On Sunday, 8th of May 2016, the Phelix-Spot-Price Index settled at -130.09 €/MWh, its lowest level since three and half years. Despite massively negative prices at the electricity market, roughly three-quarters of the wind turbines did still produce and thus threw away cost savings of more than 800,000 Euro.

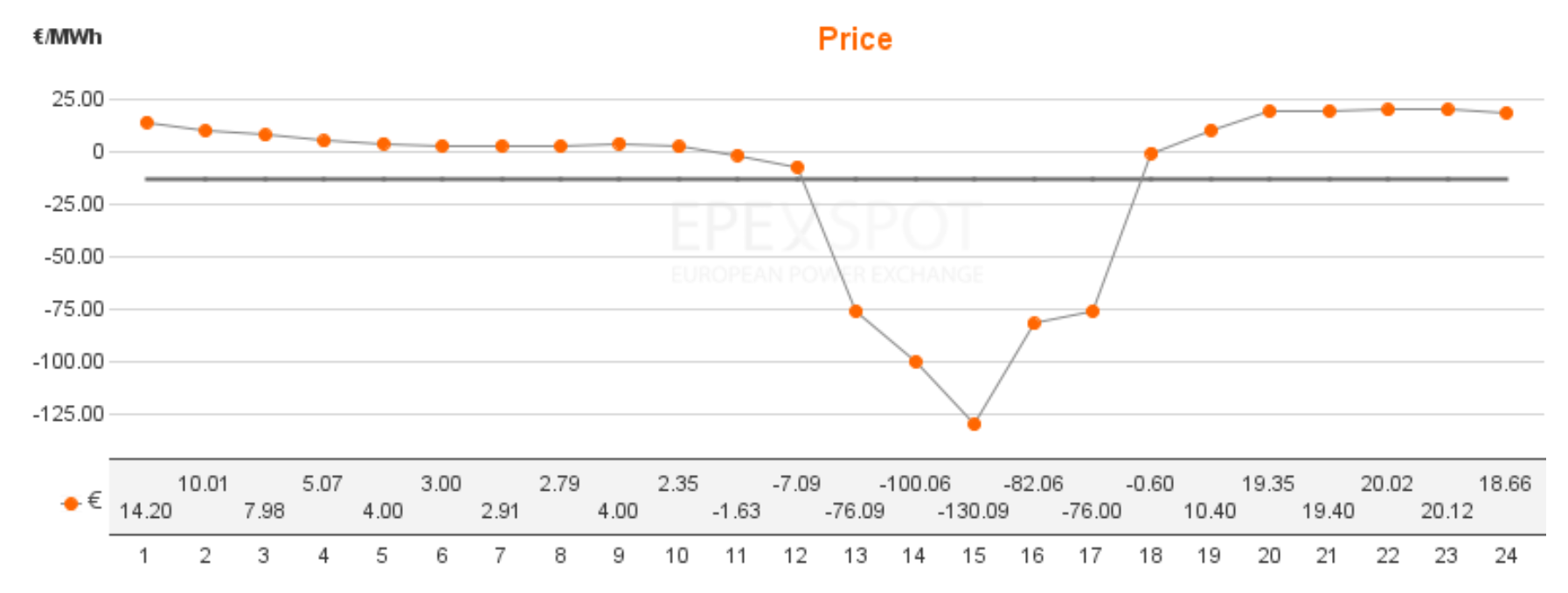

On Sunday 8th of May 2016, PV and wind power provided 25.5 GW of power on average. At 1 pm PV power plants fed a capacity of 26.232 GW into the grid, a new record. Due to the concurrent generation and feed-in of both wind and solar power, the prices of the Day-Ahead auction at the electricity exchange EPEX slumped heavily into the negative area. The baseload for Sunday settled at -12.89 €/MWh, the lowest value since 26th of December 2012. The electricity price index Phelix was negative on 8 consecutive hours, from 10 am to 6 pm (Figure 1). The peakload index, generally featuring higher electricity prices due to higher demand during the day, settled at -36.46 €/MWh, its lowest level since the introduction of negative prices in 2008, and thus also below the baseload price. With -130.09 €/MWh in hour 15, the lowest price on the Day-Ahead market has been observed since Christmas 2012.

Source: EPEX Spot

Figure 1: Market data of the EPEX Spot Day-Ahead Auction for 8th of Mai 2016

In this hour the available capacity of onshore wind power amounted to about 22 GW. Currently, more than 95 % of all German onshore wind turbines are remunerated according to the Renewable Energy Act and thus the market premium model. The market premium results from the difference between the regulated remuneration and the market value. This design should incentivize the reduction of wind power feed-in in times of extremely negative prices. In April 2016, the market value for onshore wind amounted to 2,325 ct/kWh. Also in the past the market value of wind never dropped below 2 ct/kWh. Applying an average financial remuneration for wind power of 97 €/MWh, the market premium amounts to roughly 74 €/MWh. The bidding approach in the direct marketing gives in this case a maximum production price of -74/EUR/MWh. So the wind plants and direct marketers would have saved money compaired to -130 EUR/MWh.

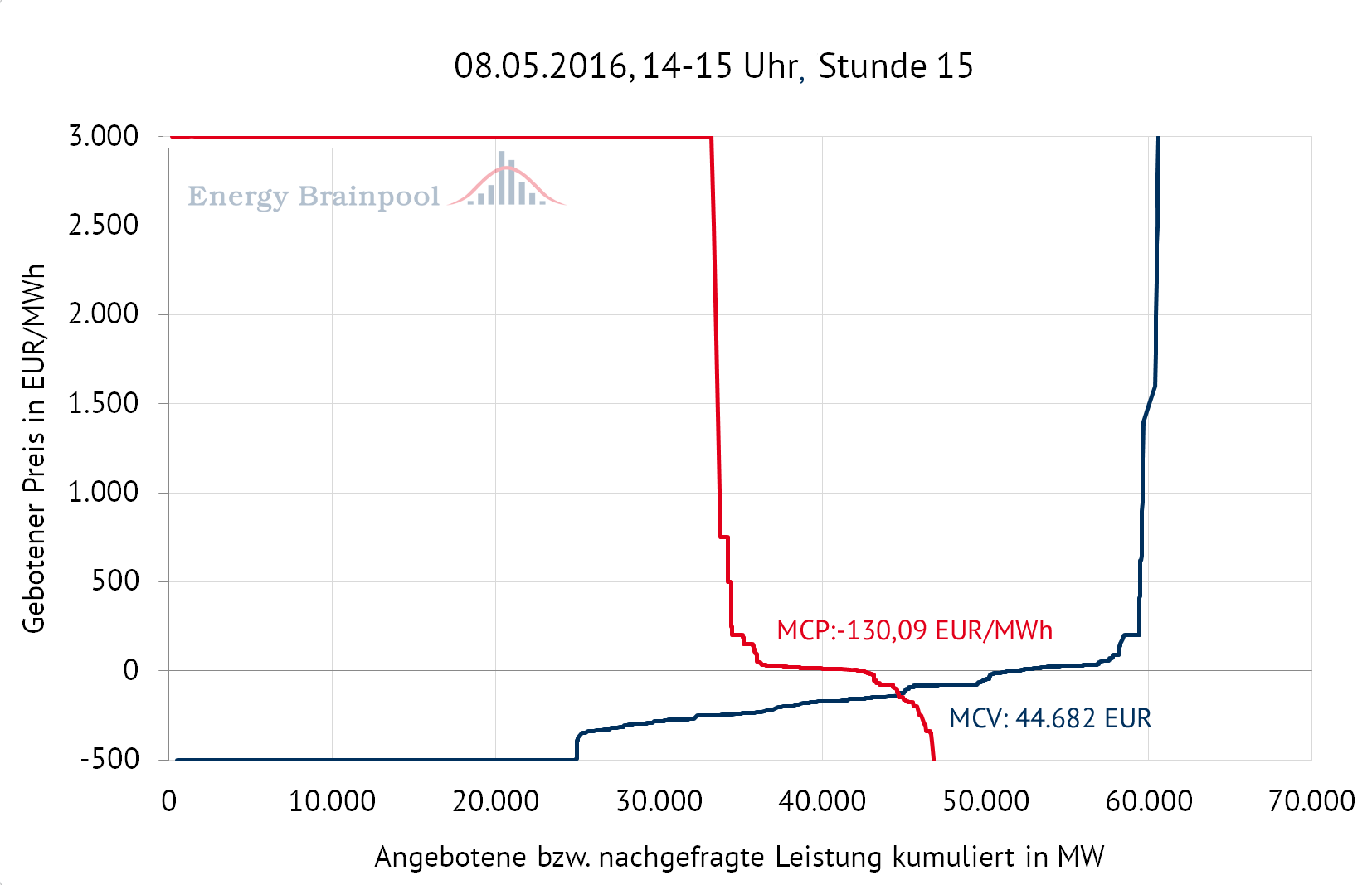

The bid and ask curve (Figure 2) of the EPEX spot market from hour 15 of 8th of May exemplifies that during the time of negative electricity prices only a quarter of the wind power operators, or direct marketers bid into the market with the negative market premium and thus turned off their turbines at lower prices. Reversely, this means that about 15 GW of wind power have been producing power and feeding into the grid at prices significantly below the negative market premium.

Source: Energy Brainpool

Figure 2: Bid and ask curves at the EPEX spot market on 8th of May 2016, hour 15

When regarding the difference between the electricity price to be paid when feeding in at negative market prices and the market premium obtained, wind turbine operators and direct marketers could have saved costs of more than 800,000 Euro by switching off the turbines in the hour from 2 pm to 3 pm alone.

“The major drop in electricity prices can certainly also be attributed to Sunday and the preceding bridging day”, Dr. Johannes Henkel, Senior Manager at Energy Brainpool explained. “Our spot price forecast on Friday already hinted at several consecutive hours with negative prices. A measures that could have prevented the occurring costs associated with that, would be the adjustment of the bidding pattern according to the marginal costs of the facilities in these times. We are surprised that those opportunities are not utilized yet.”