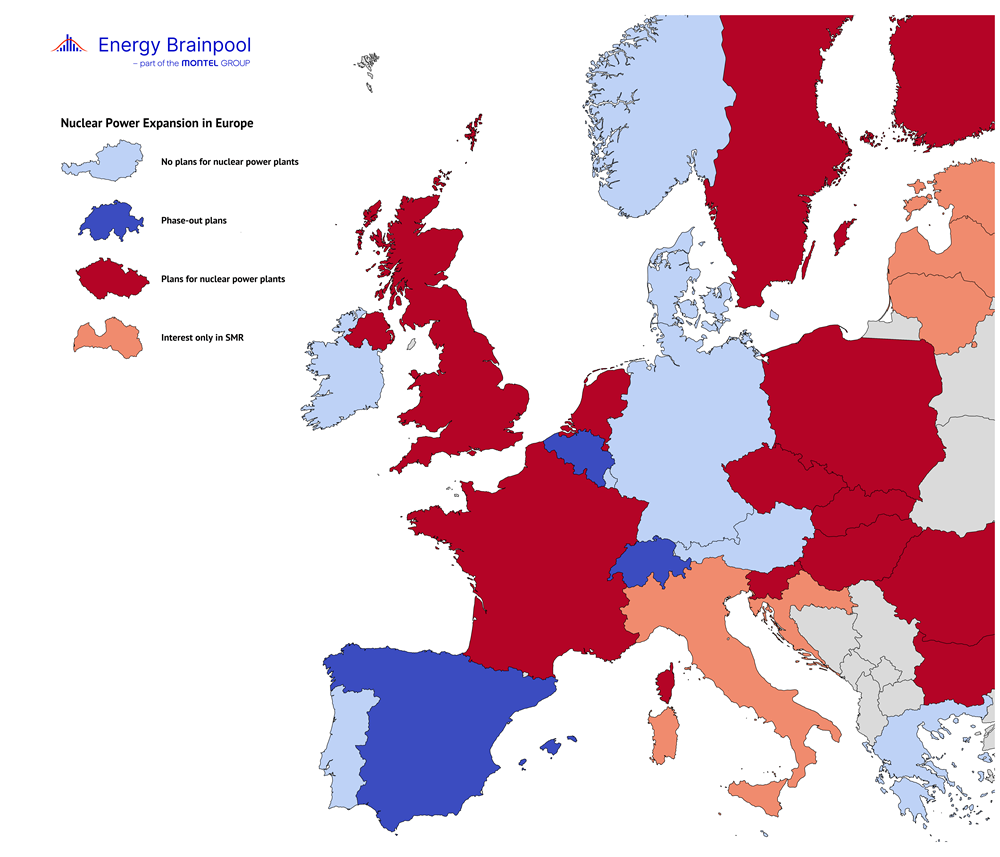

The first Nuclear Energy Summit was held in Brussels in March 2024. 32 countries, including 14 EU states, declared their intention to fully exploit the potential of nuclear power. New reactors will be built, also in Europe. Installed capacity is set to increase by a third by 2045. How many of these countries have concrete plans, and what impact will they have on power prices?

On 21 March 2024, Italy, the Czech Republic, Sweden and the Netherlands, among others, pledged to expand nuclear power. Not only by extending the life of existing reactors, but also by building new plants and investing in the development of new types of reactors, such as small modular reactors. [1,2]

Sweden has already included this in its new energy plan – ‘100% renewable’ has become ‘100% fossil-free’. At least two large reactors are to be built by 2035, and ten new reactors should bring an end to fossil fuels by 2045. There are also plans to extend the life of existing power plants. This is necessary because the Swedish government expects electricity consumption to double as a result of decarbonisation. [3]

The Czech Republic has even more concrete plans. Bids have already been received for the construction of four new reactors – with the reasoning that a higher number would significantly reduce the price of a unit. The first reactor is due to be completed as early as 2036. [4]

The UK‘s targets are much more ambitious. The island wants to generate a quarter of its electricity from nuclear power by 2050. This will require reactors with a capacity of 24 GW. The current capacity of 6GW will need to be quadrupled, as consumption is also expected to rise significantly. However, the UK government is not planning to phase out fossil fuels completely, as it has an economic interest in its own natural gas production. [5] New reactors are also planned in other European countries, including the Netherlands, Hungary and Poland.

Fig. 1: Plans of various European countries for the expansion of nuclear power (Source: Energy Brainpool)

However, not all countries that have signed the declaration have concrete roadmaps. For example, countries such as Italy and Serbia, which currently have no nuclear power plants, have not yet announced plans for future reactors, but have expressed interest in small modular reactors (SMRs). [6,7] These have a capacity of less than 300 MW. The aim of these smaller reactors is mass production. This would mean that less local expertise would be required. As a result, countries with no experience in building nuclear power plants would be in a better position to enter the nuclear energy sector. It remains unclear, however, whether SMRs will be financially viable due to the lack of experience. [8]

The EU, Switzerland, the UK and Norway currently have a total of just over 100 GW of reactor capacity in operation. According to current government plans, a third more will be installed by 2045, not including small modular reactors.

Public Opinion on Nuclear Power

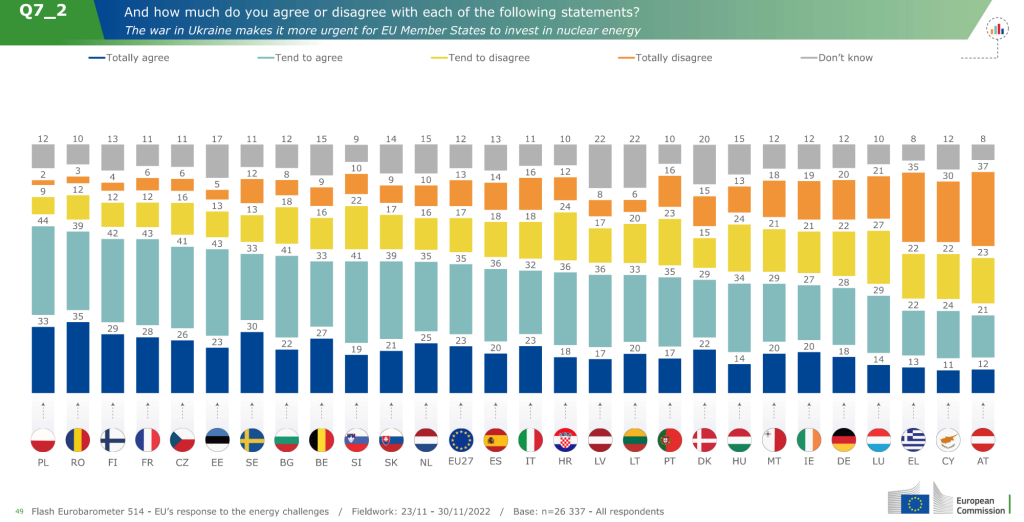

Political decisions to expand nuclear power are also supported by the public. In Europe, nuclear power has reached its highest approval rate since the Fukushima accident. In particular, the war in Ukraine and the associated goal of becoming independent of Russian gas have helped to boost support for nuclear power. Nevertheless, renewable energy remains the most popular. [9, 10]

Fig. 2: Survey results on the question of whether the war in Ukraine makes it more urgent to invest in nuclear energy. (Source: Flash Eurobarometer 514)

However, opinions vary greatly from region to region. Austria has a strong anti-nuclear stance. The Alpine republic even tried to block power plant projects in other EU countries by taking them to the European Court of Justice. This was unsuccessful. [11, 12]

The counterbalance is France, with its 56 nuclear power plants, where 50% of the population is in favour of continuing to build reactors, according to a survey conducted in 2022 by the “Institut de Radioprotection et de Sûreté Nucléaire”. Nuclear energy is considered the cheapest form of energy production after solar energy. [13] In the Czech Republic, as well, the energy crisis has led to a majority in favour of expanding nuclear power. [14]

Power price scenario with major expansion of Nuclear Power

It is not only the fundamental views on nuclear energy that differ, but also the assessment of the costs. A distinction can be made between the cost of a reactor and the impact of nuclear energy on the price of power.

To estimate how the average power price in the EU would evolve if more nuclear power plants were built, we have adjusted our “Central” scenario to reflect the new nuclear expansion plans. In general, the “Central” scenario is one of four scenarios currently offered by Energy Brainpool. The scenarios differ significantly in their assumptions about the development of commodity prices, the power plant fleet and flexible electricity demand.

The “Central” scenario models a highly decentralised energy system in the future. As a result, the energy market experiences a significant expansion of renewables in order to reduce and ultimately end Europe’s dependence on imports of fossil fuels.

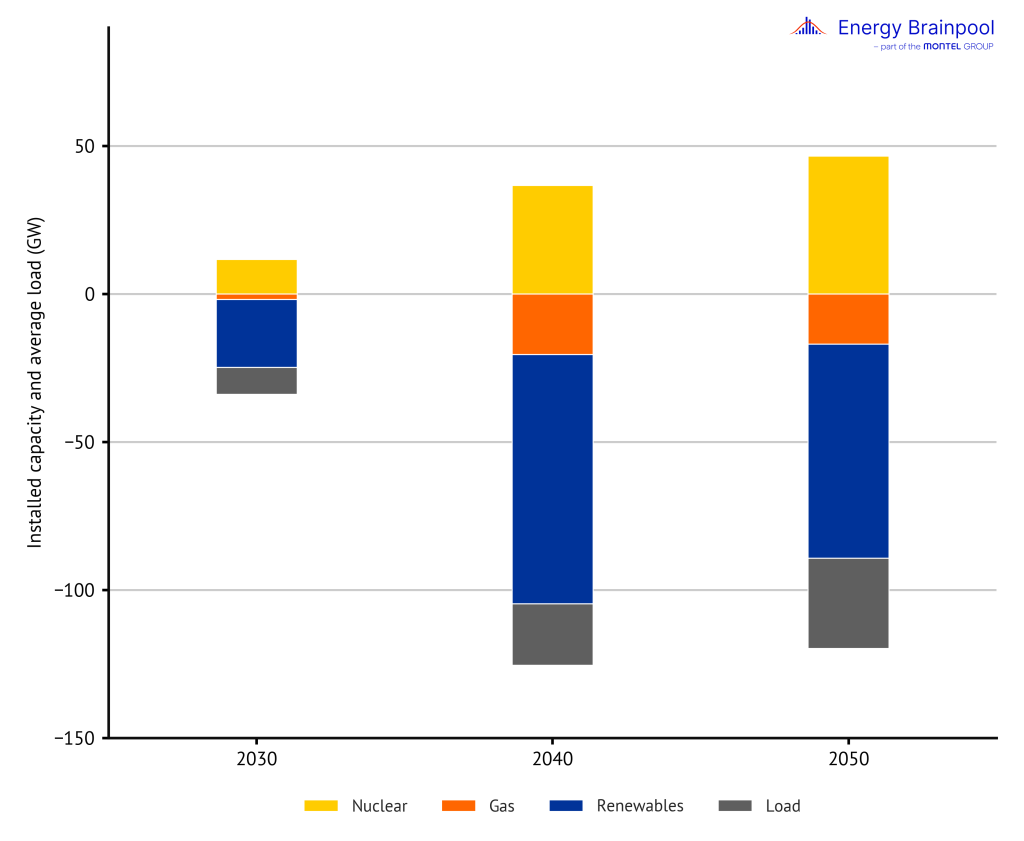

In the “GoNuclear” scenario, not only was the installed nuclear capacity increased, but the load and capacity of fossil fuels and renewables were also adjusted based on government plans and grid operator scenarios. Sweden, for example, plans to expand nuclear power to compensate for the strong increase in load. The sum of all changes compared to the “Central” scenario is shown in the following figure:

Fig. 3: Difference in capacities and load between “GoNuclear” and “Central” scenario (Source: Energy Brainpool)

It is important to note that in the figure the load is displayed correctly in terms of energy. This means that a negative difference in load means that electricity demand increases in the “GoNuclear” scenario compared to the “Central” scenario, as the increase in generation capacity is positive in the same figure. The additional nuclear capacity shown in yellow in Figure 3 must therefore compensate for the decline in renewable and fossil generation as well as the additional load. The changes described above would have the following impact on the average power price in Europe by 2060:

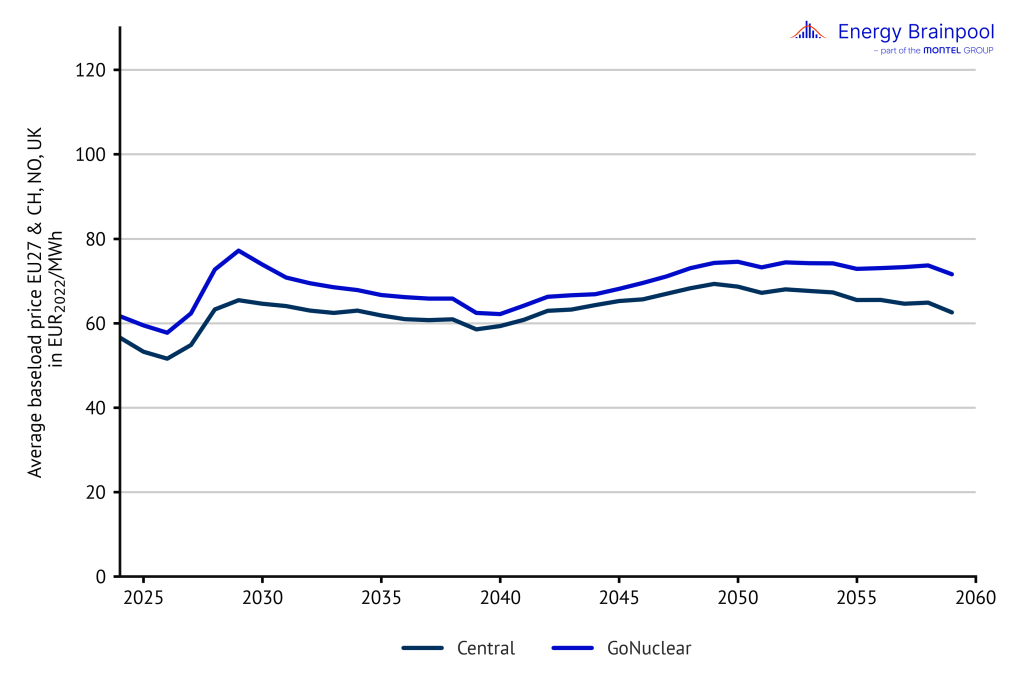

Base load prices in the “GoNuclear” scenario are significantly higher than in the “Central” scenario. This is mainly due to the higher load and the much lower expansion of renewables. The lack of solar farms is particularly noticeable. As a result, the number of hours with zero prices falls sharply. The curve also shows the commissioning of reactors in the early 2030s. As a result, power prices drop.

From 2040, however, they start to rise again as the load increases. It should be noted that the graph only shows the unweighted average price across all European countries, which means that all countries are given the same weighting, regardless of their load. It is therefore not possible to directly explain the evolution of the average power price with the differences shown in Figure 3. It is more relevant to look at the changes in the individual countries. The price changes compared to the “Central” scenario depend in particular on the extent to which the expansion of renewables is slowed down by the higher number of nuclear power plants. This is because the same installed capacity of renewables and a higher nuclear capacity, all else being equal, leads to lower power prices.

How prices will develop in Europe if more nuclear power plants are built will therefore largely be driven by how strongly governments also support the expansion of renewable energy and how economically viable it is without subsidies. Moreover, the influence of demand growth should not be neglected: Greater energy supply also allows for greater decarbonisation and therefore higher loads.

Costs of Nuclear Power

Expanding nuclear power in this way will therefore lead to higher power prices, without taking into account the construction and disposal costs. These are generally supported by the taxpayer when a reactor gets built and must therefore also be considered. This is the only way to determine whether nuclear power plants are a financial burden or a relief for the public purse. When looking at economic efficiency, system costs must also be included. For a country that wants to generate most of its electricity from renewables, policymakers will need to invest significantly more in grid development and storage technologies than they would if the system was based on nuclear power.

Various studies have looked at the capital and system costs of nuclear power. Their results are not always consistent, partly because there is no single variable that can represent the full cost picture for a technology.

The German parliamentary group Bündnis 90/Die Grünen commissioned a study by the Technical University of Berlin and the German Institute for Economic Research Berlin. The participants in the study concluded that the capital costs, the sum of construction and financing costs, make up by far the largest part of the costs. They cite the Finnish Olkiluoto 3 reactor with project costs of 7,600 USD/kW in 2018 and the French Flamanville reactor with 12,600 USD/kW in 2018 as examples.

Costs are also incurred after the end of a nuclear power plant’s operating life. For reactors in western Germany, the study shows average decommissioning costs of 1,100 €/kW by 2023. This is in addition to the cost of a final disposal. The authors conclude that nuclear power is the most expensive way to generate electricity. [15]

What about levelised full system cost of energy?

An article published in 2022 in the journal “Energy” looks at the “levelised full system cost of energy” (LFSCOE). In addition to capital and operating costs, this includes the cost of the entire power grid. They are calculated on the assumption that the electricity supply can be covered by this one source, which for solar energy would include high costs for both grid conversion and storage. For Germany, the study calculates 105 USD/MWh for nuclear and 1,479 USD/MWh for solar, or 482 USD/MWh for the combination of wind and solar. This reverses the price ratios compared to the construction costs. [16] Looking at these results, it should be noted that the aim is not to cover the electricity supply with only one source. Therefore, the significance is rather indicative.

A study by the former chief economist of the Nuclear Energy Agency compares overnight costs, i.e. construction costs excluding financing, for different countries. It is particularly striking that construction costs in European countries have risen substantially over the past 20 years.

However, only a few projects have been implemented in Europe in recent years. As a result, no scaling effects could be exploited. Nuclear construction costs in Europe are now significantly higher than, for example, in Korea (2,410 USD2018/kW) or China (3,188 USD2018/kW). [17]

In 2024, the Nuclear Energy Agency published a system cost analysis for low-carbon electricity systems. In it, the experts emphasise that the overnight costs for the construction of new nuclear power plants (4,000-6,000 USD/kW) are significantly higher than for solar and wind power plants (500-1,500 USD/kW). This also applies to the annual investment costs.

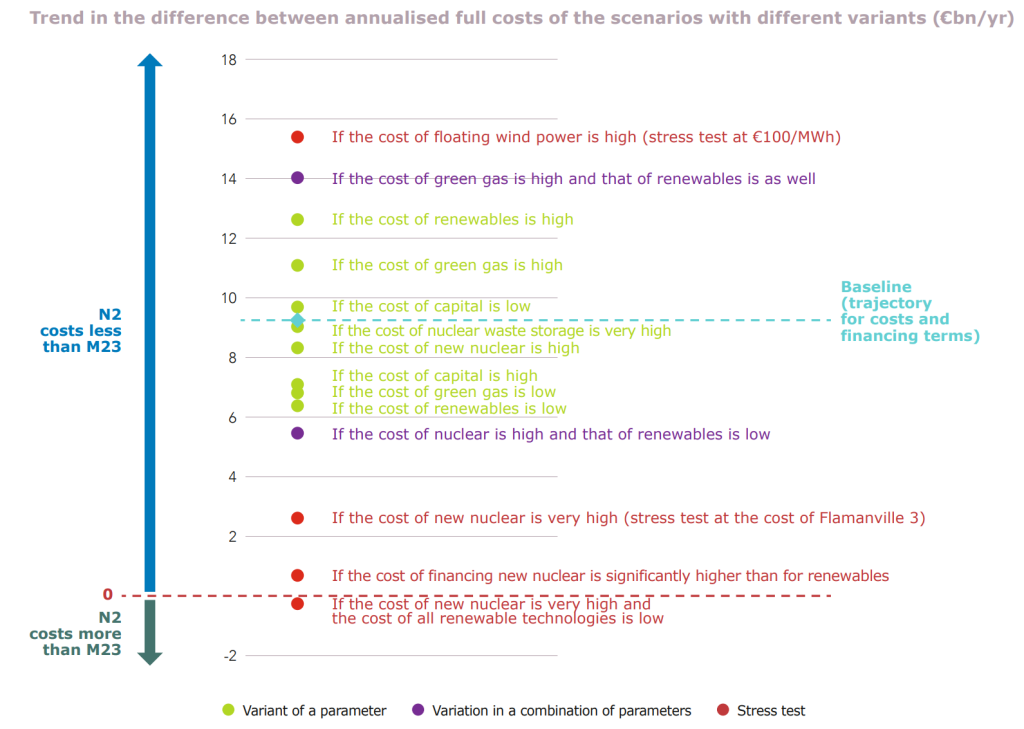

However, the costs for grid expansion and the balancing of fluctuating generation, which already amount to around 80 USD/MWh for solar energy at a penetration rate of 30 %, are significantly lower for nuclear energy. [18] In its report from 2022, the French grid operator RTE compares the costs of various scenarios with different shares of nuclear generation capacity in the electricity mix. The institution concludes that even with rising costs for nuclear energy (7,900 €/kW) and sharply falling prices for renewable energies, the construction of new nuclear power plants is economically advantageous. [19] See Figure 5.

Fig. 5: Comparison of annual costs between a scenario with a strong increase in nuclear capacity (N2) and a scenario (M23) characterised by the expansion of renewables, particularly wind power. (Source: RTE, 2021; [20])

Will 2024 mark the beginning of a new nuclear power era?

Europe is experiencing a nuclear renaissance. New nuclear power plants are being built in more and more countries, and many more are planned. In ten years’ time, new types of reactors are even expected to be part of our electricity mix. This development is supported by the public, especially since the war in Ukraine. The additional energy supply would lead to lower power prices, if the expansion of renewables is maintained.

However, if the expansion of renewables slows down, prices will rise – especially if demand increases due to decarbonisation as part of the transition in heating and transport. In addition, people in the countries building the reactors will support nuclear power through taxes, as they have done for other forms of generation. No one is currently able to quantify the potential costs of new nuclear power stations.

The “GoNuclear” scenario will be offered by Energy Brainpool as a country-specific option in the future so that you can get an even more differentiated picture of the development of power prices. In this scenario, the focus is on the expansion of nuclear power in order to reflect the current political debate and provide information on the resulting price development. More about Energy Brainpools power price scenarios here Power Price Scenarios | Energy Brainpool

Sources:

[1] Nuclear Energy Summit. Declarations On Nuclear Energy. https://nes2024.org/en/declaration. Accessed 03.05.2024

[2] World Nuclear News. Leaders commit to ‚unlock potential‘ of nuclear energy at landmark summit. https://www.world-nuclear-news.org/Articles/Leaders-back-nuclear-at-summit. Zuletzt abgerufen am 03.05.2024.

[3] Regeringskansliet. Kärnkraft: frågor och svar. https://www.regeringen.se/regeringens-politik/energi/fragor-och-svar-om-karnkraft/. Accessed 03.05.2024.

[4]https://www.idnes.cz/ekonomika/domaci/cesko-jaderne-elektrarny-tendr-dostavba-temelin-dukovany-reaktory.A240430_060840_ekonomika_jadv. Accessed 03.05.2024.

[5] HM Government. „British Energy Security Strategy“. April 2022.

[6] https://www.rinnovabili.it/mercato/politiche-e-normativa/nuove-centrali-nucleari-in-italia-mini-reattori/. Accessed 07.06.2024.

[7] https://world-nuclear-news.org/Articles/Serbian-president-s-appeal-as-country-aims-to-get. Accessed 07.06.2024.

[8] https://energy.ec.europa.eu/topics/nuclear-energy/small-modular-reactors/small-modular-reactors-explained_en. Accessed 07.06.2024.

[9] M. Brugidou, J. Bouillet „A return to grace for nuclear power in European public opinion? Some elements of a rapid paradigm shift“. Foundation Robert Schuman. March 2023.

[10] Flash Eurobarometer 514. “EU’s response to the energy challenges”. Presentation. European Union. Dezember 2022.

[11] https://newsv2.orf.at/stories/2423442/2423441/. Accessed 07.06.2024.

[12] https://www.derstandard.de/story/2000120170762/eugh-wies-oesterreichs-klage-gegen-beihilfe-fuer-akw-hinkley-point. Accessed 07.06.2024.

[13] BAROMÈTRE 2023. Institut de radioprotection et de sûrete nucléaire.

[14] Centrum pro výzkum veřejného mínění, Sociologický ústav AV ČR. „Veřejnost o jaderné energetice – podzim 2022“. Pressemitteilung Januar 2023

[15] A. Wimmers et al. „Ökonomische Aspekte der Atomkraft“ Kurzgutachten im Auftrag der Bundestagsfraktion Bündnis 90/Die Grünen. Berlin, 2023

[16] R. Idel. “Levelized Full System Costs of Electricity”. Energy. Volume 259. 2022.

[17] G. Rothwell. Projected electricity costs in international nuclear power markets. Energy Policy. Volume 164. 2022. https://doi.org/10.1016/j.enpol.2022.112905.

[18] NEA System Cost Analysis for Integrated Low-Carbon Electricity Systems. NEA NO. 7668. OECD 2024

[19] Futurs énergétiques 2050. RTE. Februar 2022. S. 600

[20] Energy Pathways to 2050. RTE. October 2021. p. 31.

What do you say on this subject? Discuss with us!