden-Wuerttemberg, North Rhine-Westphalia and Schleswig-Holstein presented their own ideas for larger auction volumes for solar, onshore and offshore wind as well as for tender conditions for the next 2 years. In particular, closing the gap which might result from the fact that citizen energy companies won most bids, but might only build after four or five years is important. Also the gap to the climate target for 2020 should thus be closed as quickly as possible.

Clearly, the abandoned climate target for 2020 and the postponed coal phase-out will only shift the challenges into the future. If Germany does not want to experience a similar situation a few years before 2030 considerable more action is required. For instance a reform of the taxes and levies on electricity, a minimum price for CO2 or sector coupling should be considered.

Power Purchase Agreements for renewable energy as a future model?

Despite the sluggish changes in the political arena, long-term supply contracts for renewable energy, including PPAs are on the rise. Falling compensations from countries or even the elimination of those for renewables, pave the way for such direct purchase agreements. In the international context PPAs for renewable energies are already more common than in Germany.

Most of the time, large enterprises want to cover part of their electricity consumption with renewable energies. Therefore they are entering contracts with project developers and owners of renewable power plants. Both sides, buyers and sellers alike, can benefit from the security of fixed or indexed electricity prices. In Great Britain, Spain but also in Scandinavia, PPAs are being used more frequently than in Germany. Thus, the volume of PPA contracts has multiplied in recent years (Source: BNEF).

In the coming years it will be particularly interesting to see how much the compensation from the EEG will fall due to the tenders and to what extent a direct supply contract may allow higher revenues and better financing conditions.

Read about PPAs, the fair price of such a contract and further background information in our white paper.

Further reductions of gas production in the Netherlands

On January 8th 2018, the strongest earthquake since more than 6 years has occurred in the region around the Dutch natural gas field near Groningen (magnitude of 3.4). Accordingly, the Dutch parliament wants to push for a further reduction in natural gas production from this field. Currently, the production reaches 21.6 billion cubic meters per year, of which a large part is exported to Germany in L-gas quality. According to the Minister of Economic Affairs, Wiebes, the output will be reduced by more than the 1.5 billion cubic meters agreed on in the coalition agreement (Source: Energate) of the Dutch government.

The Dutch government has also called on the country’s industry to completely do without L-gas within four years and to ensure that its processes are converted to H-gas or other technologies. In particular this applies to the 200 largest consumers with annual gas demand of 5.5 billion cubic meters (Source: Energate). The decline in production could also have an impact on the German areas supplied with Dutch L-gas. The market area conversion from L- to H-gas in Germany should be implemented by 2030. This timeframe for the conversion of over 5.5 million devices could now come under pressure (Source: BBH).

Falling prices at the long end after coalition talks

The electricity prices for the delivery of base load electricity for the year 2019 (candlesticks) has risen in line with the coal prices (red line) following the end of the Jamaica coalition negotiations. As shown in Figure 1, the value of the contract for the German market area increased during December 2017 to just below 37 EUR/MWh. The end-of-year business transactions can also be partially held responsible for this. However, since January 2018, the value of the contract for 2019 has fallen from just under 37 EUR/MWh to 35 EUR/MWh.

Figure 1: Price for front year delivery 2019 Base (DE) in December 2017 and January 2018 (candelsticks), coal prices (red line) and CO2 allowance prices (orange line) in comparison, (Source: Montel)

The price decline for the electricity contract can be explained: The talks between CDU / CSU and SPD and the results of those suggested that there will be no increased decommissioning of coal-fired power plants for the time being. As a result, the market will still have large capacities of lignite-fired power plants available in 2019. This means less scarcity on the production side and thus lower electricity prices for the year 2019. Furthermore, the EUR/USD exchange rate has developed in such a way that the coal paid in USD has become cheaper for European buyers (see red line in Figure 1). Power prices fell in line with coal prices.

The negotiations on the rules of the European Emissions Trading scheme for the new trading period from 2021 to 2030 have produced results. The plan of issuing less allowances and the withdrawal of allowances by the market stability reserve caused the prices for CO2 certificates (orange line) to increase from mid-January to just under 10 EUR/ton. This also explains the price increase for baseload electricity in 2019 from mid-January.

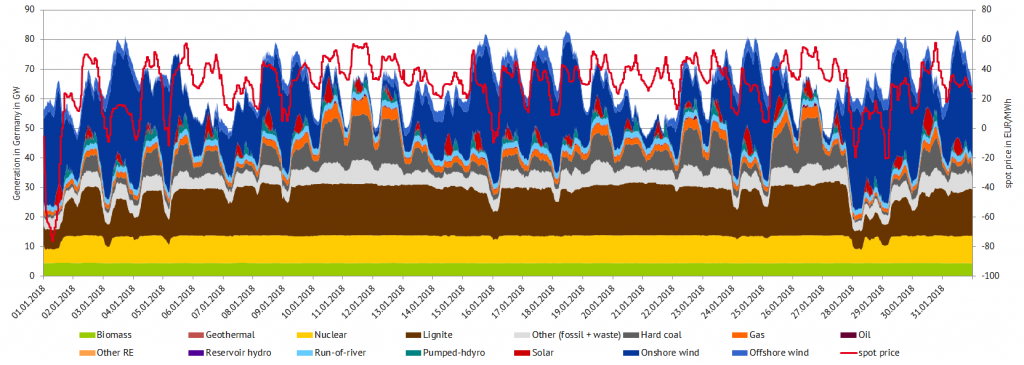

Generation from wind energy set some records in January. In the morning hours of January 1st 2018, the entire electricity demand of Germany was covered by renewable energies. At the same time, however, thermal power plants also generated electricity, which has led to high exports to neighboring countries. A detailed analysis of this record situation can be found here.

Furthermore, the wind power generation broke the previous feed-in record in the evening hours of January 3rd 2018 between 9 and 10 pm. German wind turbines produced with an average capacity 42.6 GW during that period. Figure 2 also shows the high wind generation at the beginning of January. The reduction in the output of nuclear and lignite power plants in times of high wind feed-in and low electricity prices can be seen as well. The flexible operation of coal-fired power plants, especially in times from high to low wind feed-in (or vice versa) is noteworthy.