The motivation to buy futures is basically the protection against price risks or arbitrage and speculation.

Hedging

Futures, forwards and option contracts originally came about because market participants wanted to protect themselves against price movements, also known as ‘hedging’. Selling a futures contract might serve to protect oneself from falling electricity prices (Short-Hedge). This could be of importance for a power station marketer who wants to protect the power station against falling prices in the future. With futures, forwards and options contracts it is possible to sell electricity today which is to be delivered far ahead in the future. But futures, forwards and options contracts can also be used to hedge against rising electricity prices. This is extremely important for local suppliers which have to fulfill deliveries to customers with whom they have already agreed a price.

Arbitrage

Arbitrage takes advantage of price differences between e.g futures traded on exchanges or similar products or contracts outside of exchanges. You buy the cheaper contract and sell the more expensive one at the same time. For example a product might be selling at a lower price on an exchange than on an OTC market. In this case it would make sense to buy the product on the exchange and sell it on the OTC market. Due to the fact that both transactions happen at the same time a profit can be made without any risk.

Speculation

You could also for example sell a futures or forwards contract if you thought that the price of this contract was going to fall in the future with the intention to buy it back at a lower price later in time. Speculators take on risks and supply the market with liquidity for market participants with opposite expectations for the future price development of the market.

How are electricity trading deals settled?

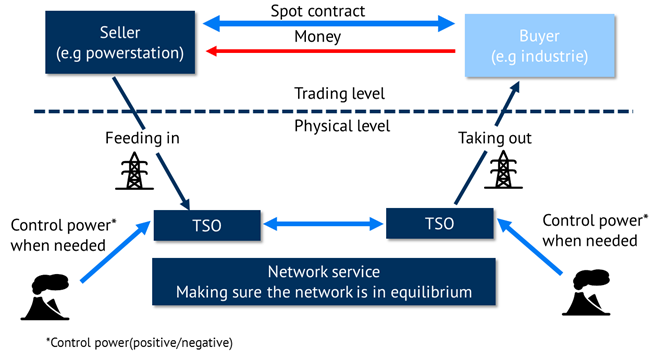

The fulfillment and settlement of electricity trading deals can be differentiated between the trading level and the physical settlement process. On the trading level money is exchanged for the delivery of a certain amount of electricity. You could say that the trading happens merely virtually. The settlement process is the physical exchange of electricity in the grid which is why network operators are always involved (Figure 1).

Figure 1: Settlement at power markets (source: Energy Brainpool)

In comparison to the spot market long-term contracts are traded on the futures market, which is why the goals of the market participants are different to those trading on the Spot market. In the futures market for electricity, contracts are traded where the fulfillment is medium- to long-term. The weekly, monthly, quarterly and yearly contracts are distinguished between base and peak load. A futures contract is an agreement between two parties today which will be fulfilled at a certain point in time in the future. Futures, forwards and options contracts are also called derivatives due to the fact that their value is dependent on the value of the underlying good (Underlyings).The Phelix index is the underlying index for trading futures contracts on the electricity market. Many different types of futures, forwards and options contracts exist, some of these are extremely complex. Fundamentally, these complex contracts still can be reduced to regular conditional and unconditional futures, forwards and options contracts.

Conditional and unconditional derivative contracts

Forwards and futures contracts are unconditional contracts. The buyer and seller (Long side and Short side) have an obligation which has to be fulfilled. In comparison to that in an option contract only the seller has an obligation towards the buyer. The buyer of the option is known as the option holder and acquires the right to use the option totally or partially. The option holder can also let the option expire. Only if the option holder makes use of his or her right on the day of expiry is he or she obliged to fulfill the terms and conditions bound to the option. Options are therefore conditional contracts.

Furthermore, participants can choose between physical and financial products. Physical products are to be fulfilled with a physical delivery. With financial products the difference between buying price and the market price on the last day of trading is balanced out with a cash settlement. Financial derivative contracts can be physically fulfilled but are at first only a transfer of money.