The third wind tender did not bring any major surprises with it – clearly oversubscribed, high dominance of the citizen energy companies and further declines of tendered values. Read more about the tender results and strategies to withstand the competitive pressure in this market environment.

The results of the third wind tender from 1st of November 2017have been published. Let us look at the facts. The tender was clearly oversubscribed, as were the previous ones. The level of oversubscription was 2.6 and thereby roughly the same as in the previous tenders (2.6 and 2.8). Citizen energy enterprises dominated just as in the other two tenders with successful bids – with an increasing quota of 98%[1] (previously 94%, 90%).

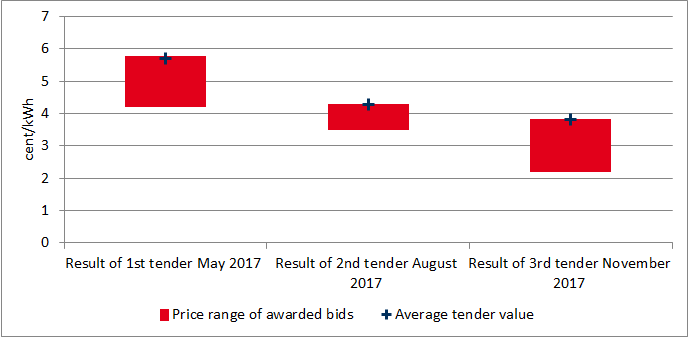

The movements of the bid prices also remained the same – clearly downwards. The highest and also the volume-weighted tender value fell again by almost 0.5 cents/kWh or 11% in comparison to the previous tender. When compared with the first tender, where the price level was already perceived as surprisingly low at the time, the price drop just settled under 2 cents/kWh (33%). The lowest bid price has even slipped to unprecedented depths: From 4.2 cents/kWh on the first call to 2.2 cents/kWh. Even though the lowest bid price was presumably made by a citizen energy company[2], it gives a clear impact on how low market participants are willing to bid to be awarded in the tender.

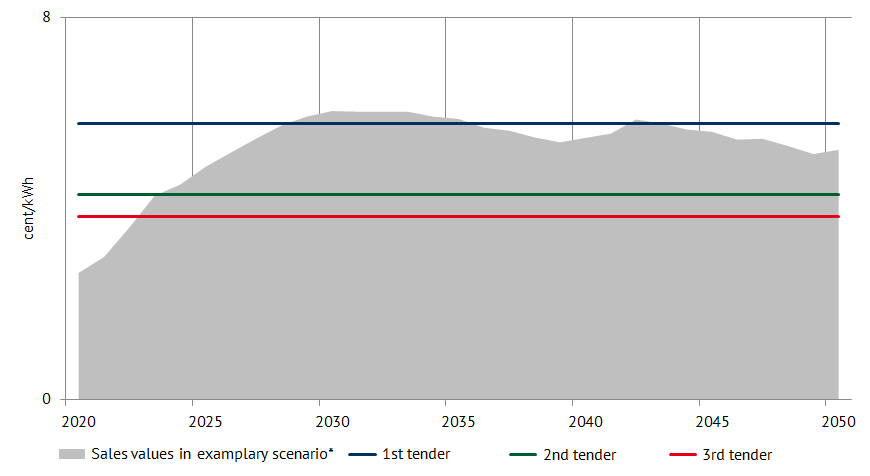

The question arises as to whether the bid values reflect only the belief in sharply falling project costs or that rising electricity prices or sales revenues[3] on the electricity market are expected and taken into account. Figure 2 displays that the sales values[4] of wind onshore (in an example scenario) could exceed the bid levels of the last tender rather soon.

Figure 2: Comparison of the highest bids submitted per tender and the sales value for an example scenario (* weather year 2015) (source: Energy Brainpool)

However, it also means that the bid value is the basis for financial gains and proceeds only for the first few years of operation. As soon as the sales value exceeds the bid price, higher revenues can be realized on the electricity market. As the results of the offshore tender are showing, the approach is quite conceivable. The bid values of 0 cents/kWh are clearly based on sufficiently high sales revenues on the electricity market.

For the next year, the maximum bid price could be lowered from 7 cents/kWh to 5 cents/kWh. This is due to the rule that the maximum price for the tenders in 2018 is 108% of the average of the highest bids yet in the last three tenders. Therefore the way for tender price increases is clearly limited. Some urgent questions arise at the end of the first tendering year:

- In which way will prices develop in the upcoming tenders?

- Will market participants price in prospective sales revenues on the electricity market in the future?

- With a view to the current tender results, is a market segment of new wind projects outside the EEG remuneration with merchant or corporate PPAs conceivable?

- Will the amendment of the tendering rules for citizen energy companies curb, stop or even reverse the price erosion?

- Will citizen energy companies actually be able to realize their projects with these bid prices?

- Will there be a wind power expansion gap due to the citizen energy companies in the coming years?

One thing is certain: A sharp breeze is blowing towards the wind industry. There is no lack of challenges although opportunities also exist. Nevertheless it is easier to navigate through these stormy times with an appropriate strategy. This also includes a sound assessment of the development of sales values, volumes and revenues on the day-ahead spot market. This market assessment can assist market participants in bid price assessment. It is also capable to play a key role in evaluating and deciding on the continued operation of assets from the 21st year of operation. In the medium term, investors are going to think about projects outside of EEG remuneration or incentives at appropriate locations, given appropriate market assessments. It is quite important to have analyse future sales revenues along with risk factors such as wind years, CO2 price developments and other relevant market influences. Exciting times ahead!

[1] Based on the number of bids

[2] The addition value for citizen energy companies corresponds to the highest bids bid value and not the own bid value

[3] White paper sales values, -revenues

[4] White paper sales values, -revenues