The marketing strategy plays a key role in assessing the revenue potential of battery storage on the spot market. Read here about the revenue potential and how marketing strategies differ in terms of effort and results.

Whether for optimizing the own consumption of your own PV system on the roof or for balancing frequency fluctuations in the grid (primary control) – battery storage devices are very popular.

Revenue potential in the primary control market

So far, the provision of primary control power (PCP) has represented the greatest revenue potential for large battery storage. In the PCP market, a limited demand (600 MW demand in Germany) is put out to tender every week. The overhead is paid with a capacity price (EUR/MW). Activation is frequency-dependent and serves to restore the frequency to the set point (50 Hz) within 30 seconds. This means that both positive (power output) and negative (power consumption) calls are made. Since the duration of these calls is limited, battery stores can also offer this product ideally, as they can either draw or deliver power within milliseconds.

The proceeds from this market have created a great incentive to invest, particularly in 2014 and 2015. Currently 160 MW battery storage units are prequalified on the German market alone. However, capacity prices and thus revenues fell by 30 percent in 2016 and could not recover again in 2017. This decline in revenues has led to battery storage projects having to open up new revenue markets in the future.

Sales revenues at the spot market for a battery store

The spot market offers itself as an alternative to PCP distribution. The day-ahead auction (hourly products) and the intraday auction (quarter-hour products) carried out the day before the delivery is supplemented by the subsequent continuous intraday trading (hourly and quarter-hour products) until shortly before the physical delivery. Quarter-hour products are particularly suitable for battery storage with a low storage capacity. The adjustment of hourly day-ahead distribution to the German quarter-hour balance leads to price spreads of four quarters of an hour, especially in the morning and evening hours. These spreads can be ideally used by battery storage.

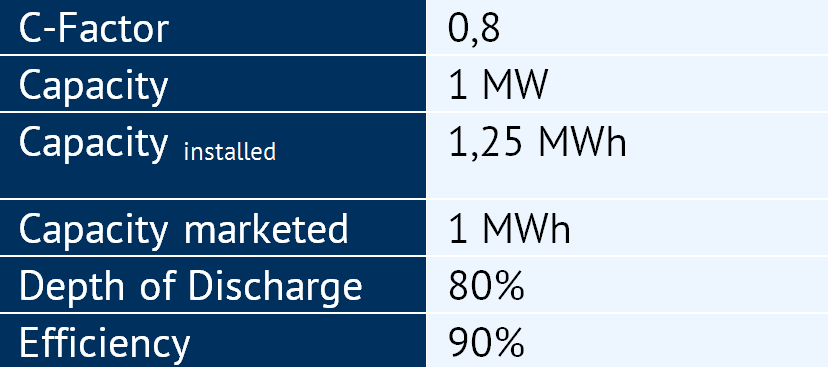

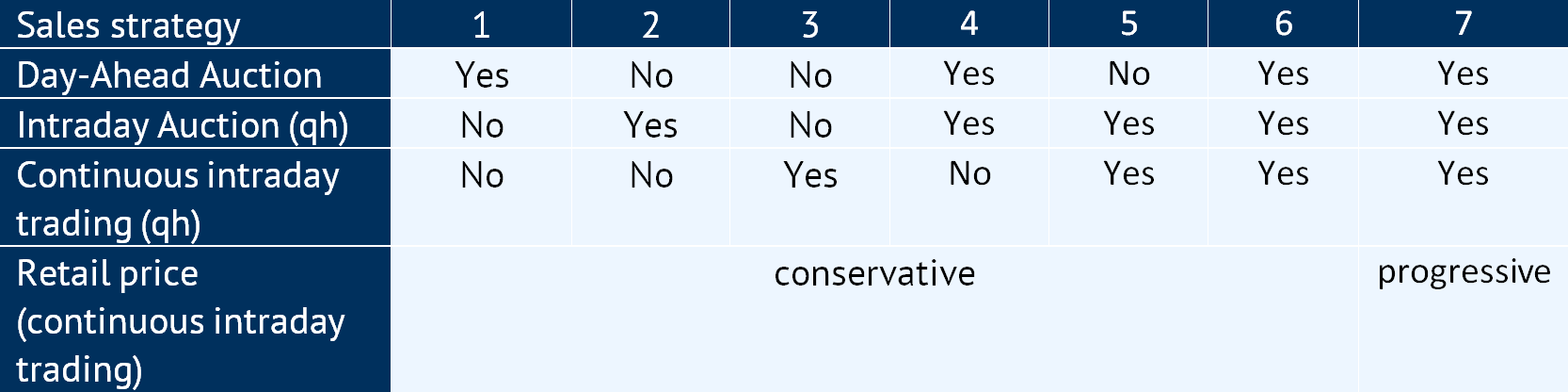

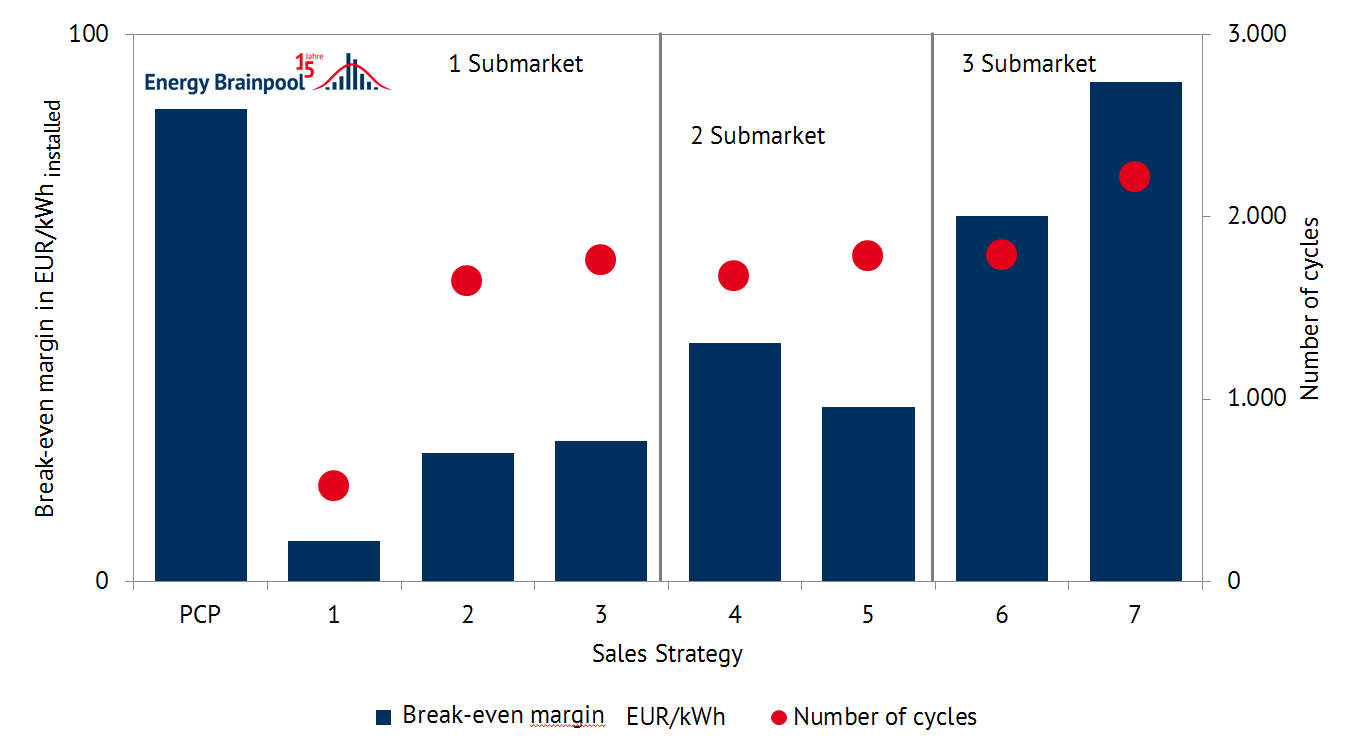

Figure 1 shows revenues for battery storage (assumptions in table 1) in 2017 that would have been possible with different distribution strategies (assumptions in table 2). The strategies differ in the sub-markets considered and the assumed trading prices in continuous intraday trading. Experts distinguish between conservative and progressive. Conservative assumes the ID3 price, i. e. the volume-weighted mean value of all traded prices within the last three hours before delivery. Progressively took into account the range of traded prices of the last three hours before delivery. The purchase price is assumed to be the 25 percent quantile and the 75 percent quantile. Network related allocations and EPEX transaction costs are taken into account.

For comparison, the revenue potential on the PCP market (average performance price) is shown.

The annual contribution margins in figure 1 (dark blue bars) clearly show that marketing in only one of the submarkets is not close to the current revenue potential in the PCP market. Marketing in all submarkets is only competitive if progressive trade prices are assumed. In addition to the break-even margins shown in figure 1, the number of full cycles (red dots) resulting from marketing is also shown, i. e. how often the energy volume dependent on the storage capacity is turned over.

Figure 1: Contribution margins and number of cycles for different marketing strategies (2017, own calculation, source: Energy Brainpool)

Requirements and consequences

In order to achieve this revenue potential, not only market access to all submarkets is a requirement, but also the corresponding sales competence. This includes a high-quality price forecast, especially for the day-ahead auction and the intraday auction. A 24/7 trading desk is a prerequisite for continuous intraday trading.

The assumed marketing algorithm is initially limited only by the assumed trading and forecast period. Marketing takes into account the trading windows of the submarkets (day-ahead auction before intraday auction, intraday auction before continuous intraday trading). No perfect price preview is assumed. This means that the potential proceeds from the intraday auction are not taken into account at the time of the day-ahead auction. The same applies to intraday auctions compared to continuous intraday trading. In the latter case, only the four subsequent hours (or 16 subsequent quarter hours) are considered for marketing.

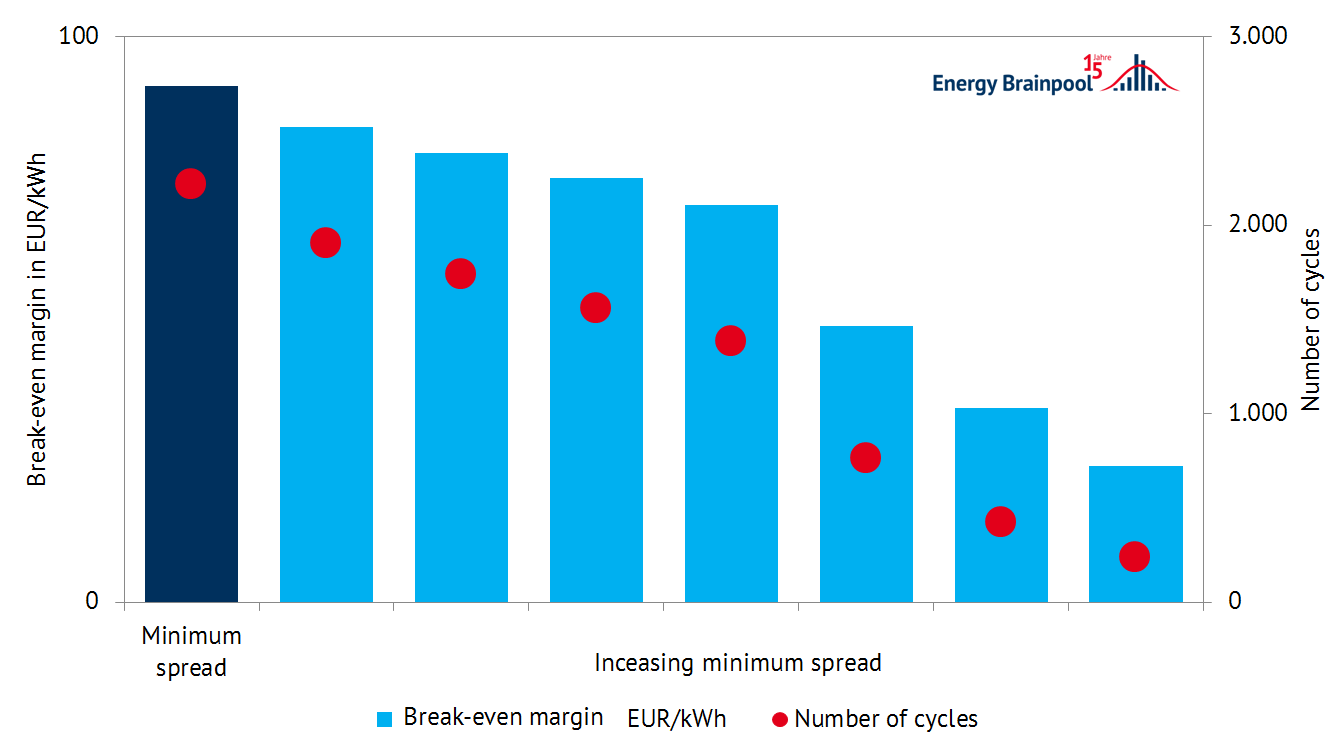

Battery types such as lithium-ion storage have a limited life of around 5,000 full cycles before their capacity decreases. With a full cycle number of over 2,000 (strategy 7) in 2017 alone, the cycle life would be reached after just under three years.

If a minimum spread (selling price versus purchase price) is assumed for strategy 7, the number of cycles can be significantly reduced. However, the resulting service life is at the expense of the annual contribution margins (light blue bars, figure 2).

Figure 2: Contribution margins and number of cycles for marketing strategy 7 (2017, own calculation, source: Energy Brainpool)

The key factors

This evaluation has shown for a technical design of a battery storage not only that the revenue potential depends significantly on the sales strategy, but also what consequences it has for the service life. Other battery types such as redox flow batteries have a significantly longer cycle life. However, the technical design, in particular the C-factor (ratio of kW to kWh) and the efficiency, differs from that of a lithium-ion battery.

Whether the earnings potential is ultimately sufficient to justify an investment depends on the respective investment costs.

This means that the following points are essential for the earnings potential of the spot market – in principle and in comparison to the PCP market:

- the C-factor (ratio of kW to kWh)

- the development and composition of investment costs (EUR/kW vs. EUR/kWh)

- technical developments (e. g. improvement of efficiency, depth of discharge, cycle life)

- the chosen sales strategies

- the future price development in the PCP market

It can only be determined whether marketing on the spot market is an economic source of revenue and for which battery storage it is worthwhile if all points are taken into account.

Learn in our Energy BrainDay seminar “Business Model Energy Storage – Marketplaces, Regulation, Outlook” on May 8 and November 14 how high the market potential of different earnings markets is and will be in the future and which technical design is the right one.