The scenario framework of the transmission system operators for gas (FNB Gas) for the 2022 – 2032 Network Development Plan contains some interesting figures. For example, there were over 100 project notifications for hydrogen projects in Germany. With almost 25 GW of electrolysis capacity by 2030, these figures exceed the plans of the German national hydrogen strategy many times over.

Hydrogen offers the opportunity to decarbonise some sectors, especially industry and parts of transport. Hardly a day goes by without a report on a new hydrogen or electrolysis project. We have already reported on the German hydrogen strategy and the required ramp-up. Here we want to take a closer look at the scenario framework of the gas transmission system operators (FNB Gas).

Gas demand and hydrogen

In the FNB Gas scenario framework from June 2021, gas demand up to 2050 is estimated on the basis of various scenarios. It should come as little surprise that the FNB choose a scenario with very high demand for gaseous energy sources in 2050 for its further considerations. However, the bandwidths of the various scenarios are also very high. In the electricity sector, basically all actors assume rising consumption. In contrast, the developments in the gas industry are much less clear and also interact with the changes in electricity generation and the electrification of the other sectors.

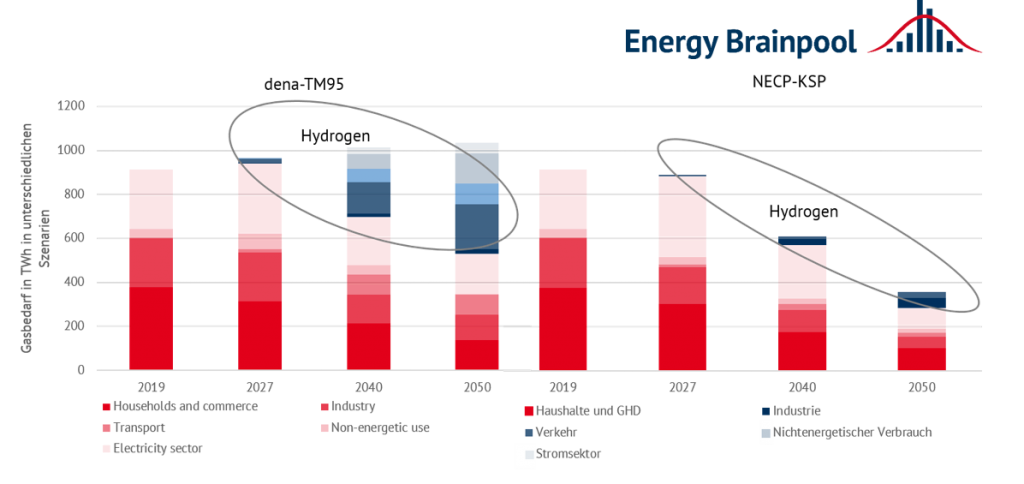

The scenarios shown in Figure 1 (source: FNB Gas) depict possible demand developments for gas in Germany until 2050 in the scenario framework of the Network Development Plan (NDP) 2022 – 2032.

In further considerations, the FNB Gas primarily assume the dena-TM95 scenario with very high gas demand and also climate-neutral methane. Further considerations by the FNB Gas are also made for the NECP-KSP 87.5 scenario of the German Ministry for Economic Affairs (BMWI) for the Climate Protection Plan. In the dena-TM95 scenario, gas consumption actually increases compared to today and ends up at over 1000 TWh in 2050, while the NECP-KSP 87.5 scenario assumes a demand reduction of about 60 percent.

The breakdown of the different consumers in both scenarios is shown in Figure 2. The share of consumption in the household and tertiary, industry and transport sectors remains similarly distributed in the dena-TM95 scenario between climate-neutral methane and hydrogen by 2050.

The situation is different in the NECP-KSP 87.5 scenario, where hydrogen covers only just under 20 percent of total gas demand, with 68 TWh in 2050. The degree of electrification is much higher in this scenario, while biomethane also plays a greater role.

Fig. 2: Sectoral demand by methane (purple) and hydrogen (blue) in the dena-TM95 and NECP-KSP 87.5 scenario in TWh (source: Energy Brainpool).

The development of gas consumption and the share of hydrogen will remain an important topic in the future, especially against the background of the Nord Stream 2 gas pipeline and the currently very high gas prices of over 40 EUR/MWh on the market. Since there has already been criticism of the draft scenario framework from environmental and energy associations, it remains to be seen whether other scenarios will come to the fore in the final document of the network development plan in 2022.

Hydrogen project boom?

The FNB Gas also conducted a market survey for green gases in its new scenario framework. More than 500 project reports were received within four months, including 102 electrolyser projects in Germany. Despite the uncertainties of such a market survey, the feedback shows that a very high number of projects are envisaged by market actors.

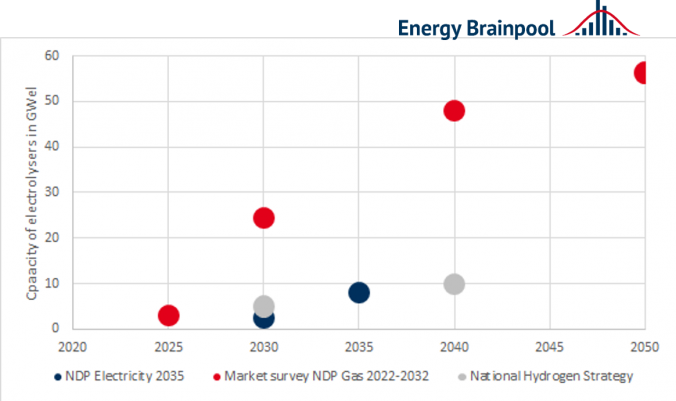

Thus, the reporting through the survey in the Gas Network Development Plan of electrolyser capacities of 21.5 GW for the year 2030 exceeds the National Hydrogen Strategy’s target of 5 GW by a factor of four. Figure 3 compares the reports of the FNB Gas market survey with the targets of the National Hydrogen Strategy and the assumptions of the electricity transmission system operators (TSOs) in their respective Network Development Plan for Electricity 2035.

The assumptions of the TSOs as well as the National Hydrogen Strategy are far behind the figures received by the FNB Gas from their market survey. The range of 5 to 24 GW of electrolyser capacity in 2030 and between 10 and 48 GW in 2040 shows the considerable differences.

However, the project managers must provide letters of intent with concrete figures to the FNB Gas by 21 October 2021. Only then will it become clear which projects are likely to be implemented. It can be assumed that not all projects will reach the implementation phase and that the figures from the FNB Gas market survey will be reduced.

Ambiguous outlook

As shown above, the assumptions on gas demand for the coming decades vary widely in different studies. The possible hydrogen share in gas consumption ranges between 20 and 50 percent. These large uncertainties in network infrastructure demand planning are to be reduced in joint network development plans between the electric and gas transmission system operators.

At the same time, the market survey conducted in the course of the Gas Network Development Plan 2022 – 2032 shows the great interest of energy industry players in hydrogen projects. Here, too, a more refined analysis must make more precise estimates. Moreover, only CO2-neutral or -negative hydrogen has a climate-positive effect. Therefore, the regulations regarding the definition of green hydrogen in the Renewable Energy law and adjacent ordinances are of great importance.

Learn more about the potentials of hydrogen in the German energy system and understand the current legal regulations and use cases from practice in our live online training “Game Changer Hydrogen?!” (in German) on 22 and 23 November 2021.