German gas-fired power generation climbed 98 percent year on year in August. Main reasons are lower gas prices compared to coal prices.

Power generation from gas reached 2.31 TWh in August, thus up 39 percent compared to July levels. Most of the increase occurred during the last two weeks of August, due to falling spot prices for gas. Cumulative hard and brown coal generation fell 15 percent year on year in August. Coal however continued to dominate the German generation mix, delivering 16.81 TWh of power.

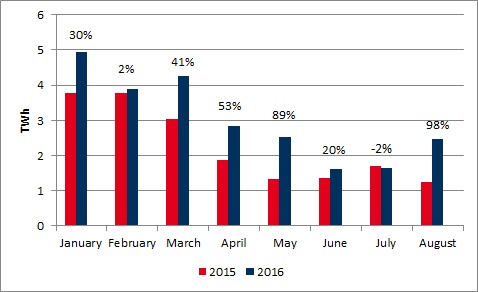

The combination of weak gas and high hard coal prices has allowed German gas-fired power plants to run around the clock. In some cases they even outbid some hard coal power plants in the merit order. Figure 1 shows the power generation from gas-fired power plants for the first eigth months of 2015 and 2016.

Figure 1: Monthly power generation from gas in Germany year-on-year 2015 and 2016 (Data source: Fraunhofer ISE, Energy Charts. Picture source: Energy Brainpool)

Gas prices have come under pressure this year from strong Russian and Norwegian exports, despite delays in LNG exports from new US and Australian terminals. Spot gas tumbled to a six-year low of EUR 10.60/MWh on Germany’s NCG hub on 19 August. The benchmark contract for front-year coal deliveries into north-western Europe last traded at USD 58.20/t, up 10% year on year at London’s Ice.

Gas-fired power plants possess a high level of flexibility, which is especially valuable in combination with fluctuating renewables. Due to the fact that power generation from coal has been cheaper than from gas during the past years, many gas-fired plants only produced during several hours a year. Consequently they just incurred losses. With coal prices rising further and LNG-deliveries from the USA arriving, this trend could reverse and allow gas-fired plants to play a more important role in the German power market.