March 2021 is characterised by low feed-in from renewables, like the entire first quarter of 2021. The results of the heavily oversubscribed second coal tender have also been released this month. Commodity and CO2 prices rose again in March.

Basically, the share of renewables in net power generation fell significantly in the first quarter of 2021 relative to the previous year. The reduction in power production from renewable sources is mainly due to the unfavourable weather in March 2021 with little sun and wind. At just 42.7 percent, the share of renewables is 12.9 percentage points lower than in the first quarter of 2020 (source: Energy-Charts), reversing the ratio of renewable and non-renewable generation compared with the previous year.

Figure 1 graphically illustrates this distribution between generation types for the first quarter in 2020 and 2021.

Figure 1: net power generation in the first quarter by type of generation in 2020 and 2021 in Germany (source: Energy Brainpool).

Renewable share declines in Q1 2021

Although wind power remains the strongest energy source in Germany with a share of 25.6 percent in the first quarter of 2021, it experienced the sharpest relative decline of -32.8 percent compared to 2020. Hydropower generation decreased by 23.9 percent, while solar feed-in also experienced a decline (-6.1 percent).

To compensate for the low feed-in of renewables, the conventional energy sources’ feed-in increased significantly. Lignite showed strong growth during the first quarter of 2021, increasing by 33.4 percent. However, gas feed-in in particular increased substantially by 46.7 percent year-on-year, making it the third-largest contributor to total net power generation. Gas feed-in was closely followed by nuclear power, which also recorded a slight growth of 12.5 percent in the first quarter.

Second tender for coal phase-out again heavily oversubscribed

On April 1st, the Bundesnetzagentur (German Federal Network Agency) published the successful bids of the second tender round from early January according to the Coal-fired Power Generation Termination Act (KVBG). The tender over 1,500 MW, which is intended to help reduce coal-fired power generation by hard coal plants and small-scale lignite plants, was again significantly oversubscribed.

Due to the strong competition, the highest accepted bid value of 59,000 EUR/MW was clearly below the statutory maximum price of 155,000 EUR/MW. The lowest awarded bid value was even 0 EUR/MW. Each successful bidder receives an award equal to its individual bid value.

Three bids for a total of 1,514 MW have been accepted in the tender process. Uniper Kraftwerke GmbH held the highest successful bid of 757 MW, submitted by for the Wilhelmshaven hard-coal-fired power plant.

The Mehrum power plant received an acceptance of a bid for the associated unit 3 with 690 MW; the smallest accepted bid quantity was for the Deuben power plant of Mitteldeutsche Braunkohlegesellschaft mbH with 67 MW. Hence, only power plants with an age of at least 40 years won the tender.

Plants that have won a tender are not allowed to burn coal from December 8, 2021 onwards.

The next tender round, with a target shutdown date of Dec. 31, 2022, starts on April 30, 2021, and includes a tender volume of 2,481 MW.

Futures market price trend

March 2021 was characterised by an increase in futures market prices. Overall, the prices for power, gas, coal; oil and CO2 at the end of the month are at a higher level than at the beginning of the month and continue to show a positive trend (Figure 2).

Figure 2: percentage price development of German power front year (candle sticks), CO2 certificates with delivery in December 2021 (orange line), Brent oil with delivery in December 2021 (red line), gas front year at the TTF (yellow line) and coal front year (green line) from the beginning of February to the end of March 2021 (source: Montel).

The CO2 lead contract shows a growth of almost 14 percent in the course of the month. In the middle of the month, the price seems to follow the financial market rather than the actual demand for CO2 and rises to a record high of 43.36 EUR/ton (source: Montel), partly due to hopes of an improvement in the pandemic situation.

Power prices follow CO2 prices and reach a two-year high of 56.20 EUR/MWh in the middle of the month for the front year.

The front year gas is initially supported by the cool weather in March and experiences price increase. In the middle of the month, a downward movement is rather observed due to milder temperatures. However, the outlook for low temperatures in early April pushes the day-ahead price upwards to a 7-week high of 19.45 EUR/MWh at the end of the month (source: Montel).

Few renewables in March 2021

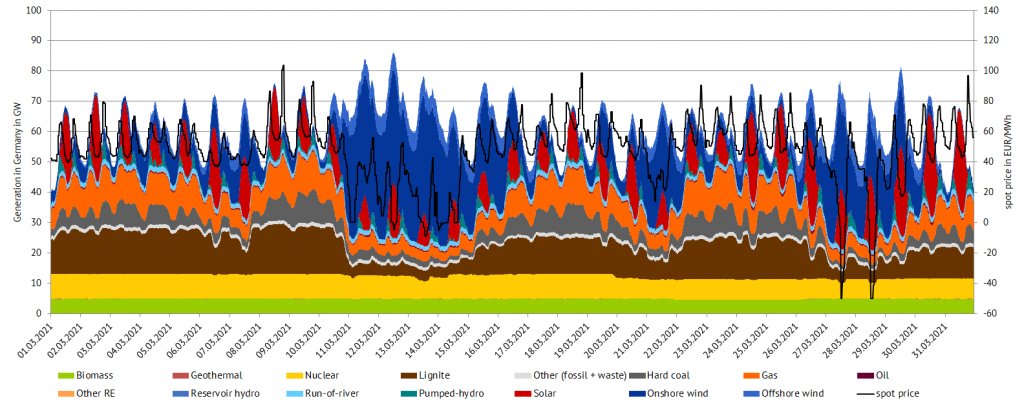

The share of renewable energies in power feed-in is only 47.4 percent in March 2021, the lowest level since 2018. Furthermore, March is characterised by strong fluctuations in the feed-in profile of wind power. In Figure 3 this power generation from different technologies and the day-ahead prices in March 2021 is shown.

At the beginning and end of the month, unusually mild temperatures prevailed and with 30 percent more sunshine hours than usual for March, there was a comparatively high solar feed-in of 4.64 TWh in March. In the middle of the month, there was less solar feed-in, but strong winds led to a high feed-in of wind energy with a maximum of 46.92 GW on 11.03.2021. In general, however, wind feed-in was at a low level of 11.6 TWh and thus caused the low share of renewable feed-in.

The feed-in of conventional energy sources was relatively high, especially due to the low wind feed-in at the beginning and end of the month. This was mainly visible as the high gas feed-in of 7.01 TWh.

What do you say on this subject? Discuss with us!