In the year 2000 the European Energy Exchange AG (EEX) started its business with electricity and other products. The most important part of their business is the futures market. The spot market is taken care for by a subsidiary company EPEX SPOT.

The EEX has to follow the exchange law which is part of the public law and dictates that an exchange has to have three main bodies. These are the exchange council, the managing director ( board of managing directors) of the exchange and the Trading Surveillance Office.

The exchange council represents its members which are from energy companies, trading companies, TSOs, customers and banks. Furthermore, the exchange council approves of regulations for the exchange and introduces and changes current regulations. On top of that the council decides on the board of managing directors is and appoints the Trading Surveillance Officer.

The managing board of directors at EEX is responsible to make sure that trading can happen continuously and that there are no problems. They are in charge of daily business and are also responsible for new products and participants being accepted.

The Trading Surveillance Office is independent from the other main bodies of the exchange and surveilles all trades done on EEX. If suspicious trades become known the Trading Surveillance Office follows up the case and checks if rules have been broken. If their suspicion turns out to be true they immediately contact the managing board of directors responsible for imposing sanctions against that trader. The Trading Surveillance Office themselves do not have the right to impose sanctions against traders.

Clearing transactions on the exchange

Due to the fact that the exchange is the main contracting partner it is responsible for the counterparty risk of their customers. This means that in case that an exchange participant goes bankrupt the exchange is obliged to fulfil the open obligations. This is a big advantage in comparison to doing business on an OTC since the exchange accepts the risk if a party defaults.

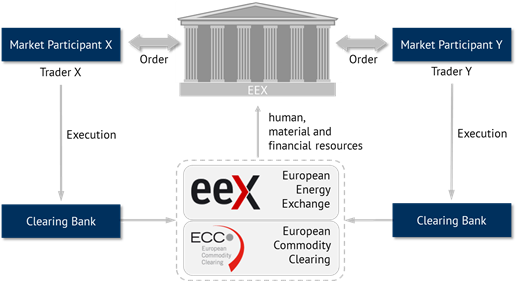

This is done through another subsidiary, the European Commodity Clearing AG, ECC AG, which is the central trading partner between the traders. In case a party defaults, also known as credit or counter party risk, the European Commodity Clearing AG (ECC AG) guaranties the other party involved in the trade deal to pay the entire amount. The different processes are depicted in figure 1.

Therefore the ECC demands security payments from all exchange participants. These margins have to at least cover the potential receivables from every single participant. Money must be deposited every time a new position is opened and has to be available during the duration of the contract. By doing so the risk that the maximum costs will be incurred to cover all open positions of a trader on the next trading day assuming the price development is unfavorable will be covered. The physical settlement is the same as in the settlement in an OTC market. However the ECC sends also sends the timetables to the responsible transmission system operator.

Figure 1: Procedures of trading at the energy exchange (source: Energy Brainpool)

OTC-Clearing

On an OTC market the participants swap electricity contracts directly. The exchange has issued standardized forward products for OTC trading which correspond to the standardized EEX futures. These EEX forwards can also be accounted through the clearing place of the exchange and offer therefore the same financial safety just like other exchange trades.

How does clearing and settlement work on the exchange?

The European Commodity Clearing AG (ECC AG) as a subsidiary of the EEX AG conducts a transparent and standardized process which clears the receivables and payables and settles the deals.

Clearing means re-adjusting the value of receivables from trading transactions. Especially the financial execution and the recording of the securities are important here. Due to the sheer amount of exchange transactions, clearing activities are still executed after trading has finished.

The settlement is the fulfilment of a business transaction, so the delivery, accounting, payment and use of electricity. With the help of ECC AG clearing procedures trading is made supposedly easier. On top of that the ECC AG minimizes counterparty risk by guarantying to cover payments for unfunded liabilities.

Tradeable products

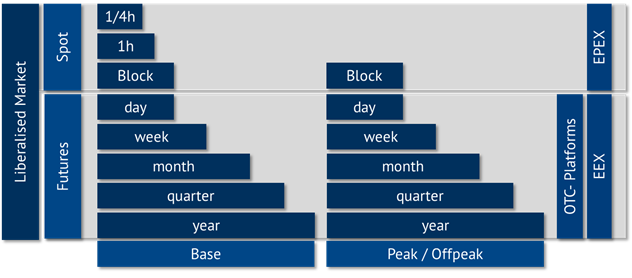

In addition to the standardised products which are offered on the OTC Spot and the OTC Futures, Forwards and Options markets, single hour contracts can be traded and swapped on the EEX Spot exchange as shown in figure 2.

Figure 2: Tradable products at the energy exchange and OTC markets (source: Energy Brainpool)

On the EEX exchange as well as on the OTC market products other than electricity can be traded as well. These are coal, gas, emissions certificates, guarantees of origin and other products.