This part is explains specific aspects of trading electricity. There will be a differentiation between the different market segments, over-the-counter and exchange, as well as the different market places, Spot and Futures market. There will also be a distinction made between the trading and settlement level.

The specific features of electricity

Due to the specific features of electricity which make it different to all other goods, the electricity market has its own laws and is not a traditional financial market. This has to do with the fact that you cannot store electricity in itself unless you transfer it into a different kind of energy.

Due to the fact that there are not many possibilities to store electricity, transport networks are necessary so that electricity being produced in power stations can be delivered to the final consumer.

At the same time the requirement for electricity at short notice is inelastic because the demand side can barely adjust quickly enough. Consumers cannot do without electricity and thus do not react quickly even if the market prices have risen.

Spot and futures market

In the electricity sector delivery contracts are traded which fulfill the exact criteria of the place of delivery, the quality of to be delivered good and the time of the delivery. On top of that the amount which is to be delivered and the price are decided on when the deal is made.

The trade can be fulfilled with a physical delivery or with cash compensation. In general you differentiate between different contract types, due to the difference in amount of time between the finalization of the deal and the fulfilment of the deal, the settlement.

Spot market transactions are trade deals where the settlement is no longer than two days into the future.

The Spot market is a short term market where deals are done with a short delivery time. An example for a Spot market deal could be buying a hundredweight of apples at a local market at the price of 3€/hundredweight. The goods are then delivered and paid for within a week. The motivation for such a transaction is that you are able to fulfill an immediate or acute physical need. If the time difference between the deal being made and the settlement is longer than 2 days (and if there is no given exception), the deal is a futures contract.

The futures or derivative market is a market place on which trades are concluded which have to be fulfilled further in the future, for example one year. These types of deals are typically called futures. An example for futures contracts would be if the two parties of a delivery of two-hundredweights of apples at a price of 3€ on the 1st of January the following year. The payment could be done at the time of delivery and the place where the contract is fulfilled could be the local market place.

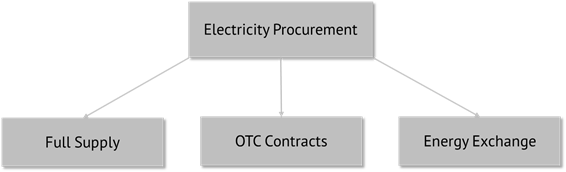

Which different ways of trading electricity are there?

Source: Energy Brainpool

Spot market and derivative market transactions can be done at the over-the-counter market (OTC) or at the electricity exchange.

Over-the-counter trades are bilateral contracts done directly between two parties and are conducted outside of an exchange. These are deals and trades which happen for example with the help of a broker. The products are individually tailored to the needs of the two parties.

The exchange is an organized and anonymous market. In comparison to the OTC market, trades are overlooked by a governing body. Electricity contracts traded on an exchange are standardized products.

Electricity trading opens up new possibilities

For suppliers this means that their produced electricity can be sold across Germany or alternatively traded on exchanges or OCTs. Consumers now have the possibility not just to get full supply contracts but can also strategically buy forecasted amounts of electricity long-term on the market at different points of time. The buying of energy on the wholesales market for you own consumption is called structured procurement.