What has changed in the power and energy sector in 2016? This short summary allows you to review the most important events of last year.

Undoubtly the biggest influence on the German energy sector in 2016 have been initiated by the legislative procedures surrounding the Renewable Energy Act 2017 (EEG 2017), the power market and the digitalization acts. The provisions in the EEG 2017 mainly target the determination of renewable energy plants by tenders instead of a governmentally-fixed feed-in tariff, as well as the interlinking of the expansion of renewables and grid extensions. The power market 2.0 is further based on a free price formation of power on the energy-only market, as well as the incentive for greater flexibility, both on the generation as well as on the demand side. The gradual introduction of intelligent metering systems aims to integrate untapped flexibility potentials on the demand side into the market.

At the same time, there has seldomly been a buzzword, which attracted such a hype in the energy sector as the Blockchain. Born of the combination of various internet technologies, this distributed ledger technology might disrupt traditional business models of the energy sector.

The announcements of several power retailers to offer electricity flat-rates for their customers have also been discussed vividly. Especially in combination with idea to finance those flat-rates by commercializing pools of house-hold battery storage systems in the balancing markets. The entire field of prosuming business models has been further developed by so-called energy communities and the legal betterment of power-for-tenants models in the EEG 2017.

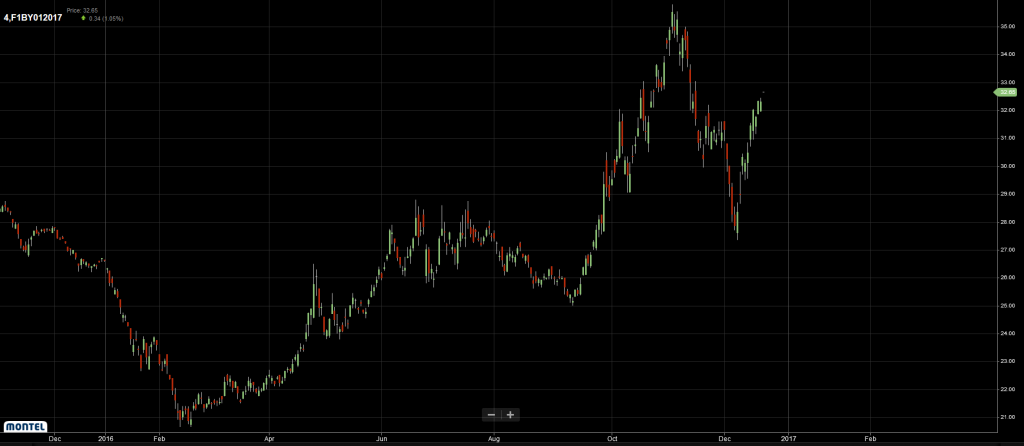

Also on the price side the year of 2016 has been one of extremes. The lowest wholesale power prices for the delivery of baseload power for the year-ahead contract since the beginning of the liberalization occurred in the mid of February with less than 21 Euro/MWh. Then an increase of more than 50 percent increased the price of the year-ahead contract for 2017 to more than 35 Euro/MWh, as shown in figure 1.

The closure of Chinese coal mines, with higher import rates into China, pulled up the price for coal on the world market, which in turn dragged power prices along. The uncertainty on the market about the simultaneous shut-down of a range of French nuclear power plants further raised power prices towards the end of the year due to shortage prices in France.

Further important events on the international stage have been the ratification of the Paris Climate Agreement, as well as the lowest bids for utility-scale PV in Dubai with 24.2 $/MWh and offshore wind in Denmark with 49.9 €/MWh.

What will the next year hold in store for the energy sector? The first tenders for onshore wind energy in Germany will certainly be exciting, as strategical bidding of market actors complicates a forecast of surcharge values. Another topic will be the realization rated of PV-projects within the set time limit, especially in view of how much quantity control is possible for the expansion of renewables.