In the procurement of gas some singularities have developed, which distinguish the gas market from other commodity markets. Import companies, for example, sometimes have very long-term contracts with gas producers (up to 20 years), a linkage to the oil price and the so called take-or-pay volumes or flexibilities with limits. This chapter aims to familiarize you with the terminology, to understand their meaning and to assess the consequences for the energy industry.

Origin of the oil price linkage

At the beginning of the 20th century the demand for natural gas could be covered by domestic production. In the mid-1970s natural gas became increasingly popular which in consequence increased the imports. However, there were considerable uncertainties for both producers and importers regarding the investment in cost-intensive pipelines and other infrastructure projects.

The producers were interested in gaining safety regarding sales and quantities and therefore to fully and even utilize their capacities.

On the one hand the German importers and distribution companies wanted to offer their customers prices which encouraged them to purchase natural gas instead of oil or coal, and long-term guarantees for quantities to provide security of supply and at the same time flexibility regarding seasonal fluctuations.

Duration and quantities

Consequently, both sides were interested in long-term contracts resulting in contracts which have terms of more than 20 years. Both sides also found a compromise in terms of flexibility and utilization of the pipelines. The contracts specified a minimum quantity or a minimum load, which the importer had to take. If the importer was not able to, the entire purchase sum was invoiced anyway. The minimum quantity is also called take-or-pay (top) quantity. At the same time these contracts contain flexible quantities which can be called up by the importer according to the demand. These minimum and maximum quantities can be based on annual quantities as well as on monthly, daily or hourly quantities.

Linkage to the oil price

To convince end customers to use natural gas instead of oil and coal could be done by the comfort of a gas heating system. Coal cellars and oil tanks should be thigns of the past as well as sooty chimneys and hurried oil orders if one forgot to keep an eye on the oil tank. But of course the price of natural gas was a crucial criterion compared to the alternative oil. If the costumer chose the gas heating system, he had to have the certainty that the future natural gas price would be better or similar compared to heating oil.

The natural gas supplier wanted to give this guarantee, but in order to be able to offer these possibilities he had to do his purchase in such way that the price of the quantities also changed with the oil prices. This has been solved by linking the procurement contracts’ gas price to the oil price.

Gas price formula

The linkage to the oil price is achieved by not including a fixed price in the gas contracts but a formula by which the gas price is calculated using the oil price.

The price of 1 kWh natural gas is calculated by a fixed component and a flexible component. The flexible component is composed of the respective oil price. This value is multiplied by the oil binding factor. 0.0049 is the heat value factor between oil and gas and was, therefore, often used as the factor. Today the factor is part of the free negotiations.

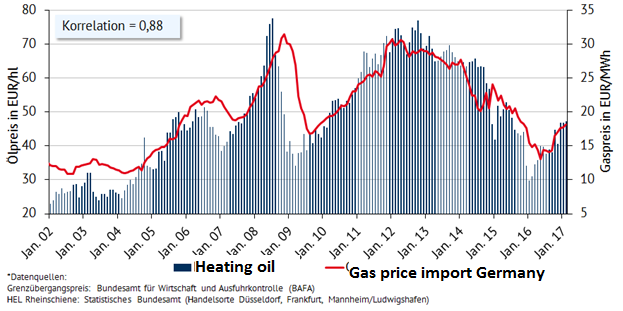

Correlation between oil and gas prices

In figure 1 you see the curves for HEL Rheinschiene (heating oil, blue) and the border-crossing price for natural gas (red) to Germany. This has been calculated on the basis of surveys of natural gas importers, how much they had to pay for the import natural gas. Consequently it must not be confused with the exchange price. It becomes clear that fluctuating oil prices directly influence the price for natural gas. However it can be seen that the price increase is delayed.