The diversity of contractual structures of Power Purchase Agreements (PPAs) and the resulting lack of useful indices makes it difficult to correctly assess offered PPA prices. What is a good PPA price and what are the means to exploit the potential of price and volume regulation? More on this in our blog post.

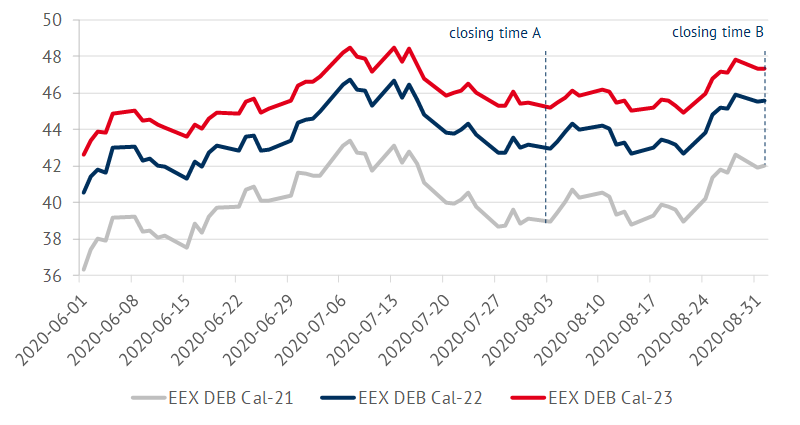

The following figure shows three important indicators for the future development of electricity prices over time. When would you have preferred to conclude your PPA?

Figure 1: comparison of forward market prices at two different times of PPA conclusion

The assessment of long-term price developments is essential for determining whether an active player is closing at a “good price”. Large industrial consumers are looking towards closing time A. Meanwhile, the latest price development is positive for the plant operator. This means: Closing time B or maybe even later would be a comparatively good result. However, many other factors determine the market, one after the other:

PPA Market in Germany: buyer or seller market?

Who has more negotiating power in PPA negotiations in Germany? Buyer or seller? There is no general answer to this question. The framework conditions are constantly changing according to needs. The manageable number of market-ready PPA projects compared to countries such as Spain argues for increased competition among large consumers or energy supply companies (utilities) interested in PPAs.

This is particularly true if internal climate targets or long-term PPA portfolio strategies increase the need for PPAs on the buyer side. In the future, however, the number of market-ready projects is likely to increase significantly.

On the other hand, these projects are matched by a limited number of customers with strong credit ratings who can include long-term price risks in their balance sheets. Structured electricity procurement on the futures markets provides customers with a convenient fallback solution at any time, but the projects absolutely need the electricity buyer.

Therefore, the need to conclude PPAs can often be greater due to project financing requirements on the generation side. Meanwhile, in many places large consumers simply tender their PPA procurement volumes and choose the most competitive offer. At the same time, large utilities have their own standard contracts and anchor purchase prices as well as contract structures.

We are observing the market closely and have gained the impression, Germany is currently a buyer’s market. But regardless of whether it is a buyer’s or seller’s market: if you get into a situation of a limited negotiating position, the question arises, especially for newcomers to the PPA business – what can I do in concrete terms?

The basis: understanding PPA price components and influencing variables

First, I need to understand what components the PPA prices offered to me consist of and how they are influenced. In addition to the base price level and the technology- and plant-specific profile discount, risk premiums and marketing costs also play a role, depending on the contract construct. Figure 2 gives an overview of this.

![Fair value of a PPA with a term of 5 years (plus current), fixed price, pay-as-prognosis, valuation at settlement prices on 28.09.2020 [extract from the free PPA price monitor of Energy Brainpool] Fair value of a PPA with a term of 5 years (plus current), fixed price, pay-as-prognosis, valuation at settlement prices on 28.09.2020 [extract from the free PPA price monitor of Energy Brainpool]](https://blog.energybrainpool.com/wp-content/uploads/2020/09/Preismonitor_EN-1024x504.png)

Figure 2: Fair value of a PPA with a term of 5 years (plus current), fixed price, pay-as-prognosis, valuation at settlement prices on 28.09.2020 [extract from the free PPA price monitor of Energy Brainpool]

Option 1: Compare profile and risk discounts for different providers and contract structures.

If a wind farm operator receives such an offer, some questions arise:

- What profile discount was used to calculate the 36 EUR/MWh? Can I prove a higher profile value for my plant?

- What risk premiums are customary in the market for this contract construct? Are there alternative contract terms or price and volume regulations whose risk-return profile suits me better? With which provider does the management of my wind farm cost the least within the respective portfolio?

From the customer’s point of view, these questions are to be asked the other way round, for example how well does the generation profile of this plant fit into my portfolio or to a specific consumption load profile? Such an analysis can be a first lever to optimise the conditions for both parties.

Our Sanity Checks provide support in answering these questions: we will confidentially check the PPA offers available to you using our price benchmarks and advise you on how to proceed. The aim: you understand which contractual partners are best suited to you. In addition, you will see which levers you can use, despite limited room for negotiation, to optimise your chances of winning, given your risk tolerance.

For our case study, this means that the wind farm operator receives the above-mentioned offer. However, he is not so much dependent on a fixed price, as he has concluded a maintenance contract with variable remuneration. He is also convinced that the electricity price will rise. If the price were not fixed for all volumes, the risk for the buyer would also be reduced. At the proposal of the operator, both parties therefore agree on the following:

Only a guaranteed minimum quantity (e.g. 70%) is remunerated with the fixed price of 36 EUR/MWh. Over- or underproduction is priced spot-indexed. Penalties are payable for underproduction, but the risk premium is reduced to 1.50 EUR/MWh.

This way, the wind farm operator assumes part of the price risk and expects a higher return. By dealing with the components of the PPA price, the wind farm operator will therefore find a contractual arrangement that better fits his risk-return profile.

Option 2: Achieve a higher price level through correct timing.

Especially for shorter maturities, prices on the PPA market are often driven by developments on the derivatives market. Clearly, for the buyer, these are the central benchmark for comparative procurement. The base futures prices there represent the current market opinion regarding the value of a base load electricity supply for the next six years, of which, however, only the next three years are traded liquid.

Beyond this period, price influences such as the power plant park, commodity prices or electricity demand change increasingly, so that fundamental modelling is necessary. Nevertheless, many customers hardly take this fact into account and instead rely primarily on the market opinion of the futures market by extrapolating it into the distant future. For example, the price at maturity “y+3” is used, adjusted for inflation, to value electricity supplies in y+4 to y+10.

As long as this remains the case and PPA price offers are adjusted to the current prevailing market opinion on the derivatives market, it is important to understand this market. A brief outline: prices there are relatively volatile, and the so-called “herd behaviour” of traders regularly leads to over- and underestimates of the intrinsic value of an electricity supply. This intrinsic value follows price trends which must be recognised.

In order to have a further lever for revenue optimisation in hand with the choice of the “log-in” time, the following questions should be dealt with intensively:

- Does the futures market overestimate or underestimate the intrinsic value right now?

- Which price trends can be identified at present? Which ones can be expected in the coming weeks?

- Is now a good time to conclude a contract or should I wait?

Both technical chart analysis and fundamental modelling can support the decision making process. For example, Energy Brainpool is currently developing its own signal generator, which is currently still in the beta phase. It combines the analysis of current futures market movements with fundamental scenario swarms in order to obtain a broad picture of possible price developments in the following days and weeks.

To get an overview of such tools of futures market analysis, our “Inhouse-Workshop PPA-Log-in-Strategy” is a good choice. In addition to imparting skills, the workshop focuses on practical application to current market movements.

What is the potential added value of exploiting these opportunities?

Compared to the analysis of risk discounts, an optimised log-in strategy in particular offers a high potential for increasing revenues. The prerequisite is that pricing is adjusted to the current futures market conditions during negotiations. We can demonstrate this by using the example of Figure 1 above.

Let us illustrate the potential in a simplified way using our case study: the wind farm operator receives the offer described above at the PPA fixed price of 36 EUR/MWh on 3 August. On this day, the average of the EEX base futures for the calendar years 2021, 2022 and 2023 on which this PPA price is based is 42.37 EUR/MWh.

Following a derivatives market analysis, the operator concludes that the derivatives market is currently undervalued. Therefore he waits with the conclusion of the contract. During the negotiation process, the buyer adjusts the PPA price offer to the current movements on the derivatives market. After a one-month waiting period, the wind farm operator concludes the PPA on 31.08. The average of the EEX futures 2021 to 2023 is just under 45 EUR/MWh, the resulting PPA price is 38.50 EUR/MWh (plus risk discount of 1.50 EUR/MWh).

How does the PPA price increase by 2.50 EUR/MWh affect the wind farm operator’s total revenues? With a term of 3 years, a wind farm with 30 MW and 1,500 full load hours generates additional revenue of: 2.50 EUR/MWh x 1,500 h/a x 3 a x 30 MW = 337,500 EUR.

For both potential PPA buyers and sellers, this example makes it clear that sometimes waiting can be the right strategy. This example is currently still limited by the low liquidity in the PPA market, as already described in the section “buyer or seller market”.

Our offer: the PPA-Sanity-Check

We will assist you in clarifying these questions and together with you we will thoroughly check the price offers. This will give you an overview of the advantages and disadvantages of the various contract structures. You can find more about the PPA Sanity Checks here. We would be happy to organise the “PPA Strategy Workshop: Futures Market Analysis and PPA Log-In Strategy” at your company. You are welcome to contact us!

You can also find a lot of interesting information about PPA in our open seminar Energy BrainSessions:

What do you say on this subject? Discuss with us!