In September 2019, the German government wants to present a new package of climate protection measures. The pricing of CO2-emissions in the sectors not covered by the EU-ETS will play a major role here. But what are the basic CO2-pricing options in the transport and heating sectors? What are the differences between the political options discussed and what are the respective advantages and disadvantages?

How are CO2-emissions currently priced?

Explicit pricing of CO2 in Germany only takes place via the European Emissions Trading Scheme (EU-ETS). Since 2005, the EU-ETS has been the central instrument for climate protection in the European Union.

The EU-ETS operates according to the “cap and trade” principle: the upper limit of CO2-certificates (cap), which is fixed between states and reduced annually, determines the maximum amount of CO2 emitted the participating sectors (source: EU Commission).

The emission allowances or certificates can be traded. Trading results in a price for certificates, which is intended to encourage companies to reduce their greenhouse gas emissions.

Currently, the EU-ETS comprises some 12,000 installations in the energy and energy-intensive industries. In the EU, around 45 percent of greenhouse gas emissions are by now subject to the EU-ETS (source: Federal Environment Agency).

Since 2012, the trading system also includes intra-European air traffic. As part of the Paris Climate Agreement, the EU has committed itself to reducing greenhouse gas emissions by 40 percent by 2030 compared to 1990 levels. The EU-ETS plays a major role here. While prices for CO2-certificates remained at around 5 EUR/ton until before 2018, prices at the end of July 2019 were just under 30 EUR/tonne (see Figure 1).

You can also find out more about CO2 trading, the changes for the next trading period and the effects on the electricity market in one of our seminars.

The EU-ETS is not sufficient for German emission targets

The EU-ETS ensures the reduction of greenhouse gases only in the energy and industrial sectors. This means that more than 50 percent of European emissions are not covered. For several years, it has been clear that the German climate target of 40 percent less greenhouse gas emissions in 2020 compared to 1990 can no longer be achieved.

In particular, emissions in the heating and transport sector decreased only slowly or stagnated. Further measures are required, in order to at least achieve the emission target of minus 55 percent CO2-emissions compared to 1990 for the year 2030.

In addition, Germany might incur costs in the three-digit million range in case emissions are too high due to the EU-Effort-Sharing-Regulation. The discussion about an additional pricing of CO2-emissions has therefore gained considerable momentum in the course of 2019 (source: DIW, IMK, FÖS, Sachverständigenrat Wirtschaft, Wuppertal Institut, CO2 Abgabe e.V.).

What possibilities are there for additional CO2 pricing?

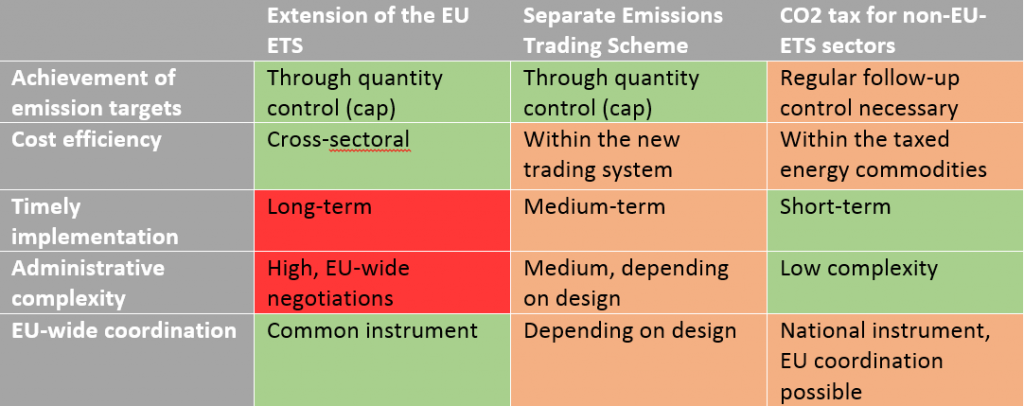

There are many possibilities for CO2-pricing in theory. Only the options discussed in Germany right now are elucidated on below. Basically, three different variants of additional CO2-pricing are being on the political agenda.

- an extension of the EU ETS to the heat and transport sectors,

- a new emissions trading system for the heat and transport sectors,

- and a CO2-tax on fossil fuels in the two sectors.

Option1: Extension of the EU-ETS protracted but appropriate on European level

The extension of the EU-ETS to the heat and transport sectors would make it possible to reduce emissions across the EU where it is most economically efficient. It would also be a relatively “accurate” instrument to reduce greenhouse gas emissions by choosing the appropriate emissions cap.

Furthermore, integration into the European framework would have the advantage that small-scale and national solutions are rendered unnecessary. A uniform price in the EU-ETS would continue to give a signal for investments in low-emission technologies in all sectors.

However, the political feasibility of an expansion can be classified as low. Especially since the new regulations for the fourth EU-ETS trading period (2021-2030) were only agreed in lengthy negotiations during 2017 and 2018 and have already entered into force.

The inclusion of the heating and transport sectors in an EU-wide emissions trading system would realistically be possible from the fifth trading period onwards, i.e. in more than ten years’ time.

However, emissions must be avoided as soon as possible. The option of an EU-ETS extension is primarily of medium and long-term character, but should be taken into account when designing short-term climate protection instruments (source: German Council of Economic Experts).

Option 2: An emissions trading scheme for non-EU-ETS sectors as a transitional solution?

In the short term, the inclusion of the heat and transport sectors in the EU-ETS is not possible. The establishment of a further emissions trading scheme for sectors that are not subject to the EU-ETS (source: German Council of Economic Experts) could, however, prepare this at least in the period 2020 to 2030. However, a number of important decisions need to be taken:

- Which non-EU-ETS sectors should be included in the new system? Should only heat and transport be included, or should emissions from agriculture also be part of the new system?

- What is the certificate obligation, or who can or must participate in emissions trading? In very heterogeneous sectors with a large number of different emitters (e.g. individual motorists, importers of fuels, small farms) the design of the certificate obligation can be very complex. A logistical and manageable solution would be for example when importers and producers of fossil fuels are obliged to buy CO2-certificates instead of end consumers.

- Will the new emissions trading system be set up throughout Germany? Or should it be structured as an European system with opt-in with a coalition of willing states? Here, too, the question arises as to whether it can be implemented quickly, and potential differences in the height of the cap for certificates in the new emissions trading system.

Option 3: CO2-tax quicker and easier to implement

The implementation of a CO2-tax is an alternative to the expansion or establishment of new emissions trading systems. Such a tax for the transport and heat sectors could be levied on top of existing energy taxes.

In July, the reports by the Ministry of the Environment examined the impact and social compatibility of this version in particular.

The revenues from an additional CO2-tax on fossil fuels could then be reused. It is conceivable, for example to reduce the electricity tax to the European minimum rate or the EEG-levy. A repayment of tax revenues as a per-capita lump sum was also discussed.

There ist one problem with the introduction of a new tax. What is the “correct” price for the ton of CO2 ? The correct level is not known and that the price might have to be adjusted annually. This could lead to the tax being set at a lower level than necessary for short-term political reasons.

In the discussion, the most recent studies assumed an additional CO2-tax of 35 EUR/ton in 2020 linearly rising to 180 EUR/tonne in 2030 (DIW, IMK, FÖS). A CO2-tax, however, is no guarantee for actually decreasing emissions. There is no upper limit compared to an emissions trading scheme. Consumption is only made more expensive. As a result, emission targets could not be achieved.

A summary of the pros and cons of the three options for additional CO2-pricing can be found in Table 1 (source: German Council of Economic Experts, CO2 Abgabe e.V.).

What is the yardstick for an additional CO2-emissions pricing scheme?

It is clear that Germany’s CO2 emissions must be reduced as quickly as possible in order to comply with both national and international emission targets. Additional pricing should have a steering effect on the various emitters. One fact must be clear: The measure must be socially compatible so that commuters or rural areas are not disadvantaged.

The redistribution of revenue from the scheme plays a major role here. When the CO2-pricing scheme is designed and applied, the European and international perspective should not be forgotten. It is absolutely expedient to include other European countries in the design. Or at least in the medium-to long-term planning.

A number of instruments exists that enable additional pricing of CO2 in Germany. They all have different implications as explained above. How will the Federal Government’s decide on its climate protection measures on 20th of September 2019? Either way it will be of great importance.

What do you say on this subject? Discuss with us!