Anyone who want to protect the climate with their consumption behaviour must also pay attention to the effects of their electricity consumption. Guarantees of Origin (GoOs) generally provide a great deal of information for this form of mindfulness. Unfortunately, today’s guarantees of origin are not always suitable for fulfilling consumer wishes. Our guest author Jens Leiding will shed light on this topic.

A lack of transparency and product differentiation creates a “green mush” that only partially fulfils the goal of “climate protection through energy transition”. IMPACT GoOs can represent climate protection qualities of GoOs. In this way, they create an opportunity for verification and price differentiation.

The demand for green electricity has been rising for years. This is because consumers want to support the expansion of renewable energies. However, there is currently a lack of transparent and credible products that can indeed fulfill this intention.

IMPACT GoOs could close this gap with an honest product. The resulting demand ensures a fair price for GoOs from young, unsubsidised renewable energy plants and thus contributes to their economic and financial viability.

How does green electricity get into the power socket?

Trading green electricity as such is physically impossible. Imagine you buy pure mountain spring water. The producer takes the water directly in the Alps from a specially protected source. He delivers this water to your home in Hamburg via the normal drinking water pipes. Is mountain spring water now coming out of your tap?

The example shows the difficulty of differentiating a uniform product. This applies not only to water but also to electricity. Basically, electricity takes the shortest route from production to consumption. This means that ecologically generated electricity from a hydroelectric power station in the Alps, for example, cannot physically reach our homes.

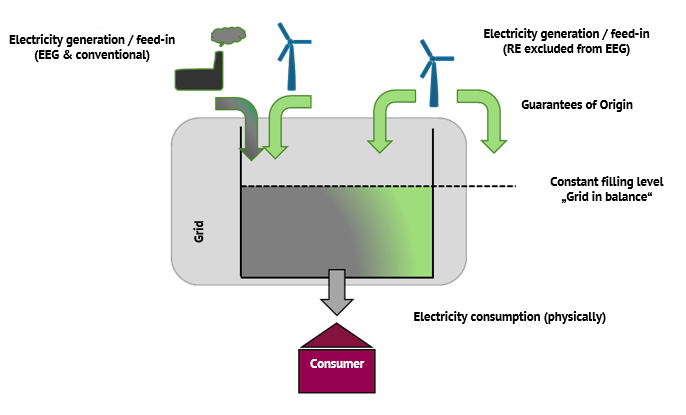

All electricity producers feed the electricity they produce into a common supply network. Once arrived in this large ” power lake”, the green electricity is inevitably mixed with other electricity from conventional sources, such as coal or nuclear power. In an alternating current network, electricity flows almost simultaneously at all points in the network. This makes it impossible to physically assign certain currents.

Figure 1: The metaphor of the “power lake” (Source: Market Analysis Green Power II, Federal Environment Agency)

The solution: an accounting approach

In order to solve this dilemma, an accounting approach was chosen for electricity trading. There are two separate and independent transactions for one megawatt hour (MWh): one for physical electricity and one for guarantees of origin (GoOs).

The second trading object, the so-called guarantee of origin, is a proof of the generation origin of the electricity. In concrete terms, it proves that a certain proportion of the electricity comes from renewable energy sources and therefore has a “green electricity” characteristic. Guarantees of origin thus serve to label the electricity and help to trace its source.

Separation into physical electricity and green electricity

For trading the physical quantity of electricity, a system of schedule and balancing group mechanisms on a 15-minute basis for energy quantities fed in, fed out and traded, has been established. This has been successful practice for over 20 years. The physical complexity of the electricity supply has been simplified to such an extent that liquid electricity trading is possible with a meaningful electricity price.

The principle has been simplified even further for the “electricity attribute”. However, the success story has not yet kicked in. The price for the tradable electricity attribute only plays a subordinate role and neither follows any logic nor is it correlated with another commodity.

Consequently, a real and independent market is missing, although there is potential for a functioning trading system and demand for the identification of a credible and effective electricity attributes.

Why Guarantees of Origin?

Background: the electricity attribute, that is, the source of the electricity, offers added value in terms of distribution. This is because it attributes the final energy consumption to a desired form of primary energy source.

The proof of the electricity’s generation plant is declaratory attached to the guarantee of origin, internationally also known as GoO. The most common product on the sales side is the “regenerative” GoO as green electricity.

Guarantees of origin are mandatory for green electricity, which means that energy suppliers must prove through GoO that a certain amount of electricity was generated in a certain plant.

Growing awareness of climate protection

Awareness of climate protection is growing steadily. Consumers want to find out what is behind the products and consider the ecological effects of their consumption. This also applies to electricity: the demand for green electricity is growing because consumers want to support the expansion of renewable energies and the energy transition.

The popularity of green electricity originally resulted from the anti-nuclear power movement. Its aim was to procure electricity from non-nuclear power sources. Norwegian hydropower was particularly suitable for this purpose, as the owners of the power plants were guaranteed not to have any nuclear power plants in their generation portfolio.

This first green electricity was generated in the nineties of the last millennium. The producers have highlighted it with independent “green electricity certificates” or “green electricity seals”. A market for this was created in Germany and is the largest European importer of GoOs to this day.

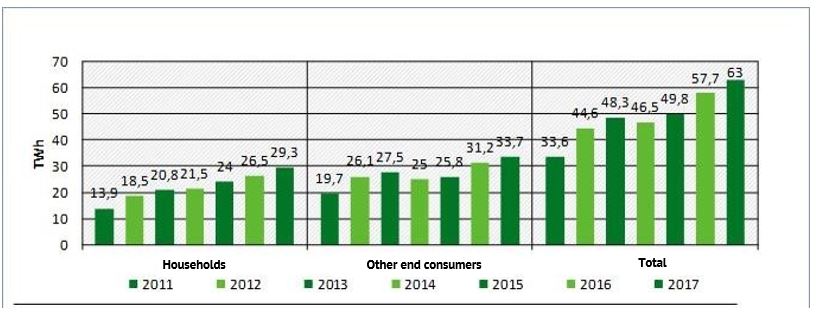

Figure 2: Green electricity sales from 2011 to 2017 (Source: Market Analysis Green Electricity II, Federal Environment Agency)

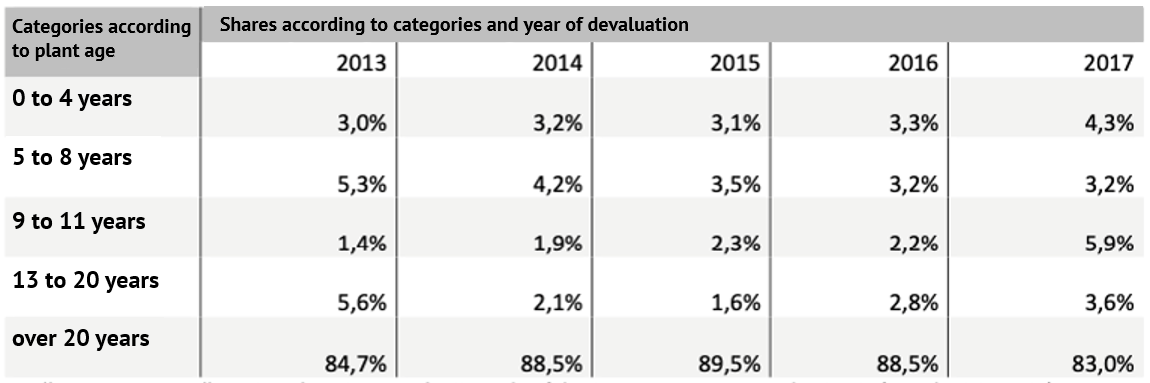

Figure 3: Devaluations of GoOs in the context of electricity labelling (year = delivery year) (Source: Market Analysis Green Electricity II, Federal Environment Agency)

Hydropower from Scandinavia and the Alpine region supported

The demand for ecologically produced electricity has been increasing for years. In essence, GoOs from Scandinavia and the Alpine region meet this demand, as they set the standard with their high capacities of large, old hydroelectric power plants.

Both regions are particularly suitable for several reasons: GoOs are available in large quantities, are cost-effective and do not compete with demand from local markets. 90.4 percent of all hydroelectric GoOs devalued in Germany in 2018 come from these two regions [1].

The GoO as a pioneer of subsidy-free energy transition

By September 2020, long-term electricity supply contracts had been concluded for the construction of around 560 megawatts of subsidy-free solar power plants in Germany. The GoOs have so far played a subordinate role. Although they have the potential to enhance the quality of electricity sales from these plants and simplify financing. In fact, GoOs could give investments a real boost.

Transparent, barrier-free trading with high-quality GoOs has the potential to improve the financing structure of young or not yet built but planned renewable energy plants in the medium term.

This has the following background: every “green” Power Purchase Agreement (PPA) involves a counterparty risk. In concrete terms, this means the risk of the electricity consumer defaulting and, consequently, the potential worthlessness of the price stipulated in the purchase agreement. Financing banks assess this risk of default and this influences the financing of new plants.

New transparent GoOs can act as a complementary risk-bearing component in the financing. The additional “green commodity” can be traded or sold separately from the generated physical megawatt hour. In this way, the GoO can become a separate risk carrier. Since the buyer of the GoOs generates its own counterparty risk, the risk profile of the investment can improve as a result of this diversification of risks in the rating.

What makes green electricity stand out?

For the required electricity labelling as green electricity, it is currently sufficient to submit any GoO from European green electricity production. As long as there are no specific characteristics and targets, GoOs from hydroelectric power plants in Scandinavia and the Alpine region are usually the first choice.

All renewable energies count

In addition to hydroelectric power, green power can also be obtained from all other renewable energies such as wind power, biomass and photovoltaics. While hydroelectric power plants have been built for over 100 years, the expansion of wind and PV power plants on a significant scale in Europe only began this millennium.

In order to achieve economic viability of renewable generation plants such as those from wind and PV, it was necessary to politically enforce financial support and investment incentives. The reasons for this are the initially high capital costs in combination with the lack of predictability of fluctuating electricity generation from renewable energy plants.

In the meantime, however, the phase of support for the purpose of technical development and reduction of production costs has been successfully concluded. The costs of the technologies have fallen by up to 90 percent over the past ten years, for example in the case of photovoltaics.

IMPACT is in demand

Corona has had the world in a stranglehold in recent months. All other issues have receded into the background in the face of this challenge. The Corona crisis shows the fragility of systems and yet is only a foretaste of future global crises.

In many different places, the economic stimulus packages for “reconstruction” are providing the impetus for more climate protection. For it is becoming clear that with a growing sensitivity to this issue, the binary signal of the green electricity property of electricity is no longer sufficient.

Consumers want to actively influence the choice of their electricity and the demand for honest products with IMPACT is growing. What many people are not aware of, however, is that not all green electricity promotes the expansion of renewable energies and contributes to active climate protection. Anyone who wants to make a real contribution to the energy transition and more climate protection must also pay attention to the quality of a GoO.

While electricity is an extremely homogeneous good, GoOs, in contrast, are much more differentiable. A GoO simultaneously contains a large amount of information. Generation technology, plant age, location and time of feed-in are differentiating features that can affect the price and IMPACT. In particular, the age of the plant plays a decisive role.

An old hydropower plant, for example, makes no additional contribution to the expansion of renewable energies. It is therefore part of the conventional power plant portfolio, is depreciated, paid off and has been in operation for decades. Only new, young plants can create a sufficient amount of clean generation to push fossil-fuelled power plants out of the inventory and at the same time guarantee security of supply.

In future, it will be essential to address the differentiation and quality characteristics of electricity products. In particular, companies must adapt their sustainability strategies to avoid possible reputation risks in the future.

How can this differentiation look and become visible?

We suggest to get more out of the concept of GoO and call it “IMPACT GoO“! IMPACT GoO is not a protectable or proprietary term. IMPACT GoO represents a thinking and implementation approach to develop a sensitivity in procurement, in contrast to well-known green electricity labels, and to protect yourself as a buyer against future reputation risks.

For example, the marketplace DIGITAL renewables (www.digital-renewables.com) already offers GoOs of IMPACT quality. They not only meet the criteria of the common eco-labels, but also have a guaranteed effect – they make an active contribution to the energy transition.

IMPACT GoOs make it easier to separate the “wheat from the chaff”. Furthermore, IMPACT GoO proves that it is more than just a green electricity certificate. The IMPACT GoO has one effect, namely a positive impact on the expansion of renewable energies and accelerates climate protection. We propose four forms of IMPACT GoO for the German electricity market:

- Pre FID: a GoO that can be completed to positively influence the final investment decision (FID=Final Investment Decision). The completion of the GoO can make the construction of the generation plant possible. It is therefore a purchase commitment for the green electricity property after construction of the plant. Technically it is a forward, but in the end it leads to better financing possibilities and has a positive influence on the decision to build the plant. The early conclusion of the contract can be used in communication. The delivery of GoOs takes place from the time the plant is commissioned.

- Young GoO – GoOs from plants that are between zero and six years old. Plants of this age have the highest financial burden and with this the highest economic risk.

- GoOs for plants between 7 and 15 years old. Financing risks are reduced, but major repairs or post-optimisation are required.

- Post-EEG: Plants that do not comply with the latest state of the art and are not eligible for EEG remuneration (or other European funding regimes). They will only continue to be operated if at least the operating costs are earned. If this is not the case, these plants disappear permanently and are replaced by fossil or nuclear power generation technologies. The economic efficiency of these plants must therefore be additionally supported.

The guarantees of origin are differentiated according to quality characteristics, in particular the age of the plant. And only GoOs of unsubsidised plants up to 20 years old and guarantees of origin from post-EEG plants are traded. Thus, on the one hand, young, small plants with regional added value are promoted, which are essential to displace thermal power plants and CO2-polluted electricity. On the other hand, the continued operation of Ü-21 plants, which are excluded from EEG support, is supported.

On the other hand, plants that have been operating without feed-in tariffs for more than 20 years no longer generate additional IMPACT GoOs. They have proven themselves on the market, are doing their job and are part of the power plant stock – but are not further accelerating the energy transition.

Figure 4: Commissioning data of the supply plants and their shares in the devalued quantities (Source: Market Analysis Green Electricity II, Federal Environment Agency)

If IMPACT GoOs are contracted en bloc for several years at the same time, this facilitates the financing of the plant. This security is purchased at a constant, i.e. calculable, price for the entire term. This can be a long-term contract with one buyer or futures trading with several contracting parties.

For the seller, this means that the speculation of rising GoO prices in subsequent years is avoided. However, the fixed adequate price is compensated by positive investment or financing decisions. In the medium to long term, three effects can be expected from IMPACT GoOs:

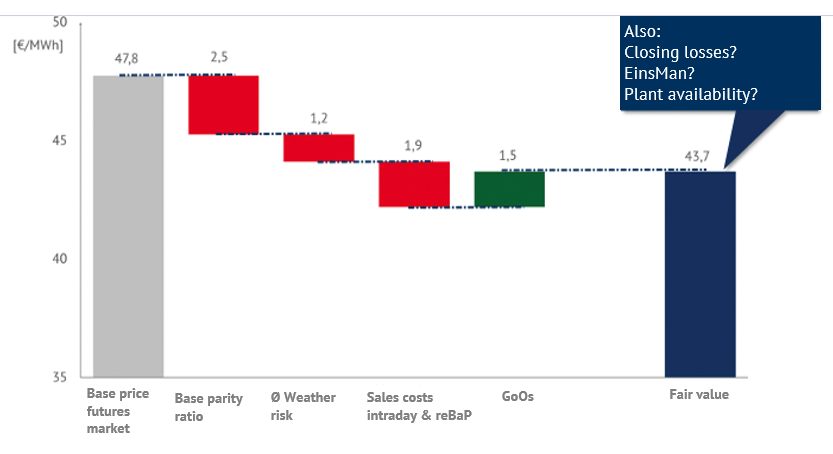

- Green electricity supply contracts differentiate between the electricity supplied with a price X and the corresponding IMPACT GoO with a price Y. Both prices X and Y are based on the market price.

- The green electricity property is no longer hidden in the electricity supply agreement (PPA), the additional pricing of the IMPACT GoO leads to a price for the PPA that is higher than the pure exchange price of the delivered electricity profile.

- As the IMPACT GoO represents an additional, independent, risk-bearing source of income, it facilitates financing on the one hand and provides credibility on the other.

The revolution eats its children – GoOs compete with each other

Today, green electricity supply contracts (PPAs) are replacing state feed-in tariffs as a market-based instrument. PPAs are long-term electricity supply contracts between a green electricity producer and a power consumer and consist of two components: firstly, electricity is supplied in MWh and secondly, an (IMPACT) GoO is issued with each MWh generated and fed into the grid, certifying the origin and characteristics of the electricity from that specific plant.

Figure 5: Exemplary PPA fair value calculation, example PV in Germany 2020 (Source: Energy Brainpool)

Such GoOs from unsubsidised German plants have the reputation of particularly promoting climate protection by purchasing the electricity and its properties. Every MWh fed into the grid from these plants displaces conventionally generated electricity that is polluted with emissions. Regardless of this, these (IMPACT) GoOs compete with all other GoOs on the market.

Changed customer interests

The lack of labelling of the differentiation and quality features of the various GoOs causes confusion among electricity customers. Whereas in the 1990s green electricity customers only wanted nuclear-free electricity, today’s customers are more interested in climate protection and renewable energies when deciding to buy green electricity.

However, consumers are usually not able to see which GoOs really contribute to this goal. This can be remedied by newly oriented green electricity labels which, as an external guarantor, can ensure the effects of green electricity supply. IMPACT GoOs will thus be an important element in the future if a positive impact on climate protection is to be proven.

As an alternative to electricity labels, it is also possible to make the green electricity directly transparent by means of a QR code newly integrated on the electricity bill. It can take the customer to a landing page of the supplier, on which he can display his procured (IMPACT) GoOs with pictures and information on the respective plants.

Electricity labelling towards the end customer shears all the differentiation and quality characteristics of the GoOs together. And in the pie chart of the electricity bill they get the same green colour. This turns the information package back into binary information: “Green or not green, that is the question!“. So it is worth taking a closer look.

Green electricity labels, which can act as an external guarantor to ensure the effects of green electricity supply, can help. IMPACT GoOs are a building block if a positive impact on climate protection is to be proven.

Where is the market?

The foundations of all economic theories are also the foundation for the trade of GoOs. The supply of and demand for a scarce good leads to a price in the market. This price generates signals for the production of the good.

High demand leads via a high price to a growing supply. In the case of GoOs, this interaction can only be achieved by increasing the use of renewable energies. In theory, therefore, the market is a powerful engine for energy transition.

But how does this market currently function? European trade is dominated by a few supply and demand markets. As described above, the Scandinavian and Alpine regions are the decisive supply markets. Their old, price-setting power plant stock ensures a high basic availability of GoOs.

The traded commodity is therefore not scarce and, as a result, the price is relatively low. Support for the energy transition is unintentionally lacking. If the GoO market was supposed to fuel the expansion of renewable energies and climate protection, it has failed to have any effect for years, with few exceptions.

What could a functioning market look like?

Let us sketch out the cornerstones of a functioning market. If the aim of a GoO market (in the sense of the consumer understanding of the 2020s) is to create an incentive for the expansion of renewable energies, then a clear distinction between plants with or without IMPACT is necessary.

The interpretation of the Bauhaus rule form follows function offers a good orientation aid here: the scarce commodity is electricity from plants that have an additional climate effect and which provide a boost to the energy transition. Green electricity generation from new, young plants or power plants still in the planning stage must therefore be distinguished from the old, established and long integrated power plant stock.

The basis for fair prices is, as in any market, transparency about product characteristics. The three central pieces of information of a GoO are the age and location of the plant and the generation technology. The age of the plant guarantees that new, young renewable energies make a major contribution to climate protection. The generation technology translates consumer preferences and acceptance into a price signal.

The place of electricity generation creates a characteristic for regional value creation and can promote identification with renewable energy plants “within sight” of the consumer. Product differentiation leads to price differences, a marketplace with standardised products clusters these differences and creates price transparency through liquidity.

The energy market in constant change

One thing is undisputed: the energy market is undergoing fundamental change. IMPACT GoOs can be an important building block for the success of the energy transition and support it. They can not only serve as the second pillar for financing subsidy-free renewable energy projects, but also pave the way for more PPA solutions.

In the course of digitalisation, considerably more transparency for electricity customers is possible and, by paying more attention to the differentiation and quality features of green electricity, each consumer can make an individual contribution to the expansion of renewable energies.

[1] Greenfact, Analysis of the German Go Market Update 5-8-2019 1 WHAT DISTINGUISHES GREEN ELECTRICITY?

What do you say on this subject? Discuss with us!