The EU Commission has presented a new legislative package with more ambitious targets. The results of the coal and solar tenders were announced. While the PV tenders were significantly oversubscribed, the bidding volume at the coal tenders was not as high. New records were set on both the short-term and forward markets.

“Fit for 55” climate package: Europe’s new climate targets

On 14 July, the EU Commission presented a comprehensive legislative package that sets the course for the new climate target. It contains drafts for twelve legislative procedures that are to be negotiated and adopted in the coming months. The goal is to reduce CO2 emissions by 55 percent – instead of the previous 40 percent – compared to the reference year 1990 by 2030. The CO2 price plays a key role in achieving this goal. It is planned to lower the CO2 cap in the European Emissions Trading Scheme (EU ETS) and to extend it to ship transport and aviation (source: Montel). The target for the use of renewable energy by 2030 has been increased to 38 to 40 percent of gross energy consumption – previously the target was 32 percent (source: pv magazine). You can read more details about the effects on European and national climate policy .

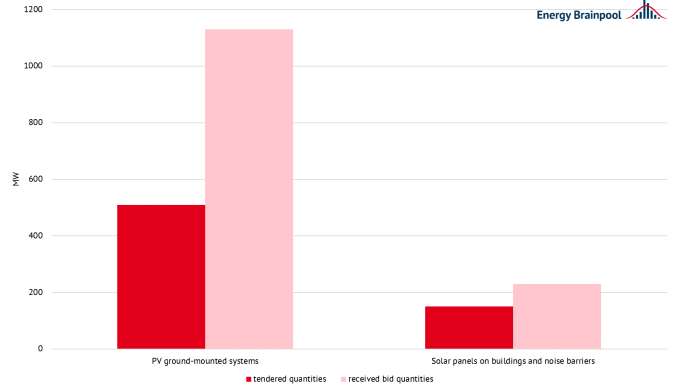

Significantly oversubscribed PV tenders for both ground-mounted and roof-mounted systems

In mid-June, the results of the first and second segments, which both had their bid date on 1 June, were published. Both segments were significantly oversubscribed.

In the first segment, bids from suppliers with ground-mounted systems larger than 750 kW can participate. A total of 242 bids amounting to 1130 MW were submitted. This means that the tendered quantity of 510 MW was exceeded by a factor of two. 95 bids with a total capacity of 513 MW will be awarded. The surcharge values determined in the bidding procedure range between 4.69 ct/kWh and 5.69 ct/kWh. The volume-weighted average award value is 5 ct/kWh. (source: Federal Network Agency)

For the first time, tenders were also held for the second segment. Solar installations on buildings and noise barriers with an installed capacity greater than 300 kW can submit bids. 168 bids with a volume of 213 MW were received. With a tendered volume of 150 MW, these were also far oversubscribed. Only 114 bids with a volume of 152 MW could be awarded. The surcharge values ranged between 5.35 ct/kWh and 7.89 ct/kWh. The volume-weighted average award value in the first round is 6.88 ct/kWh (source: Federal Network Agency).

This year, there will be one more technology-specific tender for each of the two photovoltaic segments. For ground-mounted systems, it will take place on 1 November, with a preliminary volume of 509.52 MWs. The next round of tenders for roof systems will again have a volume of 150 MWs and will take place on 1 December (source: pv magazine).

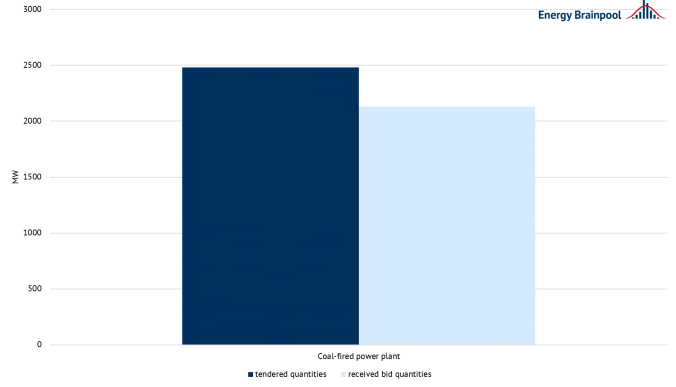

Third round of the coal tender slightly under-subscribed

A quantity of 2,480 MW was tendered. Despite large participation, these tenders were slightly under-subscribed. In total, eleven bids were received with a total quantity of 2,133 MWs. It was thus possible for all bidders to be awarded a tender. The bids varied between 8.4 MW and 717 MW. The volume-weighted average award value is 102,799 euros per MW. By 31 December 2022, only a maximum of 15 GW of small-scale hard coal and lignite plants are to be on the power grid in Germany and, despite slight undersubscription, this target will most likely be met.

The quantities not taken up will be taken into account in the upcoming tender round, which will take place on 1 October (source: Federal Network Agency).

Front year electricity reaches new record price

In July 2021, commodity prices initially fell until they experienced an increase towards the end of the month and settled back to the level they were at the beginning of the month. The front-year power contract approached a 13-year high at the end of the month as CO2 prices rose. It almost reached the level of 5 July at 75.60 EUR/MWh – the highest front-year price since 2008. (source: Montel). After the EU Commission raised the CO2 reduction target for 2030 in mid-July, a sideways trend in EUA contracts has resumed. It is estimated that also in the following months, the CO2 price should move between 50 EUR/t and 60 EUR/t (source: Montel). In addition to front year power, front year coal reached a 10-year high of USD 95.70/t due to a supply shortage. (source: Montel).

There is movement and uncertainty in the oil market because OPEC+ agreed on an increase of 0.4 million bbl/day from August 2021. This increase is to be reassessed at the end of the year (source: Montel).

The percentage price development of the commodities can be seen in figure 3 (source: Montel).

Fig. 3: Percentage price development of the German electricity front year (candle sticks), CO2 allowances with delivery in December 2021 (red line), Brent oil with delivery in December 2021 (orange line), gas front year on the TTF (green line) and coal front year (yellow line) from the beginning of May to the end of June 2021 (source: Montel).

Peak prices and negative prices on the German short-term market

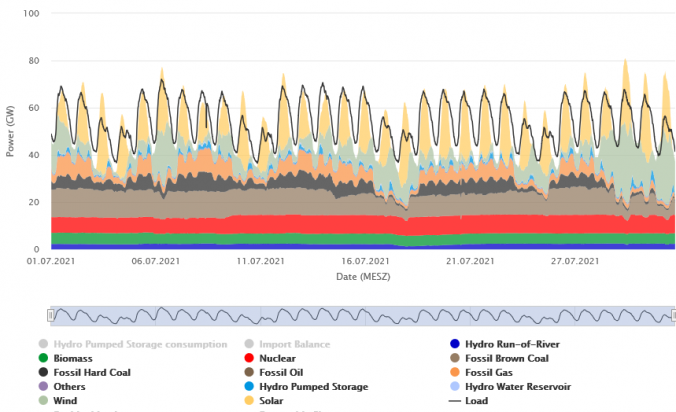

The share of renewables in electricity generation in June was 48.9 per cent, the same level as in the previous month but 5 per cent lower than in the previous year. The net electricity generation volume from renewables in July was just under 19 TWh.

On 4 July, wind and solar generation unexpectedly collapsed and wind feed-in was 8.8 GW below normal. This led to a record increase in the day-ahead price. Base load rose to a 13-year high of 109.04 EUR/MWh, while peak load was 118.12 EUR/MWh. (source: Montel). In contrast, solar feed-in reached about 27.4 GW on 19 July, i.e. about 6.7 GW above the norm. Due to this, electricity prices on the day-ahead slid into negative territory and fell up to -5 EUR/MWh (source: Montel).

Figure 4 (source: Energy-Charts) shows electricity generation and consumption in July 2021.

What happened in the energy market in June 2021? Click here for the previous blog post.

What do you say on this subject? Discuss with us!