Europe faces a transformation of its energy sector. Hydrogen is set to overtake the position of natural gas. This change is driven by the need to decarbonise the energy sector and reach the European Union’s (EU) zero-emission target in 2050.

Hydrogen can play a significant role in helping energy intensive industries reach zero emissions. It can also be used in production of synthetic fuels. Hydrogen can also help to solve the grid flexibility issues caused by variable renewable energy sources, such as solar photovoltaic (PV) panels and wind farms. However, this transition demands massive investments in research, infrastructure, production facilities and adaptation strategies.

Accelerating Production of Low-Emission Hydrogen

The supply side of hydrogen is (currently) dominated by grey hydrogen (hydrogen created from natural gas or methane). This accounted for more than 90 % of European hydrogen consumption in 2022 [1]. The remaining 10 % comes from hydrogen produced as a by-product in industrial processes. Low emission hydrogen plays a negligible role at the moment. In the next few years, production of low emission hydrogen (especially blue and green hydrogen) is expected to increase rapidly, due to increasing demand from industry players as well as increased support from funding schemes.

The funding projects aim to enable the EU to produce 50 % of the required volumes of hydrogen in 2030 according to the REPowerEU plan [2].

One of the most important funding schemes in this sector is the European Hydrogen Bank (EHB). It is funding different projects by bridging the difference between market price and their production costs. Applicants are ranked based on the size of the gap between market price and their production costs, before the projects with the lowest bid prices are chosen for support. If successful, the projects will receive a fixed amount per kilogram of hydrogen produced for a maximum of ten years. The reason behind it is to cover the price gap between green and non-renewable types of hydrogen [3]. In April 2024, the winners of the first auction were presented, where the EHB committed EUR 720 million in funding to seven different projects. The EHB is expected to open another round late in 2024.

“Auction-as-a-service” is a country specific funding scheme initiated by the EU. It basically allows countries to provide additional funding to those projects that do not receive the EHB financing. The IPCEI Hydrogen value chain is also worth mentioning. In general, it consists of a series of funding rounds supporting the whole value chain including transport infrastructure, electrolysis construction and sustainable technologies for integration into industrial processes.

Carbon-free production of hydrogen

When hydrogen is used as a fuel to generate energy, there are no direct related emissions of greenhouse gases. Emissions in the life cycle of hydrogen occur during production. This has historically involved natural gas or coal. More recently, technologies to extract hydrogen with low or zero emissions have improved, enabling a potential future for hydrogen as a large-scale renewable energy carrier.

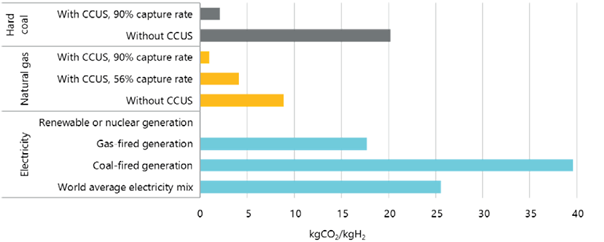

Figure 1: CO2-intensity of hydrogen production (Source: Shanghai Jiao Tong University, Source No. 4)

The conventional method of production from natural gas generates grey hydrogen. If Carbon Capture Utilisation and Storage (CCUS) is installed to reduce its emissions, it is known as blue hydrogen.

Green hydrogen can be produced by multiple kinds of electrolysis. Proton exchange membrane (PEM) electrolysis is viewed by many as the most desirable future option because of its ability to balance out an increasingly volatile power supply and high efficiency.

The dominating technology today, Alkaline Water Electrolyser (AWE), has a lower capital cost due to less expensive materials and equipment. However, it is less efficient than to PEM. Current energy efficiency for AWE is around 62-82 %, whereas PEM could reach over 90 % [5].

In addition, as the power generation in Europe relies more and more on fluctuating renewable energy, the need to stabilise supply and demand increases. PEM’s much higher ramp rate, compared to AWE, also makes it a desired technology to supplement the grid system and balance out the power production [6]. However, this only works where PEM is more cost effective than installing batteries or other grid-stabilising measures.

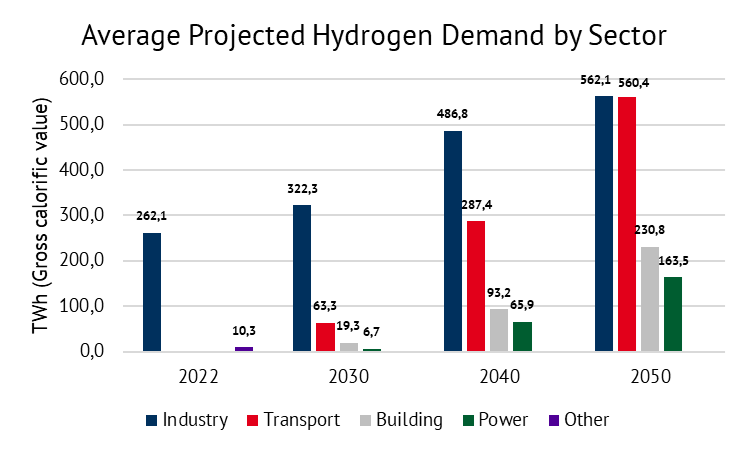

Demand will Multiply the Upcoming Decades

The demand side of hydrogen is currently driven by industrial processes to produce fertiliser, reduces iron ore and usage in refineries. For instance, in the melting of sand in production of glass or production of clinker in the cement industry, hydrogen can play a vital role to reach zero emissions. This is because of the high temperature heat hydrogen can provide, where direct electrification is not suitable.

Instead of powering ships and aeroplanes with pure hydrogen, which requires large volumes and is relatively challenging to store, there is a significant amount of research and development happening around synthetic fuels that are easier to handle. These fuels, if made by renewable energy, are produced by combining hydrogen and air-captured CO2, allowing for low to no life cycle emissions [7].

Therefore, hydrogen is expected to be a game changing feedstock for synthetic fuels – reducing emissions for long distance transport such as aviation and shipping. Already in 2030, the EU aims to have synthetic fuels accounting for 1.2 % in aviation and 2 % in the maritime sector by 2034 [4].

In addition, hydrogen gas is seen as preferred solution for heavy vehicles like long-distance busses and trucks (greater than 12 t), as the transport sector strives to reach its net zero emission target by 2050. This is mainly due to the enormous weight and volume of the batteries that would be required to achieve sufficient electric range.

Furthermore, hydrogen gas is seen as an energy storer that could provide seasonal storage for periods of higher demand and less production. By running electrolysis in periods with excess power and the hydrogen can then be stored until needed before being turned back into electricity.

This is most likely to happen during solar peaks with low power prices. Stored energy can then be converted to electricity during the winter when demand is higher. However, the process is still not truly effective. This is due to losing more than half of the power given into the initial electrolysis. It would also require many new large-scale salt caverns for storage. Salt cavern storages for natural gas are not suitable for hydrogen gas.

Demand for green hydrogen in the EU is estimated to reach between 1,350 and 1800 TWh in 2050, compared to the 2022 level of 270 TWh [8]. However, these numbers are largely uncertain, especially given the questions around whether or not Europe will produce synthetic fuels and ammonia itself or import them.

Transportation and Logistics of Hydrogen

Considering hydrogen as a widely used energy carrier, there will likely be significant imbalances between where supply is produced and demand needs to consume it. This raises the need for large-scale transport of hydrogen. For longer distances above 1500 kilometres, ships are considered the best option. Shorter distances will be covered by pipelines, trains and trucks, with a preference for pipelines due to their greater capacity.

In addition, when not using pipelines, there will also be a need for conversion and deconversion of the hydrogen adding to overall costs whilst also reducing the amount of hydrogen that arrives at the destination.

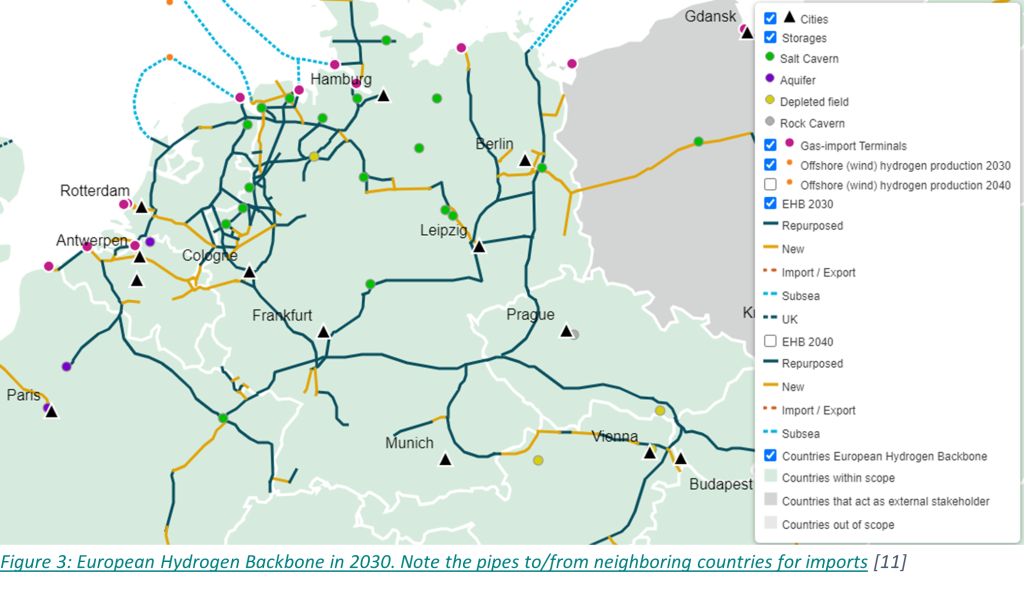

Figure 3: European Hydrogen Backbone in 2023. Note the pipes to/from neighboring countries for imports (Source No. 11)

The European Hydrogen Backbone is a collection of energy industry infrastructure companies that aim to accelerate the decarbonisation in the EU by “defining the critical role of hydrogen infrastructure” [10]. In the beginning, existing European gas pipelines could be used to transport a blend of hydrogen and methane.

In time, the initiative seeks to repurpose existing pipelines and build new pipelines for hydrogen. By 2032, they plan to have established 11,600 km, which will connect European demand clusters in the south with the production hubs in the north [10]. The figure below also depicts the interconnectors to important import sites as the Netherlands, the North Sea, Denmark and more.

Looking ahead

Hydrogen will be one of the most desired commodities in future. It will be necessary and natural evolving the current situation of opaque bilateral trading contracts into a transparent, well-functioning multilateral market of buyers and sellers.

Steps are already being taken. EEX began publishing the Hydrix Index in May 2023, which is updated weekly based on bilateral green hydrogen contracts. The goal of the index is to increase transparency and to facilitate hydrogen as an exchange traded commodity. However, the Hydrix index only reflects historic prices, since prices are updated once a week by delivered contracts.

Hydrogen will continue to increase its role in the European energy system, while the cost of hydrogen installations, transport and utilisation will all contribute to the price development of hydrogen gas. The price differential with natural gas will also be crucial in order to decarbonise sectors where natural gas is the current preferred fuel. To understand the impact on power and energy prices, it will be important to get a view of the current and future price development of hydrogen gas.

How can we support you on hydrogen? Find more here Hydrogen | Energy Brainpool

Sources

[1]: EU, Hydrogen, European Commission, https://energy.ec.europa.eu/topics/energy-systems-integration/hydrogen_en#:~:text=In%202022%2C%20hydrogen%20accounted%20for%20less%20than%202%25,gas%2C%20resulting%20in%20significant%20amounts%20of%20CO2%20emissions.

[2]: European Hydrogen Observatory (2023): EU Hydrogen Strategy under the EU Green Deal, European Commission, https://observatory.clean-hydrogen.europa.eu/eu-policy/eu-hydrogen-strategy-under-eu-green-deal#:~:text=The%20target%20is%2040%20GW%20of%20renewable%20hydrogen,balancing%3A%20daily%20and%20seasonal%20storage%2C%20backup%20and%20buffering

[3]: Hydrogen Europe (2023): Kickstarting the European Hydrogen Market, The European Hydrogen Bank, https://hydrogeneurope.eu/wp-content/uploads/2023/03/2023.03_Hydrogen-Bank_H2Europe_paper.pdf

[4]: Wang, T., Cao, X. & Jiao, L. (2022): PEM water electrolysis for hydrogen production: fundamentals, advances, and prospects, Shanghai Jiao Tong University https://doi.org/10.1007/s43979-022-00022-8

[5]: IEA (2023): The Role of E-Fuels in Decarbonizing Transport, IEA Publications, https://iea.blob.core.windows.net/assets/a24ed363-523f-421b-b34f-0df6a58b2e12/TheRoleofE-fuelsinDecarbonisingTransport.pdf

[6]: Meegahapola, L. (2023): Grid Integration of Hydrogen Electrolysers and Fuel-Cells: Opportunities, Challenges and Future Directions, IEEE https://smartgrid.ieee.org/bulletins/march-2023-1/grid-integration-of-hydrogen-electrolyzers-and-fuel-cells-opportunities-challenges-and-future-directions

[7]: IEA, (2023): Global Hydrogen Review 2023, IEA publications, https://iea.blob.core.windows.net/assets/ecdfc3bb-d212-4a4c-9ff7-6ce5b1e19cef/GlobalHydrogenReview2023.pdf

[8]: Peters, C. (2023): How much green hydrogen will Europe’s industry need in 2050? Fraunhofer ISI, https://www.isi.fraunhofer.de/en/blog/2023/europa-energiesystem-2050-wasserstoff-industrie.html

[9]: EHB, (2023): The European Hydrogen Landscape, https://observatory.clean-hydrogen.europa.eu/sites/default/files/2023-11/Report%2001%20-%20November%202023%20-%20The%20European%20hydrogen%20market%20landscape.pdf

[10]: European Hydrogen Backbone, (2023): EHB, Implementation Roadmap – Cross Border Projects and Costs Update, https://www.ehb.eu/files/downloads/EHB-2023-Implementation-Roadmap-Part-1.pdf

[11]: EHB, European Hydrogen Backbone Maps, https://www.ehb.eu/page/european-hydrogen-backbone-maps

What do you say on this subject? Discuss with us!